Advance Payments localization for Czech (extension) (Czechia)

Important

This content is archived and is not being updated. For the latest documentation, go to What's new and planned for Dynamics 365 Business Central. For the latest release plans, go to Dynamics 365 and Microsoft Power Platform release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Users, automatically |  Sep 1, 2021

Sep 1, 2021 |

Oct 1, 2021

Oct 1, 2021 |

Business value

The Advance Payments module helps companies meet regulatory requirements for registration and posting advanced payments (prepayments) include VAT requirements in the Czech Republic.

Feature details

Use the Advance Payments module to create invoices and make payments before goods or services are delivered.

With the Advance Payments functionality, you can receive advance invoices from suppliers, issue advance invoices to customers, make advance payments including payments subject to VAT, and include advance payments on receipts. It also provides relevant tax documents that are required by legislation, and outputs for financial statements and VAT reports.

The module includes the following documents:

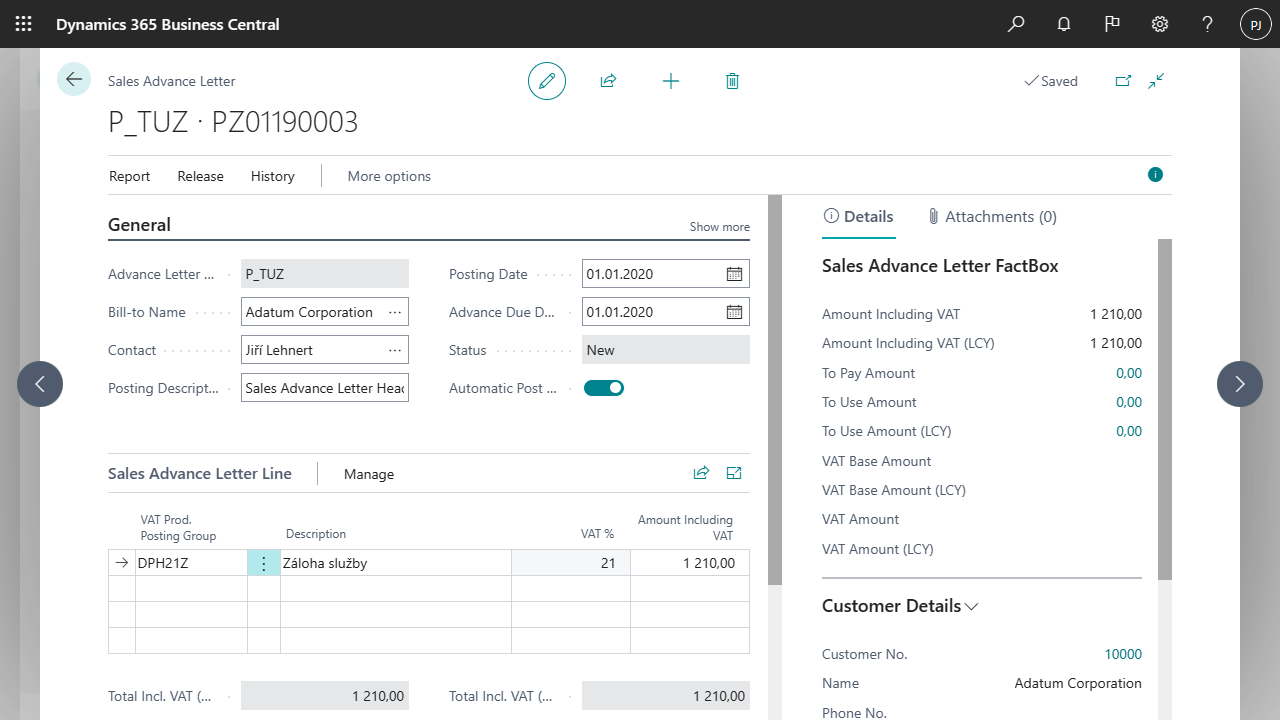

- Sales and purchase advance invoices.

- Advance payments received and issued.

- Tax documents and tax credit notes for advance payments received or issued.

Main functions of the module:

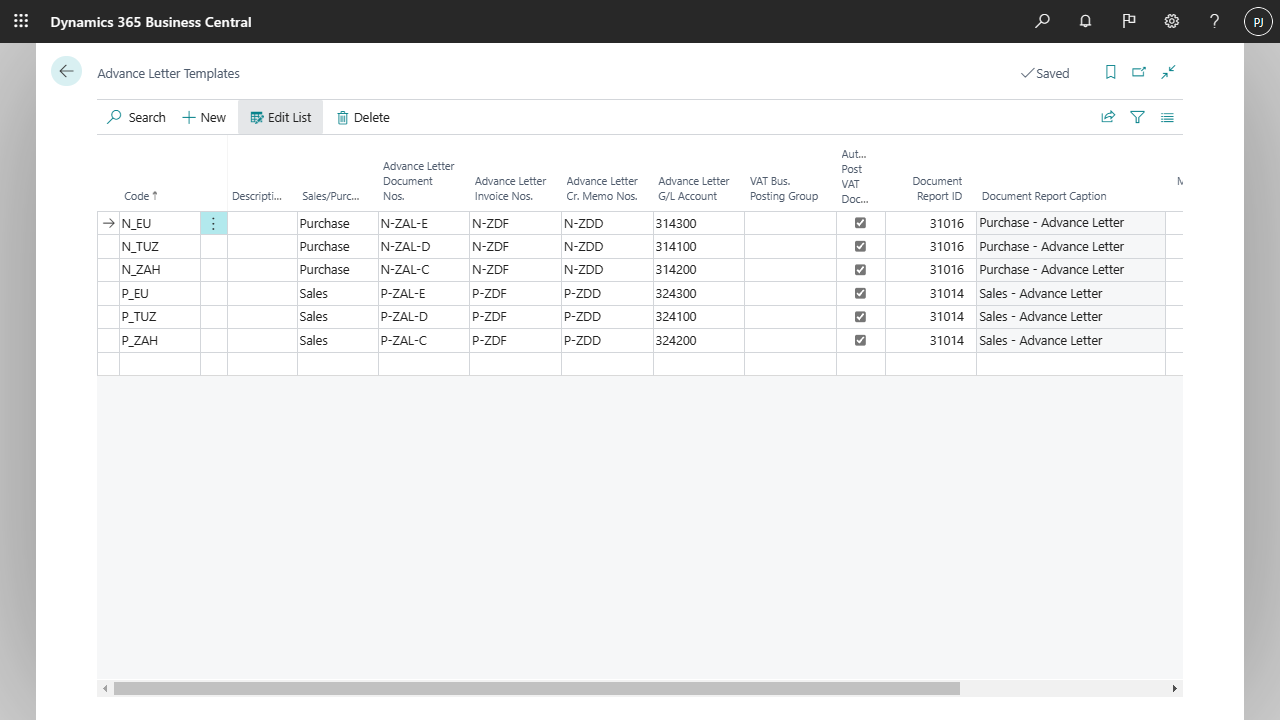

- Create sales or purchase advance invoices according to the settings in the Advance Payment Templates page.

- Create advances from sales orders based on a percentage or amount entered.

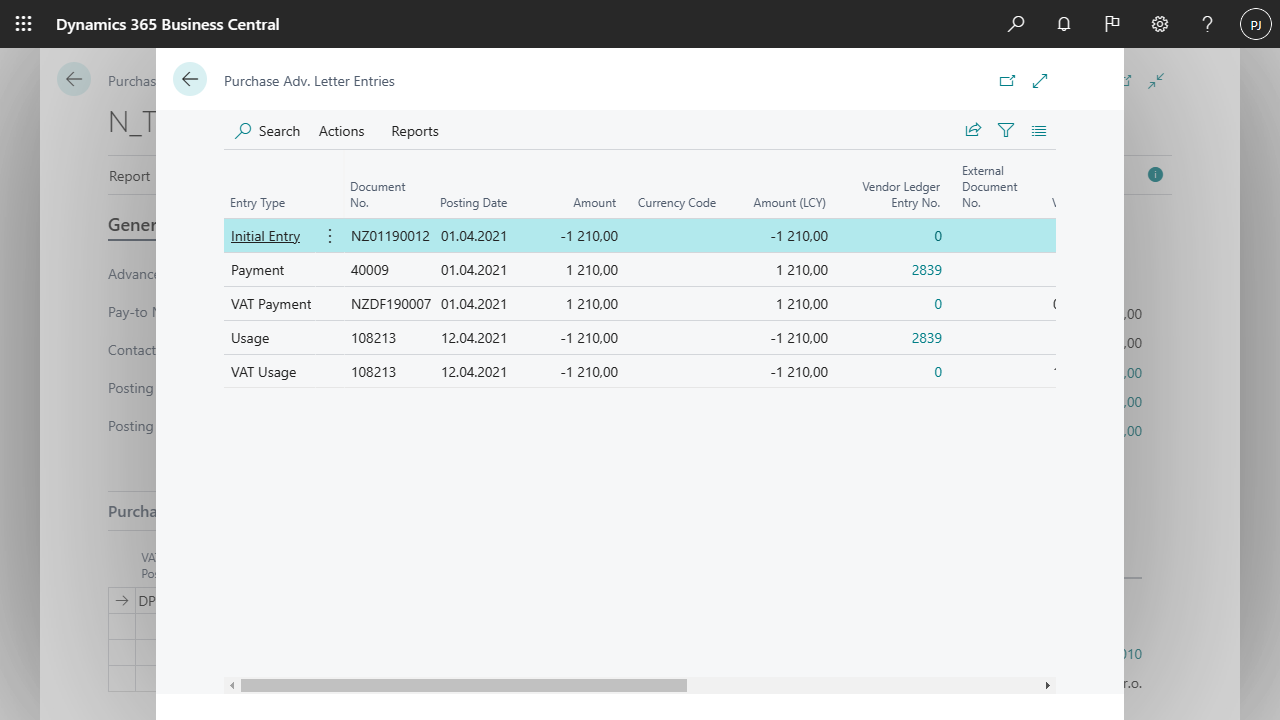

- Proposing advances into a payment order and, on the other side, payment of advances by the bank.

- Connect to the Cash Desk module to pay advances by cash.

- Issue and print advance tax documents for advance payments automatically or manually.

- Manage the use of paid advances by the final invoice.

- Close unused advances including a tax settlement.

- Manage exchange rate differences between the advance payment and invoice when you work with foreign currencies.

- Unassign payment to an advance invoice or additional linking.

- Unlink the final invoice from an advance payment or additional linking.

- Reports for recapitulation of payments and drawdown of advances, reports for recapitulation of VAT on advances.

Tell us what you think

Help us improve Dynamics 365 Business Central by discussing ideas, providing suggestions, and giving feedback. Use the forum at https://aka.ms/bcideas.