Withholding tax in purchase transactions

For vendors who are liable to withholding tax, you can assign the default Withholding tax group on the All vendors page.

Go to Navigation pane > Modules > Accounts payable > Vendors > All vendors.

Click the respective Vendor account, click Edit.

In Invoice and delivery tab, set the Calculate withholding tax field to Yes.

Note

Withholding tax will not be calculated if Calculate withholding tax is not switched on for this vendor in the data.

Select a withholding tax group in Withholding tax group.

Click Save.

For items and services that are liable to withholding tax, you can assign the default Item withholding tax group in Released Products.

Go to Navigation pane > Modules > Product information management > Products > Released products.

Click the respective Item number, click Edit.

In Purchase tab, click Calculate withholding tax.

Note

Withholding tax will not be calculated if Calculate withholding tax isn't set to Yes for this Item in the Purchase tab on the Released product page.

Select an item withholding tax group in Item withholding tax group list.

Click Save.

Withholding tax groups and Item withholding tax groups can be assigned in pages:

- Purchase order

- Vendor invoice

- Invoice journal

The default Withholding tax group and Item withholding tax group are carried into the lines when creating Purchase orders and/or Pending Vendor invoices. For Vendor invoice journal, you can switch on Calculate withholding tax and select Item withholding tax group in the General tab in the journal.

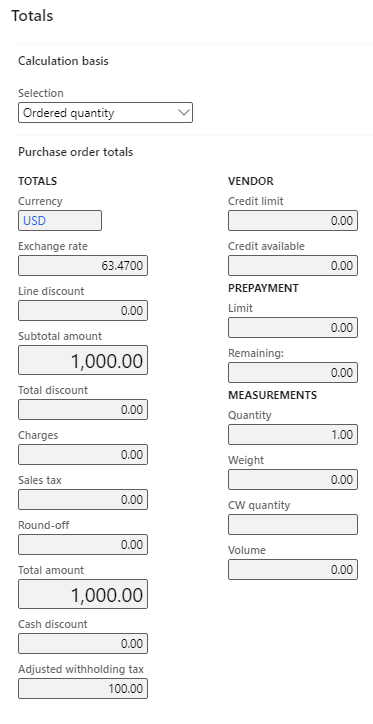

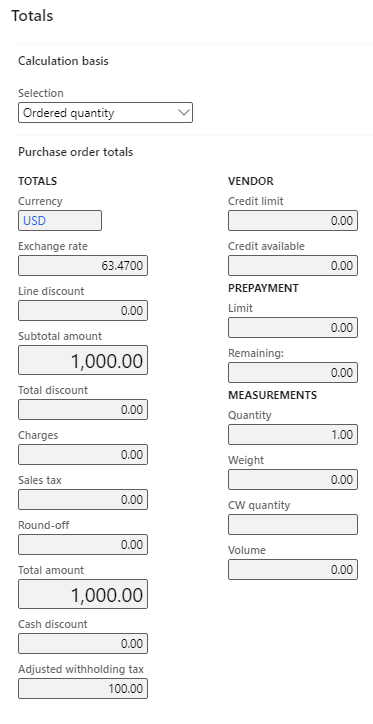

The temporary amount of withholding tax is available in the field Adjusted withholding tax of the Totals tab on the Purchase order page.

Note

Starting in version 10.0.33, a new option Estimate withholding tax amount on invoice is available on the Withholding tax tab of the General ledger parameters page. When you enable this option, a Withholding tax button is available on purchase orders and vendor invoices to estimate the withholding tax amount.

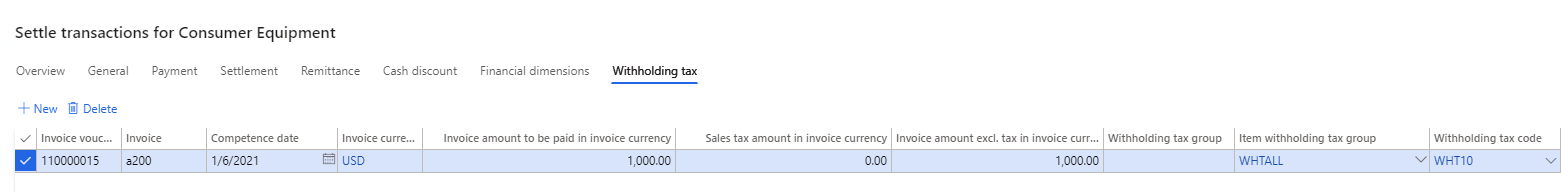

Withholding tax is calculated on Vendor payment journal. You can manually adjust the applicable withholding tax codes and the actual withholding tax amounts in the Withholding tax tab on the Settle transactions page.

The derived withholding tax amount is deducted from the vendor payment and posted to the Withholding tax account in a related voucher.

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for