Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Important

This content is archived and is not being updated. For the latest documentation, go to What's new and planned for Dynamics 365 Business Central. For the latest release plans, go to Dynamics 365, Power Platform, and Cloud for Industry release plans.

| Enabled for | Public preview | General availability |

|---|---|---|

| Users, automatically |  May 1, 2023

May 1, 2023 |

May 1, 2023

May 1, 2023 |

Business value

Users in all relevant regions have improved VAT functionality with non-deductible and partly deductible VAT enabled.

Feature details

Business Central lets businesses calculate deductible and non-deductible VAT amounts. You can configure VAT so that it isn't deducted for purchases under certain conditions:

- The type of goods or services purchased. VAT is fully or partially non-deductible by the provision of the law on goods.

- Partially deductible prorated VAT. VAT is prorated according to the ratio between sales operations for which VAT is owed and all operations performed. VAT exceeding this ratio can't be deducted.

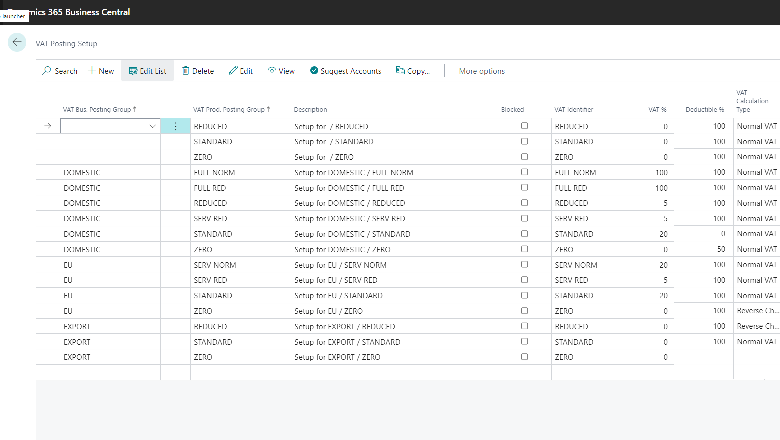

Configure deductions in VAT (percentage and G/L account) on the VAT Posting Setup page. You can configure full or partial deductions for combinations of VAT posting groups.

Before you post a document, the details are available in statistics. When you post a purchase document, the results are available on the G/L entries and VAT entries. Non-deductible VAT also works with Reverse Charge VAT and Deferrals.

Tell us what you think

Help us improve Dynamics 365 Business Central by discussing ideas, providing suggestions, and giving feedback. Use the forum at https://aka.ms/bcideas.

Thank you for your idea

Thank you for submitting this idea. We listened to your idea, along with comments and votes, to help us decide what to add to our product roadmap.

See also

Non-deductible VAT coming to Dynamics 365 Business Central worldwide (blog)

Use non-deductible VAT (docs)