Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

January 2018

New field Non-Taxable Income Type is added to Withholding Tax table and Withholding Tax Card page to allow for handling of non-taxable income in export of withholding tax.

On this Page:

Overview

Package contains objects changed to handle non-taxable income type in withholding tax export.

Reference Information

| Reference No. | 233814 |

|---|---|

| Product Area | Financial Management |

| Discovered in | Microsoft Dynamics NAV 2016 |

| Title | Non-Taxable Income Type handling in Withholding Tax for Microsoft Dynamics NAV 2016 |

| Released on | January 2018 |

Important Notice to Customers

We recommend that you contact your Microsoft Dynamics Partner before installing service packs or hotfixes. It is important to verify that your environment is compatible with the service pack(s), hotfix(es), or download(s) being installed. A service pack, hotfix, or download may cause interoperability issues with customizations, and third-party products that work with your Microsoft Dynamics solutions.

Important Notice to Partners

As per the SPA, it is non-compliant for partners to redistribute tax and regulatory updates to ERP customers not enrolled in the Business Ready Enhancement Plan. Partners can verify their customer’s status in VOICE. If they're not enrolled, Partners will need to get them current before they can distribute.

Installation

Before this update can be installed, the following prerequisites are required:

Microsoft Dynamics ® NAV 2016 Italy (CU 26)

Installation Steps:

For more information about how to install an update rollup, click the following article number to view the article in the Microsoft Knowledge Base:

3109325 - How to install a Microsoft Dynamics NAV 2016 Cumulative Update

Note:

- Existing customizations in objects that are included in this update file may break when you import the regulatory feature.

No data upgrade is required before you can use this feature.

Licensing

No new objects are added to this release, so no license refresh is needed.

Objects

The following object have been added / modified through this release:

Objects

| Type | No. | Name | Added / Modified |

|---|---|---|---|

| Table | 12116 | Withholding Tax | Modified |

| Page | 12112 | Withholding Tax Card | Modified |

| Codeunit | 12132 | Withholding Tax Export | Modified |

Setup

To start using this feature no special setup is required. Simply follow below steps to use new Non-Taxable Income Type field:

1. After creating Withholding Tax Entry, simply open Withholding Tax Card and select Non-Taxable Income Type manually

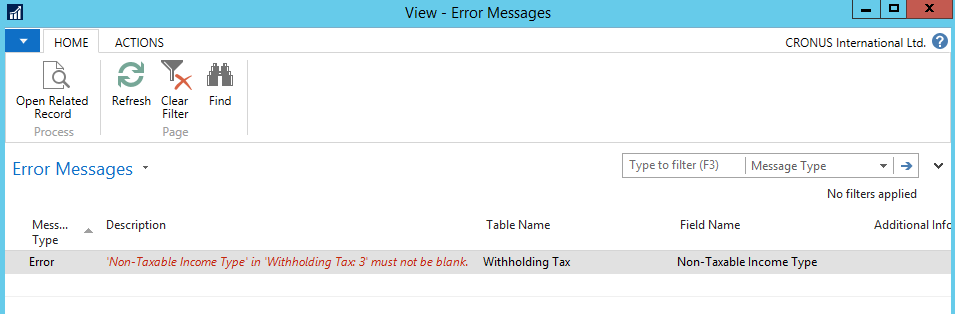

NOTE: Non-Taxable Income Type field must contain value once sum of Non-Taxable Amount by Treaty and Base – Excluded Amount is different from zero. All fields are calculated for every combination of Vendor, Reason and Non-Taxable Income Type in Withholding Tax entries. If the Non-Taxable Income Type has blank value then the error will be showed and system will stop export of the file.

2. If error occurs during export, clicking Open Related Record will open Withholding Tax Card where Non-Taxable Income Type can be set

Non-Taxable Income Types values definitions:

"1" - in the case of sums which have not contributed to taxable income (90% of the amount disbursed), relating to Remunerations perceived by the teachers and the researchers on the basis of the D.L. November 29, 2008, no. 185 converted, with amendments from L. no. 2 of January 28, 2009. The related expenditure reimbursements are also included;

"2" - in the case of sums that have not contributed to taxable income (80% of the amount paid for workers and 70% for workers) for workers belonging to the categories identified by Decree Of the Minister of Economy and Finance of June 3, 2011 in possession of the requisites required and required to Benefit from the tax benefit provided for by art. 3 of the Law of 30 December 2010, no. 238. The relevant repayments shall also be entered expenses;

"5" - in the case of sums paid that did not contribute to the formation of taxable income (30% of the amount disbursed), Relating to remuneration received by persons who have started an independent or self - employed activity on the basis of: As established by Article 16 of Legislative Decree no. n. 147 of 2015.

"6" - in the case of disbursement of other non-taxable or non-taxable income.

Support Information

For technical support questions, contact your partner or direct your questions to the Support for Business hub: https://serviceshub.microsoft.com/supportforbusiness/create