Microsoft Dynamics GP Payables Management

You can use Payables Management to maintain information about vendors, enter and post purchase transactions, and track payments to vendors. Individual posting accounts can be assigned to each vendor and you can store up to four types of transaction history for each vendor. Payments and credit documents can be applied to invoices and debit documents automatically, or individually. Payments can be generated using computer check runs or tracked after-the-fact as manual payments.

You also can use Payables Management to complete the following tasks:

Create payment schedules that help automate the process of making installment payments. In addition, you can calculate interest, amortize amounts and forecast the impact of variable interest rates, payment amounts, and installment charges.

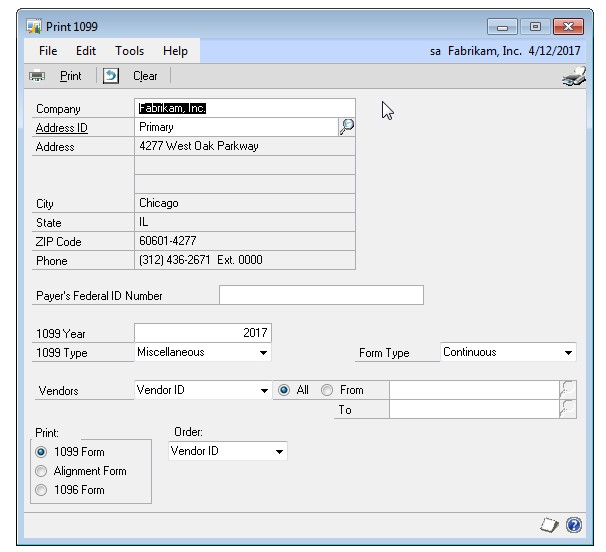

Specify vendors that 1099 information must be tracked for. You can print 1099 statements at any time.

Manage disputes with vendors by placing a Hold status on selected vendor records. The Hold status prevents vendors from being paid until the hold is removed. Individual transactions also can be placed on hold. Transactions that are on hold can’t be applied or paid.

Manage payables accounts by reporting segments, such as cost center, division, department, program or fund. You can display a breakdown of your control payables account by account segment.

Create one or more sets of reports that can be sorted by calendar or fiscal year. You can search within reports that are printed to the screen. You can create new reports, or customize predefined reports Report Writer.

This manual is designed to give you an understanding of how to use the features of Payables Management, and how it integrates with the Microsoft Dynamics GP system.

To make best use of Payables Management, you should be familiar with systemwide features described in the System User’s Guide, the System Setup Guide, and the System Administrator’s Guide.

Some features described in the documentation are optional and can be purchased through your Microsoft Dynamics GP partner.

To view information about the release of Microsoft Dynamics GP that you’re using and which modules or features you are registered to use, choose Help >> About Microsoft Dynamics GP.

The manual is divided into the following parts:

Part 1, Setup and cards, introduces Payables Management and gives detailed setup instructions.

Part 2, Transactions, provides information about working with transactions and payments, and describes the types of transactions available in Payables Management.

Part 3, Inquiries and reports, explains how to use inquiries and reports to analyze payables activity.

Part 4, Utilities and routines, describes procedures you can use to verify account balances or remove history for a group of vendors. It also lists procedures you complete on a periodic basis, such as month- or year-end closing.

Part 1: Setup and cards

You can set up Payables Management, so it meets the needs of your business and the other Microsoft Dynamics GP modules you use. Payables Management setup and cards information is divided into the following chapters:

Chapter 1, “Payables Management setup,” describes the setup routine for Payables Management, so you can prepare Payables Management for use.

Chapter 2, “Vendor classes,” explains how to group vendors into classes according to common entries, and the benefits of creating classes.

Chapter 3, “Vendor cards,” describes how to enter vendor records. It’s important to keep this information up to date to reflect your company’s current activity.

Chapter 4, “Beginning balances and vendor history,” describes how to enter beginning, or outstanding, balances owed to each vendor, and how to view historical balances.

Chapter 5, “Vendor maintenance,” describes how to complete maintenance procedures for vendor cards.

Chapter 1: Payables Management setup

One way to set up Payables Management is to follow the setup routine we’ve provided. It guides you through the various procedures you must complete, in the order you should complete them, so you can begin using Payables Management.

Setup information is divided into the following sections:

Before you set up Payables Management

Overview of 1099 tracking options

Aging periods

Apply options

Default entries

Passwords

Additional payables options

Setting up payables preferences and default entries

Setting up Payables Management options

Before you set up Payables Management

Before you begin setting up Payables Management, be sure to complete the System Manager and General Ledger setup procedures. See the System Setup or General Ledger documentation for more information about completing these procedures.

If you’re using Multicurrency Management, you also must set up the following information before you begin:

Currencies

Exchange rates

Exchange tables

Multicurrency access

Note

To print multicurrency versions of the posting journals, mark Include Multicurrency Info in the Posting Setup window.

Overview of 1099 tracking options

Your business might be required to track the purchases you make from some vendors and to send a 1099 statement that summarizes your expenditures at the end of the calendar year.

You can automatically withhold a portion of the payments you make to vendors to submit to taxing authorities. To do so, you must designate the taxing authority as a “withholding vendor” using the Company Setup Options window (Administration >> Setup >> Company >> Company >> Options button). After you specify a withholding vendor, you can specify whether or not to automatically withhold a percentage of the payments you make to each of the vendors that you send 1099 statements to. See Setting up vendor withholding options for more information.

The following points summarize additional options for working with 1099 statements.

You can print multiple types of 1099 statements for the same vendor. For example, you might need to print a 1099 MISC statement and a 1099 DIV statement for the same vendor, if you purchase goods or services from a vendor that is also a stockholder in your company and that receives dividends.

You can change box descriptions that are displayed in transaction entry windows, to make them easier to understand. Changing the box description won’t change the description printed on the 1099 statements.

You can change 1099 amounts.

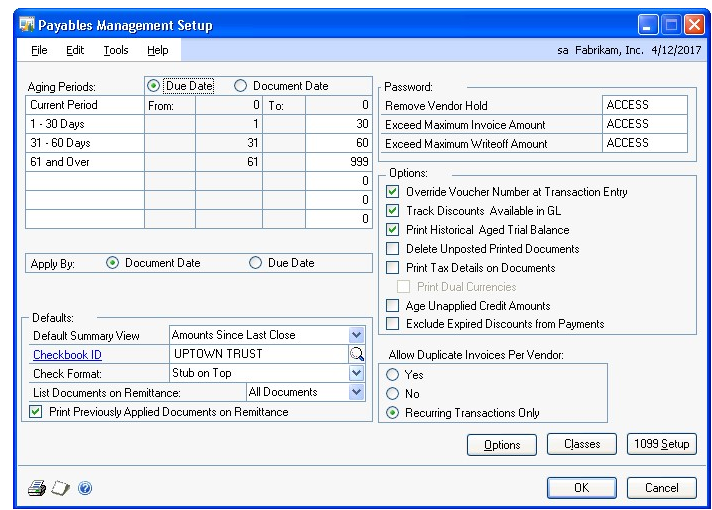

Aging periods

Use the Payables Management Setup window to select the aging periods to use and how documents should be aged. Aging is the process of determining how long you’ve owed money to specific vendors. You can use up to seven aging periods, including the current period. Information for the current period and for the following three aging periods appears on the Aged Trial Balance reports. If you use more than four aging periods (including the current period), you can add them to the Aged Trial Balance reports using Report Writer.

| Document date | Payment terms | Due date |

|---|---|---|

| January 1, 2019 | 2% 10 - Net 30 | January 31, 2019 |

| January 3, 2019* | Net 15 | January 18, 2019 |

| January 28, 2019 | Net 30 | February 27, 2019 |

* Payment is applied to this document first.

You can age vendor records by document date or due date. Assume you have an invoice dated January 15, with a due date of February 15, and you age documents on the end of the month (February 28). If you age by document date, this invoice is 44 days old; if you age by due date, this invoice is 13 days past due.

Apply options

You can apply credit documents by document date or due date when you automatically apply.

Applying by document date

If you apply by document date, the payments and credits are applied first to documents with the oldest document date.

Document date Payment terms Due date January 1, 2019* 2% 10 - Net 30 January 31, 2019 January 3, 2019 Net 15 January 18, 2019 January 28, 2019 Net 30 February 27, 2019 * Payment is applied to this document first.

Applying by due date

If you apply by due date, payments and credits are applied first to documents with the oldest due date.

Default entries

Use the Payables Management Setup window to enter a default entry for the Checkbook ID you use for computer check payments; the check format to use for computer checks; the documents listed on the remittance; and whether previously applied documents should be listed on the remittance.

Default Summary View Select a summary view to be the default view in the Vendor Yearly Summary and Vendor Yearly Summary Inquiry windows. Amounts Since Last Close displays the current summary information for the selected vendor since the last year-end close. Fiscal Year displays the selected vendor’s summary information for the fiscal year you enter. Calendar Year displays the selected vendor’s summary information for the calendar year you enter.

Checkbook ID Enter or select the ID for the checkbook to be displayed as the default throughout this module. Specify the checkbook that you use most often to pay vendors. The entry here appears as a default entry for batches created using the Payables Batch Entry window. You can change this default ID for an individual batch to use another checkbook.

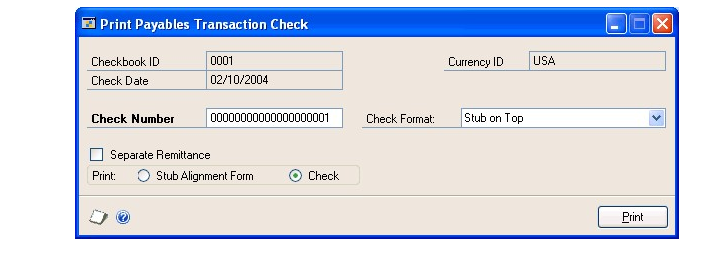

Check Format Select one of the following check formats.

No Stub, Stub on Top

Stub on Bottom

Stub Top/Bottom - Text

Stub Top/Bottom - Graphical

Stub/Stub/Check

3 per Page/No Stub

User-Defined Check 1

User Defined Check 2

The selection appears as the default entry in the Print Payables Checks and Print Payables Transaction Check windows.

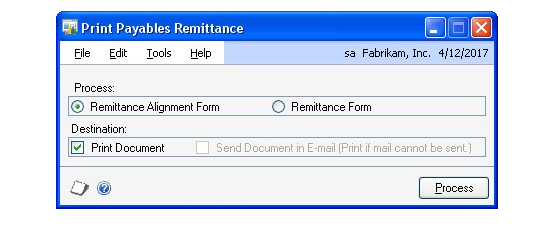

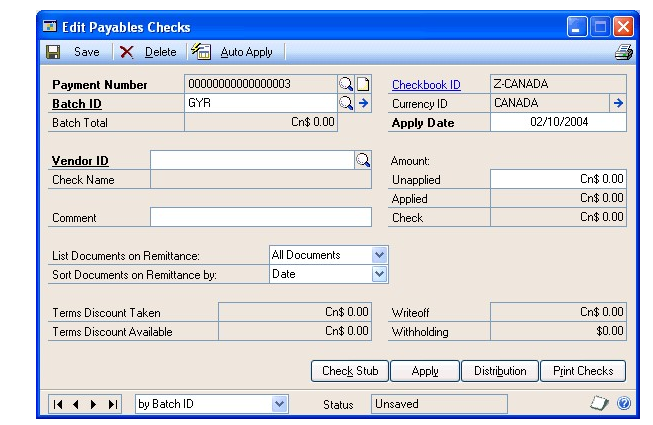

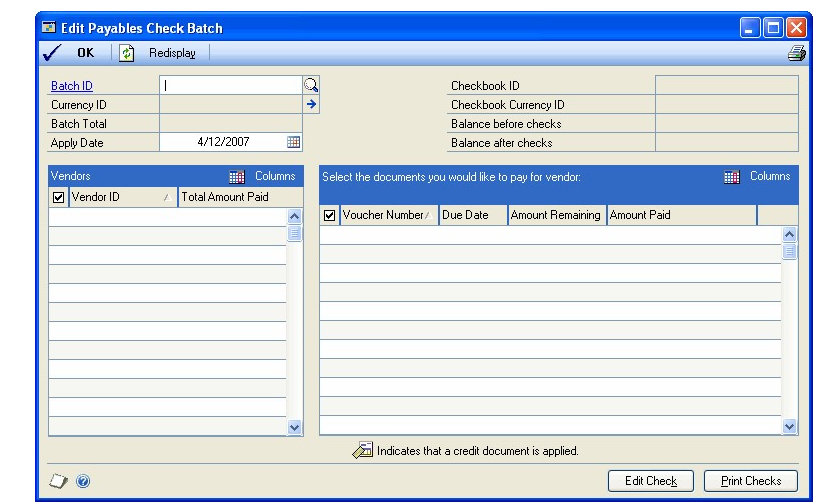

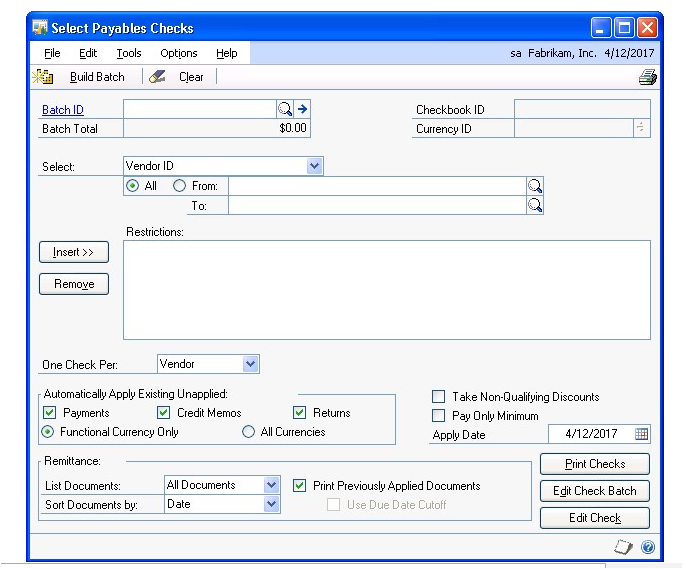

List Documents on Remittance Choose the default information to appear on the remittance and on the check stub when you print checks. A remittance shows the same detail as the check stub and is printed on blank paper after the checks are printed. The default you select here appears in the List Documents on Remittance field in the Select Payables Checks and Edit Payables Checks windows.

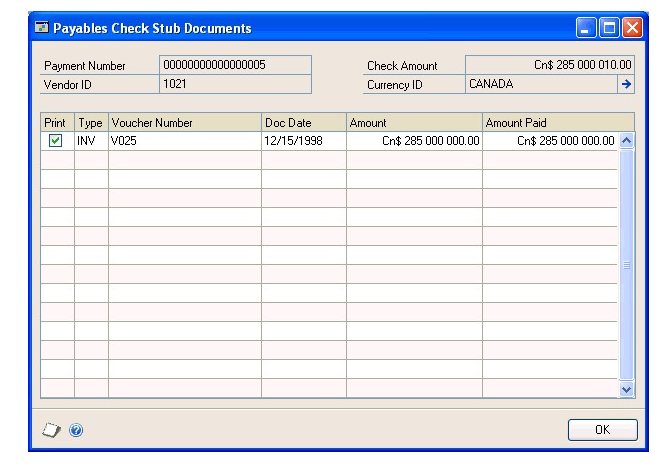

Print Previously Applied Documents on Remittance Mark this option to list documents on the remittance regardless of whether you applied them when the transaction was entered. Use the Payables Check Stub Documents window to unmark previously applied information.

Passwords

Use the Payables Management Setup window to enter passwords to limit the users who can complete certain activities in Payables Management. For example, you might permit only selected users to remove a hold on a vendor record. Use passwords to limit a user’s ability to complete the following tasks:

Remove a vendor record hold

Exceed the maximum invoice amount

Exceed the maximum writeoff amount

Additional payables options

Use the Payables Management Setup window to select additional payables options that affect how Payables Management tracks information.

Override Voucher Number At Transaction Entry If you mark this option, you can change the default voucher number when entering transactions. If you don’t mark this option, you can’t change the voucher number during transaction entry. Set up the default voucher number using the Payables Setup Options window.

Track Discounts Available In GL If you mark this option, you can track payment terms discounts available amounts in a separate General Ledger account. The terms discounts available to your company are posted to the account you assigned to discounts available in the Vendor Account Maintenance window (or the account specified in the Posting Accounts Setup window if you haven’t specified a Discounts Available account in the Vendor Account Maintenance window). If you don’t mark this option, the terms discounts available amounts aren’t posted to a separate General Ledger account.

Print Historical Aged Trial Balance If you mark this option, Microsoft Dynamics GP keeps the transaction history necessary to print the Historical Aged Trial Balance report. If you don’t mark this option, you might not be able to print the Historical Aged Trial Balance report for specific vendors, depending on the history options selected for each individual vendor record.

Delete Unposted Printed Documents Mark this option to be able to delete an unposted printed document from the Payables Transaction Entry or Payables Batch Entry windows.

Print Tax Details on Documents Mark this option to include summary tax information on all documents printed from the Payables Transaction Entry and Payables Transaction Entry Zoom windows. This information is displayed above the subtotal field.

Allow Duplicate Invoices Per Vendor Specify whether you can duplicate document numbers for the same vendor record. If you mark No, you never can use duplicate numbers. If you mark Yes, you can use duplicate numbers for all document types. If you mark Recurring Transactions Only, you can use duplicate numbers only for transactions entered in recurring batches.

Print Dual Currencies If you’re using Multicurrency Management, and you mark Print Tax Details on Documents in the Payables Management Setup window, you can mark this option to print summary tax information in both the originating and functional currencies on purchasing documents that include tax details. The documents will display the exchange rate used for the transaction, the net value of goods and services at each taxation rate in both currencies, and the amount of tax at each taxation rate in both currencies.

Age Unapplied Credit Amounts If you mark this option, the Payables Management aging process will age unapplied credit amounts based on the document date in relation to the aging date, and how you set up your aging periods in Payables Management. If you age documents by due date and you mark this option, the due date for credit documents will be the same as the document date.

Exclude Expired Discounts from Payments If you mark this option, and you select checks for a computer check run by using a range for due date\discount date cutoffs, the discount date for invoices is compared with the apply date entered in the Select Payables Checks window. If the apply date is after the discount date for an invoice, the invoice isn’t included in the computer check batch. Refer to Expired discounts and selecting checks for a computer check run for more information.

Setting up payables preferences and default entries

Use the Payables Management Setup window to set the default entries that appear throughout Payables Management. These defaults speed vendor record, transaction, and payment entry.

To set up payables preferences and default entries:

Open the Payables Management Setup window. (Purchasing >> Setup >> Payables)

Specify the aging periods to use. See Aging periods for more information.

Specify whether documents should be applied by the document date or due date. See Apply options for more information.

Select a default summary view.

Enter or select default information for a checkbook ID and check format, and choose which documents to list on remittances and whether previously applied documents should be listed on remittances. See Default entries for more information.

Enter passwords to restrict user access to certain purchasing activities. If you leave a password field blank, no password is required for that activity. See Passwords for more information.

Mark additional payables options. See Additional payables options for more information about these options.

To open the Payables Setup Options window, where you can set up additional options and default entries such as document descriptions, codes, and numbers, choose Options. See Setting up Payables Management options for more information.

To open the Vendor Class Setup window, where you can set up vendor classes, choose Classes. See Setting up vendor classes for more information.

To open the 1099 Setup window where you can specify the descriptions of boxes and the tax type for each type of 1099 statement, choose 1099 Setup. See Setting up 1099 information for more information.

To print a Payables Setup List, choose File >> Print.

Choose OK to save the entries and close the Payables Management Setup window.

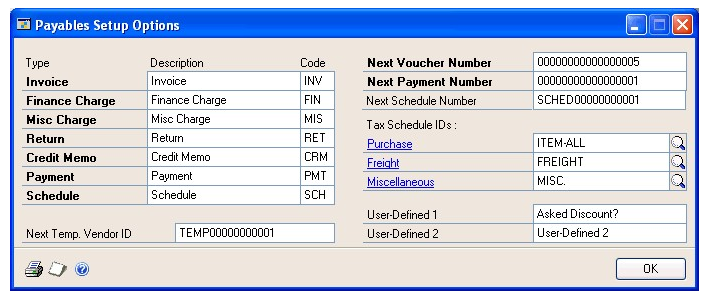

Setting up Payables Management options

Use the Payables Setup Options window to set up the options that appear throughout Payables Management. You can enter a description for each document type, assign a code, and set up the next document number for vouchers and payments.

To set up Payables Management options:

Open the Payables Setup Options window. (Purchasing >> Setup >> Payables >> Options button)

Specify default transaction descriptions and codes. The transaction description is displayed on reports. Use the transaction code when there isn’t room for the entire transaction description on reports or in windows.

Enter a next temporary vendor ID. A temporary vendor is a vendor with whom you have a short-term relationship, and for whom you’re keeping minimal information. Use this number to identify a temporary vendor record when you enter transactions. For more information about temporary vendors, see Vendor status.

Enter a next voucher number and next payment number to use in transaction entry windows.

Enter default tax schedules for purchases, freight, and miscellaneous charges. These tax schedules appear in the Payables Transaction Entry window, and you can change them per transaction. See the System Setup instructions (Help >> Contents >> select Setting Up the System) for more information about setting up tax schedules.

Enter user-defined field labels for tracking additional information for vendors.

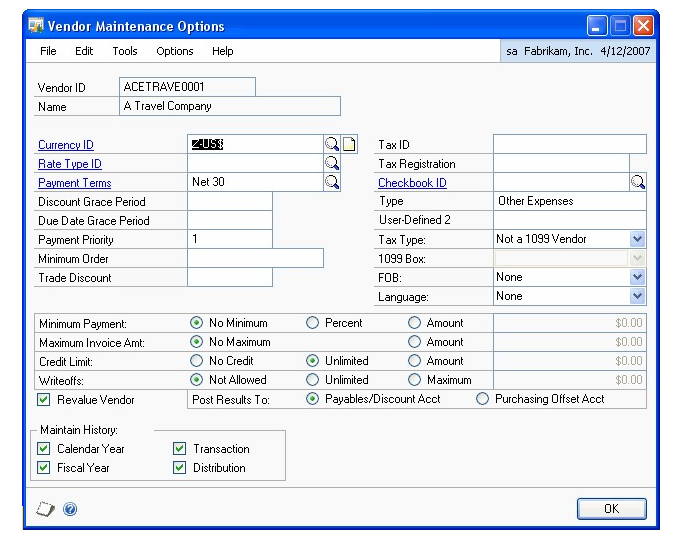

For example, suppose you keep track of the types of vendors you purchase from. You might enter Vendor Type in the User-Defined 1 field. In the Vendor Class Setup window and the Vendor Maintenance Options window, you then would see Vendor Type as a label for the field that was User-Defined 1. You also would see Vendor Type as a sorting method on most vendor reports.

Use the User-Defined 2 field to track an additional piece of information for each vendor; however, this field isn’t a sorting method for reports.

Choose OK to return to the Payables Management Setup window, where you can save the entries.

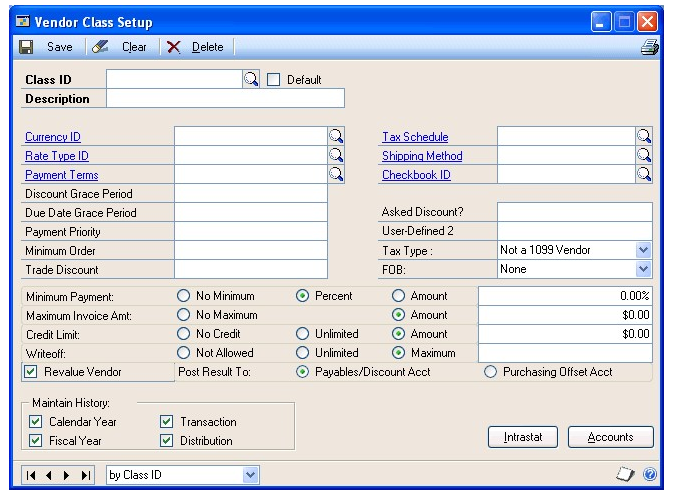

Chapter 2: Vendor classes

Use vendor classes to group vendors according to common entries. For example, you might group vendors by business type, location, or other similar characteristics.

When you make changes to vendor class information, you can roll down those changes to all the vendors in the class.

Vendor class information is divided into the following sections:

History options

Setting up vendor classes

Setting up vendor class default posting accounts

Entering vendor class Intrastat statistics

History options

You can mark whether to keep fiscal-year, calendar-year, transaction, and distribution history when you set up vendor classes. You can mark any number of these options.

The following table describes each of the history options:

| History types | What’s kept | Benefits of keeping | More information |

|---|---|---|---|

| Calendar-year | Summarized history of posted transactions for each month in the calendar year. | You can print reports that accurately reflect purchasing activity each month. Use the resulting reports to determine whether you’re meeting budget goals. | If you’re required to print 1099 statements for vendors, you should keep calendar year history so 1099 amounts are tracked accurately. |

| Fiscal-year | Summarized history of posted transactions for each fiscal period. | You can print reports that accurately reflect purchasing activity in each fiscal period. Use the resulting reports to determine whether you’re meeting budget goals. | If your fiscal year is the same as the calendar year, you don’t need to keep both fiscal-year and calendar-year history. |

| Transaction | Detailed information about paid vouchers. | You can print history reports and view information about paid vouchers using inquiry windows. You also can print the Historical Aged Trial Balance and re-create remittance forms and check stubs. | If you marked to print the Historical Aged Trial Balance in the Payables Management Setup window, transaction history is kept regardless of whether you mark this option. |

| Distribution | Detailed information about the posting account distributions for each transaction. | You can print Distribution History and Check Distribution reports. |

Setting up vendor classes

Vendor classes provide defaults for the data that groups of vendors use. You also can make changes to groups of vendors quickly by changing the class record and rolling down the change to all the vendors in a class. Use the Vendor Class Setup window to set up vendor classes to group vendors. By setting up vendor classes, you can easily assign new vendors to specific classes, making it faster and easier to set up a new vendor record.

To set up a vendor class:

Open the Vendor Class Setup window. (Purchasing >> Setup >> Vendor Class)

Enter an ID for the class, and enter a description that further identifies the class.

We recommend that you enter the class with the most common entries first and mark this class as the default class. If you mark the Default option, the information you set for this class appears as the default for every subsequent class you create. You can have only one default vendor class.

Enter multicurrency information. Enter or select an existing currency as the default currency for the class. See the Multicurrency Management documentation for more information about currencies and rate types.

Enter or select an existing rate type for the class. When you enter transactions, the appropriate exchange rate table is selected based on the currency ID and rate type you entered.

If a rate type isn’t assigned to a vendor on a multicurrency transaction, the default rate type you entered for the Purchasing series using the Multicurrency Setup window appears instead. Therefore, be sure you entered a Purchasing series default rate type.

Enter document and payment specifications. See the help for more information about fields.

Mark any or all the available history options.

See Setting up vendor class default posting accounts for more information about setting up default posting accounts, so you can assign default posting accounts to the class.

Choose Save. To print a Classes Setup List, choose File >> Print.

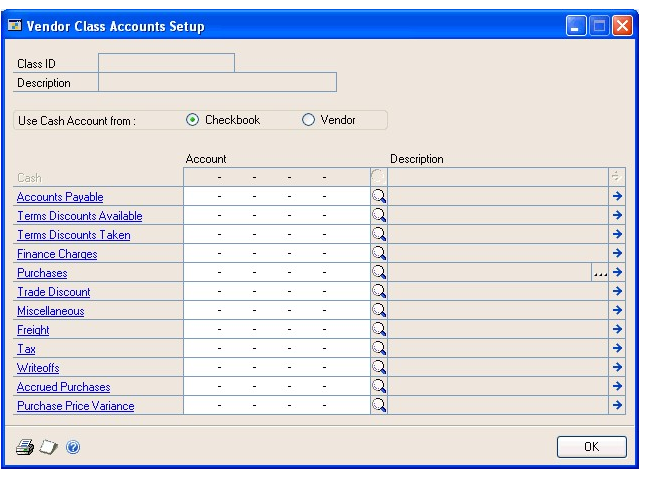

Setting up vendor class default posting accounts

Use the Vendor Class Accounts Setup window to specify posting accounts for vendor classes. You can set up posting accounts for each class, so each vendor you enter can use different posting accounts according to your needs. When you set up vendor records, use these accounts as default entries and change the accounts as needed on a per-vendor basis.

You can use the Additional Vendor Accounts window to set up additional purchase accounts to use during transaction entry when you distribute amounts to posting accounts.

For example, assume you have two employees working in separate departments who both purchase office supplies from the same vendor, and the vendor sends you one invoice for both purchases. By assigning different accounts for each employee’s department, you can track the expenses by department.

To set up vendor class default posting accounts:

Open the Vendor Class Accounts Setup window. (Purchasing >> Setup >> Vendor Class >> Accounts button)

Mark whether to use the Cash account from the checkbook or vendor.

Note

If you’re using Bank Reconciliation, we recommend that you use the Cash account from the checkbook so you can easily reconcile the checkbook balance to the Cash account in General Ledger.

Enter or select the default posting accounts, which will appear as defaults in the Vendor Account Maintenance window when you’re setting up vendor records.

To open the Additional Vendor Accounts window, choose the Purchases field ellipses button.

Enter the additional purchase accounts to use for this class.

To remove an account, select the row to delete and choose Edit >> Delete Row.

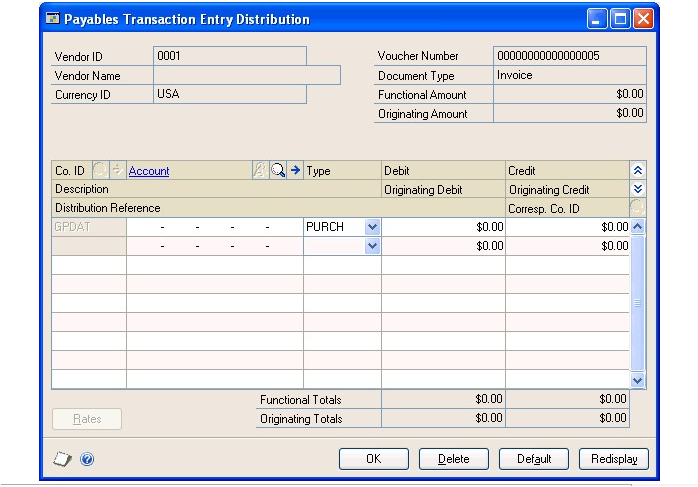

Select default purchase accounts. During transaction entry, each account you marked to appear as a default for transactions is displayed in the Payables Transaction Entry Distribution window. You also can view a list of purchasing accounts using the Accounts lookup window during transaction entry.

Choose OK to save the accounts and close the Additional Vendor Accounts window.

Choose OK to save the vendor accounts and close the Vendor Class Account Setup window.

Entering vendor class Intrastat statistics

Use the Vendor Class Intrastat Setup window to enter Intrastat information for a vendor class. You can roll down changes you make using this window to all vendors in the class.

If you set up Intrastat information for vendors, you don’t need to enter Intrastat information for individual transactions. However, you can change the information for a particular transaction using the Payables Intrastat Entry window.

You can enter Intrastat statistics only if you marked to enable Intrastat tracking in the Company Setup Options window.

To enter vendor class Intrastat statistics:

Open the Vendor Class Intrastat Setup window. (Purchasing >> Setup >> Vendor Class >> Intrastat button)

Enter or select country, transport mode, transaction nature, incoterms, procedure/regime, port, region, country of origin and tax commodity codes for the vendor class.

Enter a description for the vendor class. Choose OK to close the Vendor Class Intrastat Setup window.

In the Vendor Class Setup window, choose Save to save the changes.

Note

Deleting the vendor class deletes Intrastat information, as well.

Chapter 3: Vendor cards

The foundation of the Payables Management module is the collection of vendor cards. Use this information to track the status of vendors and to print reports. It’s important to keep this information up to date to reflect your company’s current activity.

You might be able to import the vendor records from your current system directly into Microsoft Dynamics GP. Automatically importing the vendor data saves you a considerable amount of time. Contact your reseller for more information.

Vendor card information includes the following sections:

Vendor status

Vendor approval workflow

Adding vendor cards

Setting up vendor default posting accounts

Setting up e-mail options for a vendor

Setting up e-mail options for a group of vendors

Setting up vendor withholding options

Address IDs and taxes

Entering vendor addresses

Setting up 1099 information

Entering vendor Intrastat statistics

Vendor status

Vendor statuses can be used for categorizing your vendors according to their business practices. Vendors can be active, inactive and temporary. Each of these statuses can be used to limit the data that can be entered or posted and places restrictions on deleting or modifying a vendor card. You can select the vendor status in the Vendor Maintenance window.

| Status | Active | Inactive | Temporary |

|---|---|---|---|

| Definition | An active vendor is a person or company you have a long-term relationship with and for whom you need to keep detailed information. | An inactive vendor is a person or company you don’t do business with anymore; typically these are vendors whose records you can’t delete because historical information is kept for them. | A temporary vendor is a person or company you have a short-term relationship with and are keeping minimal information for. You can change a temporary vendor to an active vendor or an inactive vendor. |

| Transaction Entry | You can enter, save and post transactions and payments and print checks. | You can’t save or post transactions and payments, or print checks. | You can enter, save and post transactions and payments and print checks. You can void vouchers or checks as long as the temporary vendors have not been deleted. |

| Deletion | You can delete an active vendor record if the vendor has no current balance, no 1099 balance, no transaction or payment history and/or no open purchase orders. | You can delete an inactive vendor record if the vendor has no transaction or payment history, and no 1099 balance. | You can delete a temporary vendor record if the vendor has no current balance, no 1099 balance, and no open purchase orders in Purchase Order Processing. This vendor type can have records in history, and still be deleted. |

Making a vendor inactive isn’t the same thing as placing a vendor on hold. You might find it helpful to think of inactivating a vendor record as a permanent change that reflects you no longer do business together, while placing a vendor on hold usually is a temporary change to the vendor’s status. If you inactivate a vendor record, you can’t enter transactions of any kind for the vendor. If you place the vendor on hold, you can’t make payments to the vendor, but you still can apply vouchers and post transactions for the vendor. For more information about vendor holds, see Placing or removing a vendor hold.

Vendor approval workflow

Your company can use the vendor approval workflow feature as part of its business controls. If you use this feature, you can define an approval process for new vendor records or modifications to an existing vendor record.

When a vendor record is ready to be approved, approvers can be notified and the vendor records can be approved, using Microsoft Outlook, Microsoft Dynamics GP, or SharePoint®. After a vendor has been approved, you can perform the following tasks for the vendor.

Post payables transactions

Select vendors and vouchers for payment

Print checks

Post manual payments

Post scheduled payments

Print 1099 statements

Apply documents

Print purchase orders

Post Purchase Order Processing invoices

For more information about Workflow, see the System Setup Guide (Help >> Printable Manuals >> select System >> select System Setup Guide) or the Workflow Administrator’s Guide (Help >> Printable Manuals >> select System >> select Workflow Administrator’s Guide).

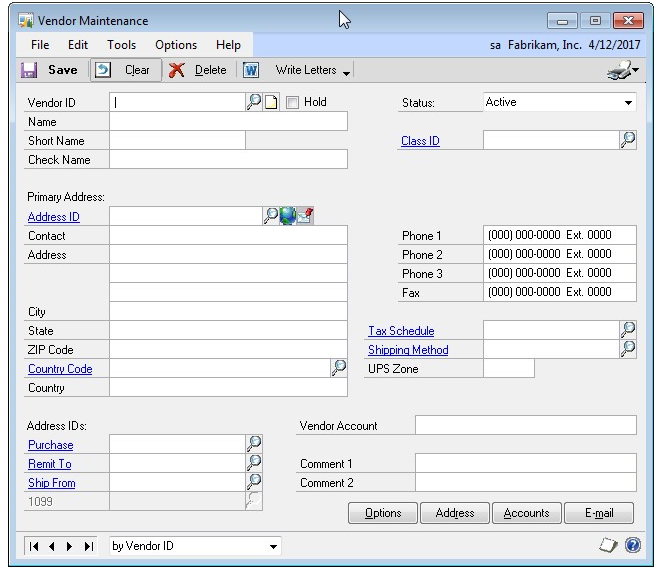

Adding vendor cards

Use the Vendor Maintenance window to create new vendor cards. Before you begin entering the first vendors, consider how to arrange the current and future vendor records. You might want to assign specified groups of IDs to different types of vendors. You also might want to assign them to different vendor classes.

Once you decide the most appropriate numbering system, be sure that all the IDs have the same number of characters. Use the system consistently for the best results when printing reports and using other windows.

To add a vendor card:

Open the Vendor Maintenance window. (Purchasing >> Cards >> Vendor)

Some fields in the window will have default values. Some default values are the same for all vendor information, but others come from the vendor class information entered in the Vendor Class Setup window and the Vendor Class Accounts Setup window. Refer to the table for more information.

Selection Default Status Active Tax Type Not a 1099 Vendor Minimum Payment No Minimum Maximum Invoice Amt No Maximum Credit Limit Unlimited Writeoffs Not Allowed Maintain History All types are marked Enter a vendor ID and name information. The short name can be used in circumstances when the vendor name is too long. The check name is the name that is printed on checks.

Vendor statuses can be used for categorizing your vendors according to their business practices. Vendors can be active, inactive and temporary. Each of these statuses can be used to limit the data that can be entered or posted and places restrictions on deleting or modifying a vendor card. See Placing or removing a vendor hold for information about vendor holds.

Assign the vendor to a class. Once a class ID is entered, much of the information in this window, the Vendor Maintenance Options window and Vendor Account Maintenance windows will appear as default values, which can be changed on a per-vendor basis.

Enter address information. A primary address ID is required if you enter any address information in this window. (Address information can also be entered and maintained in the Vendor Address Maintenance window. See Entering vendor addresses for more information.) Internet address information can also be entered by choosing the Internet Information button. To send purchase orders and vendor remittances in e-mail, use the Internet Information window to enter To, Cc, and Bcc e-mail addresses

Enter phone and fax numbers.

Enter a tax schedule, shipping method and UPS Zone, if you didn’t enter a class ID for this vendor card, or to change the class defaults.

Enter address IDs for purchases, remitting to, shipping from, and sending 1099 statements for this vendor, if the vendor has different addresses for multiple purposes.

Enter the vendor account number the vendor has assigned to you.

Enter comments. Comments are for your reference and will appear on the Vendor Setup List.

Choose Options to open the Vendor Maintenance Options window.

Enter vendor options or change vendor options from those that are provided as default values from the class. When you’re satisfied with the entries, choose OK.

Note

If you marked to print either the Historical Aged Trial Balance in the Payables Management Setup window or to reprint posting journals in the Audit Trail Codes Setup window, the system keeps history to print those reports even if you didn’t mark to keep transaction history or distribution history for vendors. If you didn’t select these options, the history selections you make for individual vendors are used.

If your business requires it, you can use the Vendor Withholding Options window to set up automatic withhold a portion of payments to forward to the appropriate taxing authority. See Setting up vendor withholding options for more information.

Choose the Attachment Management icon to attach documents to the vendor record, if applicable.

In the Vendor Maintenance window, save the vendor record or submit the vendor record for approval, if you are using vendor approval workflow.

To print a Vendor Setup List, choose File >> Print.

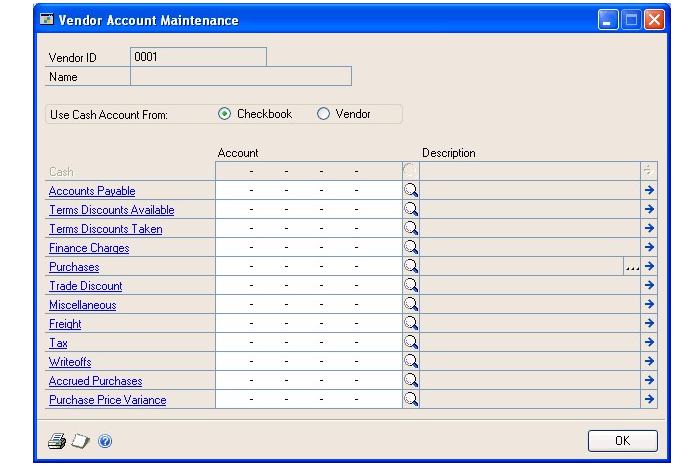

Setting up vendor default posting accounts

Use the Vendor Account Maintenance window to change the accounts for a single vendor. You can set up posting accounts on a per-vendor basis so each transaction you enter can use different posting accounts according to your needs. When you enter transactions, amounts are distributed to the accounts you assign to the vendor using this window.

If you don’t enter default posting accounts for a vendor, the accounts you set up using the Posting Accounts Setup window are used for all transactions entered for the vendor. However, you can change distributions during transaction entry.

You can use the Additional Vendor Accounts window to set up additional purchase accounts to use during transaction entry when you distribute amounts to posting accounts.

For example, assume that you have two employees working in separate departments. These employees both purchase office supplies from the same vendor, and the vendor sends you one invoice for both purchases. By assigning different accounts for each employee’s department, you can track the expenses by department.

If you entered a class ID for this vendor, the posting accounts you entered using the Vendor Class Accounts Setup window appear as default values in the Vendor Account Maintenance window.

To set up vendor default posting accounts:

Open the Vendor Account Maintenance window. (Purchasing >> Cards >> Vendor >> Accounts)

Mark whether to use the Cash account from the checkbook or vendor.

Note

If you’re using Bank Reconciliation, we recommend that you use the Cash account from the checkbook so you can easily reconcile the checkbook balance to the Cash account in General Ledger.

Enter or change the default posting accounts.

Choose the Purchases ellipses button to open the Additional Vendor Accounts window.

Enter the additional purchase accounts to use for this vendor.

Select default purchase accounts. During transaction entry, each account you marked to appear as the default value for transactions appears in the Payables Transaction Entry Distribution window.

You also can view a list of purchasing accounts using the Accounts lookup window during transaction entry.

Choose OK to close the Additional Vendor Accounts window.

Choose OK to save and close the Vendor Account Maintenance window.

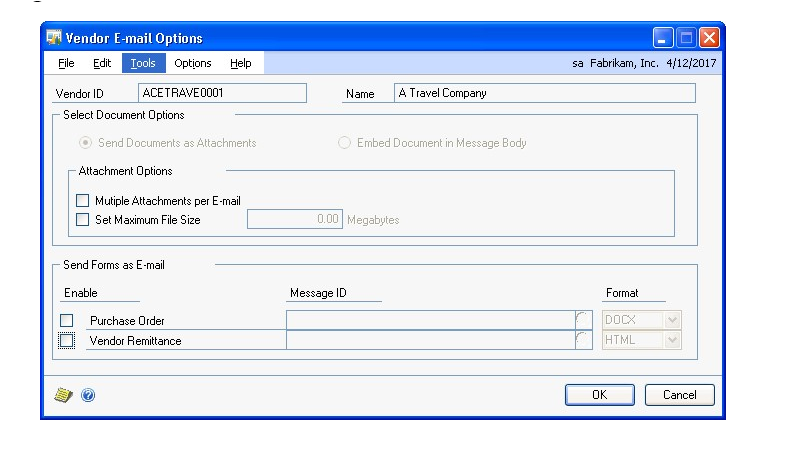

Setting up e-mail options for a vendor

Use the Vendor E-Mail Options window to select which documents you want to send to the vendor. You also can specify message IDs and the document format to use for the vendor. A message ID is a predefined message that you can assign to a document that you want to send in e-mail. For example, you can send a holiday greeting message to a vendor.

You can either send documents as attachments or embed documents in the message body. If you send documents as attachments, you can select to send multiple attachments to the vendor and set the maximum file size of the document.

The options available in this window depend on the selections you made in the Company Setup window and the Purchasing E-mail Setup window. See your System Setup Guide (Help >> Contents >> select Setting up the System) for more information.

To set up e-mail options for a vendor:

Open the Vendor E-mail Options window. (Purchasing >> Cards >> Vendor >> Select a vendor ID >> E-mail)

Select to send documents as attachments or embed documents in the message body. The options available depend on the selections in the Company E-mail Setup window.

If you are sending documents as attachments, you can mark to send multiple attachments for documents of the same document type with the same subject, message body, address to send replies to, To, Cc, and Bcc address in one e-mail.

If you are sending documents as attachments, you can mark to set a maximum file size limit for attached documents sent to the vendors, and then enter the file size limit. If this field is unmarked, there isn’t a size limit.

Mark the documents you want to send in e-mail. You can select a default message ID for each document and select the format to send the document.

If a document is unmarked, it can’t be sent in e-mail. The documents available to send depend on the documents selected in the Purchasing E-Mail Setup window.

If you didn’t select a message ID for the document type in the Purchasing E-mail Setup window, the Message ID field is blank. You can enter or select a message ID.

The file formats available to send attachments depend on the formats you selected in the Company E-mail Setup window.

Before you can send documents as DOCX, PDF, or XPS attachments, the Word template for the document must be enabled in the Template Configuration Manager window. Standard reports (reports generated by the Report Writer engine) are sent when you send documents as HTML attachments.

- Choose OK to update the selected vendor with the options you entered.

Setting up e-mail options for a group of vendors

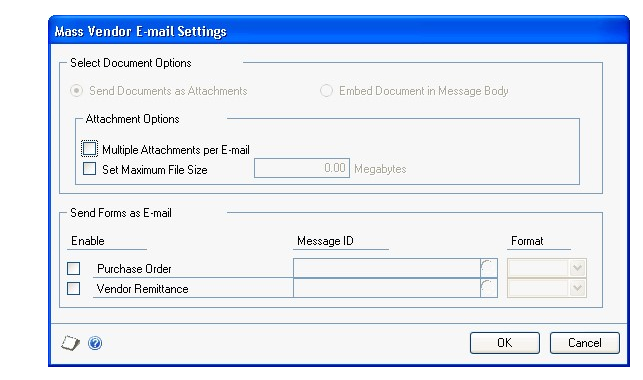

Use the Mass Vendor E-Mail Settings window to assign e-mail settings to multiple vendor records. You can select which documents you want to send to the vendors. You also can specify message IDs and the document format to use for the vendors. A message ID is a predefined message that you can assign to a document that you want to send in e-mail. For example, you can send a promotional message to your vendors when sending purchase orders in e-mail.

You can either send documents as attachments or embed documents in the message body. If you send documents as attachments, you can select to send multiple attachments to the customers and set the maximum file size of the document.

You can either send documents as attachments or embed documents in the message body. If you send documents as attachments, you can select to send multiple attachments to the vendors and set the maximum file size of the document.

To set up e-mail options for a group of vendors:

In the navigation pane, choose the Purchasing button, and then choose the Vendors list.

Mark the vendors that you want to set up e-mail options for.

In the Modify group, click the overflow menu and then select E-mail Settings to open the Mass Vendor E-mail Settings window.

Select to send documents as attachments or embed documents in the body of e-mail messages.

If you are attaching documents, you can select to attach multiple documents per e-mail and set a maximum file size for the documents.

Mark the documents you want to send in e-mail. You can select a default message ID for each document and then select the format that you want to send the document in.

If a document is unmarked, it can’t be sent in e-mail. The documents available to send depend on the documents selected in the Purchasing E-Mail Setup window.

If you didn’t select a message ID for the document type in the Purchasing E-mail Setup window, this field is blank.

The file formats available to send attachments depend on the formats you selected in the Company E-mail Setup window.

Before you can send documents as DOCX, PDF, or XPS attachments, the Word template for the document must be enabled in the Template Configuration Manager window. Standard reports (reports generated by the Report Writer engine) are sent when you send documents as HTML attachments.

Choose OK to save your entries and to close the Mass Vendor E-mail Settings window.

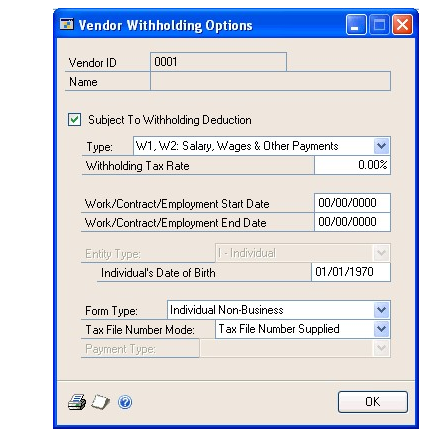

Setting up vendor withholding options

Use the Vendor Withholding Options window to specify tax withholding for a vendor.

In Australia, withholding is a way of paying taxes for people who earn money under contract by providing architectural, building and construction, cleaning, engineering, motor vehicle repair, and other services. If a vendor is subject to withholding taxes, you must set up withholding options for this vendor.

In North America, vendor withholding can be used to automatically withhold a portion of the amount you pay to a vendor to help both your business and your vendor’s business comply with applicable tax laws. Vendor withholding in North America is optional.

Before you enter withholding options, you must enter your company’s withholding rate, withholding vendor ID, and withholding file/reconciliation number information using the Company Setup Options window. Refer to the documentation for the Company Setup Options window for more information.

See the GST and Australian Taxes documentation for more information about setting up Australian taxes.

To set up vendor withholding options:

Open the Vendor Withholding Options window. (Purchasing >> Cards >> Vendor >> Withholding button)

Mark Subject To Withholding Deduction.

Select a withholding type.

Enter the vendor’s tax rate.

Note

If the variance certificate or the deduction certificate expires and the new expiration date isn’t entered, the standard rate entered in the Company Setup Options window calculates the tax until a new variance or deduction certificate number is entered.

Enter the starting and ending dates for the period the payee worked during.

Select the type of business the vendor is part of.

Enter the payee’s date of birth. This field is available only if you selected Individual as the entity type.

Select the type of withholding form the payee must complete for the Australian Taxation Office (ATO).

Select the status of the Tax File Number (TFN) for the payee.

Select the type of income being reported on the payment summary. Some options will be available based on other selections you made in this window.

Choose OK to save the information and close the window.

Address IDs and taxes

Calculation of sales taxes depends on the address ID and shipping method specified for a transaction, along with the tax schedule assigned to the transaction. If the shipping method requires you to pick up the merchandise, the tax schedule assigned to the vendor’s address ID is used. If the shipping method requires the vendor to deliver the merchandise, the tax schedule from your company is used.

Entering vendor addresses

Use the Vendor Address Maintenance window to enter multiple address IDs for an individual vendor.

To enter a vendor address:

Open the Vendor Address Maintenance window. (Purchasing >> Cards >> Addresses)

Enter or select a vendor ID.

If you are using vendor approval workflow, the vendor must have the workflow status of Approved or No Approval Needed before you can enter or select a vendor ID. You can enter or select a vendor that is pending approval if you can approve vendor records.

- Enter an address ID that appropriately names the address, such as Main, Shipping, or Billing.

Enter Internet address information, such as an e-mail address, web page URLs, or FTP sites, by choosing the Internet Information button in the Address ID field. To send purchase orders and vendor remittances in e-mail, use the Internet Information window to enter To, Cc, and Bcc e-mail addresses. See the System Setup instructions (Help >> Contents >> select Setting Up the System) for more information.

- Enter address, phone, and fax information.

Setting up 1099 information

Use the 1099 Setup window to specify the 1099 statement box descriptions and the minimum amounts to track for each box and for each type of 1099 statement your business prints.

To set up 1099 information:

Open the 1099 Setup window. (Purchasing >> Setup >> Payables >> 1099 Setup button)

Select a tax type to enter information for a specific 1099 statement: Dividend, Miscellaneous, and Interest.

Enter box descriptions and minimum amounts, as needed, for each box for the tax type you’re setting up.

Choose OK to save changes and return to the Payables Management Setup window.

Enter or select a tax schedule, shipping method, and UPS zone for the address.

Choose Save to add the address ID. To print a Vendor Addresses List, choose File >> Print.

Entering vendor Intrastat statistics

Use the Vendor Intrastat Setup window to enter a vendor’s tax registration number. If Intrastat information was entered for the vendor class and rolled down, that information appears in this window. Use the Vendor Intrastat Setup window to change Intrastat information for an individual vendor or to enter Intrastat information if none was entered for the vendor class.

You can enter Intrastat statistics only if you marked to enable Intrastat tracking in the Company Setup Options window.

To enter vendor Intrastat statistics:

Open the Vendor Intrastat Setup window. (Purchasing >> Cards >> Addresses >> Intrastat button)

Enter the tax registration number.

Enter or select country, transport mode, transaction nature, incoterms, procedure/regime, port, region, country of origin and tax commodity codes for the vendor class.

Choose OK to close the Vendor Intrastat Setup window.

In the Vendor Address Maintenance window, choose Save to save the information.

Note

Deleting the vendor address ID also deletes Intrastat information.

Chapter 4: Beginning balances and vendor history

If you’re setting up Payables Management for the first time, you must enter the beginning, or outstanding, balances owed to each vendor.

Entering vendor history gives you the historical background you need to use reports and windows to compare amounts for previous years with the current year. See Chapter 17, “Utilities,” for information about removing historical information.

Enter beginning balances before entering vendor history so amounts aren’t posted twice.

Beginning balance and history information is described in the following sections:

Entering beginning balances

Entering vendor credit summary history

Entering vendor period summary history

Entering vendor yearly summary history

Entering beginning balances

Enter beginning balances for each outstanding transaction for each vendor or enter beginning balances as one summarized transaction total for each vendor. To enter beginning balances as a summarized total, be sure to include the payments you made, along with the outstanding vouchers you owe when you calculate the beginning balance total for each vendor. This ensures the beginning balance total is correct for each vendor.

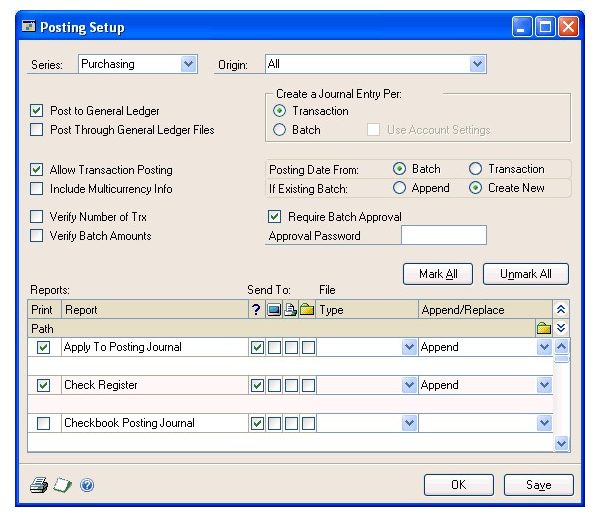

We recommend that you enter each outstanding transaction for each vendor and that you create batches instead of using transaction-level posting. You can then print edit lists to verify the entries before posting.

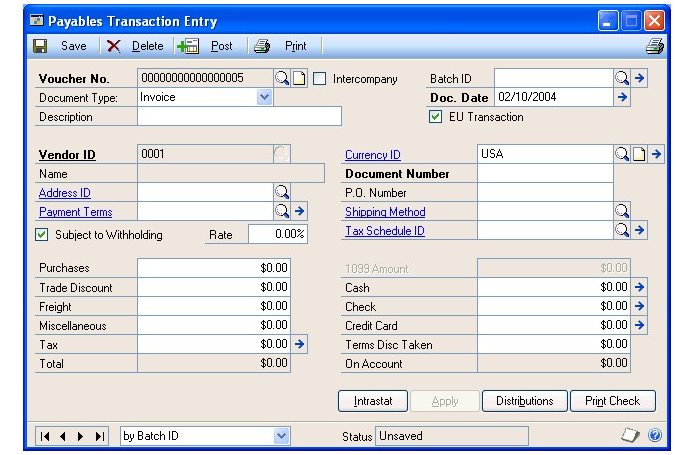

To enter beginning balances:

Open the Posting Setup window. (Administration >> Setup >> Posting >> Posting)

Choose Purchasing as the series and Payables Trx Entry as the origin. Unmark Post to General Ledger if General Ledger is part of your system. Change the origin to Payment Entry and unmark the option again.

This ensures that the beginning balance transactions you’re entering in Payables Management won’t affect General Ledger account balances. The accounts in General Ledger might be overstated if you don’t unmark this posting option before completing this procedure.

- Open the Payables Batch Entry window. (Purchasing >> Transactions >> Batches)

Create a single-use batch (typically called BBAL) for the beginning balances. Select Payables Trx Entry as the batch origin for transactions or select Manual Payment as the batch entry for payments.

Choose Transactions to open the Payables Transaction Entry window or the Payables Manual Payment Entry window—depending on the batch origin— where you can enter transaction information.

Enter beginning balance transactions. The actual balances are entered by entering transactions.

Depending on the information you keep for vendors and records, you enter different information.

| If you plan to keep | What you’ll enter |

|---|---|

| Transaction history in detail | Enter each transaction and payment as a separate entry. |

| Transaction history in summary | Enter one transaction for the entire amount due for each period or month. Enter one lump sum payment for each period or month. |

| Beginning balances only | Enter the outstanding transactions and payments as separate entries. |

See Chapter 8, “Transactions,” for more information.

Print an Aged Trial Balance as a record of the beginning balances. It shows the number of days transactions are outstanding, and any valid discount amounts already paid on invoices. See Chapter 16, “Reports,” for more information about printing reports.

After entering and posting the beginning balances for the vendors, return to the Posting Setup window. Mark Post to General Ledger Files for the Purchasing series, so regular payables transactions are posted to General Ledger.

Create a backup of the setup options and default values, class and vendor records, and beginning balances. If a power fluctuation or some other problem occurs, you can restore the beginning data. See the System Administrator’s Guide (Help >> Contents >> select System Administration) for more information about making backups. If you’re required by the US Internal Revenue Service to send 1099 statements to specific vendors, check the 1099 amounts in the Vendor Yearly Summary window to be sure the 1099 amount for each vendor is correct. Payables Management uses the 1099 amounts displayed in the Vendor Yearly Summary window when printing the 1099 statements.

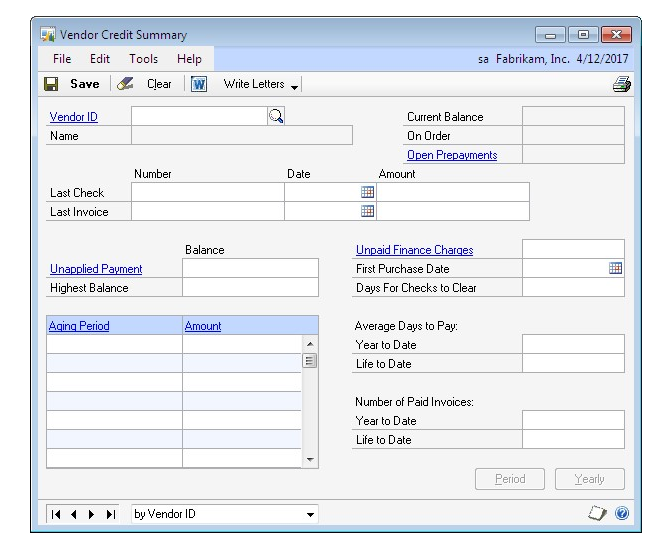

Entering vendor credit summary history

Use the Vendor Credit Summary window to enter credit summary history for each vendor. The Current Balance field and the aging period information are updated as you enter and post transactions for each vendor. If you marked Age Unapplied Credit Amounts in the Payables Management Setup window, unapplied credit amounts also are included in the aging process.

If you are allowing prepayments for purchase orders, prepayments are not included in the current balance amount because a prepayment is a deferred charge and not a payment on accounts payables.

When history has been originated by entering it here or by entering transactions, the fields in these windows are updated as transactions are posted. Information is updated in the inquiry windows, as well.

If you’re using Multicurrency Management, amounts in this window are displayed in the functional currency. If transactions were entered in foreign currencies, the functional equivalents are displayed.

To enter vendor credit summary history:

Open the Vendor Credit Summary window. (Purchasing >> Cards >> Summary)

Enter or select a vendor ID.

Enter last check and last invoice information.

Enter the unapplied payment and highest balance amounts.

Enter the unpaid finance charges amount, the first purchase date, and the number of days it typically takes your company’s checks to clear from this vendor.

Enter the average days to pay.

Enter the number of paid invoices.

Enter other history types. See Entering vendor period summary history and Entering vendor yearly summary history for more information.

Choose Save. Continue entering other types of history as needed. When you enter all the history you need, you can choose File >> Print to print a Vendor Financial Summary Report.

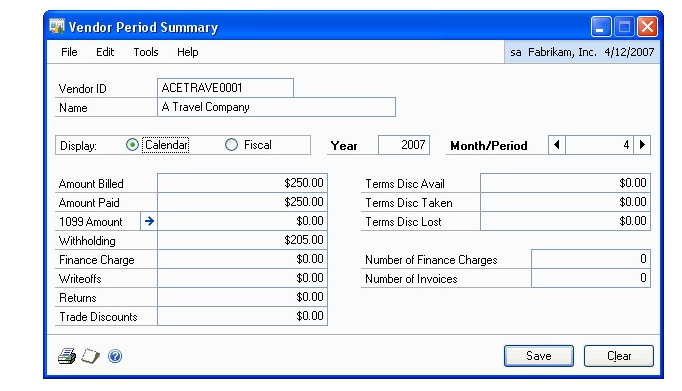

Entering vendor period summary history

Use the Vendor Period Summary window to enter historical amounts per period— fiscal or calendar. To keep both fiscal and calendar period history if those periods are different, you must enter each type separately.

To enter vendor period summary history:

Open the Vendor Period Summary window. (Purchasing >> Cards >> Summary >> Select a vendor ID >> Period button)

Mark Calendar or Fiscal, depending on the type of history you’re entering.

Enter a year.

Enter or select the number of the month or period.

Enter the amounts for the month or period you selected.

If you posted beginning balances for this vendor, balances might be displayed for some periods.

Note

Changing the 1099 amount in this window does not affect the 1099 statement amount. To change the amounts that are printed on 1099 statements, choose the expansion button for the 1099 Amount field in the Vendor Period Summary windows to open the 1099 Details window.

- Choose Save.

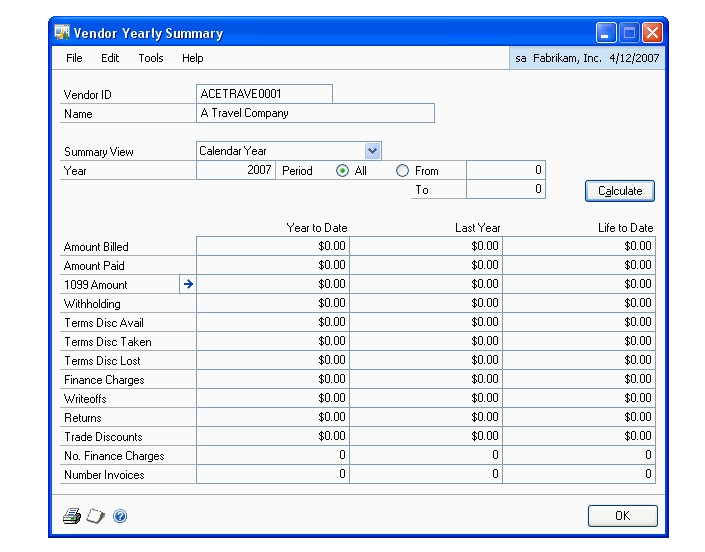

Entering vendor yearly summary history

Use the Vendor Yearly Summary window to enter summarized history information. Amounts might appear if you posted beginning balances for the vendor. You must select Amounts Since Last Close as the summary view to enter information in this window.

If you’re using this window to view vendor yearly summary information by fiscal or calendar year, the amounts in the Year-to-Date and Last Year columns are calculated using period detail information, based on the year you enter. The year-todate and last-year amounts for Amounts Since Last Close were determined during the most recent year-end closing process.

If you’re required by the US Internal Revenue Service to send this vendor a 1099 statement, be sure the vendor’s 1099 year-to-date amount is correct.

Changing the 1099 amount in this window won’t affect the 1099 statement amounts. Use the 1099 Details to change amounts that appear on 1099 statements.

To enter vendor yearly summary history:

Open the Vendor Yearly Summary window. (Purchasing >> Cards >> Summary >> Select a vendor ID >> Yearly button)

Select Amounts Since Last Close as the summary view, if you’re entering vendor yearly summary history.

Enter year-to-date, last-year, and life-to-date totals for each category.

Select Calendar or Fiscal for the summary view if you want to view the historical amounts per period. You can change the fiscal/calendar year and periods to view the amounts for specific time periods. Press Calculate to redisplay the amounts.

To print the Vendor Financial Summary Report, so you can verify the information you entered for the vendor, choose File >> Print. The report is printed with the information you’re currently viewing in the Vendor Yearly Summary window.

Choose OK.

Chapter 5: Vendor maintenance

This part of the documentation describes the maintenance tasks you encounter when working in Microsoft Dynamics GP.

Vendor maintenance information is divided into the following sections:

Placing or removing a vendor hold

Inactivating a vendor card

Modifying a vendor card

Deleting a vendor card

Deleting a vendor class

Deleting a vendor address

Placing or removing a vendor hold

During the course of business, you might want to place a vendor record on hold. For example, if you receive the wrong merchandise from a vendor, you might not want to pay the vendor until the correct merchandise is shipped. Use the Vendor Maintenance window to put the vendor card on hold and restrict what information you can enter for the vendor, or to release the vendor hold.

When a vendor card is on hold, you can’t issue or apply payments. However, you can enter, post, and apply transactions from the vendor you placed on hold.

A password might be required to remove a hold on a vendor record.

To place or remove a vendor hold:

Open the Vendor Maintenance window. (Purchasing >> Cards >> Vendor)

Enter or select a vendor ID.

Mark Hold to place the vendor card on hold or unmark Hold to remove it. Choose Save

Note

Depending on how Payables Management was set up, a password might be required to remove a hold on a vendor record.

Inactivating a vendor card

Use the Vendor Maintenance window to inactivate a vendor card. Inactive vendors are vendors you no longer want to have a business relationship with, but for whom you can’t delete records because historical information is being kept.

You can’t inactivate a vendor record if it has a current balance, or unposted and posted transactions. If a purchase order is assigned to a vendor record, the purchase order must be moved to history before you can inactivate the vendor record.

If the vendor card you’re inactivating has a current balance or a 1099 amount, you must wait to inactivate the card until after you close the Payables Management year. See Chapter 18, “Routines,” for more information about closing a year.

To inactivate a vendor card:

Open the Vendor Maintenance window. (Purchasing >> Cards >> Vendor)

Enter or select a vendor ID.

Select the Inactive status to inactivate the vendor. Choose Save.

Modifying a vendor card

Use the Vendor Maintenance window to modify a vendor card. You may have to change a vendor’s credit limit or telephone number.

If you are using vendor approval workflow, you must resubmit the vendor card for approval if you change one of the following fields.

| Window | Fields |

|---|---|

| Vendor Maintenance | City, State, UPS Zone, Remit to address |

| Vendor Maintenance Options | Discount Grace Period, Due Date Grace Period, Payment Priority, Minimum Order, Trade Discount, Minimum Payment, Maximum Invoice Amount, Credit Limit, Writeoffs |

To modify a vendor card:

Open the Vendor Maintenance window. (Purchasing >> Cards >> Vendor)

Enter or select a vendor ID.

You can modify a vendor card that is pending approval if you are the current approver of the vendor card.

To make changes to the vendor card, enter the new information.

Save the vendor card or submit it for approval if you are using vendor approval workflow.

Deleting a vendor card

Use the Vendor Maintenance window to delete a vendor card, if the card is obsolete and you’re not planning to use it again in the future. You can’t delete a vendor card if it contains any of the following information:

A current balance

A 1099 amount for the current year (United States only)

Unposted and posted transactions

Transactions in history; you can delete temporary vendors even if they have transactions in history

To see whether a vendor has records in the history table, print a Payables Transaction History Report without removing historical information. If you’re keeping transaction history for the vendor, it appears on the report. You also can use the Vendor Credit Summary Inquiry window to see whether the vendor has current-year activity, and the Payables Transaction Inquiry windows to see whether you’re keeping history.

See Chapter 17, “Utilities,” for more information about removing history.

If history is being kept for a vendor you’re planning to delete, you must remove history before deleting the card. Or, you can change the vendor status to Temporary and delete the card, because you can delete temporary vendor cards when you’re keeping history. Deleting a vendor card for a temporary vendor does not remove historical information for that vendor.

To delete a vendor card:

Open the Vendor Maintenance window. (Purchasing >> Cards >> Vendor)

Enter or select a vendor ID.

Choose Delete.

To delete a vendor record with a workflow status of Pending Approval, you must be the current approver of the vendor card or you must have permission to act on the tasks of other users during the vendor approval process.

Deleting a vendor class

Use the Vendor Class Setup window to delete a vendor class, if the class is obsolete and you’re not planning to use it in the future.

When you delete a vendor class, the vendor cards assigned to the class aren’t affected, except that the class ID will be invalid.

You might want to print a Vendor Setup List, sorted by class, to view the vendors that will be affected by the deletion.

To delete a vendor class:

Open the Vendor Class Setup window. (Purchasing >> Setup >> Vendor Class)

Enter or select a class ID.

Choose Delete.

Deleting a vendor address

Use the Vendor Address Maintenance window to delete a vendor address, if the address is obsolete and you’re not planning to use it in the future.

You can’t delete an address ID assigned to a vendor record. To delete an assigned address ID, first clear the address ID using the Vendor Maintenance window.

To delete a vendor class:

Open the Vendor Address Maintenance window. (Purchasing >> Cards >> Addresses)

Enter or select a class ID.

Choose Delete.

Part 2: Transactions

This part of the documentation includes the procedures you use to complete payables tasks in your Microsoft Dynamics GP system. Payables Management transaction information is divided into the following topics:

Chapter 6, “Multicurrency transactions,” describes the effects of using Multicurrency Management with Payables Management.

Chapter 7, “Batches and posting,” explains how to use batches to group purchasing documents for posting.

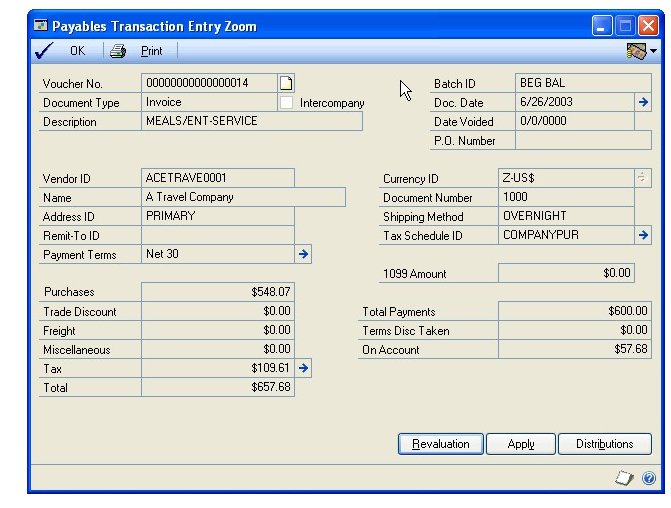

Chapter 8, “Transactions,” explains how to enter invoices, credit memos, returns, finance charges, and miscellaneous charges in Payables Management.

Chapter 9, “Transaction maintenance,” explains how to correct, delete, or void transactions, or place them on hold.

Chapter 10, “Payments,” describes the different ways to pay vendors.

Chapter 11, “Scheduled payments,” describes how to create, edit, and post payment schedules.

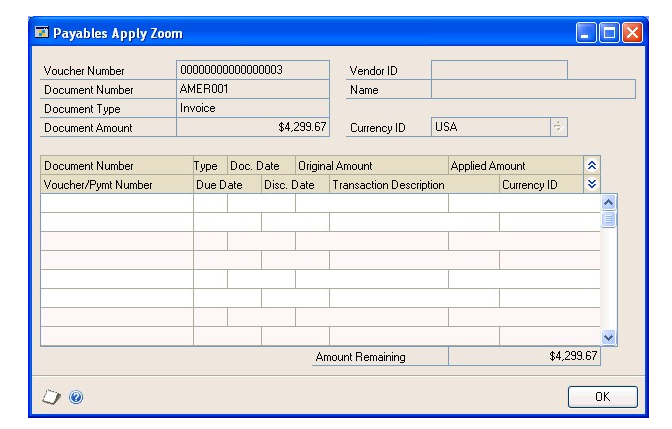

Chapter 12, “Applying,” contains information about assigning specific amounts to pay all or part of a transaction.

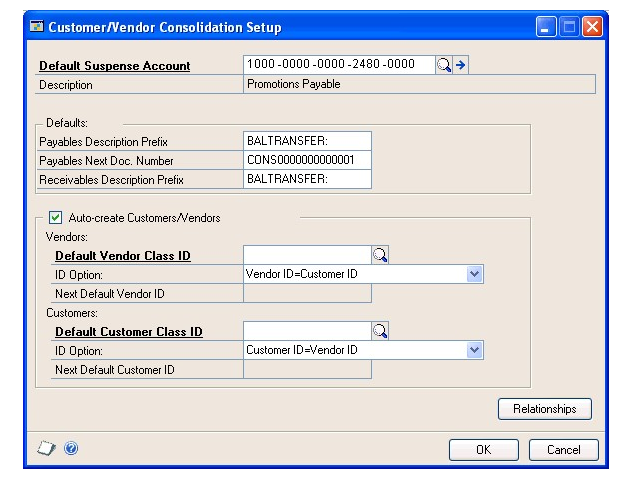

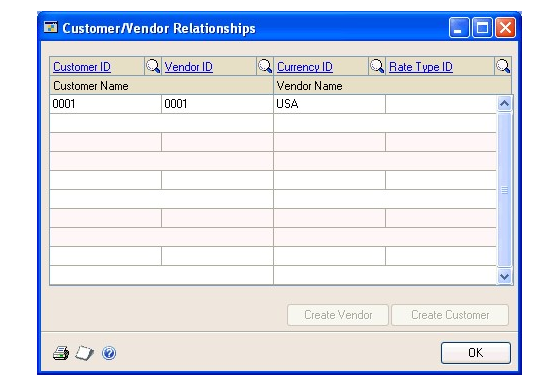

Chapter 13, “Customer/vendor consolidations,” includes information on creating customer/vendor relationships and consolidations documents.

Chapter 14, “Multicurrency applying,” contains information specific to applying and unapplying multicurrency transactions.

Chapter 6: Multicurrency transactions

If you’re using Multicurrency Management with Payables Management, you can choose the currency to enter on transactions.

This information is divided into the following sections:

Exchange rate and document date

Multicurrency account distributions

Exchange rate and document date

If a transaction’s currency ID is not in the functional currency, a rate type and associated exchange rate table are assigned to the transaction. The rate type is based on the rate type you assigned to the selected vendor. If a rate type isn’t assigned to the vendor record, the default rate type for the Purchasing series, which you specified using the Multicurrency Setup window, is used. You also can choose the Currency field expansion button to open the Exchange Rate Entry window, where you can view or modify the default exchange rate.

The document date assigned to a transaction determines the exchange rate to use, based on the currency ID and associated rate type entered for the transaction. Each time you change the document date on a multicurrency transaction, the system searches for a valid exchange rate. If a valid rate doesn’t exist, you can enter an exchange rate using the Exchange Rate Entry window. If you entered a General Ledger posting date that’s different from the document date, the exchange rate expiration date must be after the posting date.

Multicurrency account distributions

For multicurrency transactions, distribution amounts are displayed in both the functional and originating currencies. However, you can change only the originating amounts.

When you enter a multicurrency transaction, the originating debit and credit amounts must balance. If the functional equivalents don’t balance, the difference is posted to a Rounding Difference account. A distribution type of Round identifies the distribution amount in the Purchasing Distribution Entry window.

For example, assume that you’ve entered a transaction in the euro currency with a payment amount of 28,755.42 EUR, a trade discount of 586.84 EUR, and a discount available of 1544.33 EUR, when the exchange rate is 1.0922. The distributions are calculated as shown in the following table:

| Account | Euro debit | Euro credit | US dollars debit | US dollars credit |

|---|---|---|---|---|

| Accounts | 28,755.42 EUR | $31,406.67 | ||

| Receivable | ||||

| Trade Discount | 586.84 EUR | $640.95 | ||

| Discounts | 1544.33 EUR | $1686.72 | ||

| Available | ||||

| Accrued | 30,886.59 EUR | $33,734.33 | ||

| Purchases | ||||

| Totals | 30,886.59 EUR | 30,886.59 EUR | $33,734.34 | $33,734.33 |

| Rounding Diff | $0.01 | |||

| Totals | 30,886.59 EUR | 30,886.59 EUR | $33,734.34 | $33,734.34 |

Chapter 7: Batches and posting

Batches are groups of transactions, identified by a name or a number, that you can use for identification purposes, and to make the posting process easier. You can use batches to group similar transactions during data entry and review them before posting at a later time. You can identify batches as a group of transactions entered by a specific employee or on a particular date.

Posting reports will be printed when you post transactions, either individually or in batches. For more information about posting reports for Payables Management, refer to Payables Management standard report summary.

If you are using vendor approval workflow, you can post transactions in a batch only if the vendors assigned to the transactions have the workflow status of Approved or No Approval Needed. If you post a batch and a vendor isn’t approved, transactions for that vendor aren’t posted and remain in the batch. For more information about vendor approval workflow, see Vendor approval workflow .

Batch information is broken into the following sections:

Creating a batch

Payables batch approval workflow

Modifying or deleting a batch

Posting a batch

Posting batches by series

Creating a batch

Use the Payables Batch Entry window to create a batch, or group, of transactions. You can create batches that you use just one time, or recurring batches for transactions you enter on a regular basis.

To create a batch:

Open the Payables Batch Entry window. (Purchasing >> Transactions >> Batches)

Enter or select a batch ID.

Select the batch origin. The origin identifies the window that transactions for this batch will be entered in. Since batches can use only one origin, you can have several batches with the same name, but different origins.

Enter a batch comment.

If you are creating a computer check batch for purchase order prepayments, mark Purchasing Prepayment Batch.

This option is available if you have marked the Allow Purchase Order Prepayments option in the Purchase Order Processing Setup window.

Select a frequency if the origin is Payables Transaction Entry. Select Single Use for batches you enter and post only once.

If this batch is a recurring batch, select the frequency to repost the transactions.

Enter the number of times to repeat posting in the Recurring Posting field.

Leave the Recurring Posting field as zero for an unlimited number of postings. The batch must be posted at the interval you select, but you don’t need to reenter the transactions in the batch.

If you select Miscellaneous as the frequency, enter the number of days for the posting date to increment.

If you’re using Multicurrency Management and you’re planning to enter transactions involving multiple currencies, select single-use. Multicurrency batches must be single-use because exchange rates for document dates can’t be predicted.

Enter a posting date. The user date is the default posting date, but you can change it to post the batch as of a different date.

The posting date entered here is the date General Ledger files are updated. Payables Management records are updated according to the date entered in the Payables Transaction Entry window.

Enter or select a checkbook ID.

Enter currency information, if the origin is Computer Check (otherwise, these fields are unavailable). Enter a check date to appear on checks in this batch. The check date also determines the exchange rate to use for checks in this batch.

Enter a currency ID; all computer checks in this batch must use the same currency ID and have the same check date.

Enter any requirements for posting the batch, such as batch totals.

To print a batch edit list, choose File >> Print. Choose Save.

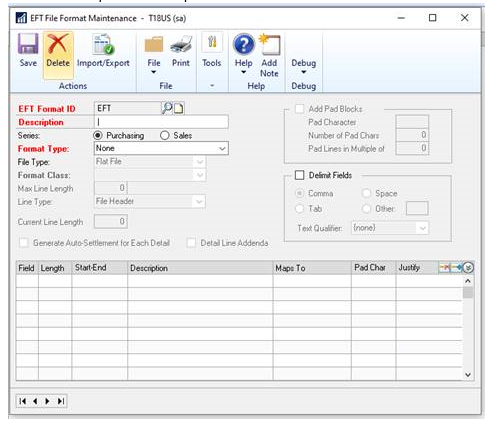

[!NOTE] You may receive an error message "The fiscal period that contains this posting date has not been set up" when you create a credit card payment in a computer check batch. What can cause this error is the following:

- You have a computer check set to have posting date from the transaction or

- You do not have EFT for payables registered under Tools | Setup | System | Registration

If you enable EFT for payables, then a new field will appear in the print payment window that allows you to set the value and you can post without issue. The other workaround is to set the posting date from the batch so you can see the posting date in the batch window.

Payables batch approval workflow

If your company uses the Workflow feature among its business controls, batches might have to be approved before posting. The rules for approving batches can be defined to fit your organization’s needs. Multiple approvers might be required, or approval might not be required for batches with few transactions or small currency amounts. When a batch is ready to be approved, approvers can be notified and the batches can be approved, using Microsoft Outlook or Microsoft Dynamics GP. After a batch is approved, it can be posted.

Before you can use the batch approval workflow for Payables Management, you must turn off the Require Batch Approval feature in Microsoft Dynamics GP. To do so, open the Posting Setup window (Administration >> Setup >> Posting >> Posting) and select the Purchasing series. Unmark the Require Batch Approval option for batches whose origin is General Entry and Clearing Entry.

Modifying or deleting a batch

Use the Payables Batch Entry window to correct or delete a batch. You can change or delete unposted batches at any time. Recurring batches are deleted after the batch has been posted the number of times you specify in the Recurring Posting field.

See Correcting or deleting an unposted transaction for information about changing the transactions in a batch.

To modify or delete a batch:

Open the Payables Batch Entry window. (Purchasing >> Transactions >> Batches)

To correct the batch, replace the incorrect information with correct information. Choose Save to save the changes or submit the batch to workflow. If you use workflow and you change a transaction, you must resubmit the batch to workflow.

To delete the batch, choose Delete and close the window.

To modify a batch using the action pane:

In the navigation pane, choose the Purchasing button, then choose the Payables Batches list.

Select a batch to modify.

Choose Edit to open the Payables Batch Entry window.

To delete a batch, choose Delete and close the window.

To correct the batch, replace the incorrect information with the correct information. Choose save to save the changes or resubmit the batch for approval, if you are using workflow.

Posting a batch

Use the Payables Batch Entry window to post batches you’ve entered in Payables Management. You also can view, print an edit list, mark, and post one or more batches using the Payables Batches list view and the buttons in the action pane.

To post a batch:

Print an edit list and review the transactions in the batch. You can print an edit list from the Payables Batch Entry window, with the appropriate batch ID displayed. If you need to make corrections, do so at this time.

Make a backup of your company’s data. See the System Administrator’s Guide (Help >> Contents >> select System Administration) for more information about making backups.

Open the Payables Batch Entry window. (Purchasing >> Transactions >> Batches)

Enter or select the batch ID and origin.

Choose Post. The transaction entries in the batch update vendor summary information, tax records, and distribution accounts, and become part of your company’s permanent records.

If you’re set up to post to rather than through General Ledger, the batch appears in the Financial Series Posting and Master Posting windows. You can edit the transactions in the General Ledger Transaction Entry window before posting them again. Accounts are updated when you post the transactions in General Ledger.

If you post through General Ledger, accounts are updated at once and you don’t need to post the batch again in General Ledger.

- Print the posting journals and distribution breakdown registers. Using the Posting Setup window, you can select posting journals to print according to your preferences. A Report Destination window might appear for each posting journal that is printed.

To post a batch using the action pane

Open the Payables Batches list view. From the Purchasing list view, select Payables Batches in the navigation pane.

Print an edit list for each batch to post and review the transactions in that batch. In the Reports group on the action pane, choose Print Edit List.

Review the transactions, make any changes necessary and print the edit list again to verify them. For more information, see Chapter 9, “Transaction maintenance.”

Save your changes and close the Transaction Entry and Batch Entry windows.

Make a backup of your company’s data. See the System Administrator’s Guide (Help >> Contents >> select System Administration) for more information about making backups.

From the Payables Batches list, mark the batches to post.

Choose to post the selected batches.

If you’re set up to post to rather than through General Ledger, the batch appears in the Financial Series Posting and Master Posting windows. You can edit the transactions in the General Ledger Transaction Entry window before posting them again. Accounts are updated when you post the transactions in General Ledger. If you’re using Workflow, and change a batch, you must resubmit that batch for approval.

If you post through General Ledger, accounts are updated at once and you don’t need to post the batch again in General Ledger.

Print the posting journals and distribution breakdown registers. Using the Posting Setup window, you can select posting journals to print according to your preferences.

Posting batches by series

Use the Purchasing Series Posting window to post Payables batches by series. Series posting lets you post any batch that’s been entered in the Purchasing series.

To post a batch by series:

Print an edit list to review the transactions. You can print an edit list from the Payables Batch Entry or Purchasing Batch Entry windows, with the appropriate batch ID displayed. You must print a separate edit list for each batch. If you need to make corrections, do so at this time.

Make a backup of your company’s data. See the System Administrator’s Guide (Help >> Contents >> select System Administration) for more information about making backups.

Open the Purchasing Series Posting window. (Purchasing >> Transactions >> Series Post)

Mark the Status check box for each batch to post. The status changes to Marked, which indicates to other users that the batch is ready to be posted.

Choose Post. The transactions in the batches update vendor summary information, tax records, and distribution accounts, and become part of the company’s permanent records. Your checkbook also is updated if you’re using Bank Reconciliation. Posting journals and distribution breakdown registers might appear for printing, depending on the options you selected in the Posting Setup window.

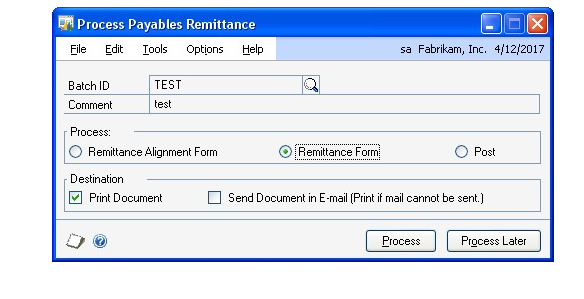

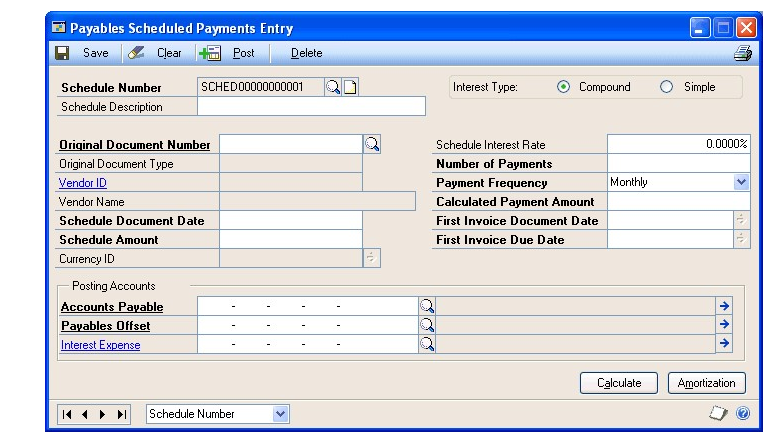

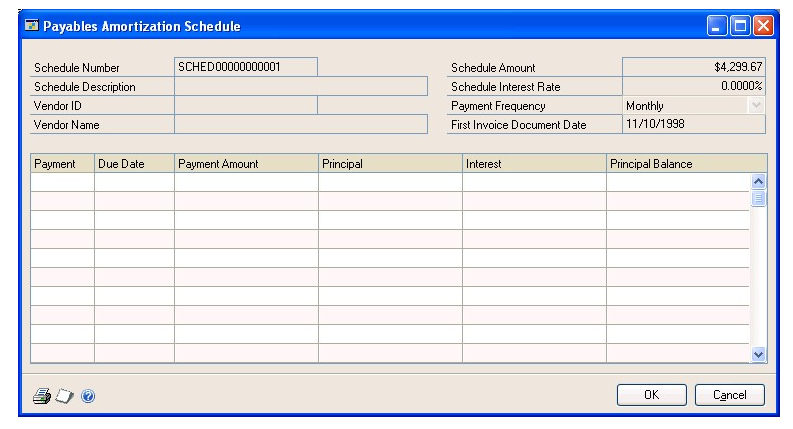

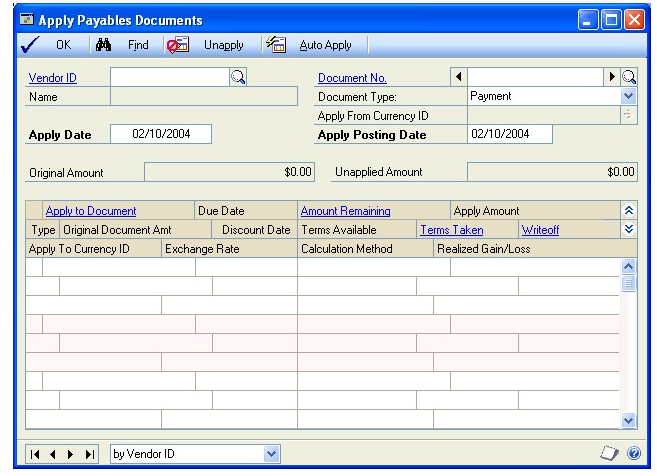

Note