Events

Power BI DataViz World Championships

Feb 14, 4 PM - Mar 31, 4 PM

With 4 chances to enter, you could win a conference package and make it to the LIVE Grand Finale in Las Vegas

Learn moreThis browser is no longer supported.

Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support.

Go to Accounts receivable > Sales orders > All sales orders.

Create a sales credit note for a taxable item.

In the Original invoice number field, select a value.

Verify that the Original invoice date field is automatically set based on the original invoice number that you selected, and then save the record.

Select Tax information.

Select the GST tab.

Select the Customer tax information tab.

Select OK.

On the Action Pane, on the Sell tab, in the Tax group, select Tax document.

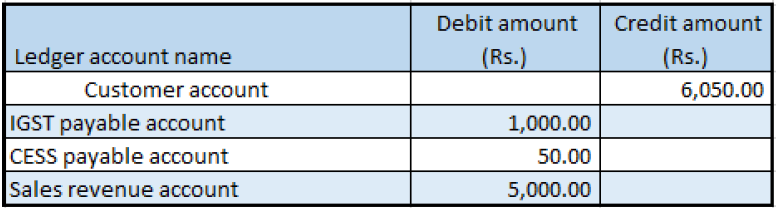

You should see something that resembles the following example:

Select Close.

On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

In the Quantity field, select All.

On the Others tab, verify that the Invoice type field is set to Original.

Note

You can post a revised credit note by selecting Revised in the Invoice type field and then adding a reference to the original credit note.

Select OK, and then select Yes to acknowledge the warning message that you receive.

Note

You can create a sales credit note through the general ledger and a free text invoice.

Events

Power BI DataViz World Championships

Feb 14, 4 PM - Mar 31, 4 PM

With 4 chances to enter, you could win a conference package and make it to the LIVE Grand Finale in Las Vegas

Learn moreTraining

Module

Create sales documents in Dynamics 365 Business Central - Training

Do you need to create sales documents like quotes, orders, and invoices? This module provides basic information you should know to create these documents in Dynamics 365 Business Central.