Configure account structures

Account structures use the main account and financial dimensions to create a set of rules that determine the order and values used when entering the account number. You can set up as many account structures as you need for your business. The account structures are assigned to a company's ledger setup, so they can be shared.

When creating an account structure, the maximum number of segments is 11. If you need more than 11 segments, thoroughly evaluate your setup and requirements, as it impacts the user experience. Consider if a segment could be derived in a reporting scenario using a hierarchy instead of during data entry, or by using a user-defined field. For example, if you want to report on location, but you can figure location by department or cost center, you won't need location as a financial dimension. If after evaluation you do determine more than 11 segments are needed, you can add additional segments using advanced rules.

Account structures require the main account. The main account doesn't need to be the first segment in the structure, but it does identify what account structure is being used during the account number entry. Because of this, a main account value can only exist in one structure assigned to the ledger so that they don't overlap. After the account structure is identified, the allowed values list is filtered to guide the user through picking only valid dimension values, decreasing the possibility of an incorrect journal entry.

Note

If you plan to budget against a financial dimension, it will need to be part of an account structure. Budgeting does not currently utilize advanced rules.

Example

To illustrate a best practice for setting up an account structure, let's assume that a company wants to track their balance sheet accounts (100000..399999) at the account and business unit financial dimension level. For revenue and expense accounts (400000..999999), they track financial dimensions Business Unit, Department, and Cost center. If they make a sale, they also like to track Customer. Using this scenario, it would be recommended to have two account structures assigned to the company's ledger - one for Balance sheet accounts, and one for Profit and Loss accounts. To optimize the user experience and validation, Customer should be an advanced rule that is only used when a sales account is used.

Balance sheet account structure

| Main account | Business unit |

|---|---|

| 100000..399999 | *;" " |

Profit and loss account structure

| Main account | Business unit | Department | Cost center | |

|---|---|---|---|---|

| 400000..999999 | *;" " | *;" " | *;" " | *;" " |

Advanced rule for adding a Customer

Criteria: Where Main account is between 400000 and 499999, then add customer. It can't be left blank.

| Customer |

|---|

| * |

In this simplified example, all values and blank are allowed so * and " " are used.

Segments and allowed values

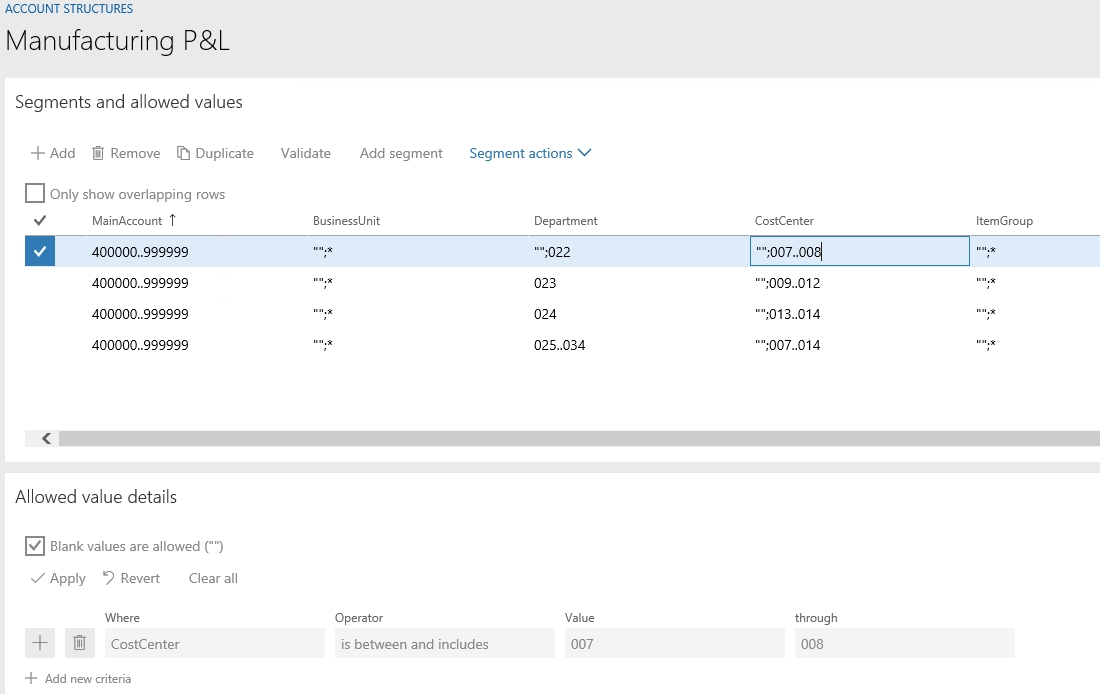

The Segments and Allowed values details section provides a grid like experience for entering the rules that will be followed on validation during posting. You can type directly in the cells in the grid, import it from Excel, or use the Allowed value details section to guide you through it.

The Allowed value details section guides you through creating criteria using Operators such as begins with, is between, includes, and many others.

Allowed values will default onto a journal or accounting distribution entry page when there are no other possible values to select according to the account structure setup.

Here's an example of the Profit and loss account structure.

| Main account | Business unit | Department | Cost center |

|---|---|---|---|

| 400000..999999 | 002 | 022 | 014 |

When entering a journal and selecting an account in the profit and loss range, selecting business unit '002' will cause values 022 and 014 to be the default on the account control. This behavior will also occur with the accounting distribution page.

More than seven criteria needed

If you have more than seven criteria that are needed, you can continue adding them on the next line. You will notice when working in the Allowed value details section that the +Add new criteria is no longer active after the seventh criteria is entered. This is due to factors such as:

- Column width

- How the data is stored

- Performance of the Allowed value details control

- Usability

Note

An upgrade from Microsoft Dynamics AX 2012 where more than seven criteria are specified isn't supported. It must be corrected before you complete the upgrade to finance and operations apps.

To continue to add additional criteria, click Duplicate in the Segment and Allowed values section. This will copy the criteria to a new line. You can then type over or modify the Allowed value details section.

Best practices

When setting up your account structures, there are some best practices you can follow. However, this is only guidance so a holistic discussion about your business, growth plan, and maintenance plan should be considered as part of that discussion.

Make the main account first or as close to the front of the account structure as possible, so users get the best guided experience they can during account entry.

- Verify that any third-party solutions you intend to use support main account in the first position.

Reuse account structures as much as possible to reduce maintenance across your legal entities.

For variations across legal entities, consider using advanced rules so that account structures can be reused.

When defining allowed values, use ranges and wildcards as much as possible. This not only allows you to grow and change without maintenance, but the system also performs more ideally with this configuration.

Don't put an asterisk for every segment in the account structure and then solely rely on the advanced rules. This can be difficult to manage and often leads to user error during maintenance that can make the system unable to post.

Account structure activation

When you are satisfied with your new setup or a change to an account structure, you must activate it. If an account structure is assigned to a ledger, this activation can be a long running process, as all unposted transactions in the system must be synced to the new structure. Posted transactions are not impacted by account structure changes. As of application version 10.0.31, a new feature that is named Account structure activation performance enhancement is available in feature management. For more information about this new feature for account structure activation, see Account structure activation performance enhancement.

For more information, see Plan your chart of accounts, Financial dimensions, and Enter account and dimension combinations (segmented entry control).

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for