Costing versions

The primary purpose of a costing version is to contain cost records about items, cost categories, and cost prices. The costing version determines current active costs and the way that the bill of materials (BOM) calculation simulation is performed.

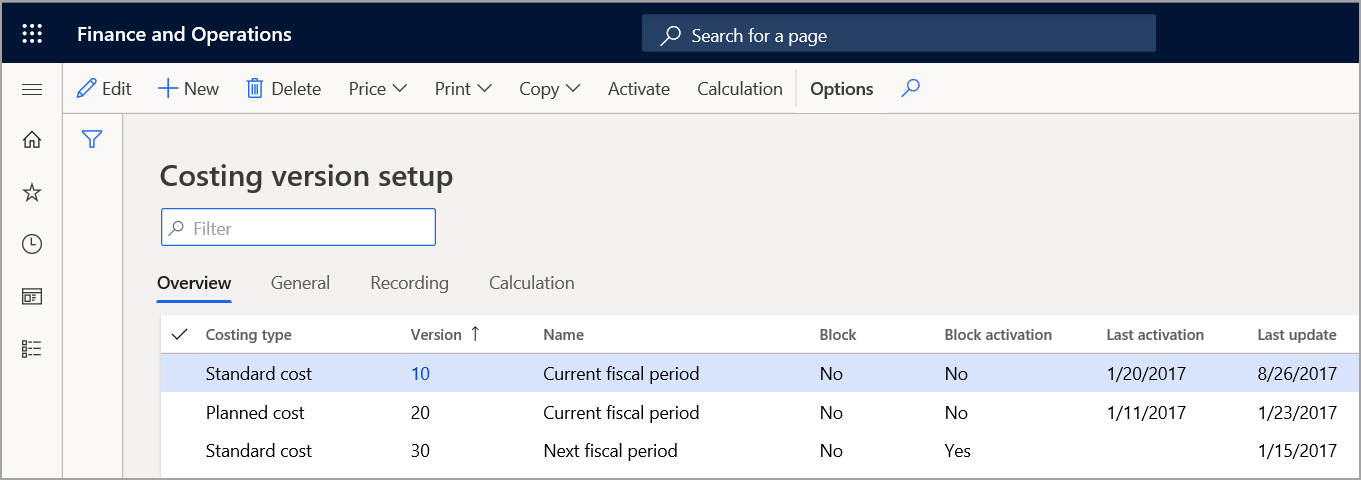

Cost management > Predetermined cost policies setup > Costing versions

A costing version can serve one or more purposes, depending on the data that the costing version contains. A costing version can contain a set of standard cost records or a set of planned cost records that are based on the costing type that is assigned to the costing version.

Standard costs

A costing version can support a standard cost inventory model for items, where the costing version contains a set of standard cost records about items and manufacturing processes.

Cost data about manufacturing processes is expressed in terms of the cost categories for routing operations, the rates, and in surcharges for manufacturing overheads.

For more information on setting up prerequisites for standard costing, see Prerequisites for standard costs overview.

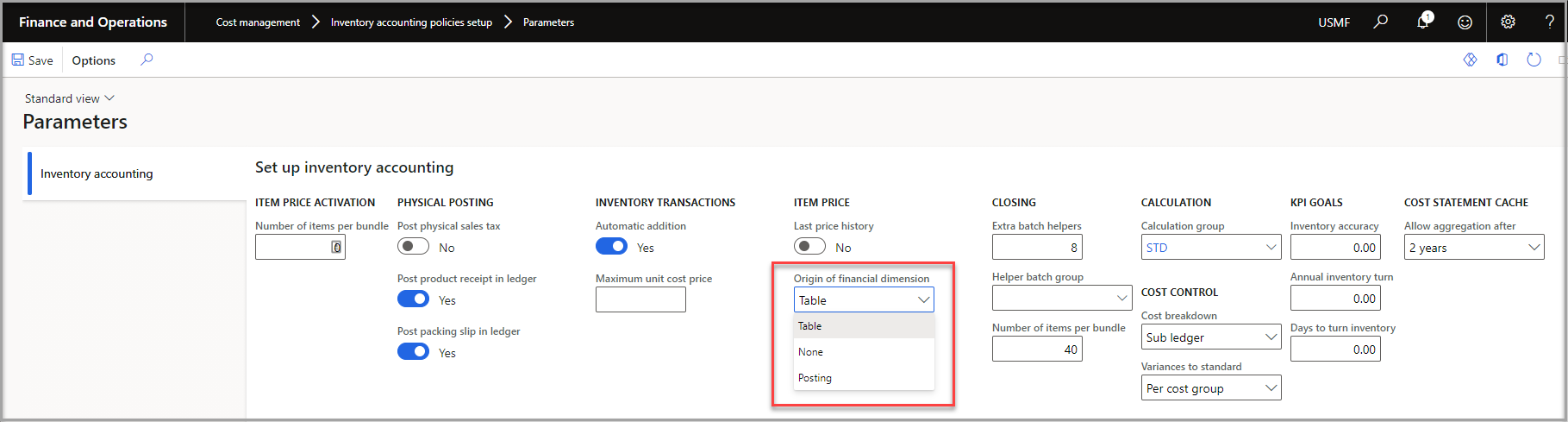

Financial dimensions for the standard cost revaluation

A Standard cost revaluation voucher is generated when activating a new standard cost. Typically, when transactions for an item are posted, the financial dimensions on the transactions come from the item. However, you can control how transactions and financial dimensions are posted using the Options of defaulting financial dimensions for inventory standard cost revaluation feature. This feature must be enabled in the Feature management workspace by your administrator.

When the feature is enabled, you can define how financial dimensions are posted by following these steps:

Go to Cost management > Inventory accounting policies setup > Parameters.

Set the Origin of financial dimension drop-down list to one of the following values:

- None – No financial dimensions are posted on the revaluation transactions.

- Table – The financial dimensions of the item are posted on the revaluation transactions. This is the default setting and is consistent with the original system behavior without turning on the Options of defaulting financial dimensions for inventory standard cost revaluation feature .

- Posting – The financial dimensions of the transaction that is being revalued are posted on the revaluation transactions. By default, the financial dimensions from the original transaction's inventory account will be used for both the inventory account and revaluation account.

Planned costs

A costing version can contain a set of planned cost records about items and manufacturing processes. A costing version that contains planned costs is often used to support cost calculation simulations, such as simulations of the effect that cost changes to purchased materials or manufacturing processes have on the calculated costs of manufactured items. You can also use item cost records for planned costs to support an actual cost inventory model by providing the initial values for item costs. These values include the calculation of planned costs for manufactured items.

By accessing the Recording tab on the Costing Versions page, you can define a default site and also turn on or off the ability to use the costing version for purchase price, cost price, and sales price. In this example, costing version will be used for Costing.

The Explosion mode in a costing version determines how the levels in a BOM affect the cost calculation.

You can select one of the following explosion modes:

Multilevel - The calculated cost reflects a complete recalculation. Each sub-BOM is calculated instead of just taking its current cost.

Make to order - Resembles Multilevel (a complete recalculation), except that the specified quantity is used to amortize constant costs.

Single level - The standard costing version is restricted to a single level, which ensures accurate and consistent calculation of standard costs. For this explosion mode, the calculated costs of first level manufactured components are applied.

According to BOM line type - The calculation depends on the BOM line type. For example, if the type is Item, the current cost is taken.

Enter costs

Data maintenance for cost records in a costing version involves entering costs for purchased items and for items that are transferred between sites. Additional data maintenance for manufacturers involves entering costs for cost categories that are associated with routing operations, entering rates and surcharges for the indirect costs that reflect manufacturing overhead, and calculating costs for manufactured items.

The item cost data in a costing version consists of one or more cost records for each item. When an item cost record is first entered, it has a Pending status and an intended From date.

When you activate the item cost record, the status is updated to Active, and the effective date is updated to the activation date. Different item cost records can reflect different sites, effective dates, or statuses.

When you calculate costs for manufactured items for a future date, the bill of materials (BOM) calculation uses cost records that have the relevant effective date, regardless of whether the status is Pending or Active.

Supply Chain Management tries to find prices/costs in the current version (Pending or Active). If you have set up a fallback version, it will either fall back to current active prices or fall back to a specific costing version to calculate the costs.

An item's current active cost record is used to estimate production order costs and to value inventory transactions under a standard costing inventory model. The maintenance of cost records for cost categories and indirect cost calculation formulas resembles the maintenance of item cost records.

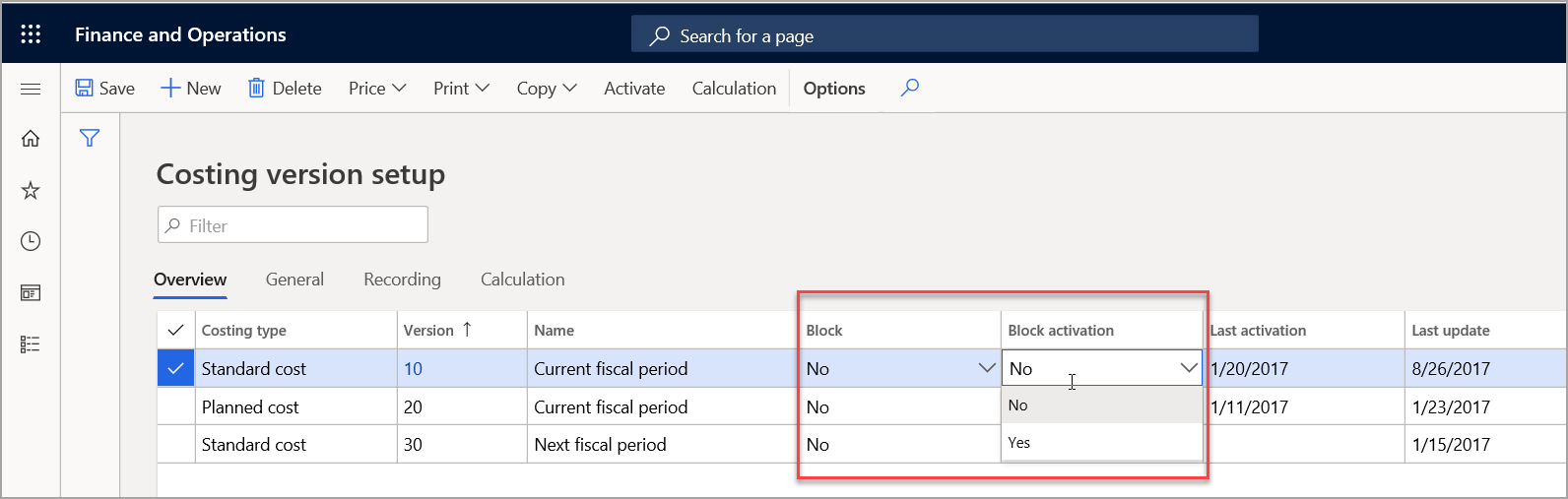

Two blocking policies for a costing version determine whether pending costs can be maintained and whether the pending cost can be activated. Use the blocking policies to permit data maintenance, and then use them to prevent data maintenance for cost records in a costing version. After you have agreed on prices and costs with your vendors, set the Block and Block activation fields to Yes to avoid accidental changes.

A costing version can also contain data about item cost, sales prices, or purchase prices for the purposes of using the Calculate item costs feature. An item that is purchased and stocked needs a purchase price so that the Calculate item costs feature can calculate the cost.