Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Variance is the difference between the actual cost and the standard cost, as described in the following formula:

- actual cost – standard cost = variance

If the actual cost changes, for example, because you post an item charge on a later date, the variance updates accordingly.

Note

Revaluation doesn't affect the variance calculation because revaluation only changes the inventory value.

Example

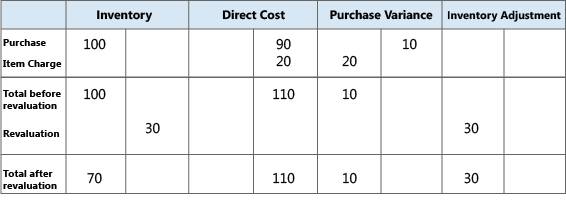

The following example illustrates how Business Central calculates variance for purchased items based on the following scenario:

- You purchase an item for 90.00 in local currency ($), but the standard cost is $100.00. Accordingly, the purchase variance is $ –10.00.

- The purchase variance account is credited with $10.00.

- You post an item charge of $20.00. Accordingly, the actual cost increases to $110.00, and the value of the purchase variance becomes $10.00.

- The purchase variance account is debited with $20.00. Accordingly, the net purchase variance becomes $ 10.00.

- You revalue the item from $100.00 to $70.00. This revaluation doesn't affect the variance calculation, only the inventory value.

The following table shows the resulting value entries.

Determining the standard cost

The standard cost is used when calculating variance and the amount to capitalize. Because the standard cost can change over time due to manual update calculation, you need a point in time when the standard cost is fixed for variance calculation. This point is when you invoice the inventory increase. For produced or assembled items, the point when standard cost is determined is when the cost is adjusted.

The following table shows how different cost shares are calculated for produced and assembled items when you use the Calculate Standard Cost action.

| Cost share | Purchased item | Produced/Assembled item |

|---|---|---|

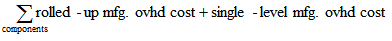

| Standard Cost | Single-Level Material Cost + Single-Level Material Non-Inventory Cost + Single-Level Capacity Cost + Single-Level Subcontrd. Cost + Single-Level Cap. Ovhd. Cost + Single-Level Mfg. Ovhd. Cost Go to the Manufacturing Setup page and turn on the Include Non-Inventory Items to Produced Items toggle to include Single-Level Material Non-Inventory Cost into produced items. Single-level material noninventory cost isn't included in the cost of assembled items. |

|

| Single-Level Material Cost | Unit Cost | Sum of standard or unit costs of components and subassemblies Only items of type Inventory |

| Single-Level Material Non-Inventory Cost | Not applicable | Sum of unit costs of components Only items of type Non-Inventory |

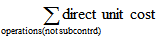

| Single-Level Capacity Cost | Not applicable |

|

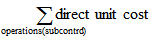

| Single-Level Subcontrd. Cost | Not applicable |

|

| Single-Level Cap. Ovhd Cost | Not applicable |

|

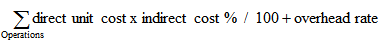

| Single-Level Mfg. Ovhd Cost | Not applicable | (Single-Level Material Cost + Single-Level Material Non-Inventory Cost + Single-Level Capacity Cost + Single-Level Subcontrd. Cost + Single-Level Cap. Ovhd Cost) * Indirect Cost % / 100 + Overhead Rate |

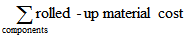

| Rolled-up Material Cost | Unit Cost |

|

| Rolled-up Material Non-Inventory Cost | Not applicable | Sum of Rolled-up Material Non-Inventory Cost + Single-Level Material Non-Inventory Cost |

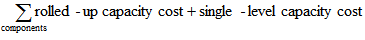

| Rolled-up Capacity Cost | Not applicable |

|

| Rolled-Up Subcontracted Cost | Not applicable |

|

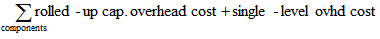

| Rolled-up Capacity Ovhd. Cost | Not applicable |

|

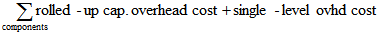

| Rolled-up Mfg. Ovhd. Cost | Not applicable |

|

Related information

Design Details: Inventory Costing

Design Details: Costing MethodsManaging Inventory Costs

Finance

Work with Business Central