Set up sales tax reporting codes

Sales tax reporting codes refer to a field number on a sales tax report. They are used on country or region-specific report layouts and the Sales tax payment by code report to print sales tax amounts for a settlement period that is summarized for each reporting code.

Sales tax must be reported and paid to tax authorities at regulated intervals (monthly, quarterly, and so on). Finance provides functionality that lets you settle tax accounts for the interval and offset the balances to the tax settlement account, as specified in the ledger posting groups. You can access this functionality on the Settle and post sales tax page. Make sure you specify the sales tax settlement period that sales tax should be settled for.

After you create Sales tax reporting codes, you can refer to them on the Report setup FastTab in the Sales tax code page.

This layout is used to filter the available reporting codes for a sales tax code. Each sales tax code belongs to a settlement period that belongs to a sales tax authority that uses a report layout.

After the sales tax has been paid, the balance on the sales tax settlement account should be balanced against the bank account.

If the sales tax authority that is specified on the sales tax settlement period is related to a vendor account, the sales tax balance is posted as an open vendor invoice and can be included in the regular payment proposal.

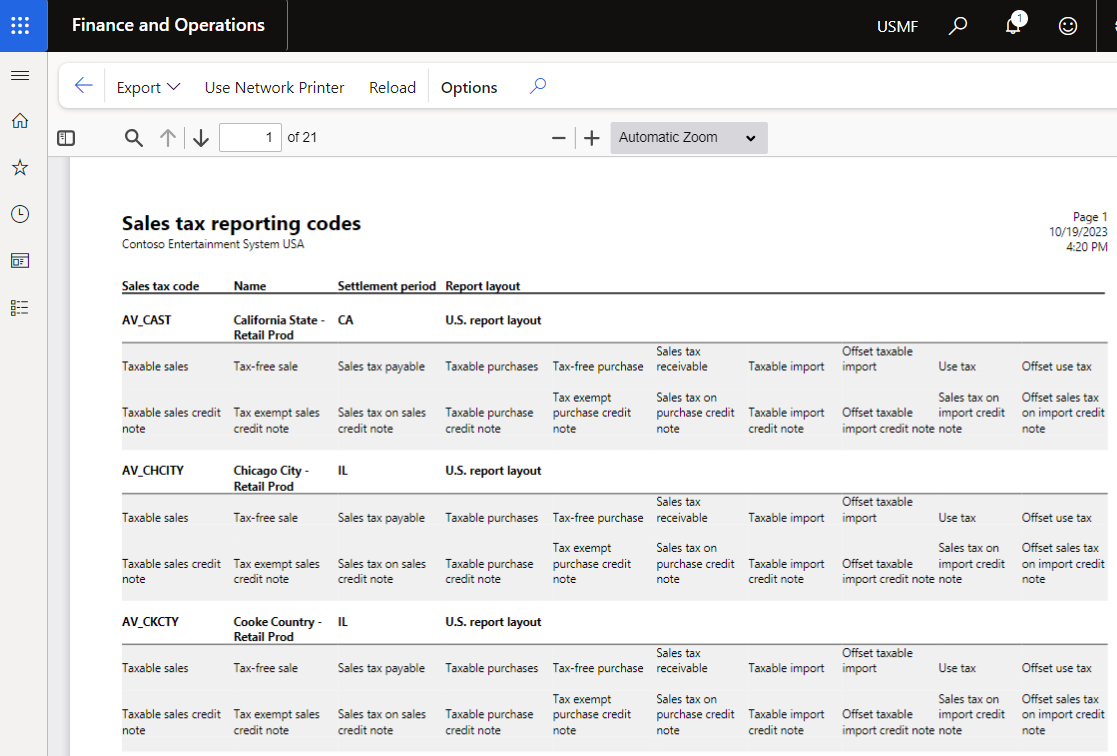

Here is a sample of the Sales tax reporting codes report: