Unified customer profile for retail banking

The Unified customer profile provides a 360-degree perspective of the customer in a clear and intuitive way. You can view the most relevant information across multiple business lines, combined into a unified dashboard that offers an accurate, consistent, and cohesive source of truth about the customer. Further, you can use this information to provide personalized experiences, reveal important opportunities, prevent potential loss, or churn, and improve customer satisfaction.

The Unified customer profile includes the following tabs:

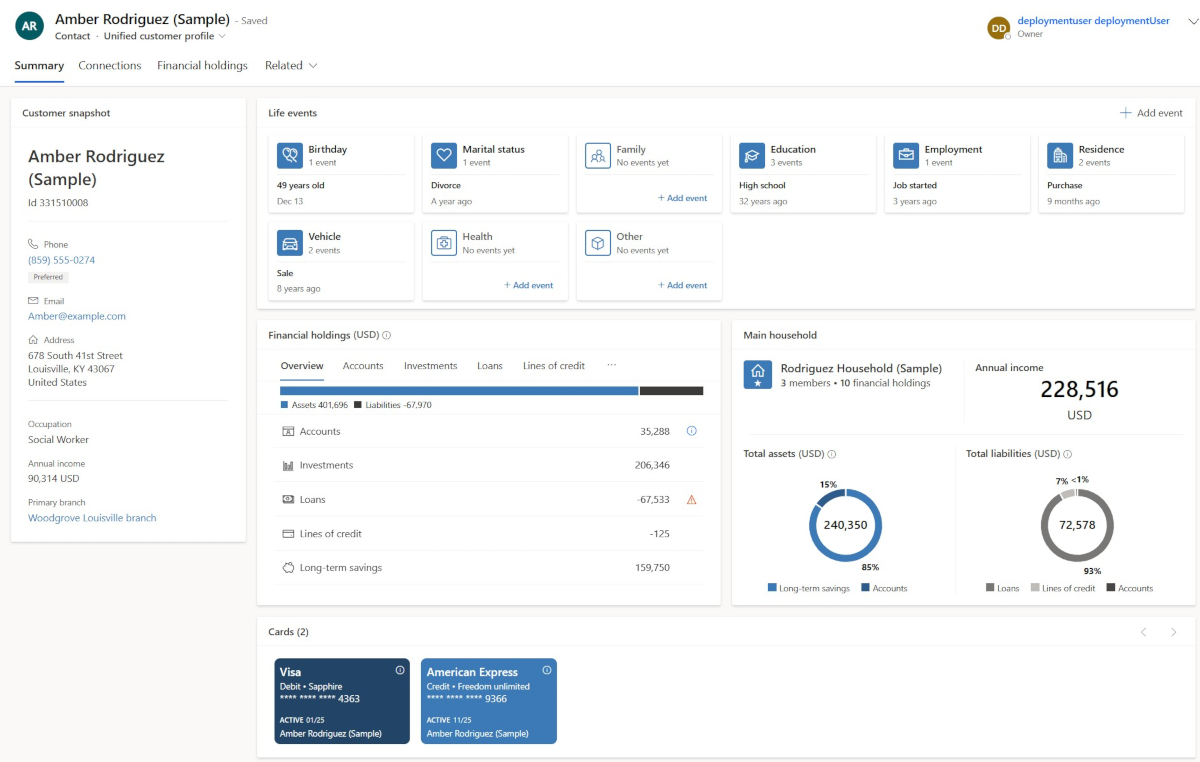

Summary: View a high-level summary of the customer, their personal details, life moments, investment portfolios, financial holdings, and household finances.

Connections: View the groups that the customer is a part of, and understand the overall financial strength of each group (such as household). Create group records, associate customer records with groups, and update general information and financial holdings relevant to the group. Easily capture relationships between contacts based on an expandable option set.

Financial holdings: View detailed information about all the financial holdings associated with the customer.

Summary tab

The Summary tab showcases the most relevant information, highlights important things to note, and provides a comprehensive view of the customer. The Unified customer profile provides the following areas on the Summary tab:

Customer snapshot: Displays your customer's relevant personal information.

Life events: Provides insight into the customers and their family’s past and future life moments.

Financial holdings: Displays a summarized view of the financial holdings.

Cards: Displays the credit and debit cards held by the customer.

Main household: Provides an overview of the financial strength of the customer's household.

Connections tab

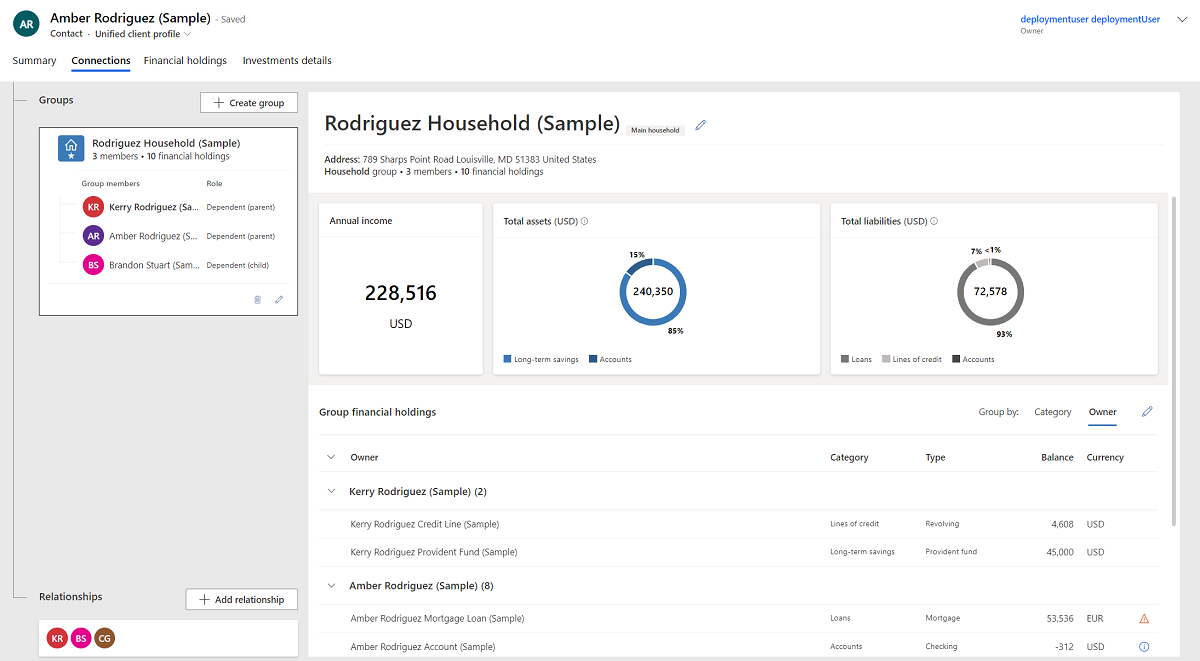

The Connections tab provides a comprehensive view of all the groups the customer is a part of, including additional households and other groups, as well as their relationships with other customers.

On the Connections tab, you can view the following information:

Customer groups: Provides information about all the groups the customer is a part of. The customer’s main household is selected by default. Other group members, as well as the customer's role in the group, are visible.

Selected customer group: Provides information about the selected customer group. The information includes address (which is derived from the group’s primary member’s address), total income, total assets, total liabilities (converted to the system’s default currency), as well as the shared financial holdings of that group.

Relationships: Provides information about relationships between a customer and other contacts, including family and professional relationships.

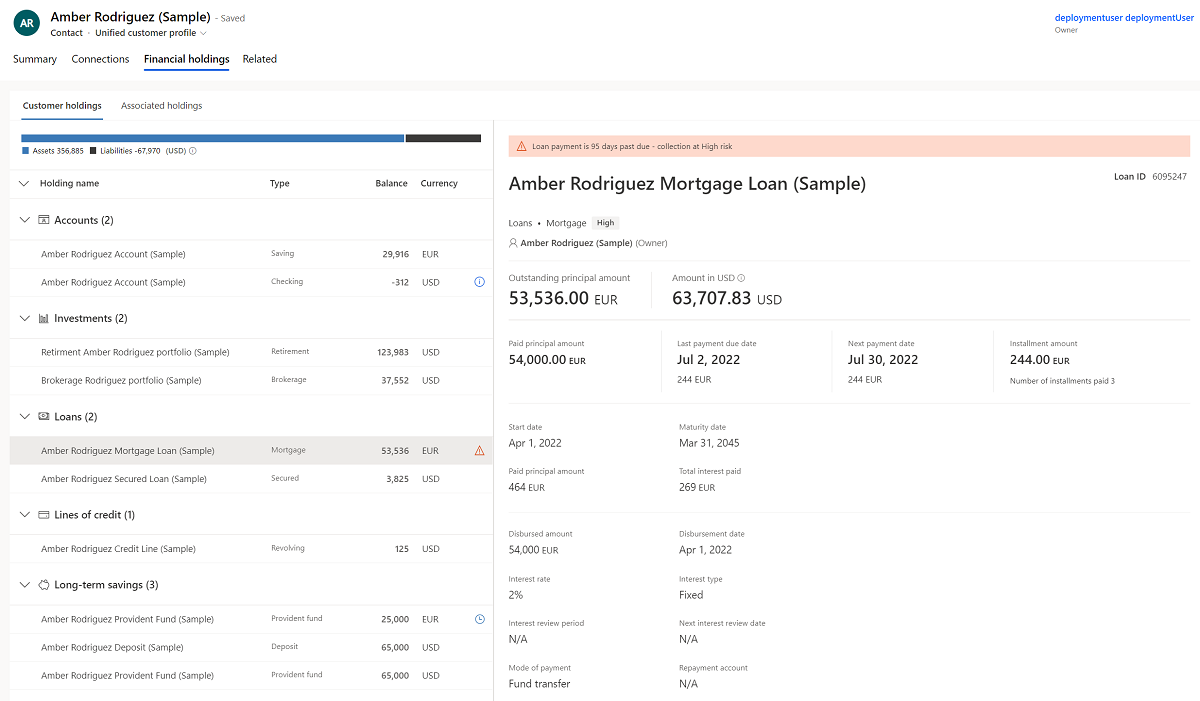

Financial holdings tab

The Financial holdings tab expands on the information presented in the Financial holdings area of the Summary tab. This tab shows the following information:

- Financial holding name

- Category

- Type

- Value

- Instruments

- Alerts for cases, such as savings or loans nearing the maturity date

You can select a financial holding, like a saving account, to view detailed information about that specific holding.

On the Financial holdings tab, the customer’s information is shown both for holdings that they own and other holdings that are associated with them (for example, if a customer is a beneficiary but not the owner of a particular financial holding).

See also

Licensing Support Deploy Microsoft Cloud for Financial Services What is Microsoft Cloud for Financial Services?