Straight Line Project Revenue Recognition in AX R3 CU8

In addition to (and compatible with) the new continuous revenue recognition that we are introducing in the upcoming CU8 release of Dynamics AX 2012 R3, we are also introducing a new revenue calculation method for straight line or subscription-style revenue arrangements. With this calculation method, the accrued revenue for the period is calculated based on a the percentage of the value of the project duration over the reporting period.

The formula used is:

Accrued Revenue = Contract Value / (Project End Date - Project Start Date) * Number of Days in the Period

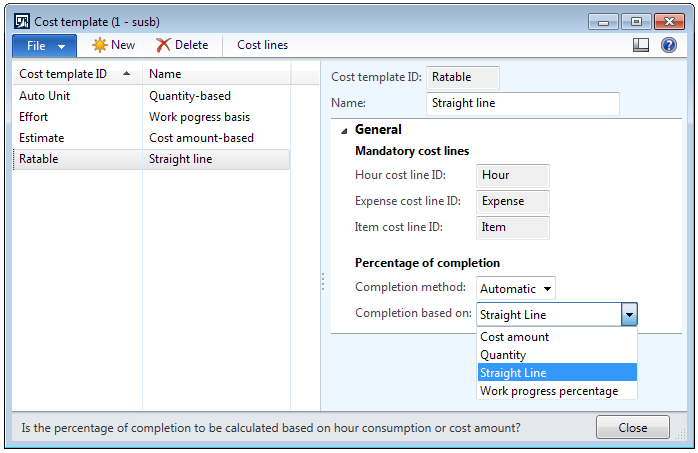

To use this new method, you will need to create a new cost (estimate) template by navigating to Project management and accounting > Setup > Estimates > Cost template. Create a new template and specify names for the 3 mandatory cost lines. These cost lines will actually not be used in the revenue calculation but still need to be specified for recording the costs. Choose "Straight line" in the Completion based on field.

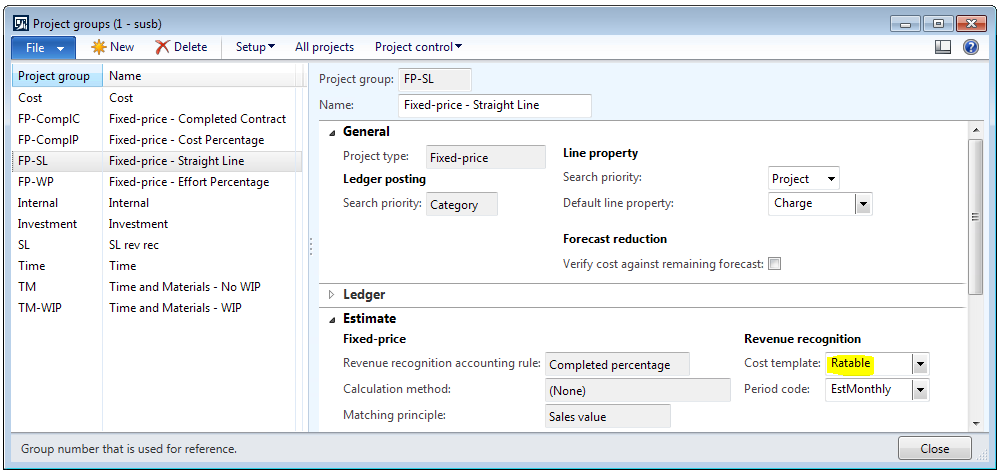

Next, you can create a new fixed-price project group that uses this cost template by navigating to Project management and accounting > Setup > Posting > Project groups. If you like to manually create the estimate project (I know some of you are out there), you can select it on the Estimate project details form.

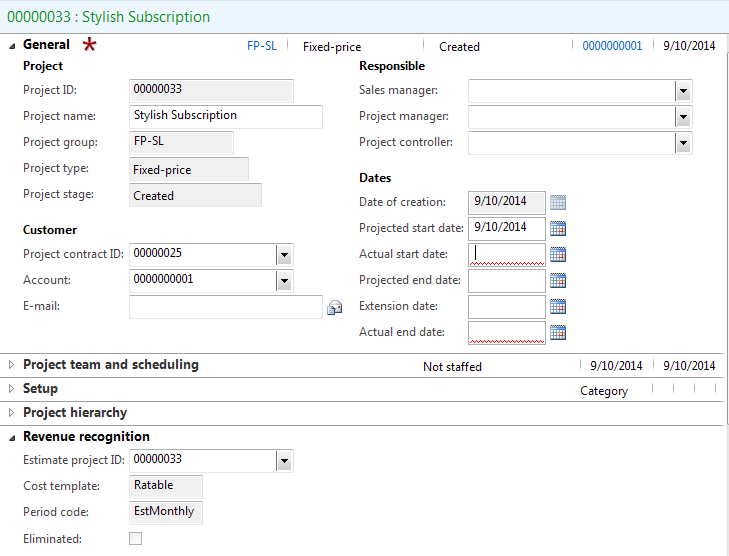

Once you create a project and assign it to this project group, you will notice that the Actual start date and the Actual end date field are required. These will be used to determine the time frame used to compute the revenue amounts for the project. If you forget to enter data into these fields, then no revenue will be recognized for the project.

As an example, let's say I have a 2 month subscription for which the customer will be charged 1,000.00 USD on October 1st. The subscription term runs from 15 October through 15 December. I specify the start and end dates on the project and set up the billing (on-account).

I set the project stage to "In process" and invoice the subscription amount. I can also record some labor or expenses against the project. Although they will not be considered in the revenue recognition calculation, they will impact the project profitability.

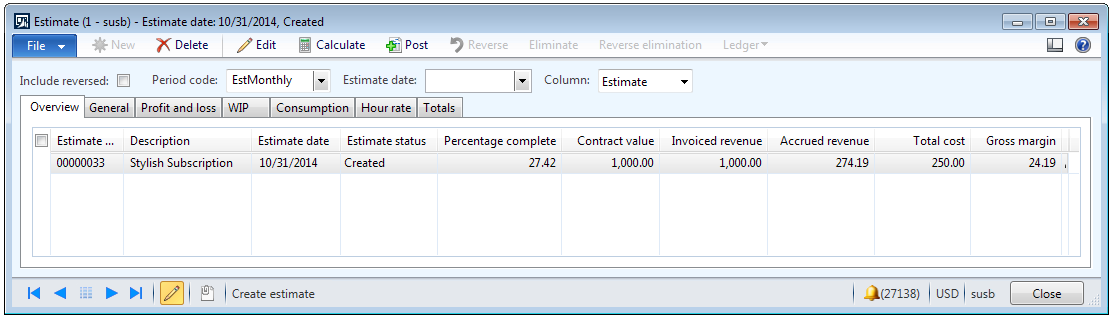

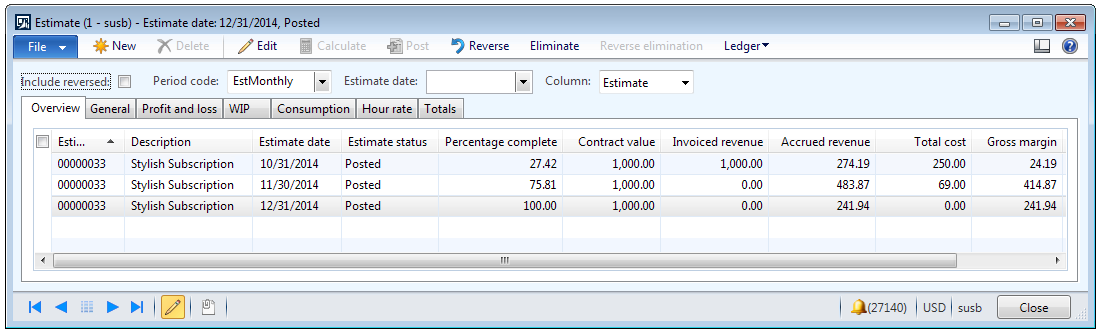

At the end of the month, I look at the amount of revenue to be recognized through the estimate system. Here's what I see in the Estimate form for the project.

As you can see, I have invoiced the full 1,000.00 of contract value. However, I am only 27.42% complete with the contract. This is because there are 17 days from October 15th through 31st (including the start date) out of the total contract duration of 62 days. This results in accrued revenue of 274.19. Here is what it looks like when I have completed the contract at the end of December.

As you can see, 75.81% was recognized in November and the remainder was recognized in December. When I include the costs, the gross margin on this contract was 241.94.

As part of this change, we have also moved the "Work progress percentage" method to the Estimate template form. This method uses the top level Percent complete field from the effort tracking view of the Work Breakdown Structure to compute the revenue. In the initial R3 release, we put this method on the cost lines but have decided that it makes more sense at the template level. If you install CU8, we recommend that you update your templates if you are using this method.