Dana wrote:

There seems to be some disagreement about the Sharpe denominator, at least among non-authoritative online sources. Even individual websites are inconsistent within themselves.

Dana uses the stdev of just the portfolio returns (R). And according to the wikipage for "Sharpe ratio", that was indeed the original definition of the Sharpe ratio in 1966.

But in 1994, Sharpe updated the definition, using instead the stdev of R - Rf, where Rf is the return(s) for a risk-free investment or benchmark.

As the wikipage points out, stdev(R) = stdev(R - Rf) when a single Rf is used, as Dana does.

But when Rf[i] is provided for each R[i], as in Farah's data, stdev(R) <> stdev(R[i] - Rf[i]). And the latter should be used.

(In another discussion of the same problem, Farah indicates that the T-bill returns should be used for Rf.)

For Dana's example (a subset of Farah's data), the difference is:

Sharpe = (mean(R) - Rf) / stdev(R) = -0.341700194655291

Sharpe = (mean(R) - Rf) / stdev(R[i] - Rf[i]) = -0.346832441888126

Not a big difference for Dana's example. I don't know about Farah's complete example.

I might also note that it makes no difference in the Sharpe numerator. That is, mean(R[i] - Rf[i]) = mean(R[i] - Rf) = mean(R) - Rf, regardless of whether Rf is mean(Rf[i]) as Dana uses, or Rf is an arbitrary value.

Dana wrote:

First question would be: Market return in Feb-70 was 1161% for the month? As a number, it would be displayed as you have: 11.61. So, I would question your data to start.

The data appears to be rates of returns, expressed as percentage times 100 (sigh). So there is no issue.

The Sharpe ratio is the same whether we use the returns as Farah posted them, or we divide them by 100 (copy 100 and paste-divide), formatted as Percentage.

I discourage the presentation of percentages times 100. Although it makes no difference for the Sharpe ratio, there are other calculations that require that we use 1+r, where "r" is the percentage change. And while that makes "good sense" (to most of us),

it does not seem intuitive to write 100+r, where "r" is the percentage change times 100.

Dana wrote:

I am not sure about monthly returns vs yearly returns.

There also seems to be some disagreement about that among non-authoritative online sources.

But one example on the wikipage for "Sharpe ratio" shows weekly data without annualizing.

So it seems that annualizing subannual returns is not required; and I would discourage it.

Dana wrote:

I have never understood the need to calculate the portfolio stdev with a formula like that, if we have access to the raw data, as Farah does and Dana relied upon.

We can avoid the complication of calculating a covariance matrix by calculating the portfolio stdev directly from the data, in one of several ways.

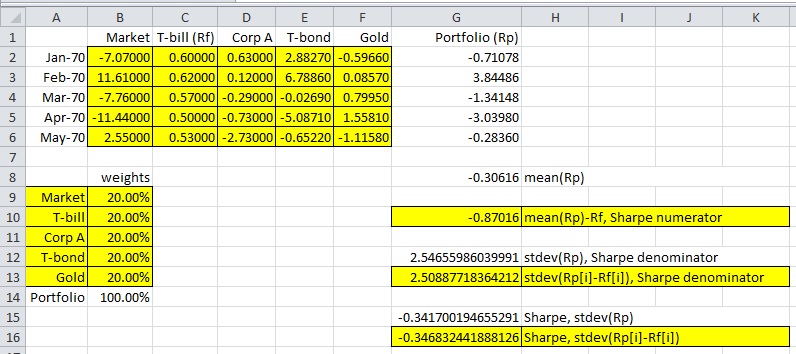

This is demonstrated in the image below. You may download the file sharpe ratio answers-ms.xslx . Ignore any preview errors; and a login is __not__ required. Just proceed to download the file.

Formulas:

G2: =MMULT(B2:F2, $B$9:$B$13)

Copy G2 into G3:G6

G8: =AVERAGE(G2:G6)

G10: =AVERAGE(G2:G6) - AVERAGE(C2:C6)

G12: =STDEV(G2:G6)

G13: =STDEV(INDEX(G2:G6-C2:C6, 0, 1))

G15: =G10/G12

G16: =G10/G13

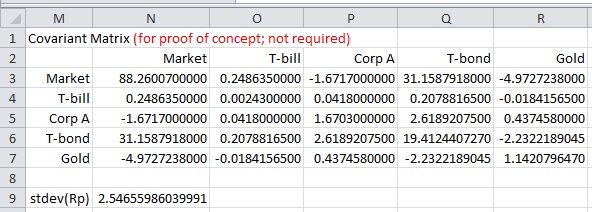

As a proof of concept, compare the stdev(Rp) in G12 above with stdev(Rp) in N9 below, based on the covariance matrix.

Formulas:

N3: =COVARIANCE.S(INDEX($B$2:$F$6, 0, ROWS($N$3:N3)), B$2:B$6)

Copy N3 into N3:R7

N9: =SQRT(SUMPRODUCT(MMULT(N3:R7, B9:B13), B9:B13))