Introduction - Set up item charges

You can use an item charge for recording the costs of handling items such as freight charges, loading and unloading items, custom duties, insurance, and other similar costs.

When related to inventory purchases, these added expenditures are inventorial costs and should be included in inventory valuations and the cost of goods sold. Additional sales costs are non-inventorial but can be recorded as expenses against sales to improve the accuracy of profit calculations.

Business Central addresses inventoriable and non-inventoriable added costs through its item charges functionality. You can use this functionality to post item charges even after you post all related purchase or sales documents.

Item charges are strictly financial and do not affect inventory quantities. This attribute also makes item charges ideal for the following occurrences:

Purchase and sales allowances (such as restocking fees or credit memos on returns)

Shipping fees that are paid by customers

Certain types of adjustments to inventory valuations

Because item charges have no impact on inventory quantities but only on financial, the item charges setup is part of the general finance setup. Companies can set up different item charge numbers to distinguish types of charges and improve cost and sales statistics.

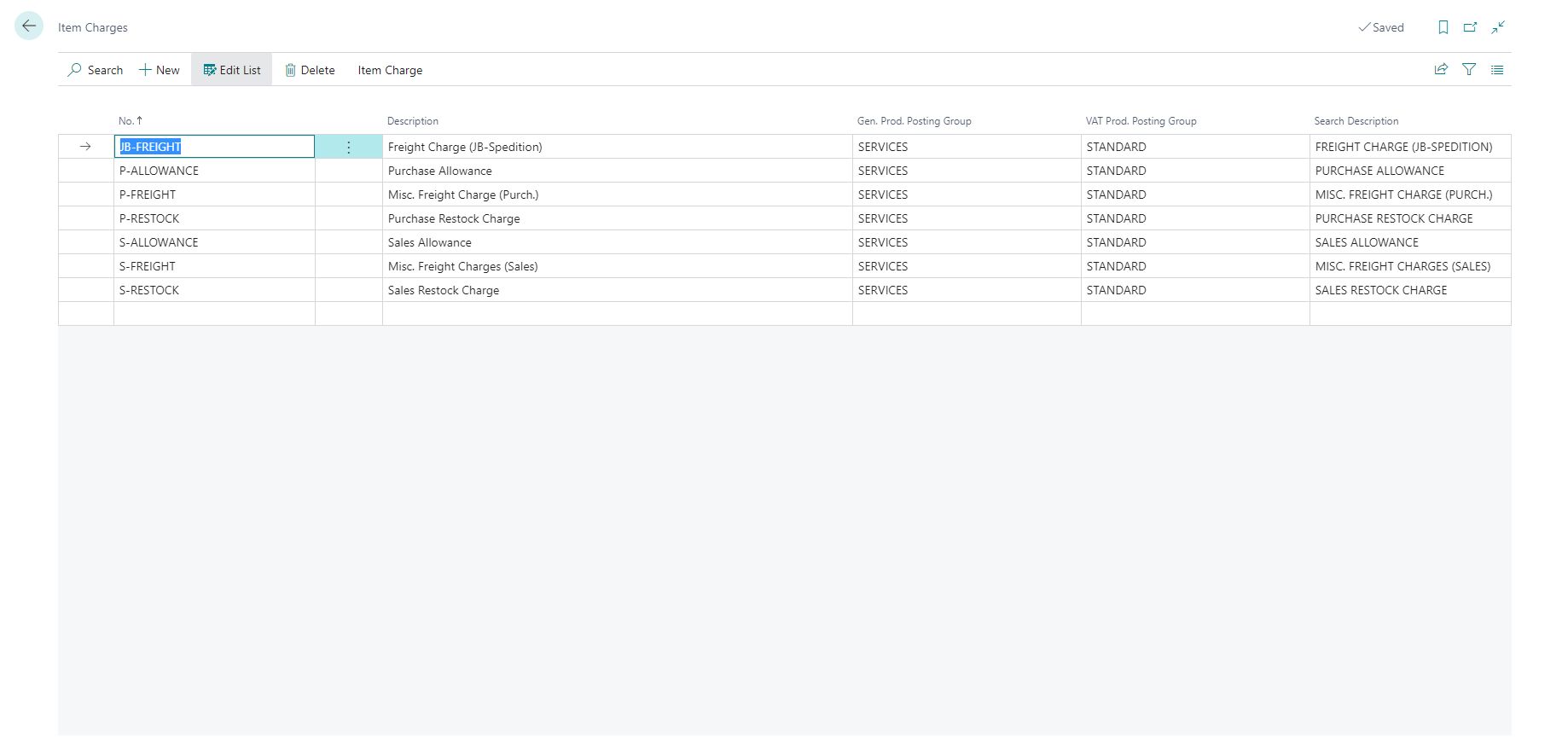

The best way to open the Item Charges page is to select the search for page icon in the top-right corner of the page, enter Item Charges, and then select the related link.

Create a new item charge

To create a new item charge number, select the New action on the Item Charges page. Fill in the fields, as necessary. Hover over a field to read a short description.

Assign G/L accounts in the general posting setup

Like an item, an item charge must have a General Product Posting Group and a VAT Product Posting Group (or a Tax Group Code, depending on the localization that you are using).

This combination of posting groups determines the general ledger account to which the item charge is posted. These posting groups are all you need to configure an item charge. After you have set up an item charge, you can select it on a purchase or sales document line.