Costing sheets

A costing sheet is the formatted display of information about the cost of goods that are sold for a manufactured item or a production order.

Setting up the costing sheet involves two tasks:

Defining the format for displaying cost of goods sold information about a manufactured item or production order. The formatted display is termed a costing sheet.

Defining the basis for calculating indirect costs. The costing sheet setup builds on the cost group feature for displaying information and for the indirect cost calculation formulas. The two objectives of the costing sheet setup are described in this article.

Cost management > Indirect cost accounting policies setup > Costing sheets

When setting up a costing sheet, you can define the format for the information and also define the basis for calculating indirect costs. The costing sheet setup builds on the cost group features for displaying information and for the formulas that are used to calculate indirect cost.

Define the format for the costing sheet

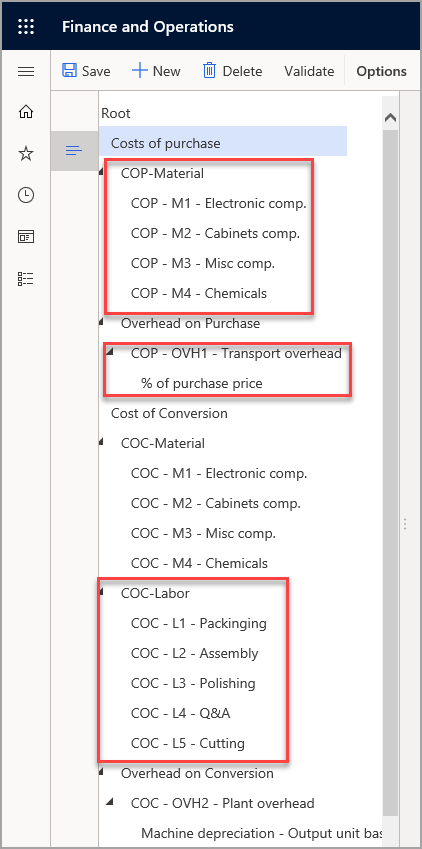

The user-defined format for a costing sheet identifies the segmentation of costs that contain a manufactured item's cost of goods sold.

For example, the information about an item's cost of goods sold can be segmented into material, labor, and overhead, based on cost groups. These cost groups are assigned to items, cost categories for routing operations, and indirect cost calculation formulas.

The format for the costing sheet typically requires intermediate totals when multiple cost groups have been defined. For example, multiple cost groups that are related to material can be aggregated. The definition of a costing sheet format is optional, but a costing sheet format must be defined if indirect costs will be calculated.

The costing sheet defines the format for displaying the cost information of a manufactured item and the elements to be included in the calculation of manufacturing overhead.

Each level in the costing sheet consists of a node that is composed of totals and subtotals. The totals and subtotals are based on the cost group list. The three types of nodes are:

- Root nodes

- Parent nodes of the Price type

- Child nodes of the Cost group and Total types

A node of the Cost group type that is associated with an indirect cost group must be calculated.

When you select a Cost group type as a node, you can add subnodes such as Rate and Surcharges and then define surcharge percentages and rate amounts.

Analyze inventory costs

Inventory costs can be viewed and analyzed in Microsoft Dynamics 365 Supply Chain Management by accessing Inventory accounting and Manufacturing accounting from the Cost administration and Cost analysis workspaces. Depending on the inventory costing method that you select for a product, the selection could have a significant impact for various aspects of a business, including inventory valuation, recorded profits from manufacturing and sales, and the pricing change and management process.

The cost management tools and costing sheets in Dynamics 365 Supply Chain Management can be configured to calculate the costs of material consumption and production for finished goods. Costing sheets can incorporate routing costs, add surcharges and other indirect costs or be setup by cost categories for summarizing, analyzing, and evaluating cost data so they can make the best possible decisions for price updates, budgets, and cost control.

Inventory Valuation: The inventory costing method directly affects how the value of inventory is determined. Different costing methods, such as First-In-First-Out (FIFO), Last-In-First-Out (LIFO), and Weighted Average Cost, can result in different inventory valuations. These valuations impact financial statements and provide insights into the company's asset value, financial health, and potential tax obligations.

Recorded Profits: The choice of inventory costing method influences the profits recorded on the manufacture and sale of products. By using different costing methods, businesses can alter the allocation of costs to inventory and cost of goods sold. Consequently, this affects the calculation of gross profit margins, net income, and overall profitability. The selection of an appropriate costing method is crucial in accurately reflecting the financial performance of a company.

Pricing Change and Management Process: Inventory costing methods also play a role in managing and adjusting product prices. The costing method chosen affects how costs are assigned to inventory, which can impact the determination of the cost basis for pricing decisions. Changes in costs, such as fluctuations in raw material prices or production expenses, need to be reflected in the pricing strategy. The selected costing method can influence the accuracy and efficiency of price adjustments, ensuring that they align with the cost structure of the inventory.

The selection of a costing model for an item has minimal impact on the overall performance of the system. However, the inventory close model selected, may have adverse effects to the time required to run the inventory close or recalculation process. For example, if you use moving average or standard cost, the inventory close process may have minimal impact on the system, because it doesn't update each inventory transaction or create settlements. Different costing models, such as First-In-First-Out (FIFO), Last-In-First-Out (LIFO), or Weighted Average Cost, have distinct calculation methods for determining the cost of goods sold and inventory valuation which consist of calculations that may involve retrieving historical data, performing calculations based on specific rules, or considering the order in which inventory items were received or sold.

The close process can be longer when you enter a high number in the Maximum number of iterations allowed per item field or a low number in the Minimum amount allowed field for the Close inventory process.

View inventory statement and KPI by cost object

The demo data company used to create this procedure is USMF. This procedure is intended for the cost controller.

Select Cost administration.

Select Released products.

Use the Quick Filter to find records. For example, filter on the Item number field with a value of d0005.

Select Manage costs on the Action Pane.

Select Cost objects.

Select Inventory statement and KPIs.

Select the From date field and enter a date.

Select the To date field and enter a date.

Define the basis for calculating indirect costs

Indirect costs reflect manufacturing overhead that is associated with the production of a manufactured item. An indirect cost calculation formula can be expressed as either a surcharge or a rate.

A surcharge represents a percentage of value, whereas a rate represents an amount per hour for a routing operation. A cost group defines the basis for the calculation formula, such as a 100-percent surcharge for a labor cost group or a USD 50.00 hourly rate for a machine cost group.

If you want to define a calculation formula and its cost group basis, the costing sheet setup requires that you identify the cost group that represents the overhead and then select whether a surcharge or rate approach is used.

Each calculation formula must be entered as a cost record. The cost record consists of a specified costing version, a surcharge percentage or a rate amount, the cost group basis, a status, and an effective date.

When a cost record is first entered, it has a Pending status and an effective date. When you activate the cost record, the status is updated so that the record is the current active record and the effective date is updated to the activation date. The cost record can also specify a site for a site-specific calculation formula.

Alternatively, you can leave the Site field blank to indicate that the calculation formula is a company-wide formula. The cost record can optionally consist of a specified item or item group when the calculation formula has been selected as a per-item formula.

The current active cost records for indirect cost calculation formulas are used to estimate production order costs. They are also used to calculate actual costs that are related to actual consumption of time and material. Pending cost records are used in bill of materials (BOM) calculations for a future date.

Two blocking policies for a costing version determine whether pending costs can be maintained and whether the pending cost can be started. Use the blocking policies to permit data maintenance and to prevent data maintenance for the cost data in a costing version.

After you have defined the costing sheet format and calculations for indirect costs, perform a separate step to validate and save the information. The costing sheet represents a company-wide format for consistently displaying information about the costs of goods sold.

The costing sheet is displayed as part of the Calculate item cost page. The costing sheet can be displayed for a manufactured item's calculated cost record on the Item price page or for an order-specific calculation record on the BOM calculation results page. It can also be displayed as part of the Price calculation page for a production order.

Watch the following demonstration about how to work with the costing sheet in Supply Chain Management.

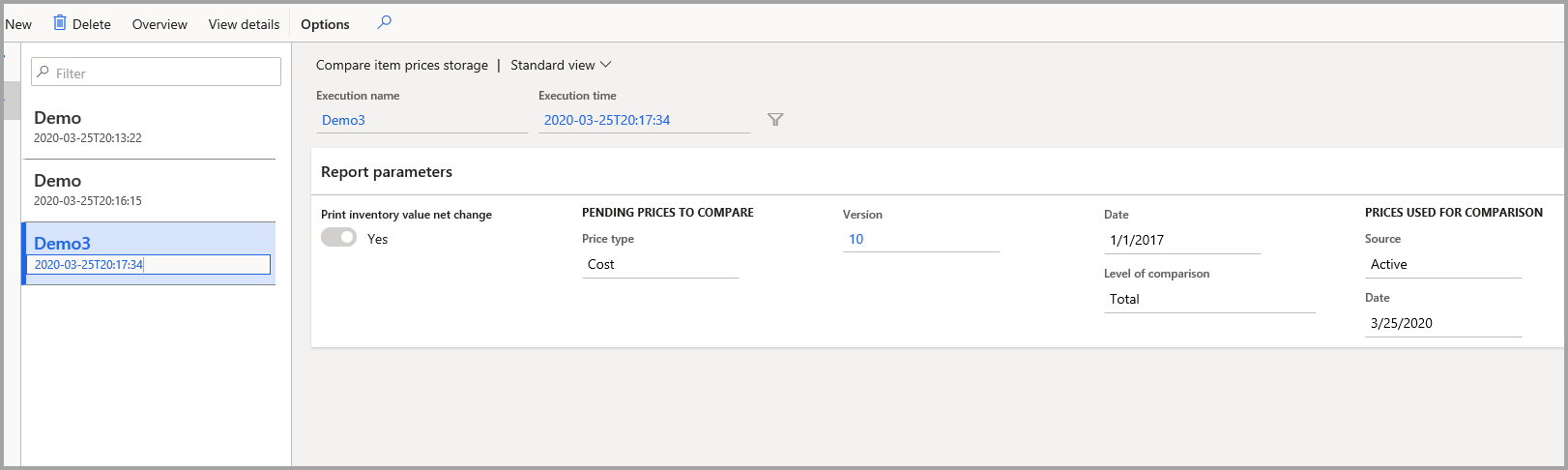

Compare item price storage

The Compare item price storage functionality will, for example, compare the current active standard cost against next year's pending standard cost. It could be for over 50,000 items and the details can be filtered by product, site, and cost group.

When the report is generated, you provide a unique name for that report, which it can be re-viewed at any time. Each report will have a configuration, which you can set at Cost management > Inquiries and reports > Predetermined cost reports > Compare item prices storage:

The details report you see below can filter and sort the results. The key calculation is the Net change unit price. The page will dynamically adjust columns and you can drill down to the Calculation details. In addition you can include various product dimensions on the form.