Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

You can use U.S. Payroll to set up, enter, and maintain employee payroll records and transactions. Employee cards are the foundation of your U.S. Payroll system and they are used to keep your U.S. Payroll information up to date. You can view current and historical payroll information and pay activity for one employee or a group of employees.

You also can use U.S. Payroll to complete the following tasks:

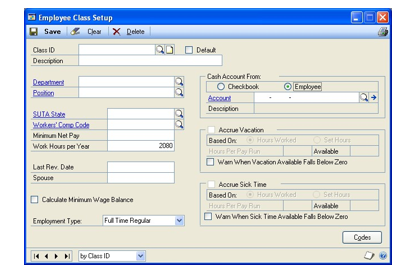

Set up employee classes to create default entries that can make data entry quicker for new employee records because the payroll information is grouped according to common factors, such as pay codes and positions

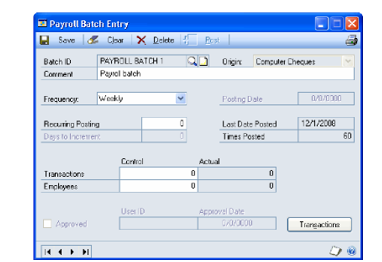

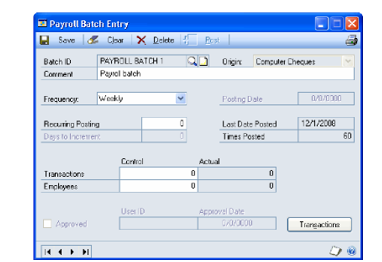

Create batches that you use just one time, or create recurring batches for transactions that you enter on a regular basis, such as weekly payroll

Use the reconciling process to check for discrepancies in employee financial information and for differences between detail records and summary records

Prepare U.S. Payroll reports to analyze payroll activity and identify errors in transaction entry

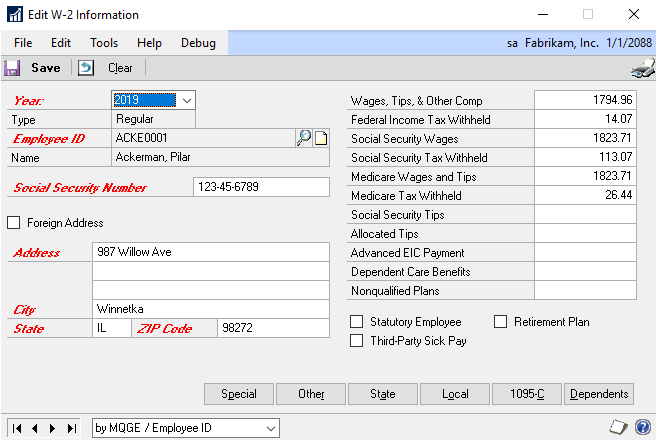

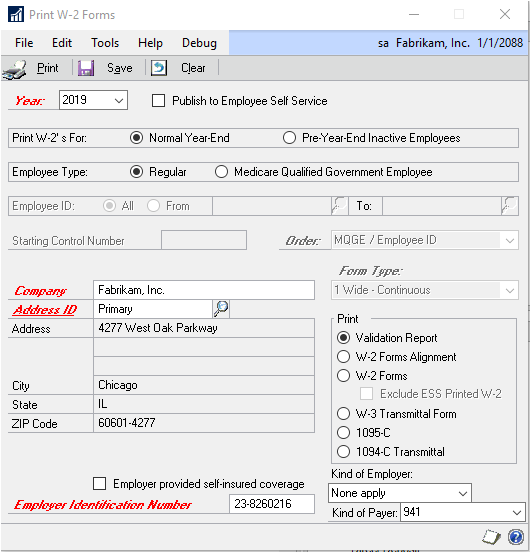

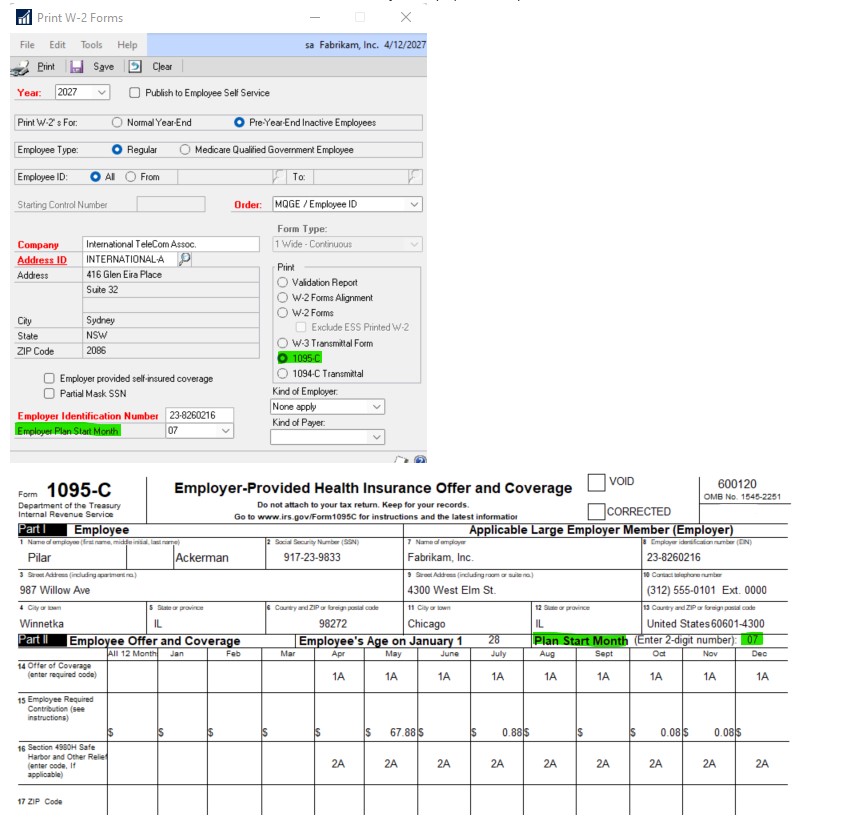

Use routines to create customized checklists for processing month-end, quarter-end, or year-end tasks, such as preparing government-required W-2 and 1099-R statements

If you are using Human Resources, you can enter and maintain your employee information in Human Resources and those transactions will automatically update your Payroll records.

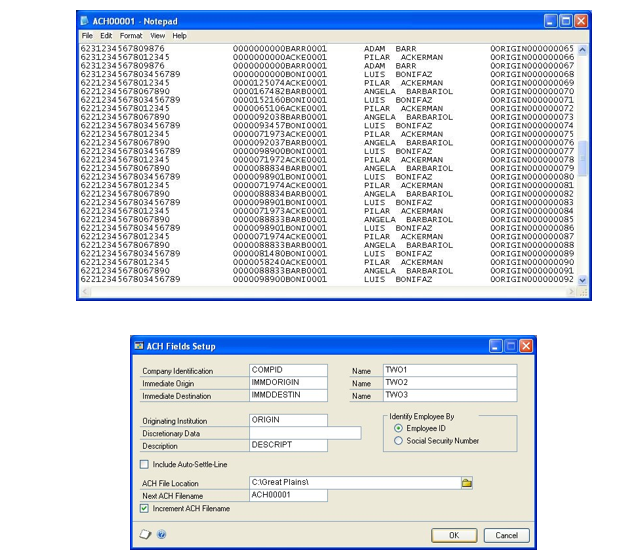

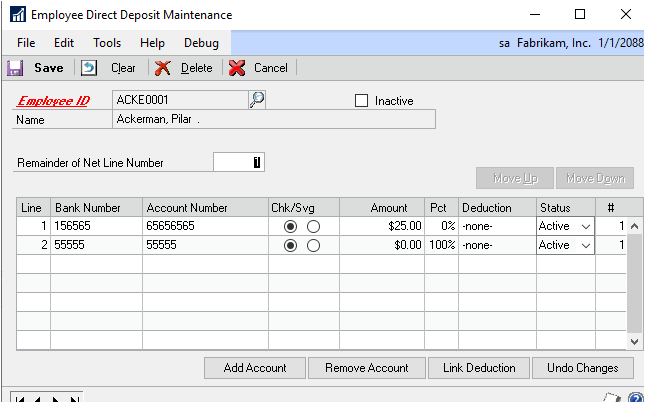

If you are using Direct Deposit, you can transfer funds directly to employee bank accounts when processing payroll transactions.

If you are using Bank Reconciliation, your checkbook is automatically updated when you post Payroll transactions.

What's in this manual

This manual is designed to give you an understanding of how to use the features of U.S. Payroll, and how it integrates with the Microsoft Dynamics GP system.

Some features described in the documentation are optional and can be purchased through your Microsoft Dynamics GP partner.

To view information about the release of Microsoft Dynamics GP that you're using and which modules or features you are registered to use, choose Help >> About Microsoft Dynamics GP.

The manual is divided into the following parts:

Part 1, Setup, describes how to set up Payroll, including department and position codes, pay codes, workers' compensation codes, and local and unemployment tax cards. It also explains how to set up deduction codes, benefit codes, and employee classes.

Part 2, Cards, describes how to create employee cards, tax cards, and deduction and benefit cards. It also describes how to enter beginning balances.

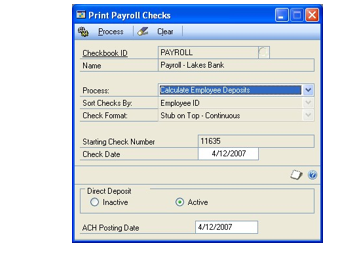

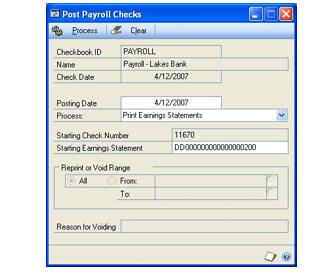

Part 3, Transactions, explains how to create single-use or recurring batches, and how to create and process Payroll check transactions.

Part 4, Inquiries and reports, describes how to view current and historical employee information, employee pay activity, and how to use Payroll reports to track changes in employee pay information.

Part 5, Utilities, explains how to help keep your Payroll records current and how to make changes to incorrect tax information.

Part 6, Routines, describes how to create customized checklists of Payroll routines or modify existing checklists. It also describes tasks that you will complete at the end of the month, quarter, or year, and tasks that relate to government regulations and required forms.

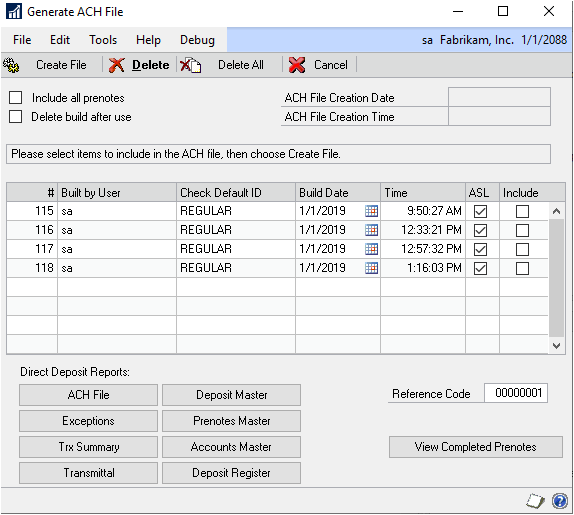

Part 7, Payroll Direct Deposit, explains how to set up and use Payroll Direct Deposit, create employee direct deposit cards, and create the ACH File used to transfer funds to employee bank accounts.

Part 1: Setup

This part of the documentation describes how to set up Payroll, department codes, position codes, and pay codes. It also explains how to set up local and unemployment tax codes, workers' compensation codes, and employee classes.

The following information is discussed:

Chapter 1, "Setting up Payroll," explains how to use the setup routine provided with the accounting system to set up Payroll.

Chapter 2, "Setting up codes," describes how to set up location, department, position, supervisor, pay, and shift codes, as well as pay types. Once set up, you can assign these codes to employee records for identification purposes.

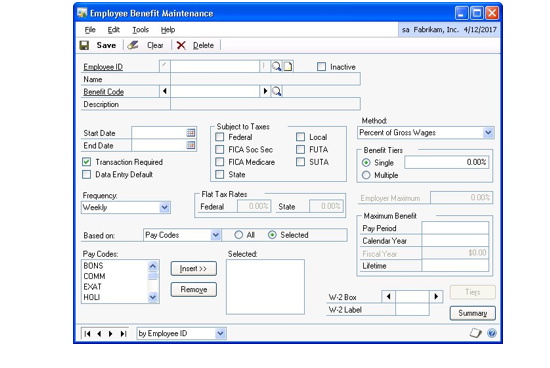

Chapter 3, "Setting up deductions and benefits," explains how to set up default deduction and benefit codes that will be used for setting up employee deductions and benefits.

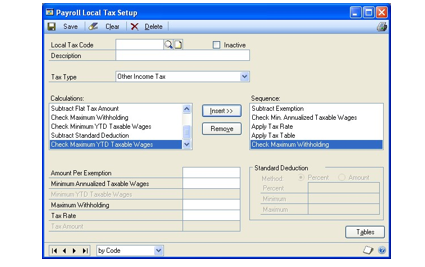

Chapter 4, "Setting up taxes and compensation codes," describes how to set up default workers' compensation, local, and unemployment tax cards that will be used for setting up employee taxes.

Chapter 5, "Setting up employee classes," explains how to set up employee classes according to similar characteristics to help make setting up employee records easier and save data entry time.

Chapter 1: Setting up Payroll

During the Payroll setup process, you'll create pay cards, benefit cards, and deduction cards for each employee and can set up employee classes. Before you begin setting up Payroll, be sure you've completed the System Setup and General Ledger setup procedures. For more information about completing these procedures, refer to Help >> Contents >> select Setting Up the System or the General Ledger documentation.

When you set up Payroll, you can open each setup window and enter information, or you can use the Setup Checklist window (Administration >> Setup >> Setup Checklist) to guide you through the setup process. See your System Setup Guide (Help >> Contents >> select Setting up the System) for more information about the Setup Checklist window.

If you're using Human Resources, set up benefit and deduction cards in Human Resources. Refer to the "Benefit setup" chapter in the Human Resources documentation.

This information is contained in the following sections:

Payment and adjustment numbers in Payroll

Overtime in Payroll

Calculating overtime pay

Employee numbers in Payroll

Options for tracking history and employees

Payroll setup options for tips

Options for including year-to-date amounts

Setting up Payroll default entries

Required Payroll posting accounts

Setting up Payroll posting accounts

Setting up default transaction dimension codes for Analytical Accounting

Employee onboarding workflow

Employee personnel maintenance workflow

Payment and adjustment numbers in Payroll

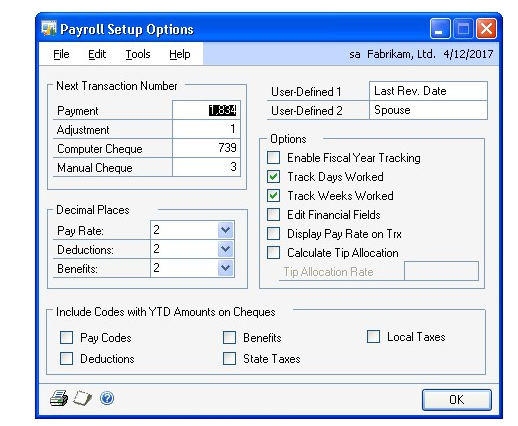

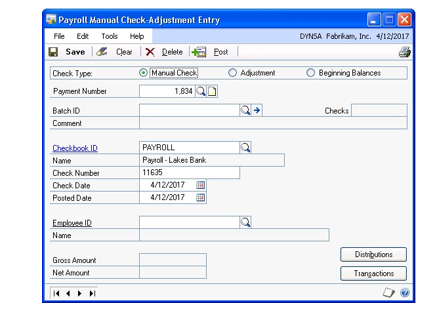

Use the Payroll Setup Options window to enter or change payment and adjustment numbers.

A payment number identifies a group of related entries that are posted collectively as a single computer or manual check.

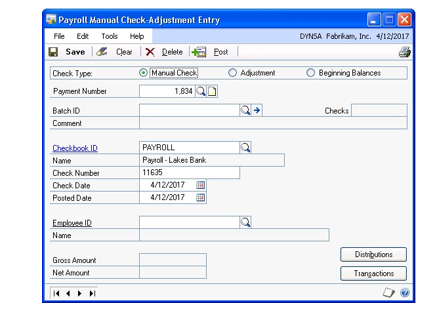

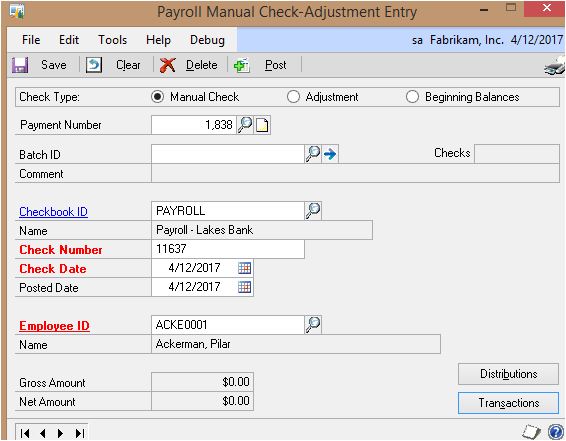

An adjustment number identifies a group of adjustments that you make in the Payroll Manual Check-Adjustment Entry window. You can use payment and adjustment numbers to trace transactions to the check they originated from in Payroll. These numbers will appear on reports as part of your audit trail.

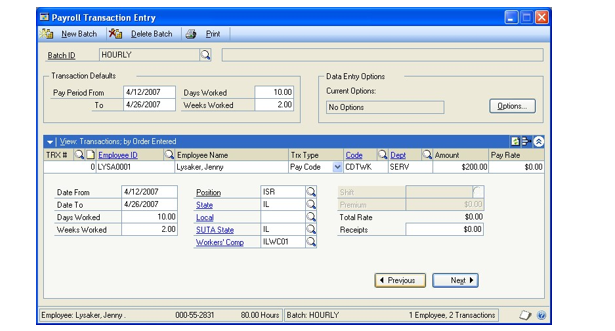

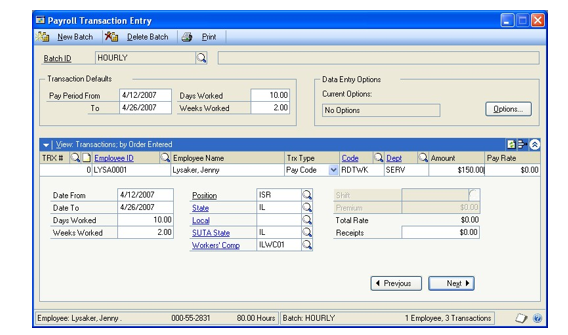

A computer check transaction number identifies a specific transaction entered in the Payroll Transaction Entry window.

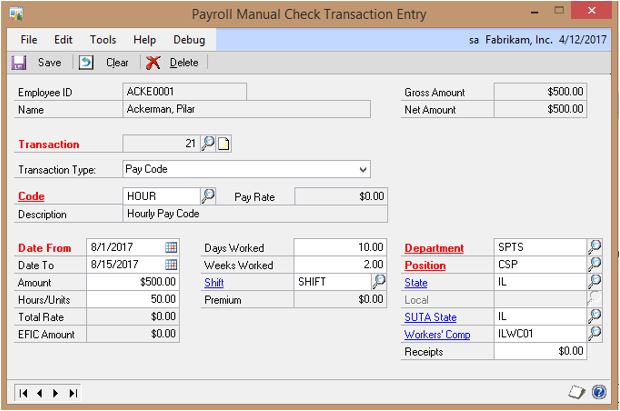

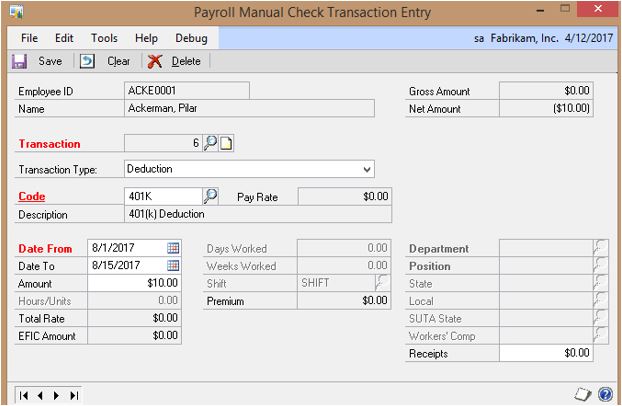

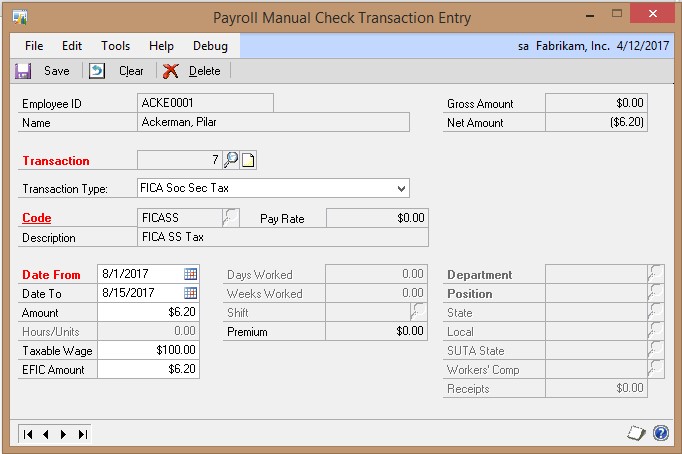

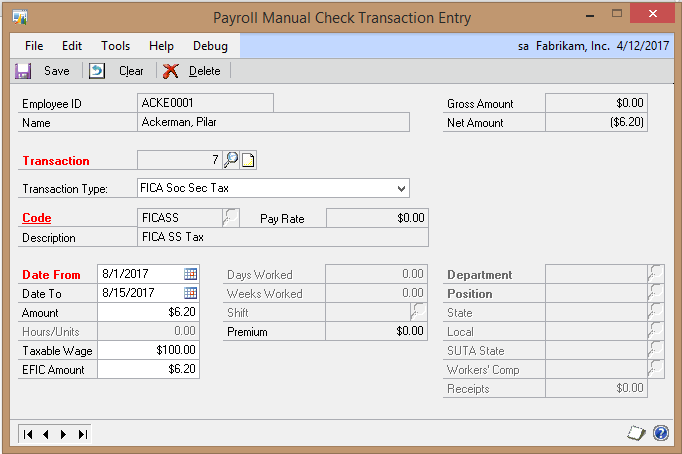

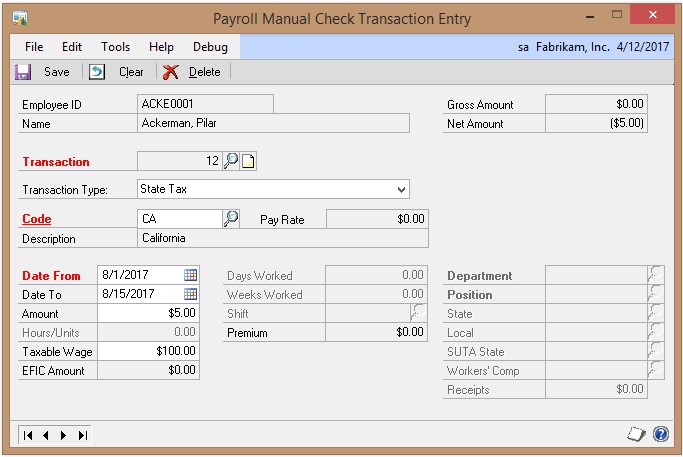

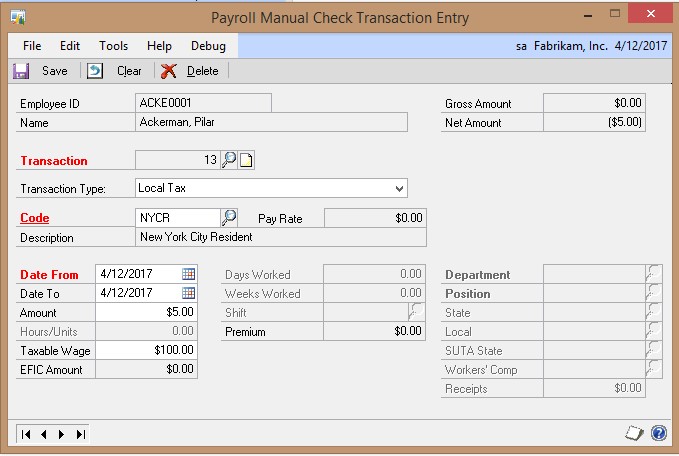

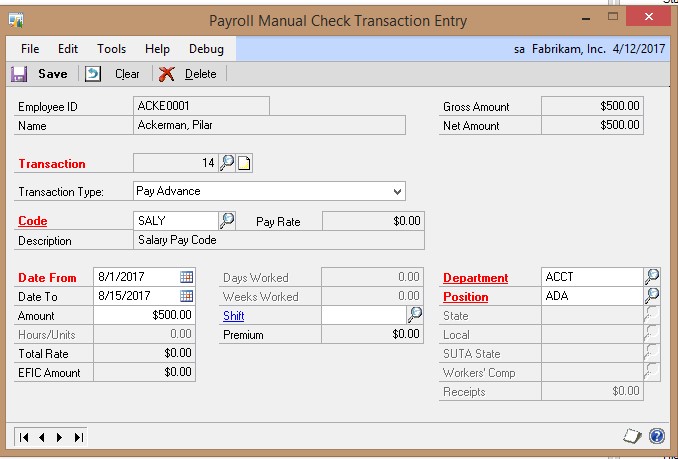

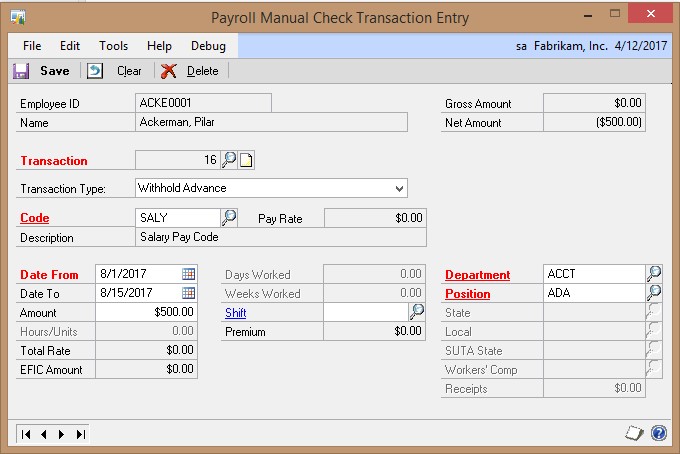

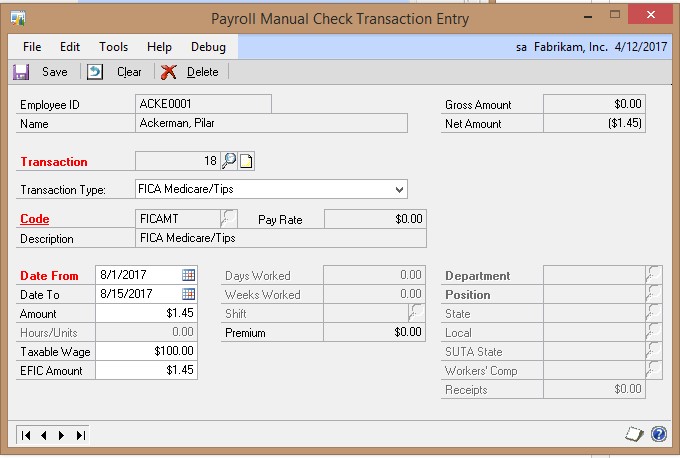

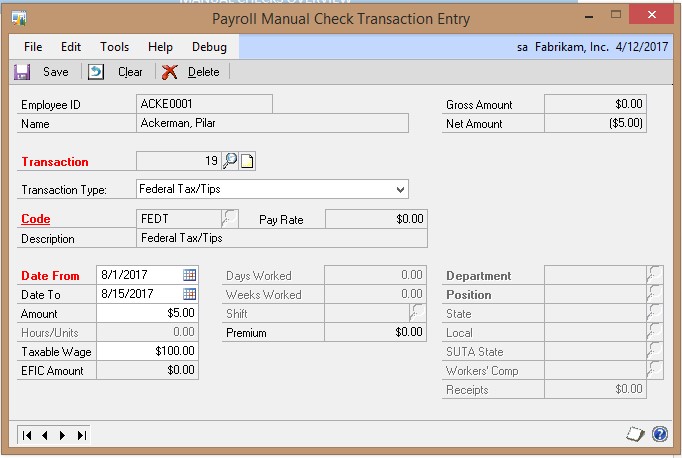

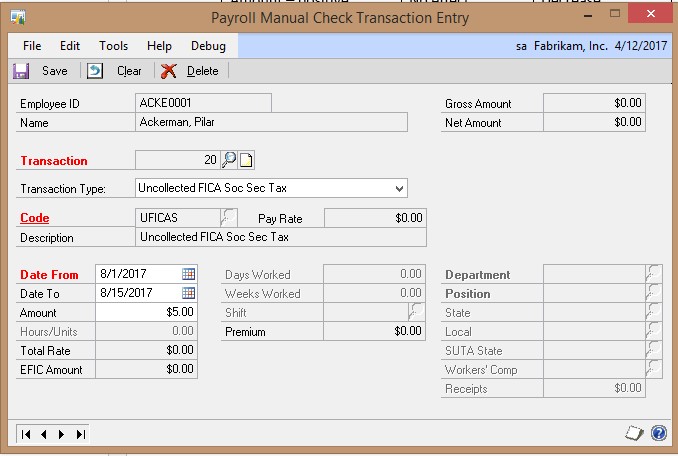

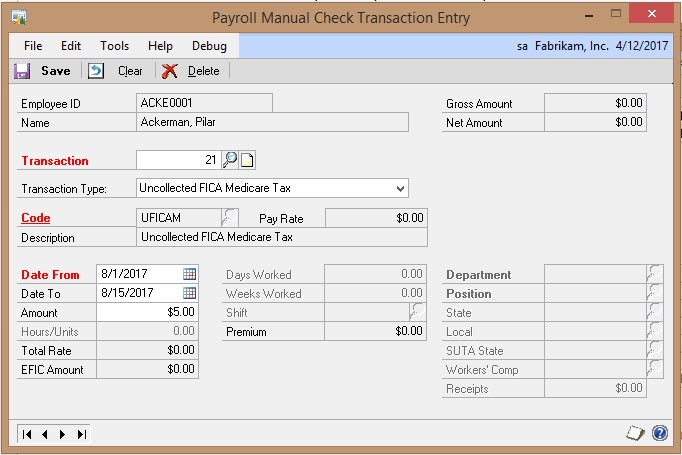

A manual check transaction number identifies a specific transaction in the Payroll Manual Check Transaction Entry window.

Each time you enter a transaction, the default numbers will increase by one to the next available number as each number is accepted. You can change the next numbers, but the default numbers will continue to be displayed for new transactions.

If you use Microsoft Dynamics GP on a network where more than one person is entering transactions at the same time, the default number might appear to increase by two or more.

Overtime in Payroll

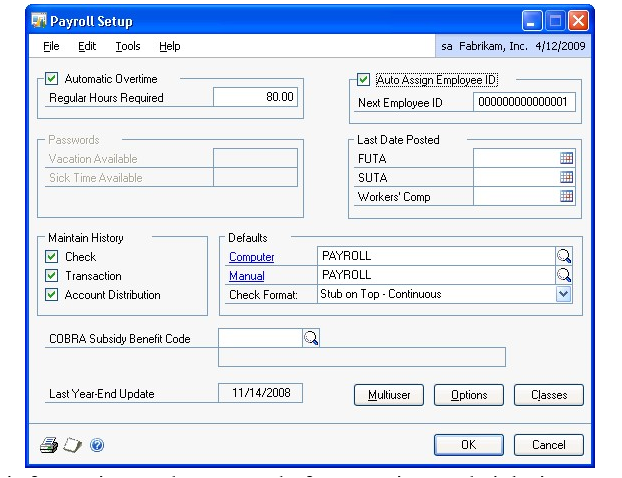

When you set up Payroll, you can mark Automatic Overtime and make other selections in the Payroll Setup window to specify how overtime pay should be calculated.

Automatic overtime is based on the total units for a specific pay code. The overtime will reduce the hourly pay code and create an overtime pay transaction for the overtime hours, based upon the transaction that you enter for the hourly pay code, and what you've set up in the Regular Hours Required field. If you don't want overtime calculated automatically, you must manually enter overtime pay transactions. For more information, refer to Entering Payroll computer check transactions .

If your company pays overtime wages and you mark Automatic Overtime in the Payroll Setup window, you must enter the number of hours an employee must work in a pay period before overtime will be paid.

For example, you might enter 40 for regular hours required if employees are paid weekly. Assume you've marked Automatic Overtime for a biweekly pay period and it is based on 40 hours a week. You must enter two hourly pay code transactions for each employee; each hourly pay code should have a corresponding overtime pay code.

If you enter a pay record transaction for an hourly employee who worked 35 hours the first week and 45 hours the next, you must enter 35 hours in the first hourly pay code transaction and 45 hours in the second hourly pay code transaction. The employee will then receive 75 hours of hourly pay and 5 hours of overtime pay.

If Automatic Overtime is not marked, you must enter transactions for both hourly and overtime pay codes—one hourly pay code transaction for 75 hours and one overtime pay code transaction for 5 overtime hours.

Total Pay / Total Hours = Average Pay Rate x Overtime Factor for the Overtime Pay Rate.

If your business needs require complex overtime calculations, consider using Overtime Rate Manager, which is included with Payroll Extensions. This module is part of the Human Resources and Payroll Suite, which can be installed as an additional product.

Calculating overtime pay

There are several ways that overtime can be calculated. Two examples are described in detail here. Refer to online help for additional examples.

Automatic overtime without shifts and without pay rate changes

The following example shows how overtime will be calculated without shifts and without pay rate changes, using the following pay codes and pay rates:

HOUR pay code set up with a $10.00 pay rate

HOUR2 pay code set up with a $12.00 pay rate

OT pay code set up to be determined by multiplying the HOUR pay rate by the overtime pay factor

OT2 pay code set up to be determined by multiplying the HOUR2 pay rate by the overtime pay factor

Payroll Setup has Automatic Overtime at 40 hours

| Pay code | Hours | X | Hourly calculation | = | Amount calculation |

|---|---|---|---|---|---|

| HOUR | 30 | X | $10.00 | = | $300.00 |

| HOUR | 20 | X | $10.00 | = | $200.00 |

| HOUR2 | 30 | X | $12.00 | = | $360.00 |

| HOUR2 | 15 | X | $12.00 | = | $180.00 |

Total gross pay equals $1,040.00.

The total pay per pay code is then divided by the number of hours for that pay code to determine the average pay rate for all the transactions. Each pay code is treated individually.

| Pay code | Total pay | ÷ | Hours | = | Average pay rate |

|---|---|---|---|---|---|

| HOUR | $500.00 | ÷ | 50 | = | $10.00 |

| HOUR2 | $540.00 | ÷ | 45 | = | $12.00 |

The overtime value is determined by multiplying the overtime hours by the employee's overtime pay code and then multiplying that by the average pay rate. Each pay code is treated individually.

| Pay code | Hours | X | Pay factor | X | Average pay rate | = | Overtime value |

|---|---|---|---|---|---|---|---|

| OT | 10 | X | 1.5 | X | $10.00 | = | $150.00 |

| OT2 | 5 | X | 1.5 | X | $12.00 | = | $90.00 |

Because we don't know which pay code should have the hours of overtime removed, we need to reduce both pay code transactions by the weight each provides. To do this, the regular pay code hours are multiplied by the overtime hours and divided by the total regular hours to determine the total number of overtime hours. Each pay code is treated individually.

| Pay code | Regular hours | X | Overtime hours | ÷ | Total regular hours | = | Total overtime hours |

|---|---|---|---|---|---|---|---|

| HOUR | 30 | X | 10 | ÷ | 50 | = | 6.00 |

| HOUR | 20 | X | 10 | ÷ | 50 | = | 4.00 |

| HOUR2 | 30 | X | 5 | ÷ | 45 | = | 3.33 |

| HOUR2 | 15 | X | 5 | ÷ | 45 | = | 1.67 |

Each hourly weight is subtracted from each transaction to determine adjusted hours. Each pay code is treated individually.

| Pay code | Regular hours | - | Total overtime hours | = | Adjusted hours |

|---|---|---|---|---|---|

| HOUR | 30 | - | 6.00 | = | 24.00 |

| HOUR | 20 | - | 4.00 | = | 16.00 |

| HOUR2 | 30 | - | 3.33 | = | 26.67 |

| HOUR2 | 15 | - | 1.67 | = | 13.33 |

The adjusted hours are multiplied by the pay rate to determine the transaction dollar value. Each pay code is treated individually.

| Pay code | Adjusted hours | X | Pay rate | = | Transaction dollar value |

|---|---|---|---|---|---|

| HOUR | 24.00 | X | $10.00 | = | $240.00 |

| HOUR | 16.00 | X | $10.00 | = | $160.00 |

| HOUR2 | 26.67 | X | $12.00 | = | $320.04 |

| HOUR2 | 13.33 | X | $12.00 | = | $159.96 |

The transaction dollar values are added to the overtime values to calculate the total paid to the employee.

| Pay code | Value | Description |

|---|---|---|

| OT | $150.00 | Overtime value |

| OT2 | $90.00 | Overtime value |

| HOUR | $240.00 | Transaction dollar value |

| HOUR | $160.00 | Transaction dollar value |

| HOUR2 | $320.04 | Transaction dollar value |

| HOUR2 | $159.96 | Transaction dollar value |

Gross pay for this employee is $1,120.00.

Automatic overtime with shifts and with pay rate changes

The following example shows how overtime will be calculated with shifts and with a pay rate change, using the following pay codes and pay rates:

HOUR pay code set up with a $10.00 pay rate

HOUR2 pay code set up with a $12.00 pay rate that changes to a $14.00 pay rate

OT pay code set up to be determined by multiplying the HOUR pay rate by the overtime pay factor

OT2 pay code set up to be determined by multiplying the HOUR2 pay rate by the overtime pay factor

SHIFT1 pay code set up with a $1.00 pay rate

SHIFT2 pay code set up with a $2.00 pay rate * Payroll Setup has Automatic Overtime at 40 hours

.

| Pay code | Hours | X | Hourly calculation | = | Amount calculation |

|---|---|---|---|---|---|

| HOUR + SHIFT1 | 20 | X | $10.00 + $1.00 | = | $220.00 |

| HOUR + SHIFT1 | 25 | X | $10.00 + $1.00 | = | $275.00 |

| HOUR2 + SHIFT2 | 30 | X | $12.00 + $2.00 | = | $120.00 |

| HOUR2 + SHIFT2 | 20 | X | $14.00 + $2.00 | = | $320.00 |

Since the total hours on the transactions are 45 hours—5 hours over the overtime limit for HOUR—and 50 hours—10 hours over the overtime limit for HOUR2—we need to calculate overtime. However, we do not know which pay rate the overtime needs to apply to so we need to take an average of the 2 pay rates. We also need to add in the Shift pay to the pay rates. Each pay code is treated individually.

The dollar value of each transaction is calculated and the shift value is added to the dollar value. Each pay code is treated individually.

| Pay code | Hours | X | Hourly pay with shift code | = | Dollar value |

|---|---|---|---|---|---|

| HOUR | 20 | X | $11.00 | = | $220.00 |

| HOUR | 25 | X | $11.00 | = | $275.00 |

The total dollar value for the HOUR pay code is $495.00.

| Pay code | Hours | X | Hourly pay with shift code | = | Dollar value |

|---|---|---|---|---|---|

| HOUR2 | 30 | X | $14.00 | = | $420.00 |

| HOUR2 | 20 | X | $16.00 | = | $320.00 |

The total dollar value for the HOUR2 pay code is $740.00.

The total dollar value per pay code is divided by the number of hours for that pay code to determine the average pay rate. Each pay code is treated individually

| Total dollar value | ÷ | Hours per pay code | = | Average pay rate |

|---|---|---|---|---|

| $495.00 | ÷ | 45 | = | $11.00 |

| $740.00 | ÷ | 50 | = | $14.80 |

The overtime hours are multiplied by the employee's overtime pay code and then multiplied by the average pay code pay rate to determine the overtime pay. Each pay code is treated individually.

| Pay code | Hours | X | Pay factor | X | Average pay rate | = | Overtime pay |

|---|---|---|---|---|---|---|---|

| OT | 5 | X | 1.5 | X | $11.00 | = | $82.50 |

| OT2 | 10 | X | 1.5 | X | $14.80 | = | $222.00 |

Because we don't know which pay code should have the hours of overtime removed, we need to reduce both pay code transactions by the weight each provides. To do this, the regular pay code hours are multiplied by the overtime hours and divided by the total regular hours to determine the total number of overtime hours. Each pay code is treated individually.

| Pay code | Regular hours | X | Overtime hours | ÷ | Total regular hours | = | Total overtime hours |

|---|---|---|---|---|---|---|---|

| HOUR | 20 | X | 5 | ÷ | 45 | = | 2.22 |

| HOUR | 25 | X | 5 | ÷ | 45 | = | 2.78 |

| HOUR2 | 30 | X | 10 | ÷ | 50 | = | 6.00 |

| HOUR2 | 20 | X | 10 | ÷ | 50 | = | 4.00 |

Each hourly weight is subtracted from each transaction to determine adjusted hours. Each pay code is treated individually

| Pay code | Regular hours | - | Total overtime hours | = | Adjusted hours |

|---|---|---|---|---|---|

| HOUR | 20 | - | 2.22 | = | 17.78 |

| HOUR | 25 | - | 2.78 | = | 22.22 |

| HOUR2 | 30 | - | 6 | = | 24.00 |

| HOUR2 | 20 | - | 4 | = | 16.00 |

The adjusted hours are multiplied by the pay rate to determine the transaction dollar value. Each pay code is treated individually.

| Pay code | Adjusted hours | X | Pay rate | = | Transaction dollar value |

|---|---|---|---|---|---|

| HOUR | 17.78 | X | $11.00 | = | $195.58 |

| HOUR | 22.22 | X | $11.00 | = | $244.42 |

| HOUR2 | 24 | X | $14.00 | = | $336.00 |

| HOUR2 | 16 | X | $16.00 | = | $256.00 |

The transaction dollar values are added to the overtime dollar values to calculate the total paid to the employee.

| Pay code | Value | Description |

|---|---|---|

| OT | $82.50 | Overtime value |

| OT2 | $222.00 | Overtime value |

| HOUR | $195.58 | Transaction dollar value |

| HOUR | $244.42 | Transaction dollar value |

| HOUR2 | $336.00 | Transaction dollar value |

| HOUR2 | $256.00 | Transaction dollar value |

Gross pay for this employee is $1,336.50.

Employee numbers in Payroll

When you set up Payroll, you can mark Auto Assign Employee ID and specify the next Employee ID number for each new employee record created for your company.

Each time you add a new employee, the default number will increase by one to the next available number as each number is accepted.

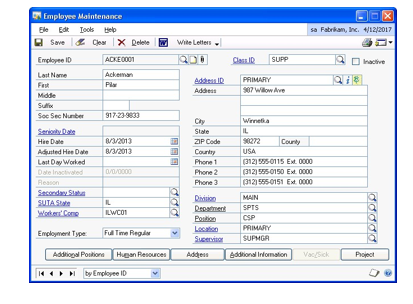

After an ID has been assigned to an employee it cannot be modified. To change the employee's ID, you must inactivate the existing ID record in the Employee Maintenance window. Then, you must create a new record for the employee. You also will have to update all year-to-date information manually for the employee's new ID.

If you use Microsoft Dynamics GP on a network where more than one person is entering a new employee record at the same time, the default number might appear to increase by two or more.

Options for tracking history and employees

When you set up Payroll, you will need to determine how much information you'll want to track about Payroll transactions, and about your employees.

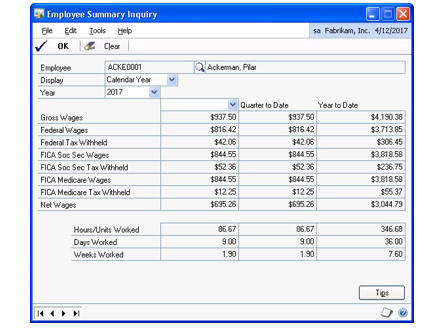

History-tracking options

You can select options for maintaining historical information for checks, transactions and account distributions in the Payroll Setup window. You can mark any or all of the following options, depending upon the needs of your business.

Check history Check history includes a summary of Payroll checks.

Transaction history Transaction history includes pay, deduction, benefit, state and local tax transaction information.

Account distribution history Account distribution history includes a record of the distributions that have been posted to posting accounts.

You can maintain Payroll history and view employee financial information for an unlimited number of years. To view past-year information, you can print a history report or view check or transaction information using the inquiry windows.

Employee tracking options

You will use the Payroll Setup Options window to select options for tracking an employee's days and weeks worked, edit financial fields throughout the Payroll system, and edit pay rates used in transactions.

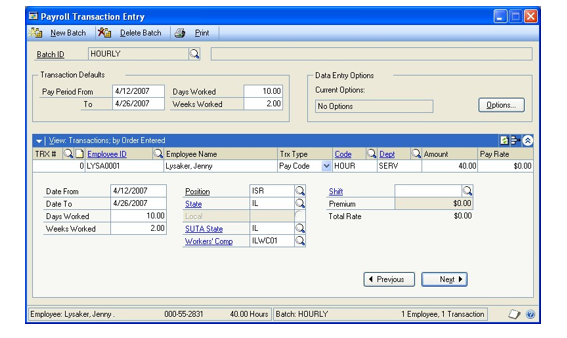

Track Days Worked To track the number of days each employee worked for each pay code, you must enter the number of days worked during the salary pay period for each transaction you enter during a pay run.

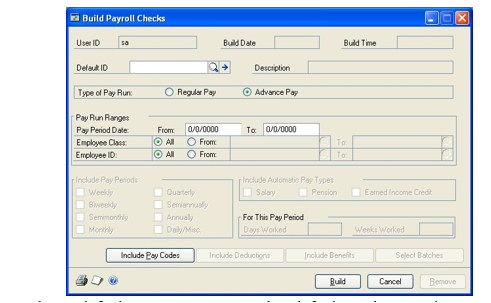

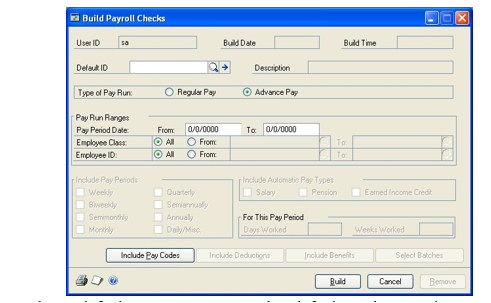

Track Weeks Worked To track the number of weeks each employee worked for each pay code, you must enter the number of weeks worked for each transaction and the number of weeks worked by salaried employees during a pay run. When you enter this information in the Build Payroll Checks window, the days and weeks worked are rolled down to all automatic pay types. This information will be printed on state unemployment reports.

Edit Financial Fields You can edit an employee's financial information, such as employee summary information. Typically, this option shouldn't be marked, to ensure that changes aren't made inadvertently. If you need to make changes, it's a good idea to mark the option, make the changes, then unmark the option again after the changes have been made. This will prevent someone from making changes that weren't meant to be made.

Display Rate on Trx Mark this option to edit pay rates in the Payroll Transaction Entry window for the following pay types:

Hourly

Piecework

Overtime, double time, vacation, sick or holiday pay types that are based on hourly or piecework pay types

However, the following pay types or pay types based on these cannot be edited in the Payroll Transaction Entry window:

Salary

Commission

Business Expense

Pension

Earned Income Credit (EIC)

Other

Overtime, double time, vacation, sick or holiday pay types that are based on salary pay types

Payroll setup options for tips

Some of the tasks you'll need to do to take advantage of tips wage tracking involve setting up various options and codes. Be sure you complete the following in the Payroll Setup Options window:

Mark the Calculate Tip Allocation option.

Verify the Tip Allocation Rate. Check IRS regulations for the current rate if you are unsure of what it should be.

Payroll uses the gross receipts method to calculate the tip allocation. When setting up charged and reported tips, be sure the Tips Received field is set up correctly, as it is used to determine the allocated tip amount.

Options for including year-to-date amounts

You can select options for including codes with year-to-date amounts on the check stub or earnings statements in the Payroll Setup Options window. Marking any of the following options from this window will allow you to reconcile Gross year-todate Amounts against the check stub or earnings statements, even if the selected options are not included in the check run:

Pay Codes

Deductions

Benefits

State Taxes

Local Taxes

Setting up Payroll default entries

Use the Payroll Setup window to set up default entries that appear throughout Payroll. Payroll history options and employee tracking options that you select can help increase your data entry time and can make compiling historical records easier for you.

To set up Payroll default entries:

- Open the Payroll Setup window. (HR & Payroll >> Setup >> Payroll >> Payroll)

Enter overtime information and passwords for vacation and sick time available, if necessary. You will need to enter a password when you create a transaction for more vacation or sick time hours than the employee has available. Refer to Overtime in Payroll for more information about setting up overtime options. If you're using Human Resources and have marked Human Resources as the accrue type in the Attendance Setup window, the vacation and sick time fields will not be available. Refer to the "Attendance setup" chapter in the Human Resources documentation for more information.

Assign the Next Employee ID for new employee records, if necessary. Refer to Employee numbers in Payroll for more information on auto-assigning employee IDs in Payroll.

Mark the options to maintain historical information for checks, transactions, and account distributions, as needed. If you don't mark any options, you won't be able to print period-end reports or view employee financial information in summary and inquiry windows.

Enter the last date posted information and enter or select the checkbook from which computer and manual paychecks typically will be issued.

Select a check format.

If your organization has multiple payroll clerks who complete separate pay runs for each department or business unit, choose Multiuser to open the Multiuser Payroll Setup window.

Specify how concurrent payroll processing tasks are queued.

Certain tasks, such as calculating payroll checks, printing checks, and printing direct deposit earning statements can only be performed by one user at a time. If another user tries to perform one of these tasks at the same time, you can specify how long that user's processing request will wait in the queue, and how often the processing request will be retried.

Choose OK in the Payroll Multiuser Setup window to save your changes.

Choose Options to open the Payroll Setup Options window and enter additional Payroll default entries.

Enter the next transaction numbers and select the number of decimal places for pay rates, deductions, and benefits.

Enter user-defined field prompts for tracking additional employee information that might be specific to your company.

Mark Enable Fiscal Year Tracking to track employee payroll information by fiscal year, as well as by calendar year.

If you enable fiscal year tracking during the year, it is a good idea to reconcile your fiscal year employee information to help ensure that your historical data is summarized correctly. For more information, see Reconciling employee records.

Mark Track Days Worked to track the number of days an employee's work was assigned to each pay code. Depending upon the calculation method used by your state, this information might be needed to calculate workers' compensation tax.

Mark Track Weeks Worked to track the number of weeks each employee worked for each pay code.

Mark Edit Financial Fields to edit employee summary information throughout the system.

Mark Display Pay Rate on Trx to display and edit employee pay rates when you enter transactions.

Mark Calculate Tip Allocation and verify the Tip Allocation Rate if you track tips wages for your employees.

Mark an option if you want all of its codes with year-to-date amounts to be included in the check stub or earning statement.

Choose OK in the Payroll Setup Options window to save your changes.

Choose File >> Print to print a Payroll Options Report to verify your information.

Tip

Although you can create employee classes at this time by choosing Classes to open the Employee Class Setup window, it's a good idea to wait until you've set up codes. For more information, refer to Chapter 2 Setting up codes, and Creating an employee class.

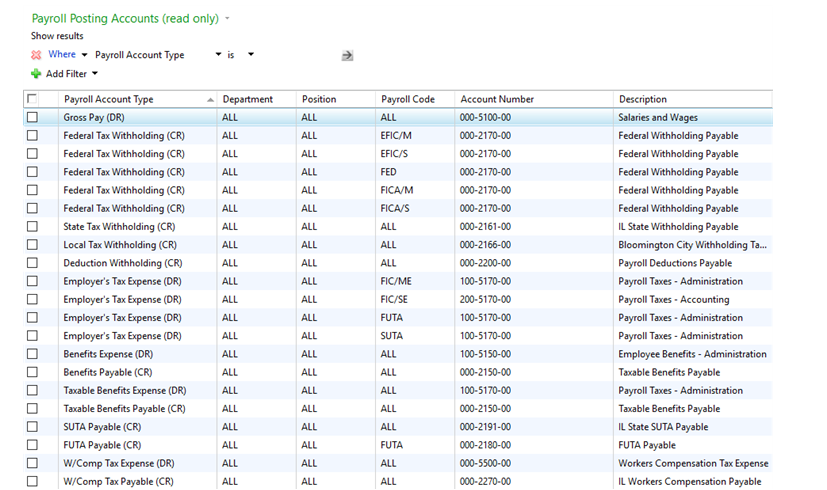

Required Payroll posting accounts

Payroll has several posting accounts that are required and are used only for Payroll transactions. They are:

Gross Pay This account type is an expense account that can be entered for all employees' salaries.

Federal Tax Withholding This account type is a liability account. Transactions will be posted to it for the following tax withholding codes:

EFIC/M (Employer FICA/Medicare Tax)

EFIC/S (Employer FICA/Social Security Tax)

FED (Federal Tax Withholding)

FICA/M (FICA/Medicare Tax Withholding)

FICA/S (FICA/Social Security Tax Withholding)

State Tax Withholding This account type is a liability account that can be entered for state tax codes.

Local Tax Withholding This account type is a liability account that can be entered for local tax codes.

Deduction Withholding This account type is a liability account that can be entered for deduction codes.

Employer's Tax Expense This account type is an expense account. Transactions will be posted to it for the following tax expense codes:

FIC/ME (FICA/Medicare Tax Expense)

FIC/SE (FICA/Social Security Tax Expense)

FUTA (FUTA Tax Expense)

SUTA (SUTA Tax Expense)

Benefits Expense This account type is an expense account that can be entered for benefit codes.

Benefits Payable This account type is a liability account that can be entered for benefit codes.

Taxable Benefits Expense This account type is an expense account that can be entered for taxable benefit codes.

Taxable Benefits Payable This account type is a liability account that can be entered for taxable benefit codes.

SUTA Payable This account type is a liability account that can be entered for state unemployment tax liability.

FUTA Payable This account type is a liability account that will allow only FUTA to be entered for federal unemployment tax liability.

Workers' Compensation Tax Expense This account type is an expense account that can be entered for state codes to record workers' compensation expense.

Workers' Compensation Tax Payable This account type is a liability account that can be entered for state codes to record workers' compensation liability.

It's a good idea to set up default information using the Payroll Setup window before setting up posting accounts. If you haven't set up default information yet, see Setting up Payroll default entries for more information about using the Payroll Setup window.

The following table shows the posting accounts required in Payroll and the departments, positions, and codes associated with each.

Review this information for enhancements around payroll posting in Microsoft Dynamics GP 2016.

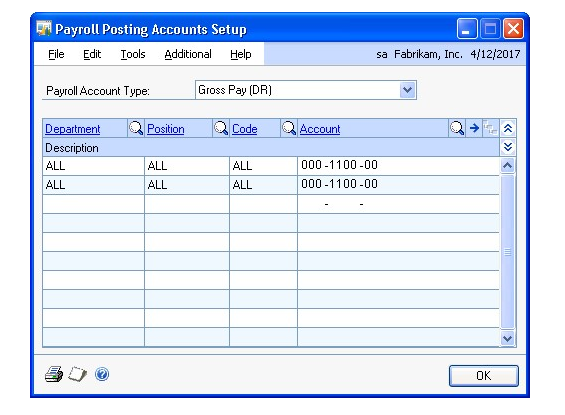

Setting up Payroll posting accounts

Use the Payroll Posting Accounts Setup window to set up Payroll posting accounts. Payroll posting accounts are used to track gross pay, taxes withheld, tax expenses, and various benefit and deduction accounts. Transactions posted to these accounts will appear on the Payroll Check Posting Register.

You must set up departments and positions before setting up Payroll posting accounts. Refer to Setting up department codes and Setting up position codes for more information.

Important

Before you set up posting accounts, be sure to set the account format using the Account Format Setup window. For more information, refer to Help >> Contents >> select Setting Up the System. You also should have completed Setting up Payroll default entries.

To set up Payroll posting accounts:

- Open the Payroll Posting Accounts Setup window. (Administration >> Setup >> Posting >> Payroll Accounts)

Select an account type and position for the employee's Payroll code. When you select an account type, existing accounts, and an account description for the account type chosen, will be displayed in the scrolling window. You can either accept the default entry for all departments and positions, or you can post with more detail to General Ledger if you enter departments and positions. You also can enter a department and position for the employees' pay code transactions when you enter transactions. The Code lookup window displays codes for the selected posting account type. For example, if you selected Gross Pay for the Payroll account type, the window displays pay codes.

Enter or select the posting account that transactions with the selected account type should be posted to.

Repeat steps 2 and 3 for all posting accounts.

Choose Save to save the posting accounts.

Choose File >> Print to print a Posting Accounts List to verify your information.

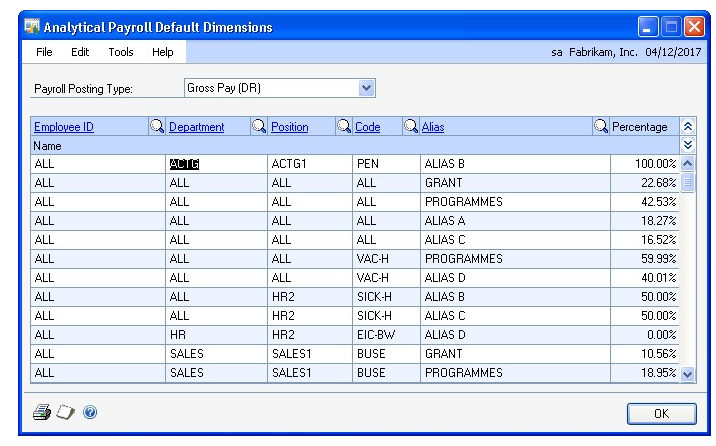

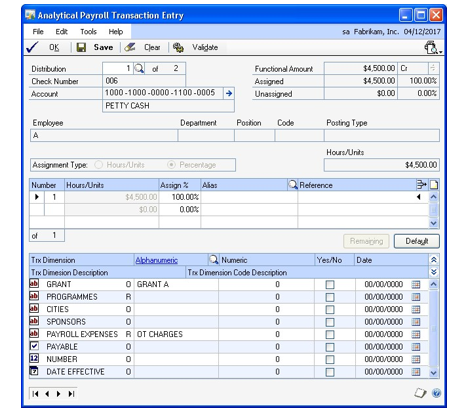

Setting up default transaction dimension codes for Analytical Accounting

Use the Analytical Payroll Default Dimensions window to set up default transaction dimension codes. This feature lets you link transaction dimension codes to ledger transactions in U.S. Payroll, which makes classifying, reporting, and analyzing transactions easier and more powerful. For more information on transaction dimensions and transaction dimension codes, see the Analytical Accounting documentation.

Before you can complete the procedure in this section, you must define the Payroll pay codes, benefits, deductions, and so on that you plan to use with Analytical Accounting. Also, you must install, activate, and set up Analytical Accounting, and create Analytical Accounting dimension codes and account classes. For more information, see the Analytical Accounting documentation.

To set up default transaction dimension codes for Analytical Accounting

Open the Analytical Payroll Default Dimensions window. (Administration >> Setup >> Posting >> Payroll Accounts >> Analytical Accounting button)

Select a payroll posting type.

When you select a payroll posting type, the default entries that you defined when you set up Payroll are automatically entered in the scrolling window.

The Code lookup window displays codes for the selected payroll posting type. For example, if you selected Gross Pay for the Payroll account type,the window displays pay codes.

Enter or select, as necessary, new entries for Employee ID, Department, Position, Code, or Percent.

The alias that links Analytical Accounting to U.S. Payroll is a combination of the Payroll Posting Type, Employee ID, Department, Position, and Code. Accordingly, the same combination of those fields can exist only once. For the same reason, the Percent cannot total more than 100% for records with the same combination of those fields.

Choose the Print button to print the Analytical Payroll Default Dimensions report to verify your information.

Choose OK to save your changes and exit the window.

Chapter 2: Setting up codes

You can set up location codes, department codes, position codes, and pay codes to which you can assign employees for identification purposes.

This information is contained in the following sections:

Setting up location codes

Setting up department codes

Setting up position codes

Setting up supervisor codes

Payroll pay codes and types

Setting up pay codes

Setting up pay codes for tips

Setting up shift codes

Setting up secondary status codes

Setting up location codes

Use the Company Addresses Setup window to set up a location code, which includes an address, phone numbers, and a contact person for each location. If your company has multiple sites, you can track which employees are working from which sites by setting up location IDs.

To set up location codes:

Open the Company Addresses Setup window. (HR & Payroll >> Setup >> Payroll >> Location)

Enter an identification and name for the company's location.

Enter contact, address, and phone information.

Choose Address ID Internet to enter or view Internet information for this address.

Choose Save.

Setting up department codes

Use the Department Setup window to enter and maintain department codes and descriptions. Department codes help you track employee cards by providing a list of all the departments and their descriptions within your company. The following are some examples of department codes you might use:

ACTG - Accounting

SALS - Sales

PROG - Programming

MKTG - Marketing

COMM - Communications

RSDV - Research/ Development

SSUP - Sales/Support

DPT1 - Department 1

CONT - Contract Work

SRVC - Service Work

FDWK - Field Work

Before setting up department codes, you should have completed Setting up Payroll default entries . To ensure reports are printed in the correct order, each department code should have the same number of characters. The characters are sorted from left to right, and numbers take priority over letters.

To set up department codes:

Open the Department Setup window. (HR & Payroll >> Setup >> Payroll >> Department)

Enter the code and description for a department.

Choose Save to store the code. Continue entering codes for all your departments.

Choose File >> Print to print a Department Codes List to verify your information.

Setting up position codes

Use the Position Setup window to set up a position code. A position is a defined role within a company. Positions can be used to track employee cards by providing a list of all positions and their descriptions for your company. The following are some examples of position codes you might use:

ACT - Accounting

CEO - Chief Executive Officer

BUY - Buyer

MFG - Machinist First Grade

GMR - Group Manager

LBR - Laborer

CPR - Computer Programmer

JB1 - Job 1

PLM - Plumber

ELE - Electrician

If you're using Human Resources, you can link training courses and specify which skill sets, if any, are required for a position. You also can link pay codes and Americans with Disabilities Act (ADA) physical requirements to a position code. If your company uses salary matrices, you can link the low, middle and high salaries for each position to a position code. You also can add information using extra fields.

To set up position codes:

Open the Position Setup window. (HR & Payroll >> Setup >> Payroll >> Position)

Enter a code that identifies the position and a description. Choose the notes icon button to add additional comments.

These fields are available if you're using Human Resources. For more information, see your Human Resources documentation. EEO Class Select an Equal Employment Opportunity (EEO) class FLSA Status Select a Fair Labor Standards Act (FLSA) status.

Reports to Position Enter or select a position the individuals in the position report to.

Review Type Enter or select the review type to be used for employees in this position.

Default Skill Set Enter or select a required skill set.

Position Description Enter a description of the position.

Choose the paperclip icon button to open the OLE (Object Linking and Embedding) container and store a position description file.

These buttons are available if you're using Human Resources. For more information, see your Human Resources documentation.

Linked Pay Codes Opens the Position\Pay Code Setup window to link pay codes and salary ranges to this position code.

ADA Opens the ADA Physical Requirements window to add an ADA requirements record.

Training Opens the Courses Available to Link window to link courses to a position code.

Extra Fields Opens the Position Extra Fields window to set up extra fields for a position code.

Choose Save. Continue entering codes for all positions.

Choose File >> Print to print a Position Codes List to verify your information.

Setting up supervisor codes

Use the Supervisor Setup window to enter and maintain supervisor codes and descriptions. You can set up a supervisor record and assign an employee record to the position.

To set up supervisor codes:

Open the Supervisor Setup window. (HR & Payroll >> Setup >> Payroll >> Supervisor)

Enter the code and description of the supervisor.

Enter or select the employee ID of the employee that holds this supervisor position.

- 4.Choose Save to store the code. Continue entering codes for all supervisors.

- Choose File >> Print to print a Supervisor Codes List to verify your information.

Payroll pay codes and types

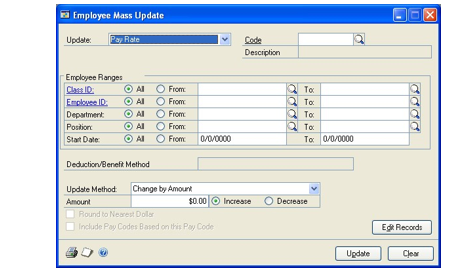

With Payroll you can set up different company pay codes to be the basis of employee pay codes and to apply changes to employee pay codes. You also can assign company pay codes to employee classes.

When you define a pay code, you can assign pay types to it. The pay types you assign to a pay code will depend on how you're using a specific pay code. For example, if you define a pay code SLRY for salaried employees, you probably wouldn't include the overtime or double time pay types in that pay code.

Available pay types include:

Hourly

Hourly pay type will be used for employees who are paid by the hour.

Salary

Salary pay type will be used for employees who are paid a specific pay amount each pay period. With this pay type, the pay per period is automatically calculated. If you select this pay type, you also can enter the amount to be paid for an advance pay run. An advance pay run is a way to pay salaried employees an advance on their regular salary pay. The advanced amount will be subtracted from the employees' net pay in the next salary pay run.

Piecework

Piecework pay type will be used for employees who are paid a certain amount per unit made or completed.

Commission

Commission pay type will be used for employees who earn their wages according to what and how much they sell. You can enter the maximum earnings per pay period, and you also can enter the amount to be paid for an advance pay run. An advance pay run is a way to pay commissioned employees an advance on their commission pay. The advanced amount will be subtracted from the employees' net pay in the next commission pay run.

Business Expense

Business Expense pay type will be used to track the records of employees who are reimbursed for mileage and travel expenses. You can include the pay in the gross wages amount that will be reported on the W-2 statement.

If you mark Report as Wages, the pay will be included in gross wages on the W-2 statement and will be treated as a nonaccountable plan. If you don't mark this option, the pay won't be included in gross wages on the W-2 statement and will be treated as an accountable plan.

Nonaccountable plans are reported as wages on the W-2 statement and are subject to taxes. Accountable plans aren't subject to taxes and aren't reported on the W-2 statement.

If you pay a per diem or mileage allowance and expenses exceed the Internal Revenue Service guidelines, you must tax the excess amount and report it as wages on the W-2 statement; the non-taxable portion must be reported in box 13. For more information, refer to the W-2 instructions supplied by the IRS.

Overtime

Overtime pay type will be used for employees who receive pay for working more than the assigned number of hours and are paid at a different pay rate for the additional hours.

Double Time

Double Time pay type will be used for employees who qualify for Double Time pay, normally paid at twice the rate of the Based on Pay Code rate.

Vacation

Vacation pay type will be used for employees who receive pay while on vacation.

Sick

Sick pay type will be used for employees who receive pay while they're sick.

Holiday

Holiday pay type will be used for employees who receive paid time off during holidays.

Pension

Pension pay type will be used for employees who are retired and receive pension pay from the company.

Other

Other pay types can be used to classify additional types of pay. Some examples of other pay types are jury duty, bonus pay, long-term disability, and short-term disability.

Earned Income Credit

Select Earned Income Credit if the pay code will be used for employees who qualify for earned income credit and have filed a W-5 form.

Charged Tips

Select Charged Tips if the pay code will be used for employees who receive tips from customers through a charge card or check. This amount will be included in the amount paid to employees.

Reported Tips

Select Reported Tips if the pay code will be used for employees who receive tips (cash) from customers that they report to the employer. This amount will not be included in the amount paid to the employee, but will be used to determine taxes on the reported tips.

Minimum Wage Balance

Select Minimum Wage Balance if the pay type will be used for employees who must earn a specified minimum hourly amount. This is available only for Charged Tip and Reported Tip pay types.

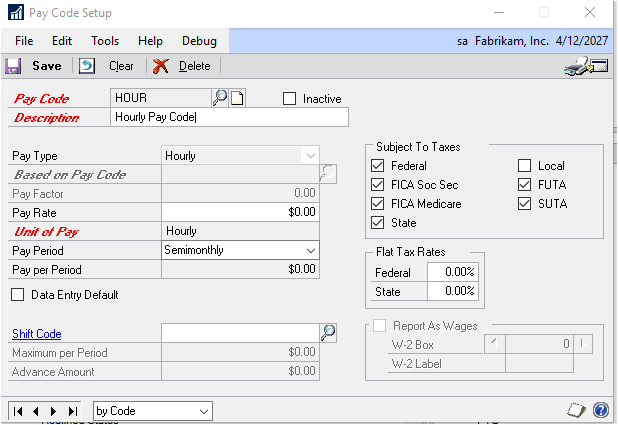

Setting up pay codes

Use the Pay Code Setup window to enter and maintain company pay codes. These codes are used as default entries when setting up employee pay codes, can be used to apply changes to employee pay codes, and also can be included in employee classes. You can enter your own identifying pay codes and a description for each type of pay. You also can assign pay types to pay codes. For example, you might assign an hourly pay type to the HOUR pay code. You can set up as many pay codes for each pay type as you need for your business.

Changes made to a pay code can be reflected in any pay codes that are based on it, causing the dependent codes, including overtime and double time codes, to recalculate their pay rates. Overtime and double time pay rates are also affected by changes made to the pay factor.

If you're using Human Resources, changes made to pay rate values in the Pay Code Setup window are not applied to employee pay records that are assigned to a pay step. If you want to make pay rate adjustments and you have pay rates assigned to pay steps, you must first use the Employee/Pay Step Table Assignment window to remove the pay step assignments. Refer to the Human Resources documentation for more information about pay steps.

The following are some examples of pay codes you might use:

HOUR - Hourly

SALY - Salary

VACN - Vacation

SICK - Sick time

PCWK - Piecework

COMM - Commission

OVER - Overtime

To set up pay codes:

Open the Pay Code Setup window. (HR & Payroll >> Setup >> Payroll >> Pay Code)

Enter a pay code and description.

Select a pay type.

If you're setting up an overtime, double time, vacation, sick time, or holiday pay code, select the Based On Pay Code the pay type is based on. For example, if you're setting up an overtime pay code for an employee with an hourly pay type, you must base the overtime pay type on the employee's hourly pay, or the wages won't be calculated accurately. Enter the code for a specific hourly, salary or piecework pay code that you're basing the overtime, vacation, sick, or holiday pay type on. If the pay type is overtime or double time, the based on pay rate appears next to the Based On Pay Code field.

When setting up pay codes, select vacation or sick as pay types for vacation and sick time. This ensures that when you enter transactions, they will automatically reduce the available amount of vacation and sick time.

If your pay type is overtime or double time, you also can specify a pay factor that is multiplied with the pay code's pay rate to determine the overtime or double time pay rate. If the pay factor is selected, the overtime or double time pay rate is automatically recalculated every time the pay factor is changed. The pay factor information is saved with the pay code. When the pay rate is changed for a pay code on which overtime or double time is based, the overtime or double time pay rate is automatically recalculated by multiplying the pay rate of the based-on pay code by the pay factor.

If your business needs require complex overtime calculations, consider using Overtime Rate Manager, which is included with Payroll Extensions. This module is part of the Human Resources and Payroll Suite, which can be installed as an additional product.

Enter the pay rate for the amount of pay.

If Earned Income Credit is the pay type, leave the Pay Rate field blank to use the EIC tables supplied with Payroll to calculate the EIC payment.

Enter the name of the unit of work in the Unit of Pay field if the pay type is Piecework. This unit name will be printed on Payroll reports.

If the pay type is Salary or is based upon a salary pay type, select the unit of pay from the list of pay periods.

If the pay type is Charged Tips or Reported Tips, the Unit of Pay label changes to Tips Received. Select Directly or Indirectly.

Select the pay period for the wages and mark Data Entry Default to automatically use the information in this window when you create a transaction for the pay code during a pay run.

Enter or select a shift code to assign to the pay code. For more information, refer to Setting up shift codes .

Mark the taxes the pay is subject to.

If you selected a commission or business expense pay type, enter the maximum amount per pay period.

If you selected a salary or commission pay type, enter an amount to pay in advance if the employee is to receive an advance.

Enter the federal and state tax rate for the pay if the pay type is subject to federal or state taxes, and should be calculated at a flat rate. For example, bonus pay can be taxed at a 20.00 percent flat rate. You can leave these fields blank to use the tax calculations from the federal and state tax tables instead of a flat tax rate.

Mark Vacation and Sick Time to accrue vacation and/or sick time on this pay code.

If you're using Human Resources and have marked Human Resources as the accrue type in the Attendance Setup window, these fields will not be available. Refer to the Human Resources documentation for more information.

Enter W-2 information.

If the amount of the business expense should be included with gross wages on the W-2 statement, mark Report as Wages. If the business expense should also be printed in a special box on the W-2 statement, enter the number of the box in the W-2 Box field. Then enter a label, if required, to be printed in the box on the W-2 statement.

If the amount must be reported in multiple locations on the W-2 statement, use the browse buttons to select an additional location, and enter the appropriate box number and label. You can specify as many as four locations.

Choose Save to store the pay code.

Choose File >> Print to print a Company Pay Codes List to verify your information.

Setting up pay codes for tips

Use the Pay Code Setup window to set up pay codes for Charged Tips, Reported Tips, and Minimum Wage Balance, in addition to your regular hourly pay code. The following table shows possible pay codes and descriptions:

| Pay code | Description |

|---|---|

| CTIPS | Charged tips |

| RTIPS | Reported tips |

| MINWG | Minimum wage balances |

| HR-W | Hourly weekly |

Refer to Setting up pay codes for more information.

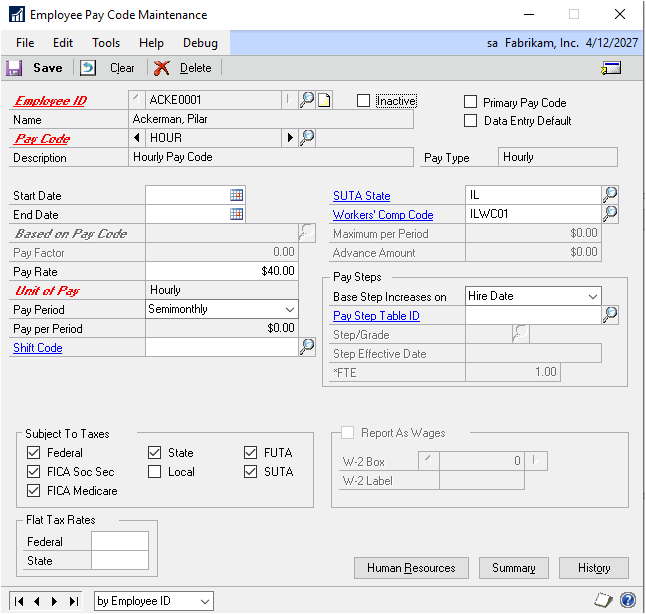

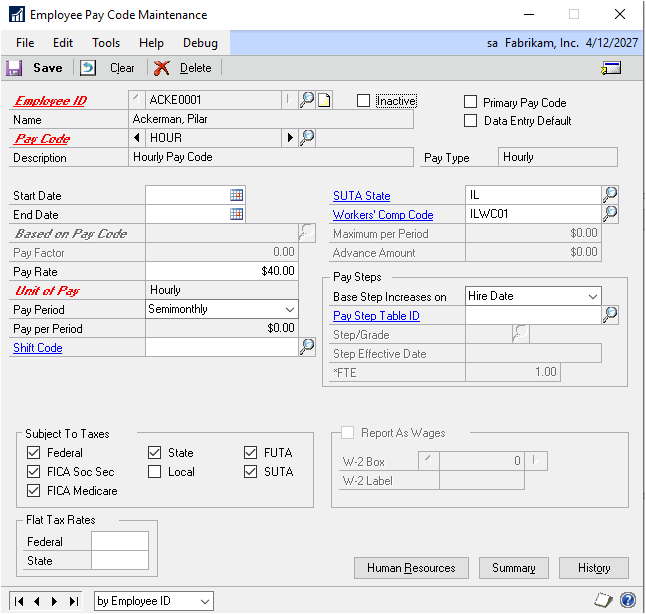

Suppose an employee has the four pay codes listed above—hourly weekly, minimum wage balance, charged tips, and reported tips. The first pay code would be the normal hourly pay rate and weekly pay period, as shown in the following Employee Pay Code Maintenance window.

Because her wages are derived primarily from tips, she also needs a charged tips and reported tips pay code.

The charged tips pay code is used to report tips included in charge cards or checks, not cash paid directly to the employee. Generally, these are paid to the employee in the paycheck on a regularly scheduled basis, in this case, weekly. The following is an example of how you could set up the reported tips pay code.

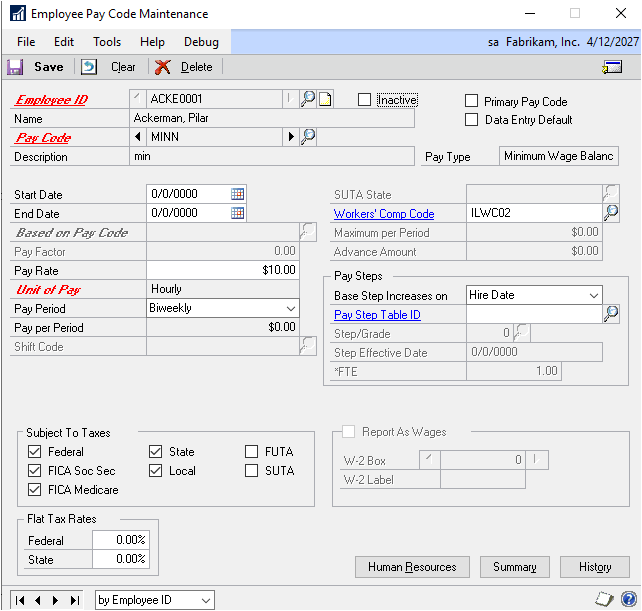

Reported tips are tips the employee receives from patrons in cash. Employees need to report this amount to employers on a regular basis so that a transaction can be entered for these tips. Taxes are calculated on the tips wages, and reported on the employee's W-2, but not withheld from the employee's paycheck. So, the employee also needs a pay code for reported tips, as shown in the following Employee Pay Code Maintenance window.

The employee also is guaranteed a minimum hourly wage, so she needs a minimum wage balance pay code in addition to the three pay codes already assigned to her. The following is an example of how you could set up the minimum wage balance pay code.

Note

Once you setup a pay code pay type, you cannot change the Pay type it will grey out.

You can change it in the database if need be.

There are two tables the pay type is stored in:

Pay code Setup - UPR40600 Pay code Employee - UPR00400

These scripts should be run against the company database.

This is an example of changing the type to Holiday pay type for a specific code.

Update UPR00400 Set PAYTYPE = '10' where PAYRCORD = 'FLOAT'

Update UPR40600 Set PAYTYPE = '10' where PAYRCORD = 'FLOAT'

Below is a list of Pay types with the associated number in SQL

Hour = 1 Salary = 2 Piecework = 3 Commission = 4 Business Expense = 5 Overtime = 6 Double Time = 7 Vacation = 8 Sick = 9 Holiday = 10 Pension = 11 Other = 12 Earned Income Credit = 13 Charged tips = 14 Reported tips = 15 Minimum Wage Balance = 16

Setting up shift codes

Use the Shift Code Setup window to set up a shift code. You can enter a shift premium as an amount or percentage.

To set up shift codes:

Open the Shift Code Setup window. (HR & Payroll >> Setup >> Payroll >> Shift Code)

Enter a code that identifies the shift code and a description.

If the employees assigned to the shift code are eligible for additional pay for working this shift, mark Amount or Percent for the shift premium, and enter the shift amount or percent.

Choose Save.

Choose File >> Print to print a Shift Codes List to verify your information.

Setting up secondary status codes

Use the Secondary Status Setup window to define codes that provide more detail about an employee's status, such as why an employee is inactive or isn't being paid. For example, you could set up codes for inactive employees who are taking military or family leave, or active employees who are on probation, awaiting a grant assignment, or between school terms

To set up a secondary status code:

Open the Secondary Status Setup window. (HR & Payroll >> Setup >> Payroll >> Secondary Status)

Enter a code that defines the secondary status and a description.

Select whether the status code applies to active or inactive employees. Active status types can only be assigned to active employees, and Inactive status types can only be assigned to inactive employees.

Choose Save.

Choose File >> Print to print a Secondary Status Codes List to verify your information.

Chapter 3: Setting up deductions and benefits

You can set up company deduction and benefit cards, also known as deduction and benefit codes, to be used as default entries for employee deductions and benefits. You can use these company cards to apply changes to several employees' deduction and benefit cards at once, and assign them to employee classes.

If you're using Human Resources, set up benefit and deduction cards in Human Resources. Refer to the "Benefit setup" chapter in the Human Resources documentation.

A deduction is an amount withheld from an employee's wages. For example, donations to a charity, union dues, and contributions to retirement plans could be set up as deductions. A garnishment is a court-ordered deduction, often for child support, delinquent taxes, or bankruptcy debts. A tax-sheltered annuity (TSA) is a deduction exempt from one or more types of taxation. You can set up a deduction as a percentage of gross, net, or earnings wages, as a fixed amount, or as an amount per unit of wages.

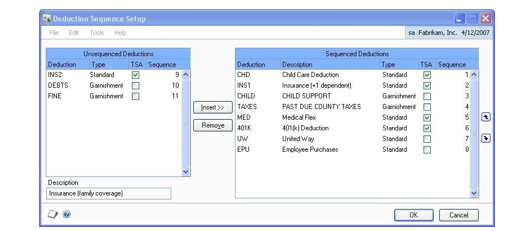

You also can set up deduction sequences at the company or employee level to specify the order in which deductions are taken. If you do not create deduction sequences, the Payroll system applies a default sequence.

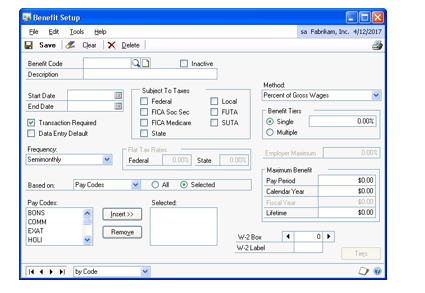

A benefit is an amount paid by the employer on the employee's behalf. Some benefits are taxable. Examples of benefits include employer-paid portions of insurance premiums, and 401(k) matching contributions. You can set up a benefit as a percentage of gross or net wages, as a percentage of a deduction, as a fixed amount, or as an amount per unit of wages.

Before setting up a deduction or benefit, first complete Setting up Payroll default entries . To ensure reports are printed in the correct order, be sure that each deduction and benefit code has the same number of characters. The characters are sorted from left to right, and numbers take priority over letters.

Review this blog post to set up and HAS (Health Savings Account) in Microsoft Dynamics GP.

Information is contained in the following sections:

Using zero benefit and deduction amounts

Deduction types

Deduction tiers

Setting up a standard deduction

Setting up a garnishment

Setting up earnings codes

Setting up maximum garnishment rules

Deducting multiple garnishments

Setting up a company-level deduction sequence

Benefit types

Benefit tiers

Setting up a benefit

Setting and activating post-dated pay rates

Modifying a pay, benefit, or deduction code

Inactivating or deleting a pay, benefit, or deduction code

Using zero benefit and deduction amounts

You can use zero for benefit and deduction amounts when you set up benefit and deduction cards. If you enter a zero amount, you create a zero default for new employee records. Then, you can enter the appropriate amount of the benefit or deduction for each employee without having to edit a standard default amount.

You can choose to not enter a benefit or deduction amount in the following windows:

| Window | Fields |

|---|---|

| Benefit Setup | Benefit Tiers and Maximum Benefit |

| Deduction Setup | Deduction Tiers and Maximum Deduction |

| Employee Benefit Maintenance | Benefit Tiers and Maximum Benefit |

| Employee Deduction Maintenance | Deduction Tiers and Maximum Deduction |

When you leave any of the foregoing fields blank, the record will be saved in Payroll even if you're not using Human Resources.

Deduction types

A deduction can be based upon a specified percentage or an amount of income. You can use one of the following five calculation methods to calculate deductions.

Percent of Gross Wages Calculates the deduction as a percentage of total wages before taxes are deducted. Taxes are calculated before deductions are made, so deducting from gross wages won't affect taxable amounts unless the deduction is a tax-sheltered annuity.

Percent of Net Wages Calculates the deduction as a percentage of gross wages after taxes. This method is only permitted when all TSA check boxes are unmarked and when the deduction is based on all pay codes.

Fixed Amount Deducts a fixed amount from the employee's wages.

Amount per Unit Calculates the deduction based upon units using piecework, hourly, double time or overtime pay.

Percent of Earnings Wages Calculates the deduction as a percentage of an employee's Net Disposable Income (NDI). NDI is a legally-defined sum of wages, deductions, and taxes from which garnishments and other deductions may be taken. The definition of NDI depends on state law.

This method is not permitted for Tax Sheltered Annuities.

This method is only permitted for deductions based on all pay codes.

Deduction tiers

You can select either a single deduction tier or multiple tiers. The following are some examples of how you might set up your deduction method and tier.

Example 1 If you select Percent of Gross Wages as the calculation method, the tiered deduction might be set up as follows:

| Percentage | Wage level |

|---|---|

| 4.375 percent | Up to and including $2,541.66 |

| 7.25 percent | Over $2,541.66 |

If the gross wages equaled $3,000, the deduction is calculated as follows:

| Wage | Rate | Deduction amount |

|---|---|---|

| $2,541.66 | 4.375 percent | $111.20 |

| $458.34 | 7.25 percent | $33.23 |

| Total deduction | $144.43 |

Example 2 If you select Fixed Amount as the calculation method, the tiered deduction might be set up as follows:

| Amount | Wage level |

|---|---|

| $10 | Up to $1,000 |

| $15 | Over $1,000 and up to $2,000 |

| $20 | Over $2,000 |

If the wages equaled $3,000, the deduction is calculated as follows:

| Wage | Deduction amount |

|---|---|

| First $1,000 | $10 |

| Second $1,000 | $15 |

| Third $1,000 | $20 |

| Total deduction | $45 |

Example 3 If you select Amount per Unit as the calculation method, the tiered deduction might be set up as follows:

| Rate per unit | Number of units |

|---|---|

| $0.10 | Up to 100 |

| $0.20 | Over 100 units up to 500 units |

| $0.39 | Over 500 units |

If the number of units equaled 250, the deduction is calculated as follows:

| Units | Rate per unit | Deduction amount |

|---|---|---|

| First 100 units | $0.10 | $10 |

| Remaining 150 units | $0.20 | $30 |

| Total deduction | $40 |

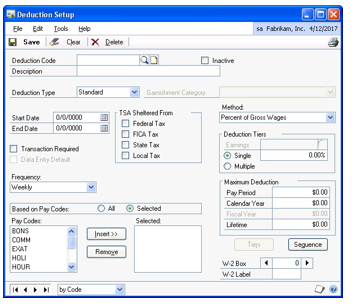

Setting up a standard deduction

Use the Deduction Setup window to enter and maintain company deduction cards that you can use as default entries for setting up employee deductions. You can apply changes to employee deduction cards and can include them in employee classes. Deductions can be taken from net, unit or gross pay. Examples of deductions include donations to charities, union dues, and contributions to pension plans.

Garnishments are mandatory deductions, such as debt payments enforced by court order. To set up garnishment deductions, follow the steps in Setting up a garnishment .

Before changing a deduction code to apply a new earnings code, confirm that the earnings code does not use the same deduction code in its own definition. Such a circular reference could cause inconsistent and undesired results.

The frequency with which a deduction is taken depends on selections you make when you build the paychecks. Your selections in the Frequency field in the Deduction Setup window will be used to annualize the tax-sheltered deduction when taxes for paychecks are calculated.

If your business needs require you to track deduction balances when the employee's net pay cannot meet all deductions, or to collect mandatory arrears for employee deductions where the employee does not receive a pay check, consider using Deductions in Arrears, which is included with Payroll Extensions. This module is part of the Human Resources and Payroll Suite, which can be installed as an additional product.

The following are some examples of deduction codes you might use:

ADV - Advance to Employee

CHD - Child Care Deduction

DEP - Family Health

401 - 401(k) Contribution

MED - Medical

SGL - Single Insurance

UWY - United Way

To set up a standard deduction:

- Open the Deduction Setup window. (HR & Payroll >> Setup >> Payroll >> Deduction)

Enter a deduction code and description.

Select Standard as the deduction type.

Enter start and end dates for the deduction. The start date should be on or before the ending date of the pay period the first deduction is to be made; otherwise, the deduction won't be taken. If it's a continuous deduction, leave the end date field blank. If the ending date is on or after the ending date for the pay run, the deduction will be taken.

Mark Transaction Required if the dollar amount or percentage of the deduction varies each time it's calculated. For example, if you have an employee purchase plan and the amount you withhold varies with each paycheck, or there is no withholding for some paychecks, mark Transaction Required.

If you mark the deduction as Transaction Required, you'll need to enter a transaction for the amount or percentage of the deduction for each pay run in which the deduction is taken.

Mark Data Entry Default to use the information in this window when you create a transaction for the deduction code during a pay run.

Select the deduction frequency.

Mark the taxes from which the deduction is sheltered. Taxable wages will be reduced by the amount of the tax-sheltered deduction before taxes are calculated. If federal tax is marked, the amount of the deduction won't be included in the Wages, Tips, and Other Comp field on the employee's W-2 form.

Select whether to base the deduction on all pay codes or on a selected list of pay codes. To base the deduction on all pay codes, mark All. If you mark Selected, the pay codes list will be displayed. Select each code to base the deduction on and choose Insert to add the pay code to the Selected list.

Select a deduction method, and a single deduction tier or multiple tiers. For more information, refer to Deduction tiers and Setting up earnings codes .

Enter deduction maximums. You can enter the maximum amount an employee can have deducted each pay period, each calendar year, each fiscal year, and for the entire time the employee works for your company.

If you need to print the year-end total amount for this deduction on the W-2 statement, enter the number of the appropriate W-2 statement box, and enter appropriate label information. See IRS rules for the applicable year for a current list of labels.

If the amount must be reported in multiple locations on the W-2 statement, use the browse buttons to select an additional location, and enter the appropriate box number and label. You can specify as many as four locations.

You can choose Sequence to specify the order in which the deductions will be deducted from the employee's wages. For more information about setting up deduction sequences, see Setting up a company-level deduction sequence .

Choose Save to store the code. You can then continue to set up more deductions.

Choose File >> Print to print a Company Deduction Codes List to verify your information.

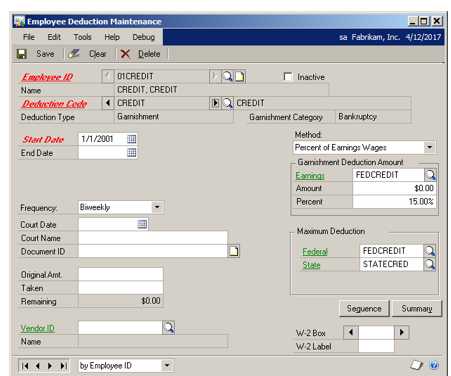

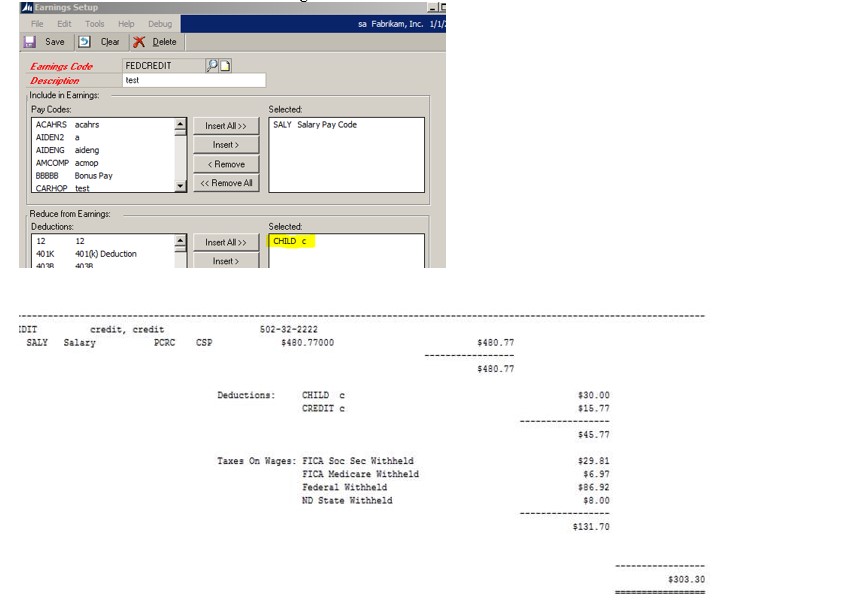

Setting up a garnishment

Use the Deduction Setup window to enter and maintain garnishments. Garnishments are mandatory deductions from employee pay, such as debt payments enforced by court order. For example, a bankruptcy court may order an employer to deduct wages to pay an employee's outstanding debts.

Specify which portion of an employee's wages are subject to garnishments. See Setting up earnings codes .

Federal and state governments also set maximum percentages for garnishments. See Setting up maximum garnishment rules .

Review this detail document for examples of how Garnishments are set up.

To set up a garnishment:

Open the Deduction Setup window. (HR & Payroll >> Setup >> Payroll >> Deduction)

Enter a deduction code and description.

Select Garnishment as the deduction type.

Select a garnishment category.

Select a garnishment deduction method. If you select Percent of Earnings Wages, enter or select an earnings code. Earnings codes specify the amount and type of earnings that are subject to a deduction. See Setting up earnings codes .

To deduct a company fee from employee wages for processing garnishments, create a deduction code and include it in the earnings code.

Select the deduction frequency.

If you need to print the year-end total amount for this garnishment on the W-2 statement, enter the number of the appropriate W-2 statement box, and enter appropriate label information.

See IRS rules for the applicable year for a current list of labels.

Choose Save to store the code. You can then continue to set up more garnishments or other deductions.

You can choose Sequence to specify the order in which deductions will be taken from the employee's wages. For more information about setting up deduction sequences, see Setting up a company-level deduction sequence .

Choose File >> Print to print a Company Deduction Codes List to verify your information.

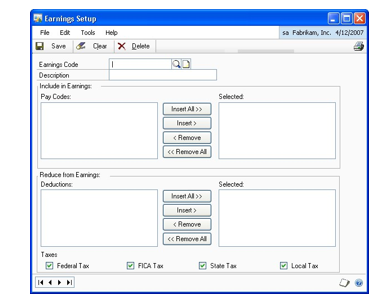

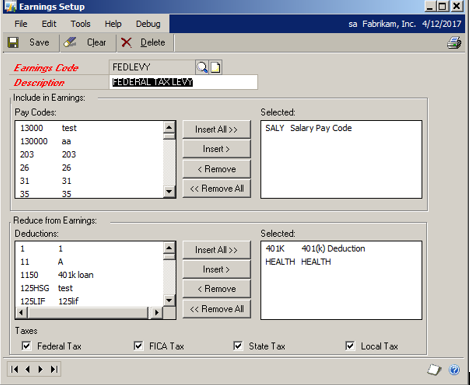

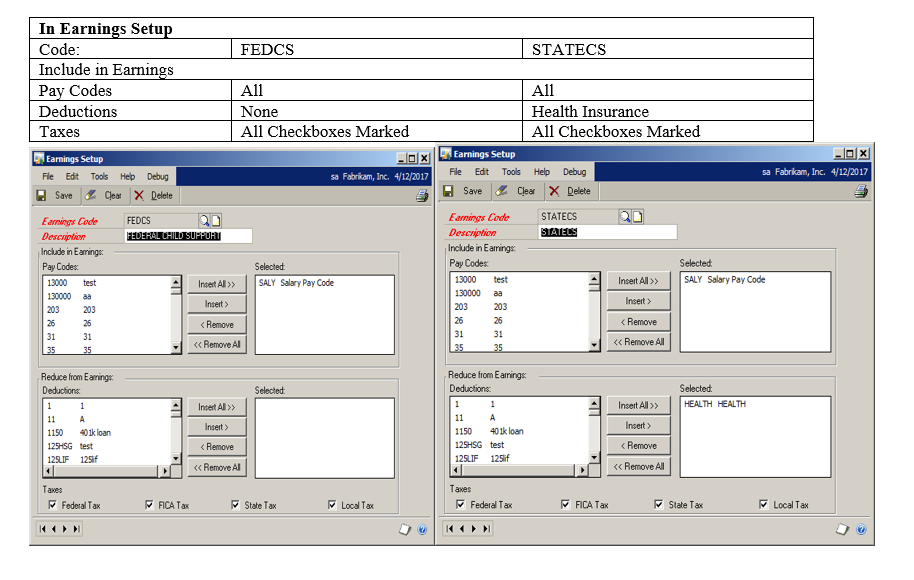

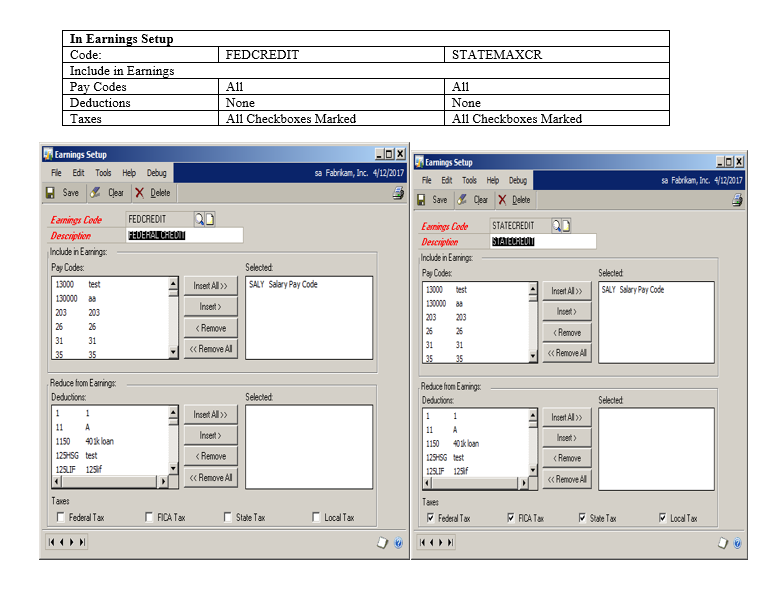

Setting up earnings codes

Use the Earnings Setup window to define an employee's Net Disposable Income (NDI). NDI is a legally-defined selection of wages, deductions and taxes from which garnishments and standard deductions may be taken. The definition of NDI depends on state law.

You can set maximum deduction amounts in the Garnishment Maximum Setup window. See Setting up maximum garnishment rules .

To set up earnings codes:

Open the Earnings Setup window. (HR & Payroll >> Setup >> Payroll >> Earnings Setup)

Enter or select an earnings code.

Enter a description.

Select a pay code and choose Insert to move it to the Selected list for inclusion in this earnings code. Choose Insert All to move all pay codes to the Selected list.

To remove a pay code from the Selected list, select it and choose Remove. Choose Remove All to remove all pay codes.

Select a deduction code and choose Insert to move it to the Selected list for inclusion in this earnings code. Deductions in the Selected list reduce net disposable income.

To deduct a company fee from employee wages for processing garnishments, create a deduction code and include it in the earnings code.

Mark the taxes to apply to this earnings code and reduce net disposable income.

Choose Save to store the code.

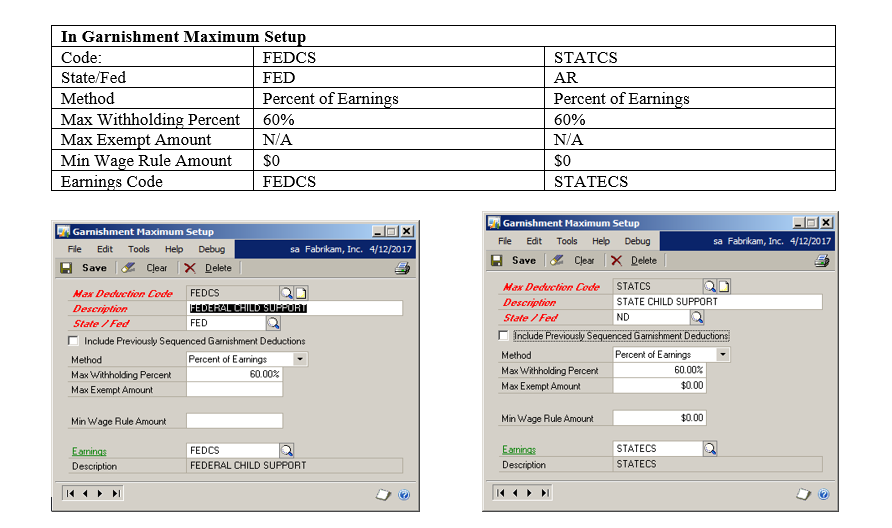

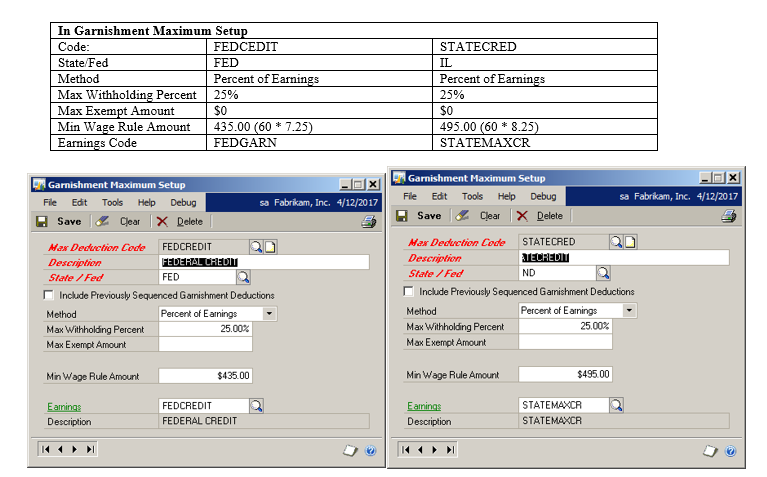

Setting up maximum garnishment rules

Federal and state law each establish maximum rates and amounts for garnishments. Payroll calculates garnishment amounts using both state and federal maximum amount rules, compares them to the target garnishment amount, and selects the lesser of the three amounts as the garnishment.

To set up maximum garnishment rules:

Open the Garnishment Maximum Setup window. (HR & Payroll >> Setup >> Payroll >> Garnishment Maximum Setup)

Enter or select a maximum deduction code.

Enter a description.

Mark Include Previously Sequenced Garnishment Deductions if multiple garnishments are levied against an employee, and you want to deduct the garnishments in sequence until the maximum value is reached. If the full amount of a given garnishment can't be deducted without the total exceeding the maximum, Payroll will deduct as much of the garnishment as possible. For more information, see Deducting multiple garnishments .

Enter a state by postal abbreviation, enter FED for federal, or select a jurisdiction from the lookup window.

Select the method of garnishment. If selecting Percent of Earnings as the method, confirm that the earnings code you select does not use the same garnishment that will use this maximum deduction code.

Enter the maximum percentage of wages to be garnished.

Enter the maximum amount of wages exempt from garnishment.

Enter the minimum wage rule amount, if required. For some types of garnishments, the law may exempt an amount of the employee's wages equal to a specified number of hours multiplied by the minimum wage.

If you selected Percent of Earnings as the calculation method, enter or select an earnings code.

Choose Save to store the code.

Deducting multiple garnishments

If multiple garnishments are levied against an employee, you'll first need to set up codes defining the maximum rates and amounts that can be withheld, in accordance with applicable state and federal regulations. (See Setting up maximum garnishment rules ) Then you'll need to decide how to apply the maximums when calculating an employee's pay. Payroll provides several ways to apply maximums:

To each garnishment individually When you define maximum codes in the

Garnishment Maximum Setup window, leave the Include Previously Sequenced Garnishment Deductions option unmarked. Each garnishment is compared to the maximum, and deducted if it does not exceed the maximum. This method works best for single garnishments; however, if you use this method for multiple garnishments, you may want to define separate maximum deduction codes for each garnishment.

To multiple garnishments, in a priority sequence In the Garnishment

Maximum Setup window, mark the Include Previously Sequenced Garnishment

Deductions option. Garnishments will be deducted in the order defined in the Employee Deduction Sequence window, until the maximum value is reached. If the full amount of a given garnishment can't be deducted without the total exceeding the maximum value you define, Payroll will deduct as much of the garnishment as possible. If the same maximum deduction code applies to any garnishments with later sequence numbers, those garnishments won't be deducted.

To multiple garnishments, without priority In the Employee Deduction

Sequence window, assign the garnishments the same sequence number. In the Garnishment Maximum Setup window, define a maximum code that applies to the total of all the garnishments that have the same sequence number, and leave the Include Previously Sequenced Garnishment Deductions option unmarked. If the total of all the garnishments that have the same sequence number exceeds the maximum, the garnishments will be reduced by an even or proportional value specified in the Split Method window.

For example, assume an employee has three garnishments of differing priority. The total of all garnishments cannot exceed $200, so a maximum deduction code is set up with this amount, and applied to all three garnishments. The Include Previously Sequenced Deductions option is marked in the Garnishment Maximum Setup window.

| Name | Target | Maximum | Taken | Calculation |

|---|---|---|---|---|

| GARN1 | 150 | 200 | 150 | |

| GARN2 | 75 | 200 | 50 | 200 (maximum) - 150 (previous amount) |

| GARN3 | 50 | 200 | 0 | 200 (maximum) - 200 (previous amount) |

Be aware that when there are separate state and federal maximums, Payroll will always apply the maximum that deducts the smallest amount from an employee's pay.

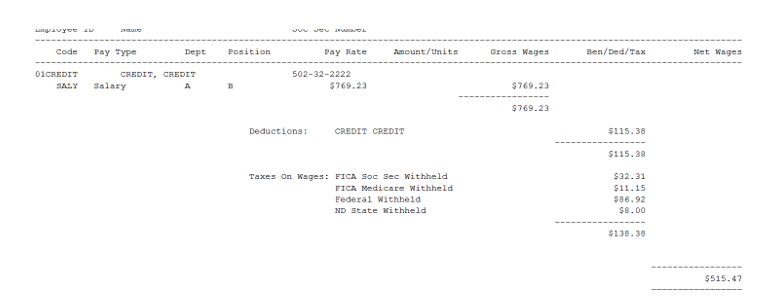

Garnishment Setup Examples

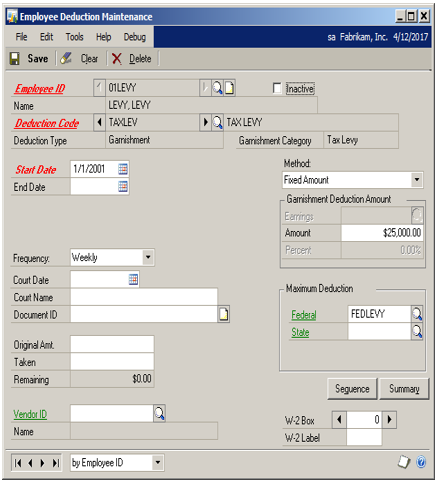

Tax Levies

A federal tax levy is accomplished by ‘garnishing’ an employee’s wages to the extent that they are not exempt from the levy. For example, there may be a tax levy that is for $25,000. The tax levy deduction will be taken from the employees ‘take-home pay’ until it reaches the exempt amount.

The exempt amount is an amount that comes from the table (after looking at form 668-W that the employee fills out – (according to the number of exemptions, the pay period, and the filing status)).

The ‘take-home pay’ will be calculated as Wages, minus all Taxes and Deductions (both voluntary and involuntary) that were in effect at the time of receiving the tax levy. Once an employee’s take-home pay has been determined, all but the exempt amount is subject to the levy.

Any new payroll deductions that are initiated by the employee after the levy has been received by the employer must be deducted from the exempt amount when determining the employee’s net pay, unless they are required as a condition of employment. (This also includes increases in elective deductions such as a 401k.)

It looks like Tax Levies are always an amount (by looking at the form 668-W).

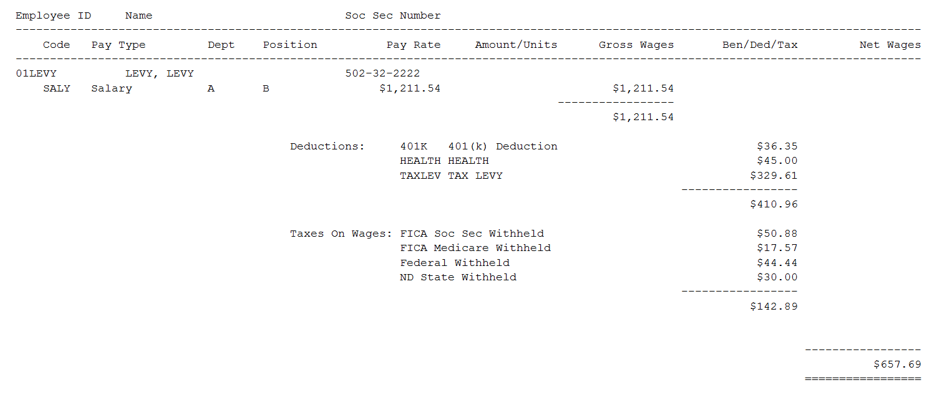

Example: Employee Arthur receives $1,211.54 every two weeks. On Aug 1, 2010, the employer receives form 668-W stating that a federal tax levy was being issued against Arthur’s wages for $25,000. Arthur claimed married filing jointly with 3 personal exemptions on Part 3 of the form. (The exempt amount taken from the table is $657.69.) As of Aug 1, Arthur had the following deductions:

| Type | Amount |

|---|---|

| Federal income tax | $44.44 |

| Medicare tax | 17.57 |

| State income taxes | 30.00 |

| 401K plan(3% of salary) | 36.35 |

| Health INS (after tax) | 45.00 |

| Total: | $224.24 |

Prior to the Tax Levy, Arthur’s take-home pay is $987.30 ($1,211.54 - $224.24). The exempt amount of Arthur’s take-home pay (taken from the table) is $657.69. Therefore, the amount subject to the tax levy is $329.61 ($987.30 - $657.69). And the take home pay after the Tax Levy is $657.69.

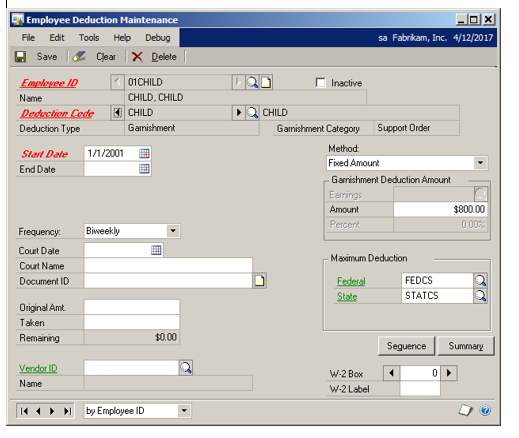

How would we set up this deduction?

In the Employee Deduction Maintenance window:

| Field | Value |

|---|---|

| Deduction Type | Garnishment |

| Original Amount | $25,000 |

| Method | Fixed Amount |

| Garnishment Category | Tax Levy |

| Amount | $25,000 |

| Percent | N/A |

| Earnings | N/A |

| Maximum Deduction Codes | |

| Federal | FEDLEVY (this is just an example) |

| State | N/A |

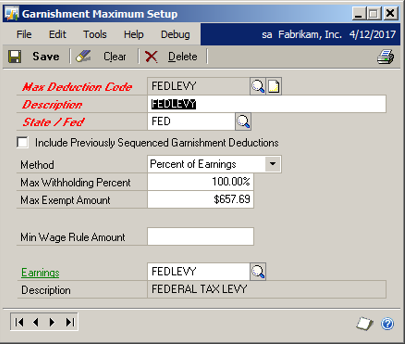

In the Garnishment Maximum Setup window:

| Field | Value |

|---|---|

| Code | FEDLEVY |

| Method | Percent of Earnings |

| Max Withholding % | 100% |

| Max Exempt Amount | $657.69 (This is the amount taken from the table) |

| Min Wage Rule Amt | $0 |

| Earnings Code | FEDLEVY |

In the Earnings Setup window:

| Field | Value |

|---|---|

| Code | FEDLEVY |

| Pay Codes | All |

| Deductions (According to the info we have about Federal Tax Levies, it should be all deductions that are being taken at the time the tax levy was issued. New deductions after the tax levy is in place would not be included.) |

401K & Health Insurance |

| Taxes | All Checkboxes Marked |

Recap of the Calculate Checks report:

Prior to the Tax Levy, Arthur’s take-home pay is $987.30 ($1,211.54 - $224.24). The exempt amount of Arthur’s take-home pay (taken from the table) is $657.69. Therefore, the amount subject to the tax levy is $329.61 ($987.30 - $657.69). And the take home pay after the Tax Levy is $657.69.

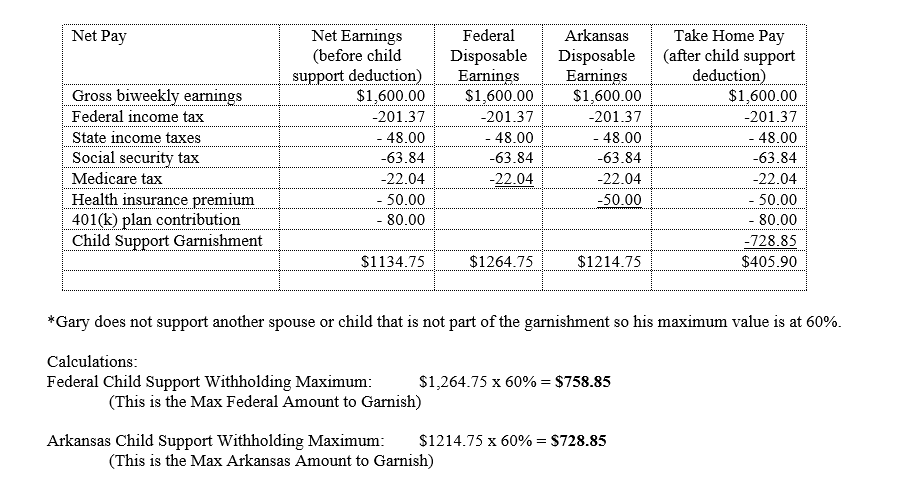

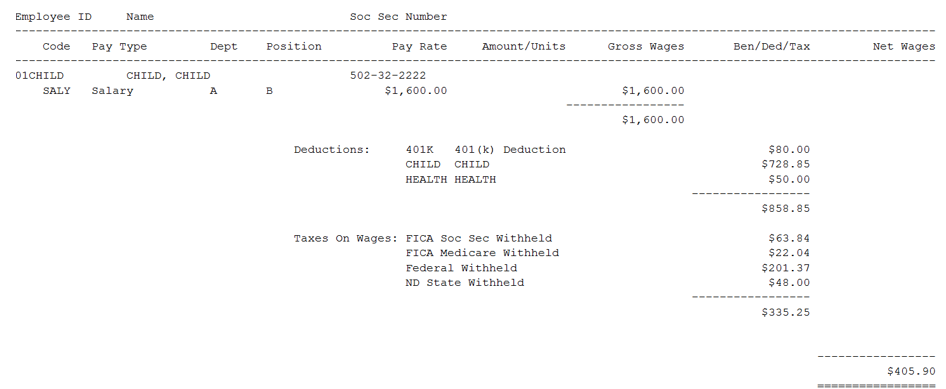

Child Support Withholding Orders

Maximum amount to withhold: Under the CCPA, the maximum amount that can be withheld from an employee’s wages for spousal or child support is:

- 50% of the employee’s ‘disposable earnings’ if the employee is supporting another spouse and/or children.

- 60% if the employee is not supporting another spouse and/or children.

Note: These amount increase to 55% and 65%, respectively, if the employee is at least 12 weeks late in making support payments. State laws may impose lower limits.