Introduction - Prepare for the VAT rate change

With the VAT Rate Change tool in Microsoft Dynamics 365 Business Central, you can perform VAT and general posting group conversions. The tool enables you to change VAT rates to maintain accurate VAT reporting.

Countries or regions can apply VAT rate changes for different reasons. A higher VAT rate can be a fiscal measure to increase the earnings of a country or region. Conversely, lowering the VAT rate is, in most cases, a measure to boost economics. The new VAT rate always applies from a specific date forward, meaning that from that date forward, the new VAT rate should be used in documents and journals.

Before setting up the VAT Rate Change Tool, make the following preparations:

Create new posting groups.

Separate different VAT rates into different groups.

Reduce the number of documents that are converted.

Create new posting groups

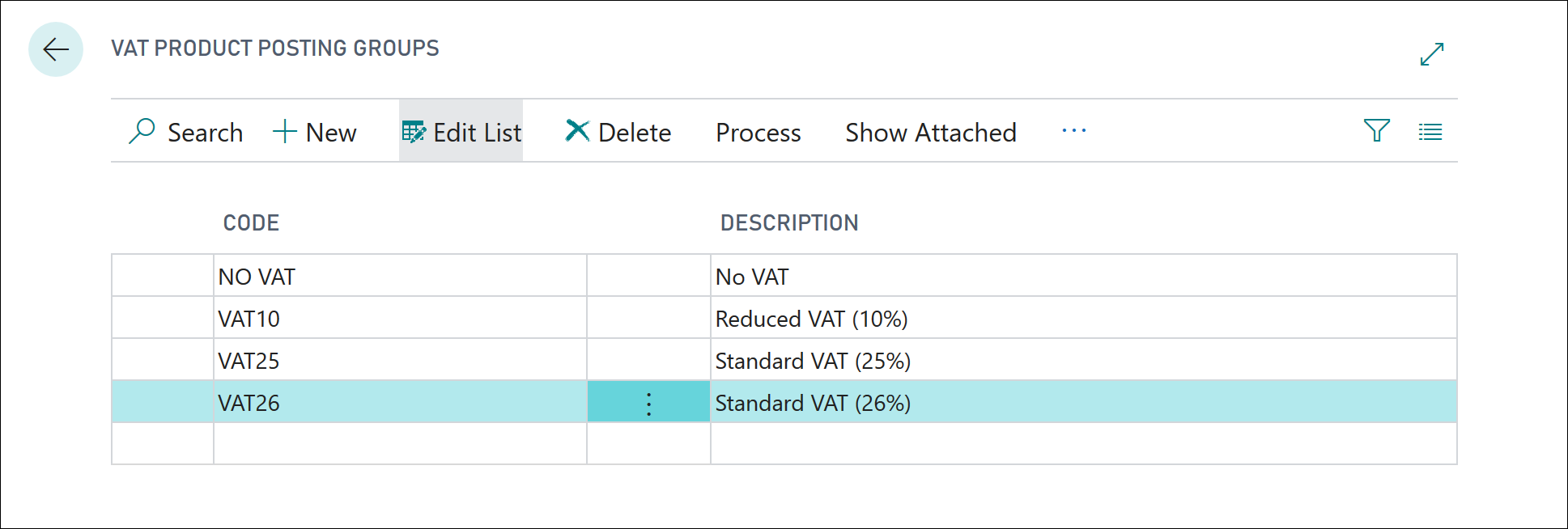

Business Central calculates VAT by combining the VAT business posting group and the VAT product posting group. When a VAT rate changes, a new VAT product posting group is required to set up the new VAT rate in the VAT posting setup.

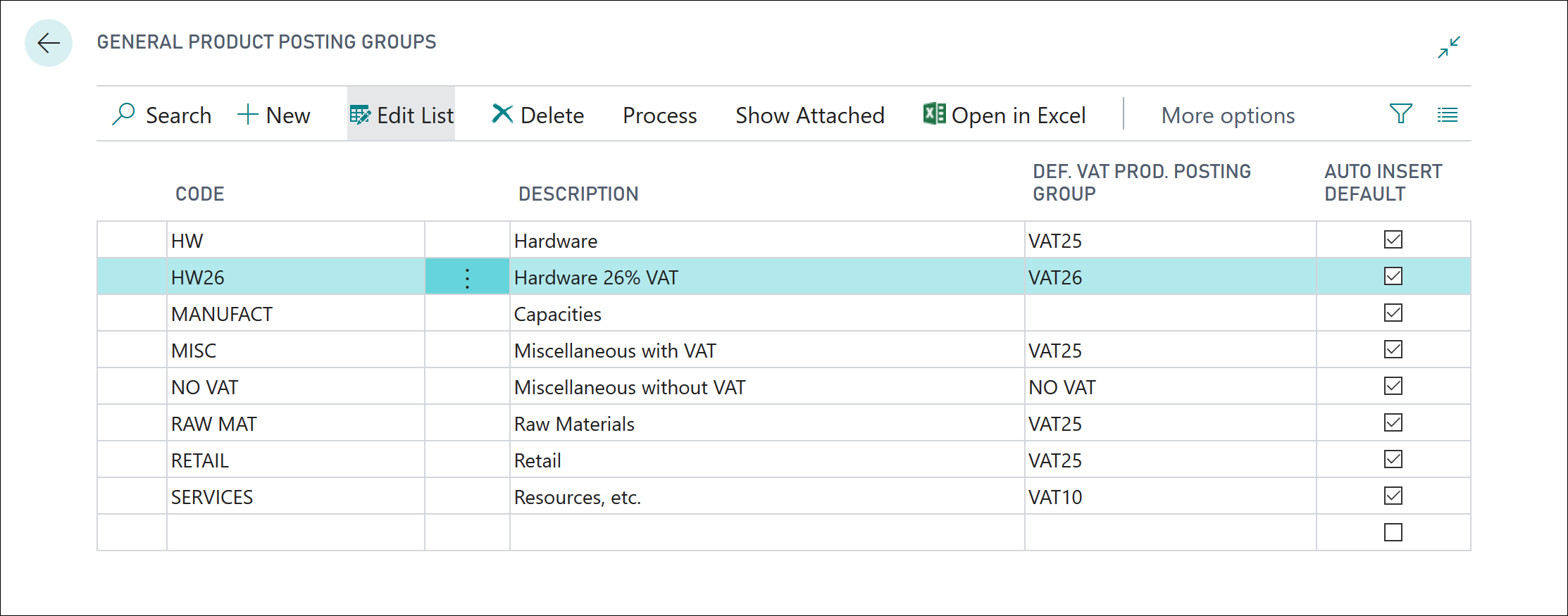

The general product posting group codes determine posting according to the type of item and resource that is being purchased or sold. To update master data such as items and resources, you must create a new general product posting group.

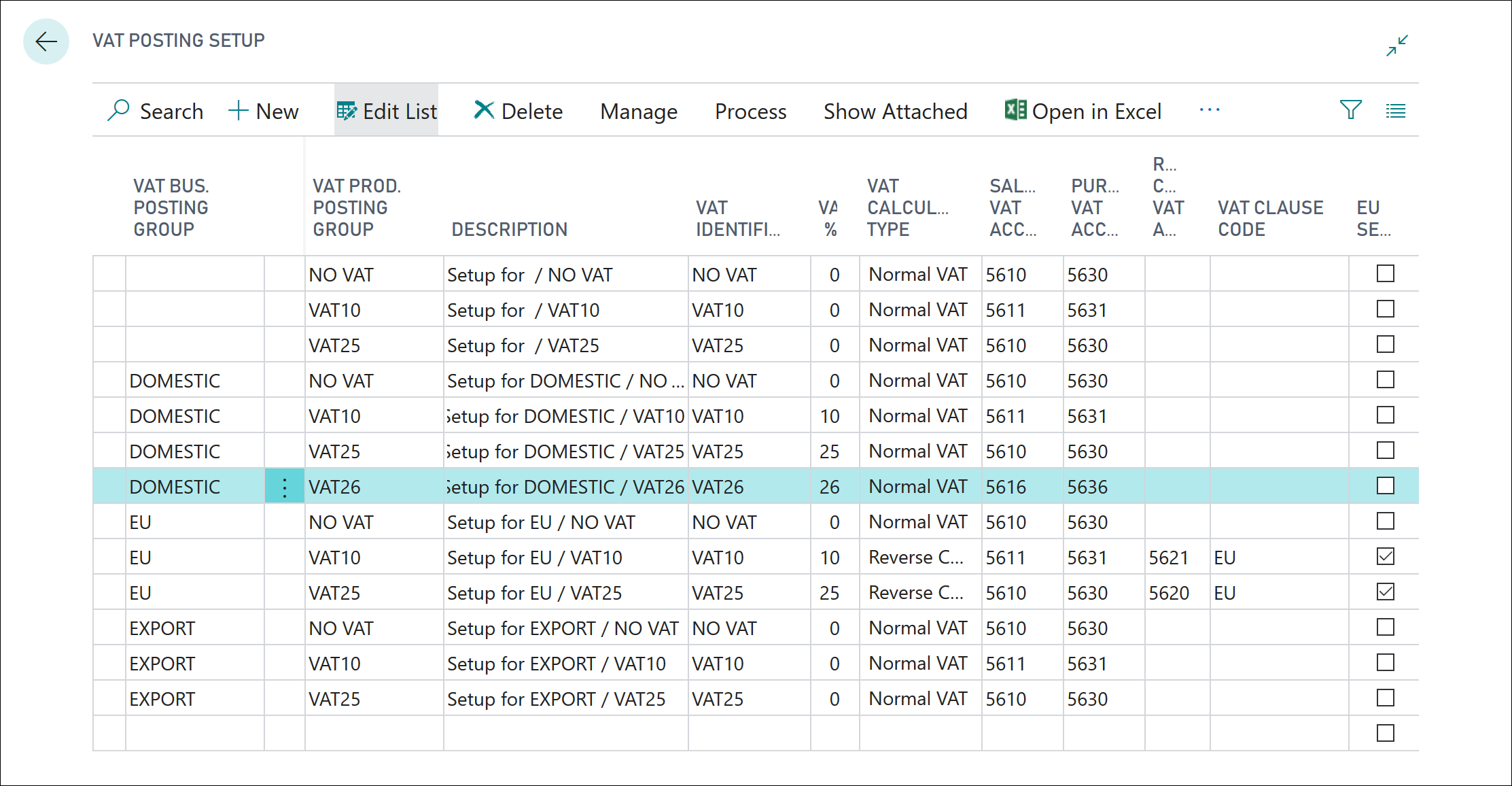

Create posting setup lines for the new product posting groups

Now, you must create new posting setup lines for the new product posting groups (for both VAT and general product posting groups). If you need additional details on how to create VAT posting setup lines, you can review the Set up VAT in Dynamics 365 Business Central module in this learning path.

Separate VAT rates into different groups

If you have transactions that use different rates, then they must be separated into different groups either by creating new general ledger accounts for each rate or by using data filters to group transactions according to rate.

With different types of transactions that are posted on a single G/L account, after a VAT rate change, different VAT rates might be used for one G/L account. Essentially, you must change the VAT product posting group on the journal line or document line before posting. This approach is not necessary when you create new G/L accounts for each VAT rate.

Reduce the number of converted documents

To reduce the number of documents that are converted, you can post as many documents as possible and reduce unposted documents to a minimum.

When you use that approach, consider the capabilities of the VAT rate change tool:

Sales Orders - If an order is fully or partially shipped, the shipped items keep the current general product posting group and VAT product posting group. The system creates a new order line for the unshipped items. This new order line is updated to align current and new VAT or general product posting groups. In addition, item charge assignments, reservations, and item-tracking information are updated accordingly.

Purchase Orders - This capability is similar as sales orders, but for received or partially received purchase orders.

Prepayments - Documents that have posted prepayment invoices are not converted by the VAT Rate Change Tool. Therefore, a difference might occur between the VAT that is due and the VAT that was paid in the prepayments when the invoice is completed. The VAT Rate Change Tool skips these documents, and you will be required to manually update them.

Drop Shipments and Special Orders - Drop shipments and special orders are not converted by the VAT Rate Change Tool.

Warehousing - Sales or purchase orders with warehouse integration are not converted by the VAT Rate Change Tool if they are partially shipped or received.

Service Contracts - Service contracts are not converted by the VAT Rate Change Tool.