Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Appropriate roles: Admin agent | Billing admin

This article provides an overview of the Azure credit offer (ACO) and explains the process for reconciling and determining the balance.

Understand ACO

ACO is an initiative that supports the use of Azure credits to win and accelerate Azure consumption. ACO provides customers with a fixed amount of free Azure usage, which they can use within a defined timeframe.

Learn about Azure credit offers eligibility

To ensure you can benefit from ACO, it's crucial to understand the eligibility criteria and terms:

- Eligibility: You and your customer must sign an agreement with Microsoft. Only then is the ACO applied to the eligible resources.

- Effective date: ACO becomes effective from the date specified in the agreement.

- Expiration: ACO has an expiration date, which is also outlined in the agreement.

Understand which resources are eligible to receive ACO benefits

All first-party Microsoft Azure products qualify for ACO benefits. But the benefits are only applied within the effective period specified in the agreement.

Find a customer's ACO balance

To check the ACO balance of a customer, follow these steps:

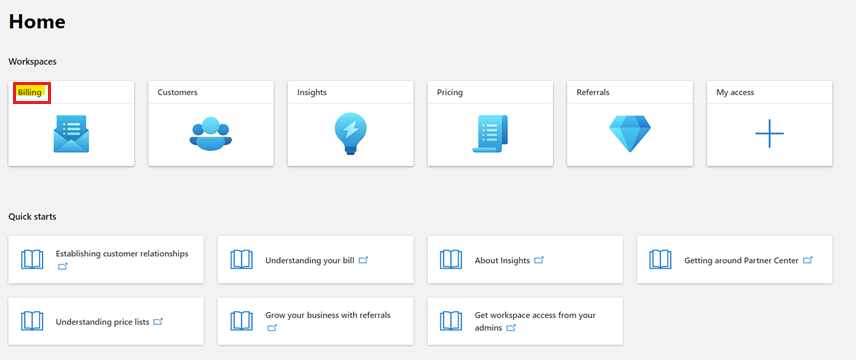

Sign in to Partner Center and select the Billing workspace.

Select the Billing overview (NCE) task menu.

On the Billing | Billing Overview (NCE) page, under Reports, select Credit balance and then select the Azure credit balance report.

The report then appears on the Reports (NCE) page, where you can download it.

The credit balance .csv file updates simultaneously with your invoice reconciliation data for any closed billing period. This file includes the following information:

| Fields | Description |

|---|---|

| PartnerTenantId | Partner's Microsoft Entra ID—a unique identifier for partners |

| CustomerTenantId | Customer's Microsoft Entra ID—a unique identifier for customers |

| InvoiceMonth | Month or billing period that the invoice covers |

| InvoiceYear | Year of the billing period or the month that the invoice covers |

| CreditName | Name of the credit: "ACOForCSP" |

| ApprovedAmount | Approved credit amount as per the agreement |

| CreditAmount | Credit amount given in the specific month or billing period |

| CreditType | Type of credit: "ACO" |

| Status | Status of the agreement (active/expired) |

| BalanceAmount | Remaining balance amount at the end of the month or the billing period |

| CurrencyCode | Currency code of the credit |

| AgreementId | Unique identifier for the agreement |

| EffectiveDate | Date when the agreement takes effect |

| ExpiryDate | Date when the agreement expires |

Understand how to use ACO

You can use your ACO until it expires. The ACO expiration date is specified in the signed agreement. If a balance remains after the expiration date, the ACO is no longer applicable.

Learn how ACO applies to the invoice

The system automatically applies these discounts to your invoice when you have eligible resources. You don't need to take any manual action.

Understand when Azure credit offers apply to an invoice

To understand when ACOs apply to your invoice, it's important to focus on the timing of credit application and reporting.

Ensure accurate billing by noting these key points:

Credits are applied only for closed billing periods: Azure credit offers are applied to invoices only after the billing period closes. For example, if your billing period ends on March 31, 2024, the ACO credits used during that period are reflected in the April 2024 invoice.

No credits displayed for open or current billing periods: ACO credits aren't shown in the ACO balance report for the current or open billing period. If you're approved for credit during the current month, it doesn't appear in the ACO balance report until the billing period closes and the invoice is generated in the next month.

Reconciliation with closed billing periods: To ensure accuracy, compare the ACO credits in the ACO balance report with the invoice reconciliation line items from the same billing period. If your last closed billing period was March 2024, match the credits in the ACO balance report with the March 2024 invoice reconciliation data.

Visibility of approved credits: If credit is approved during a specific month (for instance, May 2024), it's only visible in next month's ACO balance report (June 2024) once the invoices for the previous month are available.

Use best practices

- Regular monitoring: Stay updated on your ACO balance reports and invoice reconciliation files or line items for closed billing periods to ensure timely and accurate credit management.

- Comparison and verification: To ensure consistency and accuracy, compare the credits in the ACO report with your invoice reconciliation files or line items.

By following these guidelines and best practices, you can effectively manage your ACO credits, ensuring accurate billing and optimal utilization of your Azure resources.

Reconcile ACO credit

To manage and reconcile Azure billing effectively, especially concerning Azure credit offers (ACO), follow this detailed process to match ACO data with invoice reconciliation for each customer within a billing period. Here's a step-by-step guide:

- Identify ACO credits: Look for line items where the

CreditReasonCodeattribute has the text"Azure Credit"for aCustomerId. - Calculate total credits: After filtering, sum up all the credit amounts applied under the

"Azure Credit"category for each customer. This total gives you the ACO credits used by the customer during the billing period. - Compare with ACO balance report: Cross-reference the total ACO credits used with the ACO balance report for the same month and customer. This comparison ensures consistency between the credits applied and the balance reported, helping in accurate reconciliation.

Note

The ACO isn't visible in the daily rated usage files or line items. To verify your ACO, use your invoice reconciliation files or line items only.

Reconcile ACO example

Scenario: The customer has $100 ACO, and total Azure charges are $150.

Apply ACO: ACO credits cover $100 of the total charges.

Here's a summary of key fields relevant to ACO in the invoice reconciliation files or line items:

| Field name | Description | Relevance to ACO |

|---|---|---|

CreditReasonCode |

Specifies the type of credit ("Azure Credit") | Identifies credit type for filtering |

ChargeType |

Indicates if the line item is a charge or credit ("customerCredit") | Helps filter credit line items |

CustomerId |

Unique identifier for the customer | Links credits to specific customers |

Total |

Total amount for the line item, negative for credits | Used for summing credit amounts |

EffectiveUnitPrice |

Price after discounts and adjustments | Ensures accurate cost calculation |

Learn how the PEC applies along with ACO in the same billing period

Yes, PEC is applied during the same period that ACO is effective. However, ACO is applied first at 100%, and PEC provides an extra15% credit on any remaining charges.

Reconcile both ACO and PEC for the same billing period

To reconcile Azure credit offer (ACO) and partner earned credit (PEC), it's important to understand the sequence of credit applications. Follow these steps:

- Step 1: ACO credits first: ACO credits are always applied before any PEC reductions. This sequence ensures you understand the order of credit application when both types are available for a customer.

- Step 2: Identify ACO credits:

- Filter the

CreditReasonCodefor"Azure Credit"in the invoice reconciliation line items for theCustomerId. - Sum up all the credit amounts applied under this category for each customer.

- Filter the

- Step 3: Calculate remaining charges: To determine the remaining balance, subtract the total ACO credits applied from the customer's total Azure charges.

- Step 4: Apply PEC reductions:

- Calculate the PEC reductions based on the remaining charges after ACO credits are applied.

- Look for the

CreditReasonCodelabeled"PEC Adjustment for Azure Credit"to identify these reductions in the reconciliation line items.

Here’s a summary key fields relevant to ACO and PEC in the invoice reconciliation line items:

| Field name | Description | Relevance to ACO/PEC |

|---|---|---|

CreditReasonCode |

Specifies the type of credit (like "Azure Credit" for ACO, "PEC Adjustment for Azure Credit" for PEC) | Identifies credit type for filtering |

ChargeType |

Indicates if the line item is a charge or credit ("customerCredit") | Helps filter credit line items |

CustomerId |

Unique identifier for the customer | Links credits to specific customers |

Total |

Total amount for the line item, negative for credits | Used for summing credit amounts |

EffectiveUnitPrice |

Price after discounts and adjustments | Ensures accurate cost calculation |

Reconcile an ACO and PEC credits example

Let's say your total Azure charges are $150, available ACO credit is $100, and PEC reductions are at 15%.

Reconciliation steps:

- Apply ACO credits: ACO credits cover $100 of the total charges. Remaining charges:

$150 - $100 = $50. - Apply PEC: PEC covers 15% of the remaining $50:

15% × $50 = $7.50. - Reconciliation line items:

CreditReasonCode:"Azure Credit"→ $100.CreditReasonCode:"PEC Adjustment for Azure Credit"→ $7.50.- Final charges: $42.50.

By following these steps, you can ensure accurate and efficient invoice reconciliation for customers with both ACO and PEC credits.