Document Intelligence invoice model

Important

- Document Intelligence public preview releases provide early access to features that are in active development.

- Features, approaches, and processes may change, prior to General Availability (GA), based on user feedback.

- The public preview version of Document Intelligence client libraries default to REST API version 2024-02-29-preview.

- Public preview version 2024-02-29-preview is currently only available in the following Azure regions:

- East US

- West US2

- West Europe

This content applies to: ![]() v4.0 (preview) | Previous versions:

v4.0 (preview) | Previous versions: ![]() v3.1 (GA)

v3.1 (GA) ![]() v3.0 (GA)

v3.0 (GA) ![]() v2.1 (GA)

v2.1 (GA)

This content applies to: ![]() v3.1 (GA) | Latest version:

v3.1 (GA) | Latest version: ![]() v4.0 (preview) | Previous versions:

v4.0 (preview) | Previous versions: ![]() v3.0

v3.0 ![]() v2.1

v2.1

This content applies to: ![]() v3.0 (GA) | Latest versions:

v3.0 (GA) | Latest versions: ![]() v4.0 (preview)

v4.0 (preview) ![]() v3.1 | Previous version:

v3.1 | Previous version: ![]() v2.1

v2.1

This content applies to: ![]() v2.1 | Latest version:

v2.1 | Latest version: ![]() v4.0 (preview)

v4.0 (preview)

The Document Intelligence invoice model uses powerful Optical Character Recognition (OCR) capabilities to analyze and extract key fields and line items from sales invoices, utility bills, and purchase orders. Invoices can be of various formats and quality including phone-captured images, scanned documents, and digital PDFs. The API analyzes invoice text; extracts key information such as customer name, billing address, due date, and amount due; and returns a structured JSON data representation. The model currently supports invoices in 27 languages.

Supported document types:

- Invoices

- Utility bills

- Sales orders

- Purchase orders

Automated invoice processing

Automated invoice processing is the process of extracting key accounts payable fields from billing account documents. Extracted data includes line items from invoices integrated with your accounts payable (AP) workflows for reviews and payments. Historically, the accounts payable process is performed manually and, hence, very time consuming. Accurate extraction of key data from invoices is typically the first and one of the most critical steps in the invoice automation process.

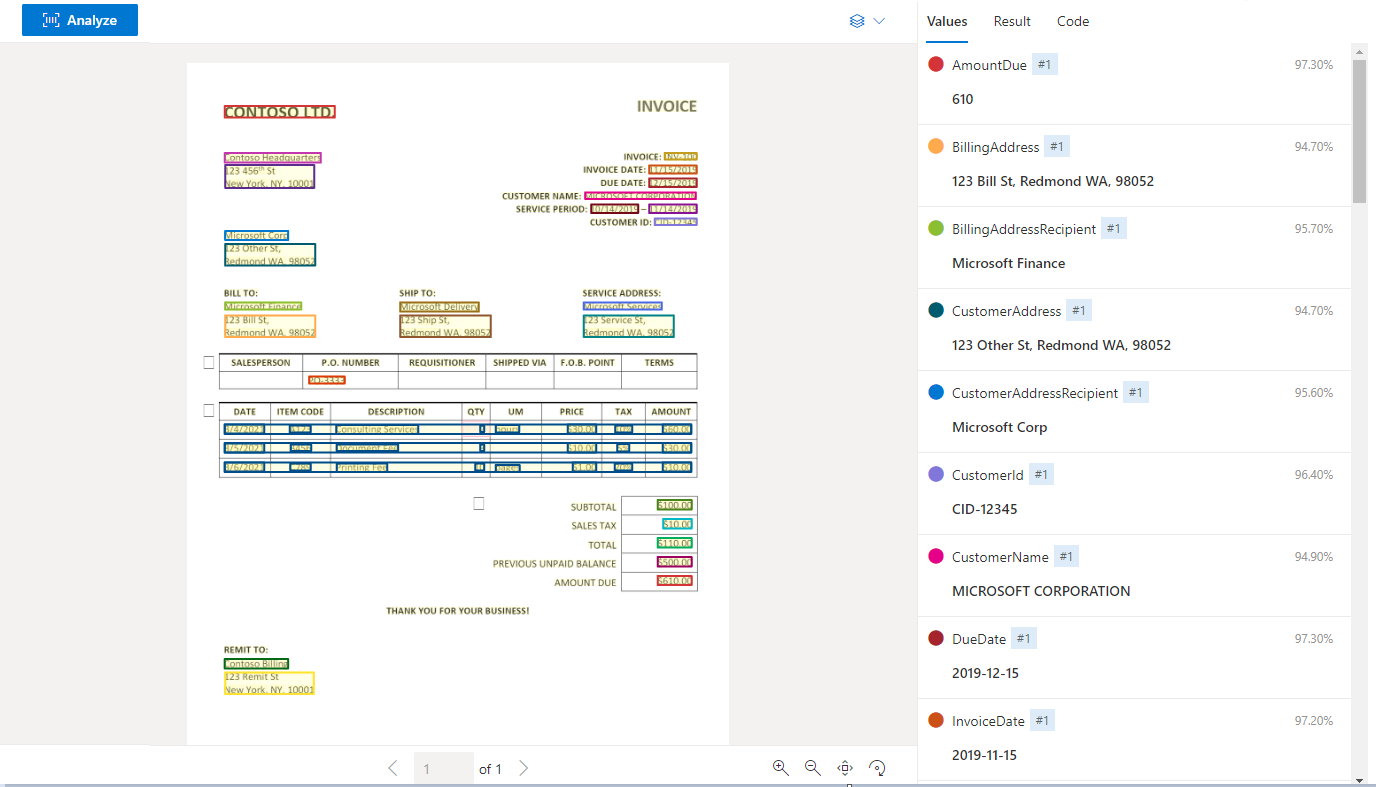

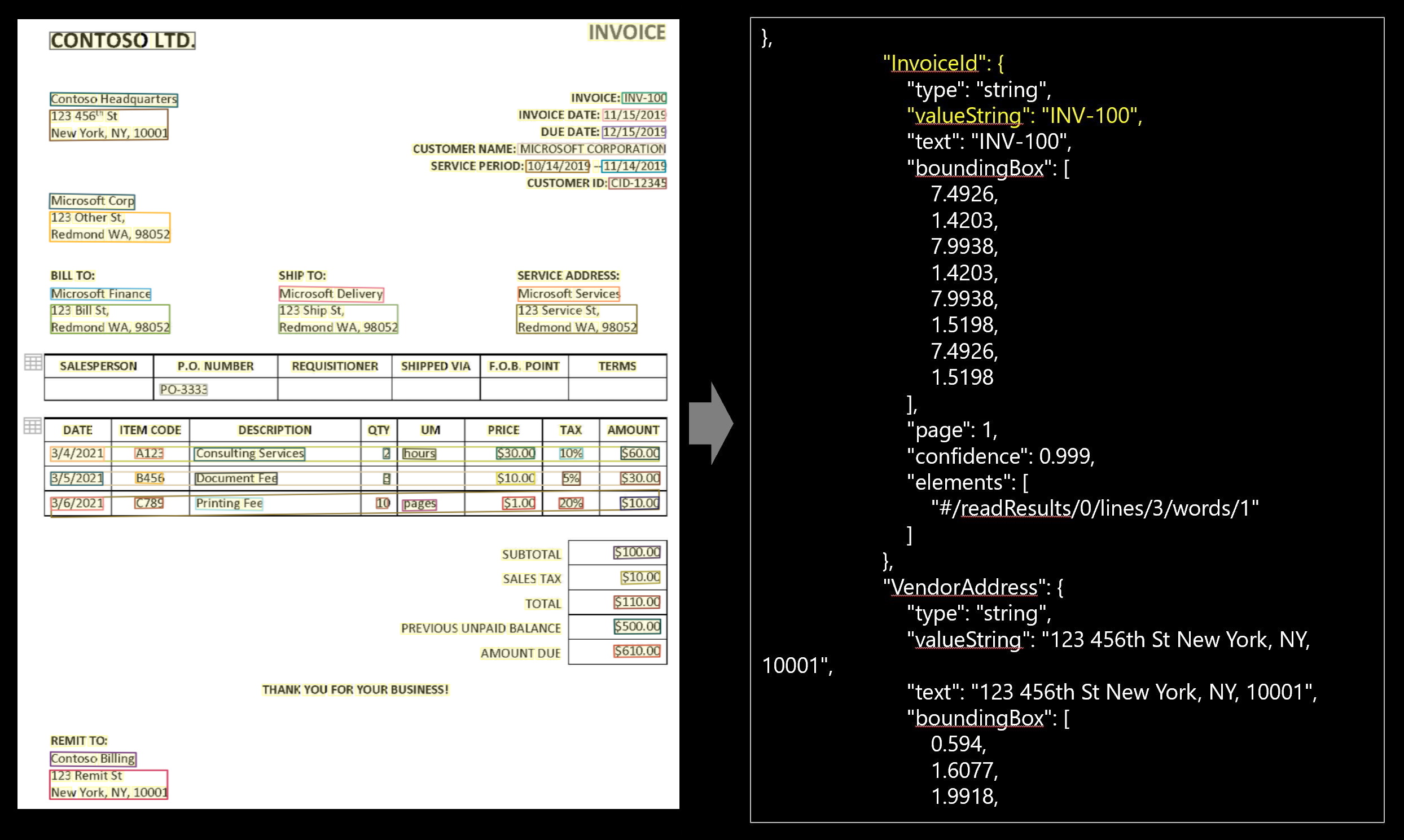

Sample invoice processed with Document Intelligence Studio:

Sample invoice processed with Document Intelligence Sample Labeling tool:

Development options

Document Intelligence v4.0 (2024-02-29-preview, 2023-10-31-preview) supports the following tools, applications, and libraries:

| Feature | Resources | Model ID |

|---|---|---|

| Invoice model | • Document Intelligence Studio • REST API • C# SDK • Python SDK • Java SDK • JavaScript SDK |

prebuilt-invoice |

Document Intelligence v3.1 supports the following tools, applications, and libraries:

| Feature | Resources | Model ID |

|---|---|---|

| Invoice model | • Document Intelligence Studio • REST API • C# SDK • Python SDK • Java SDK • JavaScript SDK |

prebuilt-invoice |

Document Intelligence v3.0 supports the following tools, applications, and libraries:

| Feature | Resources | Model ID |

|---|---|---|

| Invoice model | • Document Intelligence Studio • REST API • C# SDK • Python SDK • Java SDK • JavaScript SDK |

prebuilt-invoice |

Document Intelligence v2.1 supports the following tools, applications, and libraries:

| Feature | Resources |

|---|---|

| Invoice model | • Document Intelligence labeling tool • REST API • Client-library SDK • Document Intelligence Docker container |

Input requirements

For best results, provide one clear photo or high-quality scan per document.

Supported file formats:

Model PDF Image:

JPEG/JPG, PNG, BMP, TIFF, HEIFMicrosoft Office:

Word (DOCX), Excel (XLSX), PowerPoint (PPTX), and HTMLRead ✔ ✔ ✔ Layout ✔ ✔ ✔ (2024-02-29-preview, 2023-10-31-preview) General Document ✔ ✔ Prebuilt ✔ ✔ Custom extraction ✔ ✔ Custom classification ✔ ✔ ✔ (2024-02-29-preview) For PDF and TIFF, up to 2000 pages can be processed (with a free tier subscription, only the first two pages are processed).

The file size for analyzing documents is 500 MB for paid (S0) tier and 4 MB for free (F0) tier.

Image dimensions must be between 50 x 50 pixels and 10,000 px x 10,000 pixels.

If your PDFs are password-locked, you must remove the lock before submission.

The minimum height of the text to be extracted is 12 pixels for a 1024 x 768 pixel image. This dimension corresponds to about

8-point text at 150 dots per inch (DPI).For custom model training, the maximum number of pages for training data is 500 for the custom template model and 50,000 for the custom neural model.

For custom extraction model training, the total size of training data is 50 MB for template model and 1G-MB for the neural model.

For custom classification model training, the total size of training data is

1GBwith a maximum of 10,000 pages.

- Supported file formats: JPEG, PNG, PDF, and TIFF.

- Supported PDF and TIFF, up to 2,000 pages are processed. For free tier subscribers, only the first two pages are processed.

- Supported file size must be less than 50 MB and dimensions at least 50 x 50 pixels and at most 10,000 x 10,000 pixels.

Invoice model data extraction

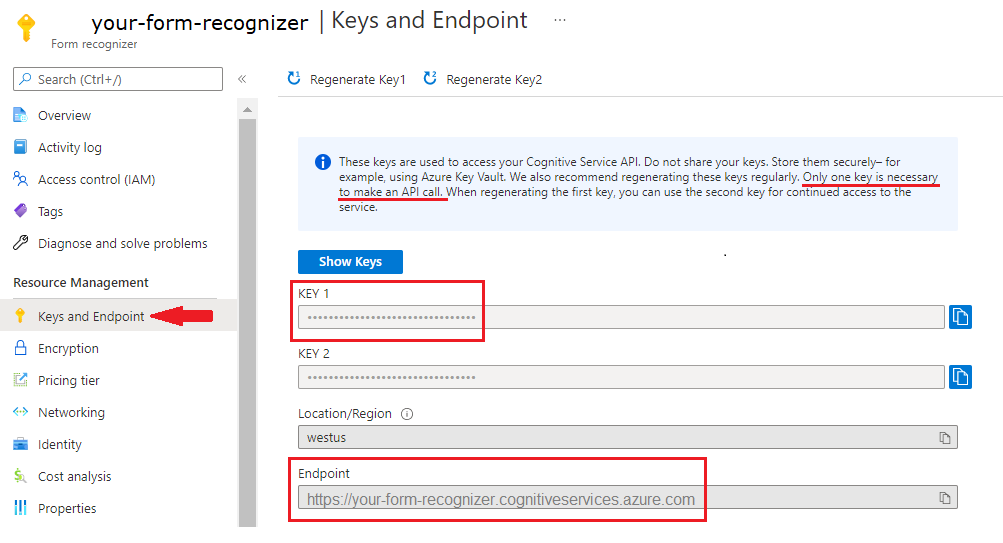

See how data, including customer information, vendor details, and line items, is extracted from invoices. You need the following resources:

An Azure subscription—you can create one for free.

A Document Intelligence instance in the Azure portal. You can use the free pricing tier (

F0) to try the service. After your resource deploys, select Go to resource to get your key and endpoint.

On the Document Intelligence Studio home page, select Invoices.

You can analyze the sample invoice or upload your own files.

Select the Run analysis button and, if necessary, configure the Analyze options :

Document Intelligence Sample Labeling tool

Navigate to the Document Intelligence Sample Tool.

On the sample tool home page, select the Use prebuilt model to get data tile.

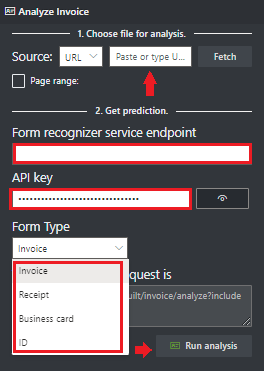

Select the Form Type to analyze from the dropdown menu.

Choose a URL for the file you would like to analyze from the below options:

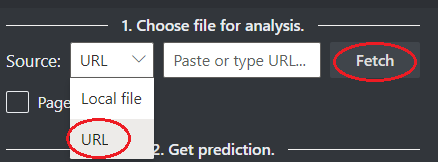

In the Source field, select URL from the dropdown menu, paste the selected URL, and select the Fetch button.

In the Document Intelligence service endpoint field, paste the endpoint that you obtained with your Document Intelligence subscription.

In the key field, paste the key you obtained from your Document Intelligence resource.

Select Run analysis. The Document Intelligence Sample Labeling tool calls the Analyze Prebuilt API and analyze the document.

View the results - see the key-value pairs extracted, line items, highlighted text extracted, and tables detected.

Note

The Sample Labeling tool does not support the BMP file format. This is a limitation of the tool not the Document Intelligence Service.

Supported languages and locales

See our Language Support—prebuilt models page for a complete list of supported languages.

Field extraction

The Document Intelligence invoice model prebuilt-invoice extracts the following fields.

| Name | Type | Description | Standardized output |

|---|---|---|---|

| CustomerName | string | Invoiced customer | Microsoft Corp |

| CustomerId | string | Customer reference ID | CID-12345 |

| PurchaseOrder | string | Purchase order reference number | PO-3333 |

| InvoiceId | string | ID for this specific invoice (often Invoice Number) | INV-100 |

| InvoiceDate | date | date the invoice was issued | mm-dd-yyyy |

| DueDate | date | date payment for this invoice is due | mm-dd-yyyy |

| VendorName | string | Vendor who created this invoice | CONTOSO LTD. |

| VendorAddress | address | Vendor mailing address | 123 456th St, New York, NY 10001 |

| VendorAddressRecipient | string | Name associated with the VendorAddress | Contoso Headquarters |

| CustomerAddress | address | Mailing address for the Customer | 123 Other St, Redmond WA, 98052 |

| CustomerAddressRecipient | string | Name associated with the CustomerAddress | Microsoft Corp |

| BillingAddress | address | Explicit billing address for the customer | 123 Bill St, Redmond WA, 98052 |

| BillingAddressRecipient | string | Name associated with the BillingAddress | Microsoft Services |

| ShippingAddress | address | Explicit shipping address for the customer | 123 Ship St, Redmond WA, 98052 |

| ShippingAddressRecipient | string | Name associated with the ShippingAddress | Microsoft Delivery |

| SubTotal | currency | Subtotal field identified on this invoice | $100.00 |

| TotalDiscount | currency | The total discount applied to an invoice | $5.00 |

| TotalTax | currency | Total tax field identified on this invoice | $10.00 |

| InvoiceTotal | currency | Total new charges associated with this invoice | $10.00 |

| AmountDue | currency | Total Amount Due to the vendor | $610 |

| PreviousUnpaidBalance | currency | Explicit previously unpaid balance | $500.00 |

| RemittanceAddress | address | Explicit remittance or payment address for the customer | 123 Remit St New York, NY, 10001 |

| RemittanceAddressRecipient | string | Name associated with the RemittanceAddress | Contoso Billing |

| ServiceAddress | address | Explicit service address or property address for the customer | 123 Service St, Redmond WA, 98052 |

| ServiceAddressRecipient | string | Name associated with the ServiceAddress | Microsoft Services |

| ServiceStartDate | date | First date for the service period (for example, a utility bill service period) | mm-dd-yyyy |

| ServiceEndDate | date | End date for the service period (for example, a utility bill service period) | mm-dd-yyyy |

| VendorTaxId | string | The taxpayer number associated with the vendor | 123456-7 |

| CustomerTaxId | string | The taxpayer number associated with the customer | 765432-1 |

| PaymentTerm | string | The terms of payment for the invoice | Net90 |

| KVKNumber | string | A unique identifier for businesses registered in the Netherlands (NL-only) | 12345678 |

| CurrencyCode | string | The currency code associated with the extracted amount | |

| PaymentDetails | array | An array that holds Payment Option details such as IBAN,SWIFT, BPayBillerCode(AU), BPayReference(AU) |

|

| TaxDetails | array | An array that holds tax details like amount and rate | |

| TaxDetails | array | AN array that holds added tax information such as CGST, IGST, and SGST. This line item is currently only available for the Germany (de), Spain (es), Portugal (pt), and English Canada (en-CA) locales |

Line items array

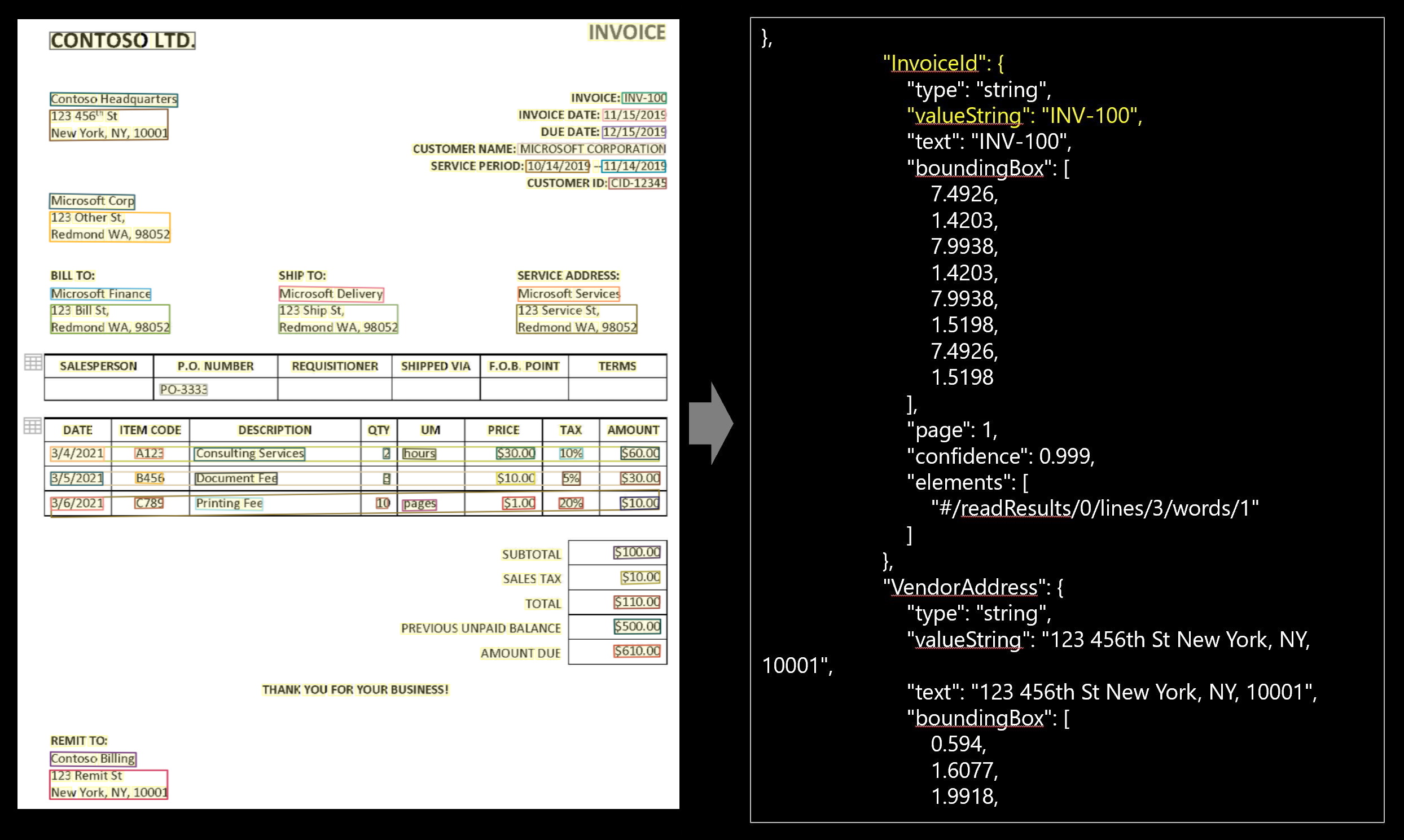

Following are the line items extracted from an invoice in the JSON output response (the following output uses this sample invoice:

| Name | Type | Description | Value (standardized output) |

|---|---|---|---|

| Amount | currency | The amount of the line item | $60.00 |

| Date | date | Date corresponding to each line item. Often it's a date the line item was shipped | 3/4/2021 |

| Description | string | The text description for the invoice line item | Consulting service |

| Quantity | number | The quantity for this invoice line item | 2 |

| ProductCode | string | Product code, product number, or SKU associated with the specific line item | A123 |

| Tax | currency | Tax associated with each line item. Possible values include tax amount and tax Y/N | $6.00 |

| TaxRate | string | Tax Rate associated with each line item. | 18% |

| Unit | string | The unit of the line item, e.g, kg, lb etc. | Hours |

| UnitPrice | number | The net or gross price (depending on the gross invoice setting of the invoice) of one unit of this item | $30.00 |

The invoice key-value pairs and line items extracted are in the documentResults section of the JSON output.

Key-value pairs

The prebuilt invoice 2022-06-30 and later releases support the optional return of key-value pairs. By default, the return of key-value pairs is disabled. Key-value pairs are specific spans within the invoice that identify a label or key and its associated response or value. In an invoice, these pairs could be the label and the value the user entered for that field or telephone number. The AI model is trained to extract identifiable keys and values based on a wide variety of document types, formats, and structures.

Keys can also exist in isolation when the model detects that a key exists, with no associated value or when processing optional fields. For example, a middle name field can be left blank on a form in some instances. Key-value pairs are always spans of text contained in the document. For documents where the same value is described in different ways, for example, customer/user, the associated key is either customer or user (based on context).

Fields extracted

The Invoice service extracts the text, tables, and 26 invoice fields. Following are the fields extracted from an invoice in the JSON output response (the following output uses this sample invoice).

| Name | Type | Description | Text | Value (standardized output) |

|---|---|---|---|---|

| CustomerName | string | Customer being invoiced | Microsoft Corp | |

| CustomerId | string | Reference ID for the customer | CID-12345 | |

| PurchaseOrder | string | A purchase order reference number | PO-3333 | |

| InvoiceId | string | ID for this specific invoice (often "Invoice Number") | INV-100 | |

| InvoiceDate | date | Date the invoice was issued | 11/15/2019 | 2019-11-15 |

| DueDate | date | Date payment for this invoice is due | 12/15/2019 | 2019-12-15 |

| VendorName | string | Vendor that created the invoice | CONTOSO | |

| VendorAddress | string | Mailing address for the Vendor | 123 456th St New York, NY, 10001 | |

| VendorAddressRecipient | string | Name associated with the VendorAddress | Contoso Headquarters | |

| CustomerAddress | string | Mailing address for the Customer | 123 Other Street, Redmond, Washington, 98052 | |

| CustomerAddressRecipient | string | Name associated with the CustomerAddress | Microsoft Corp | |

| BillingAddress | string | Explicit billing address for the customer | 123 Bill Street, Redmond, Washington, 98052 | |

| BillingAddressRecipient | string | Name associated with the BillingAddress | Microsoft Services | |

| ShippingAddress | string | Explicit shipping address for the customer | 123 Ship Street, Redmond, Washington, 98052 | |

| ShippingAddressRecipient | string | Name associated with the ShippingAddress | Microsoft Delivery | |

| SubTotal | number | Subtotal field identified on this invoice | $100.00 | 100 |

| TotalTax | number | Total tax field identified on this invoice | $10.00 | 10 |

| InvoiceTotal | number | Total new charges associated with this invoice | $110.00 | 110 |

| AmountDue | number | Total Amount Due to the vendor | $610.00 | 610 |

| ServiceAddress | string | Explicit service address or property address for the customer | 123 Service Street, Redmond, Washington, 98052 | |

| ServiceAddressRecipient | string | Name associated with the ServiceAddress | Microsoft Services | |

| RemittanceAddress | string | Explicit remittance or payment address for the customer | 123 Remit St New York, NY, 10001 | |

| RemittanceAddressRecipient | string | Name associated with the RemittanceAddress | Contoso Billing | |

| ServiceStartDate | date | First date for the service period (for example, a utility bill service period) | 10/14/2019 | 2019-10-14 |

| ServiceEndDate | date | End date for the service period (for example, a utility bill service period) | 11/14/2019 | 2019-11-14 |

| PreviousUnpaidBalance | number | Explicit previously unpaid balance | $500.00 | 500 |

The following are the line items extracted from an invoice in the JSON output response and uses this sample invoice:

| Name | Type | Description | Text (line item #1) | Value (standardized output) |

|---|---|---|---|---|

| Items | string | Full string text line of the line item | 3/4/2021 A123 Consulting Services 2 hours $30.00 10% $60.00 | |

| Amount | number | The amount of the line item | $60.00 | 100 |

| Description | string | The text description for the invoice line item | Consulting service | Consulting service |

| Quantity | number | The quantity for this invoice line item | 2 | 2 |

| UnitPrice | number | The net or gross price (depending on the gross invoice setting of the invoice) of one unit of this item | $30.00 | 30 |

| ProductCode | string | Product code, product number, or SKU associated with the specific line item | A123 | |

| Unit | string | The unit of the line item, e.g, kg, lb etc. | hours | |

| Date | date | Date corresponding to each line item. Often it's a date the line item was shipped | 3/4/2021 | 2021-03-04 |

| Tax | number | Tax associated with each line item. Possible values include tax amount, tax %, and tax Y/N | 10% |

The following are complex fields extracted from an invoice in the JSON output response:

TaxDetails

Tax details aims at breaking down the different taxes applied to the invoice total.

| Name | Type | Description | Text (line item #1) | Value (standardized output) |

|---|---|---|---|---|

| Items | string | Full string text line of the tax item | V.A.T. 15% $60.00 | |

| Amount | number | The tax amount of the tax item | 60.00 | 60 |

| Rate | string | The tax rate of the tax item | 15% |

PaymentDetails

List all the detected payment options detected on the field.

| Name | Type | Description | Text (line item #1) | Value (standardized output) |

|---|---|---|---|---|

| IBAN | string | Internal Bank Account Number | GB33BUKB20201555555555 | |

| SWIFT | string | SWIFT code | BUKBGB22 | |

| BPayBillerCode | string | Australian B-Pay Biller Code | 12345 | |

| BPayReference | string | Australian B-Pay Reference Code | 98765432100 |

JSON output

The JSON output has three parts:

"readResults"node contains all of the recognized text and selection marks. Text is organized via page, then by line, then by individual words."pageResults"node contains the tables and cells extracted with their bounding boxes, confidence, and a reference to the lines and words in readResults."documentResults"node contains the invoice-specific values and line items that the model discovered. It's where to find all the fields from the invoice such as invoice ID, ship to, bill to, customer, total, line items and lots more.

Migration guide

- Follow our Document Intelligence v3.1 migration guide to learn how to use the v3.0 version in your applications and workflows.

Next steps

Try processing your own forms and documents with the Document Intelligence Studio.

Complete a Document Intelligence quickstart and get started creating a document processing app in the development language of your choice.

Try processing your own forms and documents with the Document Intelligence Sample Labeling tool.

Complete a Document Intelligence quickstart and get started creating a document processing app in the development language of your choice.

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for