Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Important

Some or all of the functionality noted in this article is available as part of a preview release. The content and the functionality are subject to change. For more information about preview releases, see Service update availability.

This article describes the method that is used in fixed assets to calculate depreciation using the half-year convention. The half-year convention calculates six months of depreciation during an asset’s first and last year of service. For more information about depreciation conventions, see Depreciation methods and conventions.

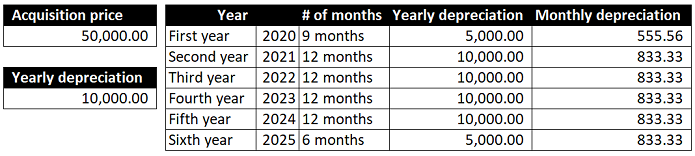

When you use the six-month depreciation convention, the system uses the acquisition year or the year that the asset was placed in service, then calculates five years of depreciation from that year, and then adds six months. To illustrate this process, consider an asset that was acquired for the price of 50,000, and placed in service in April 2020. Also assume that the asset has a five-year service life.

The first year of service will conclude in December 2020, which means the end of the asset’s five-year service life will be December 2024. The half-year depreciation convention will add six months to the asset’s life, which means its service life will end in June 2025.

Yearly depreciation 50,000/5 = 10,000 monthly depreciation 10,000/12 = 833.33

First year depreciation 10,000/2 = 5,000 and the subsequent monthly depreciation 5,000/9 = 555.56

The extended depreciation periods that are added by the half-year convention provide more accurate allocation of depreciation. The six-month convention represents depreciation expenses more equally, which is useful for reporting on the profit and loss statement.