Describe core accounts receivable components

Accounts receivable is money owed to a business by its customers presented as an asset on a company's balance sheet. For example, an electric company that bills customers for electricity after the customer has already received it would record an account receivable until the customer pays.

Customers

When customers buy products or services, you can create customer invoices based on sales orders or packing slips. You can also enter free text invoices that aren't related to sales orders. You can receive payments by using several different payment types. These include bills of exchange, cash, checks, credit cards, and electronic payments. If your organization includes multiple legal entities, you can use centralized payments to record payments in a single legal entity on behalf of the other legal entities.

Customer invoices

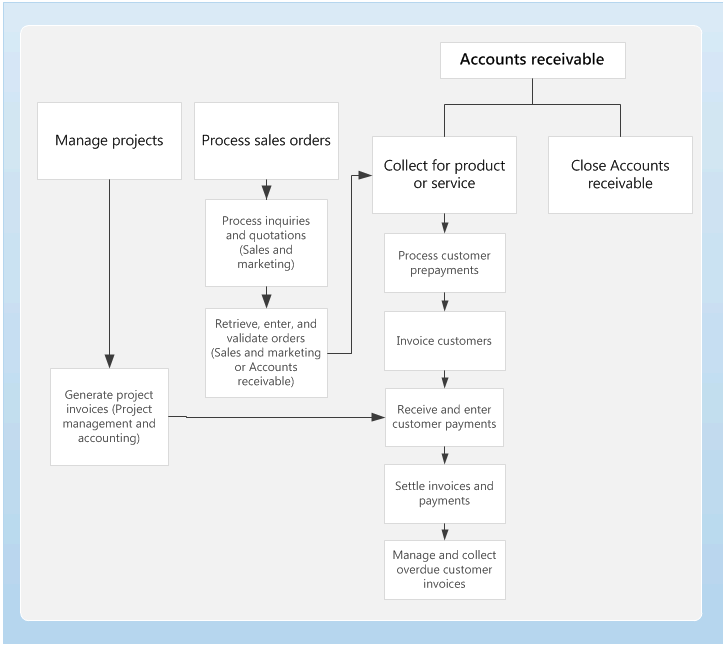

To discuss customer invoices, we must first examine where they fit in with the business processes for Accounts receivable, as depicted in the illustration:

The Manage projects and Process sales orders processes feed into Accounts receivable in different steps of the Collect for product or service process. This process involves the following steps:

Process customer prepayments.

Invoice customers.

Receive and enter customer payments.

Settle invoices and payments.

Manage and collect overdue customer invoices.

Three types of customer invoices are available:

Customer invoices for sales orders

Free text invoices

Pro forma invoices

Customer invoices for sales orders

A customer invoice for a sales order is a bill that is related to a sale and that an organization gives to a customer. This type of customer invoice is created based on a sales order, which includes order lines and item numbers. Item numbers are specified and posted in the ledger.

To learn more about creating customer invoices for sales orders, access the corresponding links in the Summary unit at the end of this module.

Free text invoices

A free text invoice isn't related to a sales order. It contains order lines that include ledger accounts, free-text descriptions, and a sales amount that you enter. You can't enter an item number on this kind of invoice. You must enter the appropriate sales tax information. A main account for the sale is indicated on each invoice line, which you can distribute to multiple ledger accounts by selecting Distribute amounts on the Free text invoice page. Additionally, the customer balance is posted to the summary account from the posting profile used for the free text invoice.

Accounting distributions

Accounting distributions are used to define how an amount will be accounted for, such as how the revenue, tax, or charges are accounted for on a free text invoice. Every amount that must be accounted for when the free text invoice is journalized will have one or more accounting distributions.

You can use the following buttons in the Free text invoice page to view, and possibly change, the accounting distributions for each amount on the free text invoice.

Distribute amounts - View and change the accounting distributions for an individual line and any child lines, such as taxes or charges. You can also view and change the accounting distributions for the child line directly from the Sales tax transactions page or the Charges transactions page.

Change free text invoice header amounts, such as charges or currency rounding amounts.

Change free text invoice line amounts.

View distributions - View the accounting distributions for all lines on the document. You can't change the accounting distributions from this view.

- View header and line amounts.

Pro forma invoices

A pro forma invoice is an invoice that is prepared as an estimate of the actual invoice amounts before the invoice is posted. You can print a pro forma invoice either for a customer invoice for a sales order or for a free text invoice.