Describe periodic financial processes

In Finance, you can complete closing procedures for a period, such as a day, month, or year. Closing processes prepare the system for a new period.

Prepare for financial period close

Each organization has different processes and steps that it performs for the end of a period. Optional steps for period end include:

Settle invoices and payments.

Post all transactions for period end.

Verify that all journals are posted.

Run foreign currency revaluation for the general ledger to generate any unrealized gain or loss amounts.

Run foreign currency revaluation for accounts payable and accounts receivable.

Settle ledger transactions.

Process any required allocations.

Reconcile the subledgers to the general ledger.

Manually post period-end adjustments.

Journalize transactions and review the Ledger journal report.

Perform a consolidation by using a consolidation company or financial reporting.

Generate period-end financial statements by using financial reporting.

Set ledger periods to On hold so that no further posting occurs. For better control, you can also restrict a period to a specific user group while period-end activities are occurring. As a best practice, don't use the Permanently closed status, because you can't reopen a period that has been set to Permanently closed. This status could be used at a much later time.

Financial period close workspace

The Financial period close workspace lets you track your financial closing processes across companies, areas, and people. Depending on the security role assigned to your user profile to view the Financial period close workspace, you'll see either all tasks and statuses for a closing schedule or only the tasks that are assigned to you.

You can find the Financial period close workspace by accessing General ledger > Workspaces > Financial period close. You can use the workspace to organize and track the tasks that are required for various period-end processes.

You must first select a closing schedule at the top of the workspace. All data presented on the workspace is then filtered by the selected closing schedule.

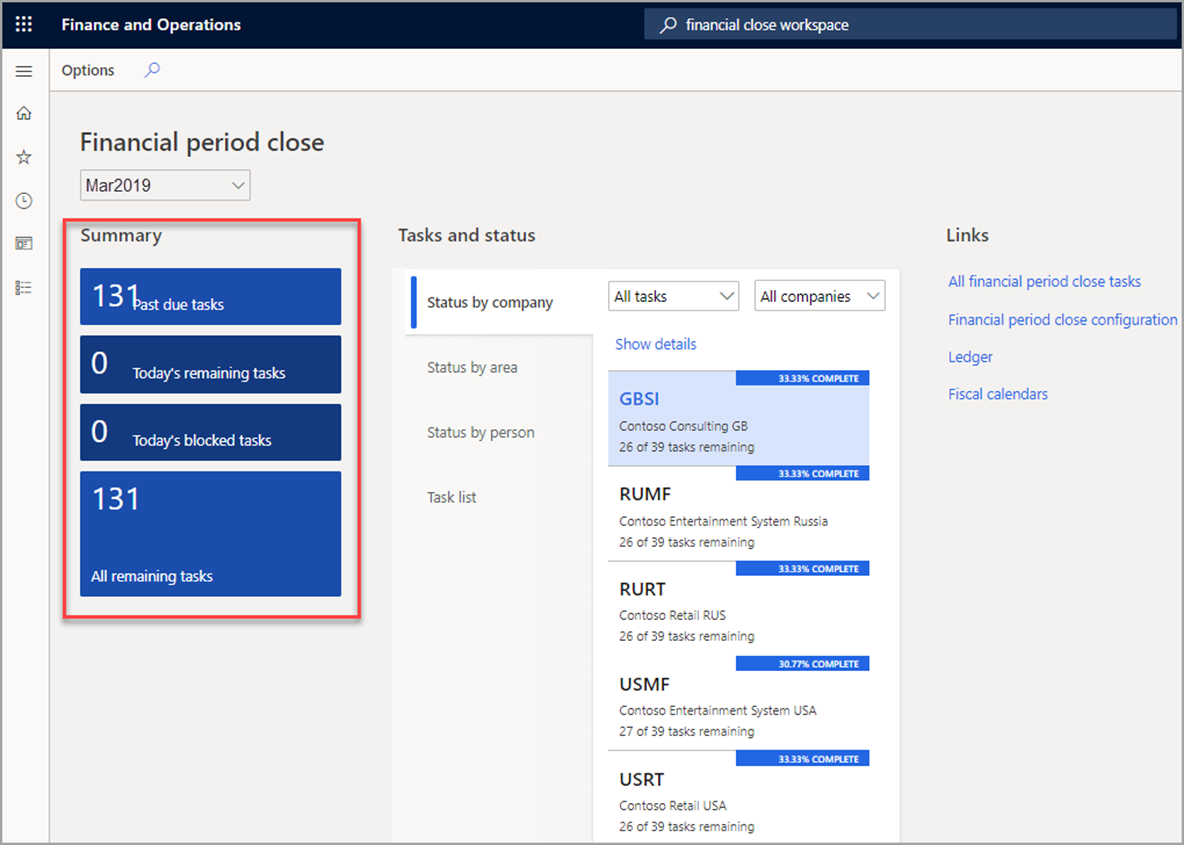

Summary tiles in the workspace, depicted in the following screenshot, provide an overview of the process, and indicators help you keep the closing process on track. They list out the tasks that are past due, remaining tasks for today, tasks that are due today but are blocked because of dependencies, and all remaining tasks for the process. This information is for all companies that are included in the selected closing schedule.

To learn more about configuring the financial period close, access the corresponding link in the Summary and resources unit at the end of this module.

Year-end 1099 reporting

If you do business with vendors that are subject to United States 1099 tax reporting, you must track the amount you pay to each vendor and report that information to the US tax authorities at the end of the calendar year. The vendors are typically individuals who aren't employees and who provide services to your organization. You must also send a statement to each 1099 vendor you do business with, informing them of the amount you're reporting to the tax authorities.

For each vendor that you have set up to be a 1099 vendor, the amounts are tracked within Finance throughout the year. On invoice lines, you can use the 1099 box and 1099 amount fields to track 1099 amounts. Even if you don't enter a value in the 1099 amount field, any payment that is posted for the invoice amount contributes to the 1099 total for the specified 1099 box. If you do enter a 1099 amount, the amount you entered is used instead of the posted payment amount.

Finance can process the 1099-MISC, 1099-DIV, 1099-INT, 1099-S (Proceeds from Real Estate Transactions), and 1099-G (Certain Government Payments) information. You can pay an invoice with 1099-G and 1099-S information and process 1099-G and 1099-S tax statements.

To learn more about Year-end 1099 reporting, access the corresponding link in the Summary unit at the end of this module.

Month-end closing

Let's go through a demo that explains how to process month-end close.

Play this video to learn more about month-end closing.

Process year-end close

At year-end, it's necessary to complete the following tasks:

Make adjustment entries that reflect transactions from the previous year.

Print reports, including financial statements.

Back up data.

Create a new fiscal year, and transfer opening balances.

Create and post a closing sheet

A company might print a trial balance sheet to look for inconsistencies and make any adjustments necessary before closing the period. To make adjustments in Finance, you can perform either of the following tasks:

Make typical journal entries, depending on adjustment.

Use the Closing period adjustments page.

Consider the following information when you use the Closing period adjustments page:

It presents an advanced view of the balances on accounts, and you can perform year-end postings directly from it.

The postings to the page typically occur in the closing period of the fiscal year.

You can create several specific closing sheets (for revenue, expenses, balance accounts, and so on) and then load the balances from the General Ledger into the closing sheet. After you load the transactions, make transfers from one account to another.

It resembles a journal, because you can create as many new closing sheets as needed, and you can post several lines of entries.

It's not possible to make transactions to the Opening period in a closing sheet; use the Opening option only for a beginning balance transaction. You can make adjustments, however, to the regular period(s) and to the closing period(s). Usually, this field is set to Closing.

Which columns are populated depends on the Close option that is selected when you set up each account in the chart of accounts.

Post the closing period adjustment

After you complete the necessary transfers or adjustments, select the Post button to post the closing period adjustment. The closing period adjustment only posts to the closing period.

At this time, you should also run reports and verify results before closing the period and transferring ending balances into the new year as opening balances.

To post the closing sheet, open the closing period on the Periods page. After you post the closing sheet, ensure that you change the period back to On hold.

Financial reporting

Reporting allows users to create, maintain, deploy, and view financial statements. It moves beyond traditional reporting constraints to help you efficiently design various types of reports.

Financial reporting includes dimension support to determine which financial dimensions you want to include, and the sequence, and it enables you to build a custom reporting structure.

You can map the following to gain better insight of financial data:

Main accounts

Financial dimensions

Combinations of the two

For example, you can create financial row structures to focus on cost accounts. You can set up unlimited financial dimensions that allow for cost detail. The following financial dimensions are examples that might be associated with cost accounts:

Cost centers

Departments

Combinations of the two

To learn more about financial reporting, access the link in the Summary and resources unit at the end of this module.

Year-end close

At the end of a fiscal year, you must run the year-end close process to transfer opening balances to the new year. Most companies run the year-end close process multiple times. The first time would be to move the balances into the new fiscal year. The year-end close can then be run again, as many times as required, to move the balances from adjusting entries into the new fiscal year.

Two types of possible transactions are created during the year-end close process. An Opening transaction is always generated and is used to create the opening balances in the new fiscal year. The Opening transaction presents the balance sheet ledger account balances in the new fiscal year and balances from the profit and loss ledger account balances in the retained earnings ledger account in the new fiscal year. The Closing transaction is optionally created to bring the balances of the profit and loss accounts down to zero in the fiscal year that is being closed.

For guidance on how the year-end close process is configured and run, access the corresponding link in the Summary and resources unit at the end of this module.

Perform financial consolidation

In a consolidation, it's possible to gather transactions from several company accounts into a single set of company accounts. You can print reports, such as financial statements, from the consolidation company, but you can't use this company for daily transactions.

Before you perform a consolidation at the close of a period, ensure that the period-closing preparatory activities are performed, but don't close the subsidiary accounts until the consolidation is complete.

You can consolidate data from companies with databases that are external to the consolidation company database, or you can consolidate data from companies in the same database, a so-called "online" consolidation.

Consolidations don't necessarily require that you set up the consolidation company in advance. However, if you want to use the consolidation conversion principles to convert subsidiary data in foreign currencies, you must set up the consolidation company main accounts.

To prepare a consolidation company (the company that collects the results and balances of the subsidiaries), you should have a legal entity created with the Use for financial consolidation process option enabled. Like any other legal entity, you should complete the General ledger module configuration for the consolidation company.

To learn more about configuring the General ledger module, access the corresponding link in the Summary unit at the end of this module.

After you complete the setup process in the consolidation company, you can focus on the subsidiary company. The amount of setup that is needed in a subsidiary depends on how closely the chart of accounts and dimensions for the consolidation company and subsidiary are aligned.

Consolidation can be performed by using a shared or blank chart of accounts.

To learn more about intercompany consolidation, access the corresponding link in the Summary and resources unit at the end of this module.

Intercompany eliminations

Elimination transactions are required when a parent company conducts business with one or more subsidiary companies and uses consolidated financial reporting.

Some transactions that occur between the companies must be eliminated because consolidated financial statements must only include transactions that occur between the consolidated entity and the other entities that are outside the consolidated group. Because of this requirement, transactions between a parent company and its subsidiary companies must be removed or eliminated.

Predefined elimination rules create elimination transactions in a company that is specified as the destination company for eliminations. You can generate the elimination journals during the consolidation process or by using an elimination journal proposal.