Set up Electronic invoicing parameters

The process of submitting electronic documents to the Electronic invoicing service requires that a message be generated in your Microsoft Dynamics 365 Finance or Dynamics 365 Supply Chain Management environment in a unified structure that corresponds to the structure of the Electronic reporting (ER) invoice model and metadata that is known as context. For more information, see Electronic invoicing overview.

Because the message is generated by ER, its structure is customizable and flexible.

Before you can submit documents to Electronic invoicing and process responses, you must import ER configurations from the Global repository and define them in parameters.

These steps are optional if you set up your connected application directly from Regulatory Configuration Service (RCS) by completing the procedures in the following topics:

To set up, adjust, or review electronic documents directly in your Finance or Supply Chain Management environment, complete the following procedures.

Import ER configurations from the Global repository

Sign in to your Finance or Supply Chain Management environment.

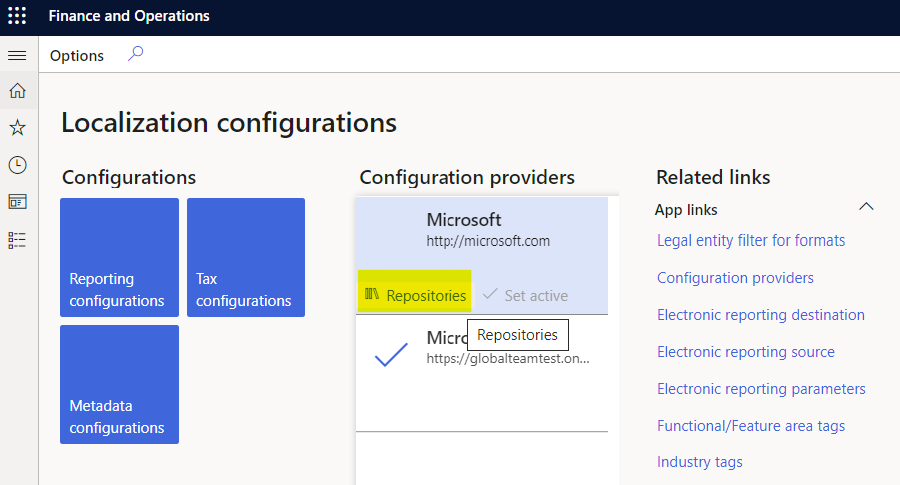

In the Electronic reporting workspace, in the Configuration providers section, select the Microsoft configuration provider, and then select Repositories.

Select Global, and then, on the Action Pane, select Open.

Import the following ER models:

- Customer invoice context model

- Invoice model

- Fiscal documents (for Brazilian scenarios, if required)

- Retail channel data (for Saudi Arabian Retail-specific scenarios, if required)

- Response message model

Verify that the following mapping configurations were automatically imported. If they weren't, import them, and then close the page.

- Invoice model mapping

- Fiscal documents mapping (for Brazilian scenarios, if required)

- Advance invoice model mapping (for Polish scenarios, if required)

- Retail fiscal document mapping (for Saudi Arabian Retail-specific scenarios, if required)

Set up Electronic document parameters

Go to Organization administration > Setup > Electronic document parameters.

On the Electronic document tab, select Add above the Electronic reporting grid.

Depending on the scenarios that you want to support, enter the following information in the grid, and then save your changes.

Table name Document context Electronic document model mapping Features that it's required for CustInvoiceJour Mapping name: Customer invoice context

Configuration: Customer invoice context model

Mapping name: Customer Invoice

Configuration: Invoice model mapping

- Austrian electronic invoices (AT)

- Belgian electronic invoice (BE)

- Danish electronic invoice (DK)

- Egyptian electronic invoice (EG)

- Estonian electronic invoice (EE)

- Finish electronic invoice (FI)

- French electronic invoice (FR)

- German electronic invoice (DE)

- FatturaPA (IT)

- Dutch electronic invoice (NL)

- Norwegian electronic invoice (NO)

- Polish electronic invoice (PL)

- Spanish electronic invoice (ES)

- PEPPOL electronic invoice

- Saudi Arabian electronic invoice (SA)

- Australian electronic invoice (AU)

- New Zealand electronic invoice (NZ)

ProjInvoiceJour Mapping name: Project invoice context

Configuration: Customer invoice context model

Mapping name: Project Invoice

Configuration: Invoice model mapping

- Austrian electronic invoices (AT)

- Belgian electronic invoice (BE)

- Danish electronic invoice (DK)

- Egyptian electronic invoice (EG)

- Estonian electronic invoice (EE)

- Finish electronic invoice (FI)

- French electronic invoice (FR)

- German electronic invoice (DE)

- FatturaPA (IT)

- Dutch electronic invoice (NL)

- Norwegian electronic invoice (NO)

- Polish electronic invoice (PL)

- Spanish electronic invoice (ES)

- PEPPOL electronic invoice

- Saudi Arabian electronic invoice (SA)

- Australian electronic invoice (AU)

- New Zealand electronic invoice (NZ)

CzCustAdvanceInvoiceTable Mapping name: Advance invoice context

Configuration: Customer invoice context model

Mapping name: Advance invoice model mapping

Configuration: Advance invoice model mapping

Polish electronic invoice (PL) RetailTransactionFiscalTransDocumentView Mapping name: Retail fiscal document context

Configuration: Customer invoice context model

Mapping name: Retail fiscal document

Configuration: Retail fiscal document mapping

Saudi Arabian electronic invoice (SA) FiscalDocument_BR Mapping name: Fiscal document context

Configuration: Customer invoice context model

Mapping name: Fiscal documents mapping

Configuration: Fiscal documents mapping

Brazilian NF-e (BR) Correction letter Mapping name: FD correction letter context

Configuration: Customer invoice context model

Mapping name: Correction letter mapping

Configuration: Fiscal documents mapping

Brazilian NF-e (BR) Service Fiscal document Mapping name: Fiscal document context

Configuration: Customer invoice context model

Mapping name: Fiscal documents mapping

Configuration: Fiscal documents mapping

Brazilian NFS-e ABRASF Curitiba (BR) VendInvoiceInfoTable Mapping name: Pending vendor invoice context

Configuration: Customer invoice context model

Mapping name: Pending vendor invoice model mapping

Configuration: Pending vendor invoice model mapping

Danish electronic invoice (DK)

If you derive a configuration from the configuration that is mentioned in the preceding table, define the new configuration.

To set up the rules to process responses from the Electronic invoicing service, and to update Finance and Supply Chain Management data based on invoices that are processed by the service, set up response types. In most scenarios, this setup is country/region-specific. Therefore, we recommend that you follow the country/region-specific instructions. For more information, see Availability of Electronic invoicing features by country or region

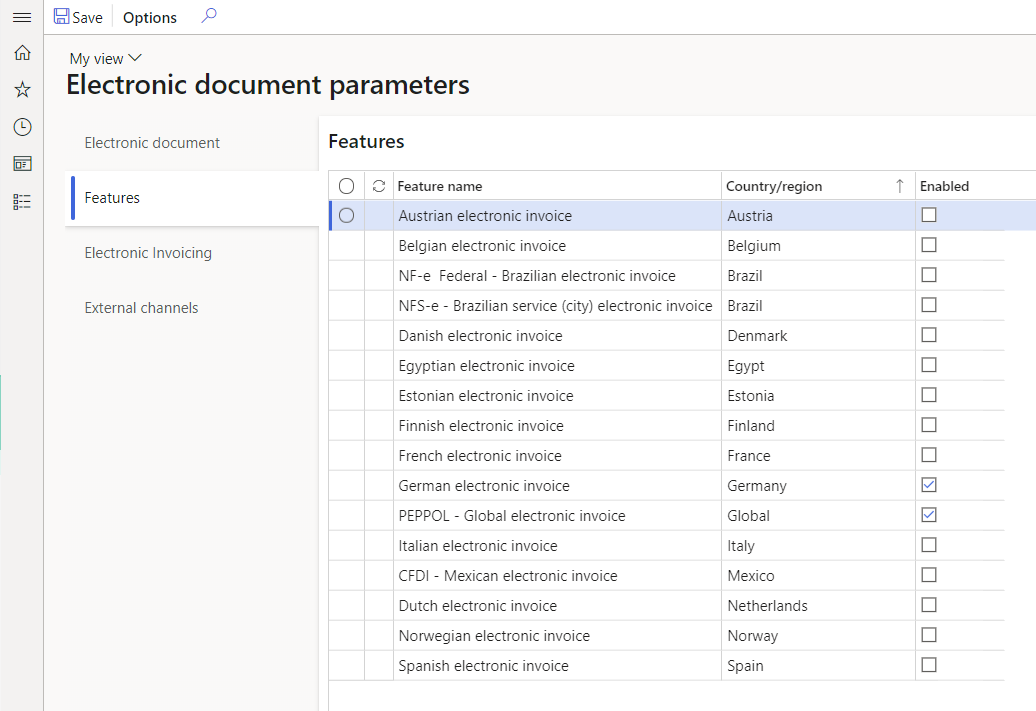

To inactivate old (legacy) ER functionality for some features and activate additional functionality in Finance and Supply Chain Management for some country/region-specific scenarios, enable the corresponding feature on the Features tab of the Electronic document parameters page.

When you enable a new feature, the legacy functionality will be inactivated for the corresponding country or region and feature name.