Introduction - Set up VAT posting groups

Value-added tax (VAT) is a transaction tax that is paid by the end consumer, including businesses.

The following table provides descriptions of the two VAT posting groups and where they are assigned to.

| VAT posting group | Description | Assigned to |

|---|---|---|

| VAT business posting group | Specifies whom is being sold to (customers) and whom is being purchased from (vendors). | Customers, Vendors, G/L Accounts |

| VAT product posting group | Specifies what is being sold (items and resources) and what is being purchased (items). | Items, Resources, G/L Accounts, Item charges |

Combinations of VAT business and product posting groups are specified on the VAT Posting Setup page.

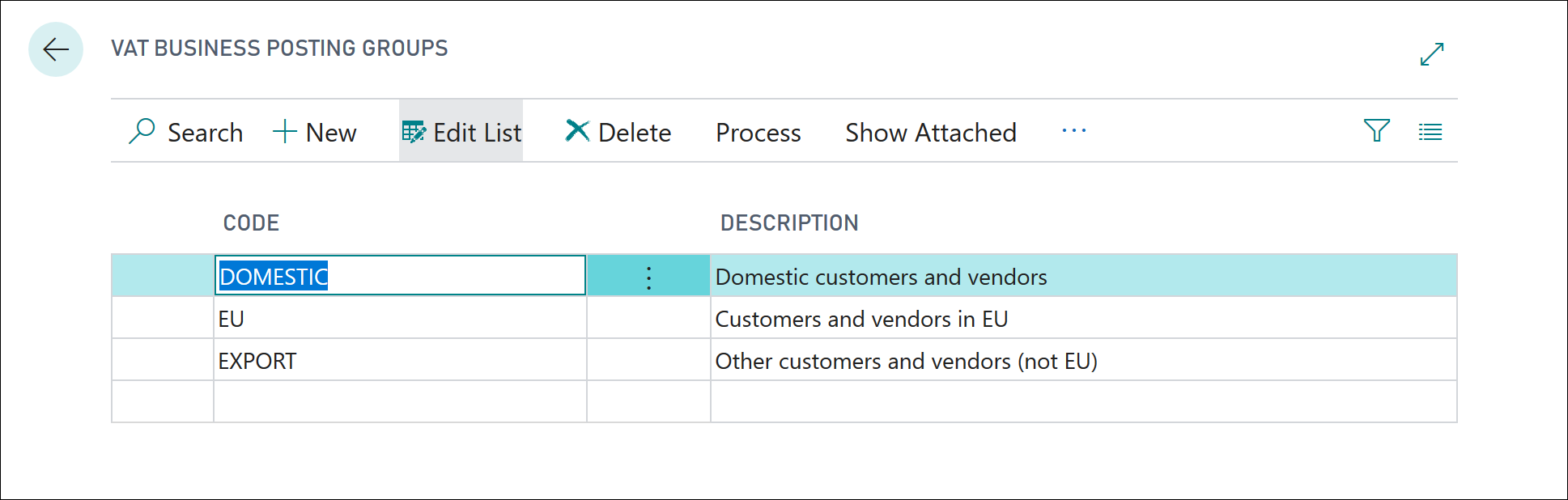

VAT business posting groups

VAT business posting groups determine the calculation and posting of VAT according to the location (country or region) of the customer or vendor who is involved in a transaction.

When you set up VAT business posting groups, consider how many groups are needed based on several factors, including:

Local legislation

Trading both domestically and internationally

To set up VAT business posting groups, follow these steps:

Select the Search for Page icon in the top-right corner of the page, enter VAT business posting groups, and then select the related link.

Select New.

In the Code field, enter a unique identifier for the business group.

In the Description field, enter a short description.

Close the VAT Business Posting Groups page.

Instead of manually assigning VAT business posting groups to the relevant accounts, you can set up default VAT business posting groups to general business posting groups.

Business Central then automatically inserts the relevant code as the VAT business posting group when the relevant general business posting group is assigned to a customer, vendor, or G/L account. When it's required, you can change the VAT business posting group for an individual record.

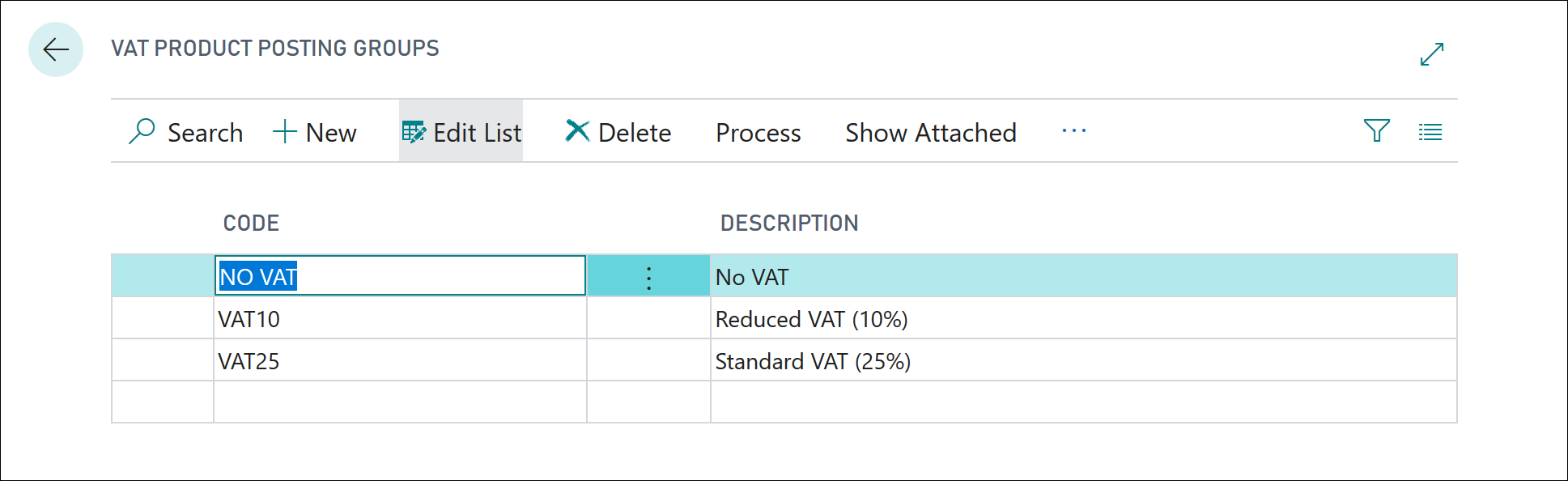

VAT product posting groups

VAT product posting groups can help you determine the calculation and posting of VAT according to the type of:

Item being purchased.

Item or resource being sold.

Costs, such as item charges.

When you set up VAT product posting groups, consider how many groups are needed based on the tax liability for items and resources. For example, VAT product posting groups can be set up to group items into food items that require 10 percent VAT and non-food items that require 15 percent VAT.

To set up VAT product posting groups, follow these steps:

Select the search for page icon in the top-right corner of the page, enter VAT product posting groups, and then select the related link.

Select New.

In the Code field, enter a unique identifier for the product group.

In the Description field, enter a short description.

Close the VAT Product Posting Groups page.

Instead of manually assigning VAT product posting groups to the relevant accounts, you can set up default VAT product posting groups to general product posting groups.

Business Central then automatically inserts the relevant code as the VAT product posting group when the relevant general product posting group is assigned to an item, resource, or G/L account.

When it is required, you can change the VAT product posting group for an individual record.