Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

This article provides information about the European Union (EU) sales list report that is based on form U13. The Austrian EU sales list report contains information about the sale of goods and services for reporting in XML format.

The following fields are included on the Austrian EU sales list report:

EU sales list header:

- Reporting period

- Authority ID

- Company tax registration number

- Date and time of the report creation

EU sales list lines:

- Customer VAT ID

- The total amount of items

- The total amount of services

- Total amount of the triangular trade

Setup

For general setup information, see EU Sales list reporting.

Note

The company's tax registration number will be shown in the .xml file for the EU sales list report.

Set up company information

First create a registration type and assign it to the VAT ID registration category for Austria and all the countries or regions that your company does business with. For more information, see Registration IDs.

Then follow these steps to set up information about your company.

- Go to Organization administration > Organizations > Legal entities.

- In the grid, select your company.

- On the Action Pane, select Registration IDs.

- On the Registration ID FastTab, select Add.

- On the Overview tab, in the Registration type field, select the registration type that you created earlier.

- Enter your company's value-added tax (VAT) ID.

- Optional: On the General tab, in the General section, change the period that the VAT ID is used for.

- Close the page.

Note

If the VAT exempt number export field in the Intrastat section of the Foreign trade and logistics FastTab is set (that is, it isn't blank), the value will be used, instead of the VAT ID that you created in step 6, in the .xlsx file for the EU sales list report.

Import Electronic reporting configurations

In Microsoft Dynamics Lifecycle Services (LCS), import the latest versions of the following Electronic reporting (ER) configurations for the EU sales list:

- EU Sales list model

- EU Sales list by columns report

- EU Sales list by rows report

- EU Sales list (AT)

For more information, see Download Electronic reporting configurations from Lifecycle Services.

Set up foreign trade parameters

In Dynamics 365 Finance, go to Tax > Setup > Foreign trade > Foreign trade parameters.

On the EU sales list tab, set the Report cash discount option to Yes if a cash discount should be included in the value when a transaction is included on the EU sales list.

On the Electronic reporting FastTab, in the File format mapping field, select EU Sales list (AT).

In the Report format mapping field, select EU Sales list by rows report or EU Sales list by columns report.

On the Country/region properties tab, select New, and set the following fields:

- In the Country/region field, select AUT.

- In the Country/region type field, select Domestic.

List all the countries or regions that your company does business with. For each country/region that is part of the EU, in the Country/region type field, select EU to show trade with those countries/regions on the EU sales list page.

Set up a sales tax authority

- Go to Tax > Indirect taxes > Sales tax > Sales tax authorities.

- Create a sales tax authority.

- In the Authority identification field, enter a two-digit code in the range from 01 through 98.

Work with the EU sales list

For general information about which types of transactions are included on the EU sales list, how to generate the EU sales list report, and how to close the EU sales list reporting period, see EU Sales list reporting.

Generate the EU sales list report

Go to Tax > Declarations > Foreign trade > EU sales list.

Transfer transactions as required.

On the Action Pane, select Reporting.

In the EU sales list reporting dialog box, on the Parameters FastTab, set the following fields.

Field Description From date Select the start date for the report. To date Select the end date for the report. Generate file Set this option to Yes to generate an .xml file for your EU sales list report. File name Enter the name of the .xml file. Generate report Set this option to Yes to generate an .xlsx file for your EU sales list report. Report file name Enter the name of the .xlsx file. Customer information Enter any required information about the customer. Authority Select the sales tax authority. Select OK, and review the generated reports.

Example

For information about how to create a general setup, create postings, and transfer transactions by using the DEMF legal entity for Austria, see Example for generic EU Sales list.

[IMPORTANT] Contrary to what the following example shows, use ATU700600500 as the company's VAT ID.

Set up a sales tax authority

- Go to Tax > Indirect taxes > Sales tax > Sales tax authorities.

- In the Sales tax authority field, select AT.

- In the Authority identification field, enter 55.

Create an EU sales list report

Go to Tax > Declarations > Foreign trade > EU sales list.

On the Action Pane, select Reporting.

In the EU sales list reporting dialog box, on the Parameters FastTab, set the following fields:

- In the From date field, select 8/1/2021 (August 1, 2021).

- In the To date field, select 8/31/2021 (August 31, 2021).

- Set the Generate file option to Yes.

- In the File name field, enter AT-001F.

- Set the Generate report option to Yes.

- In the Report file name field, enter AT-001R.

- In the Customer information field, enter KUNDENINFO.

- In the Authority field, select TA.

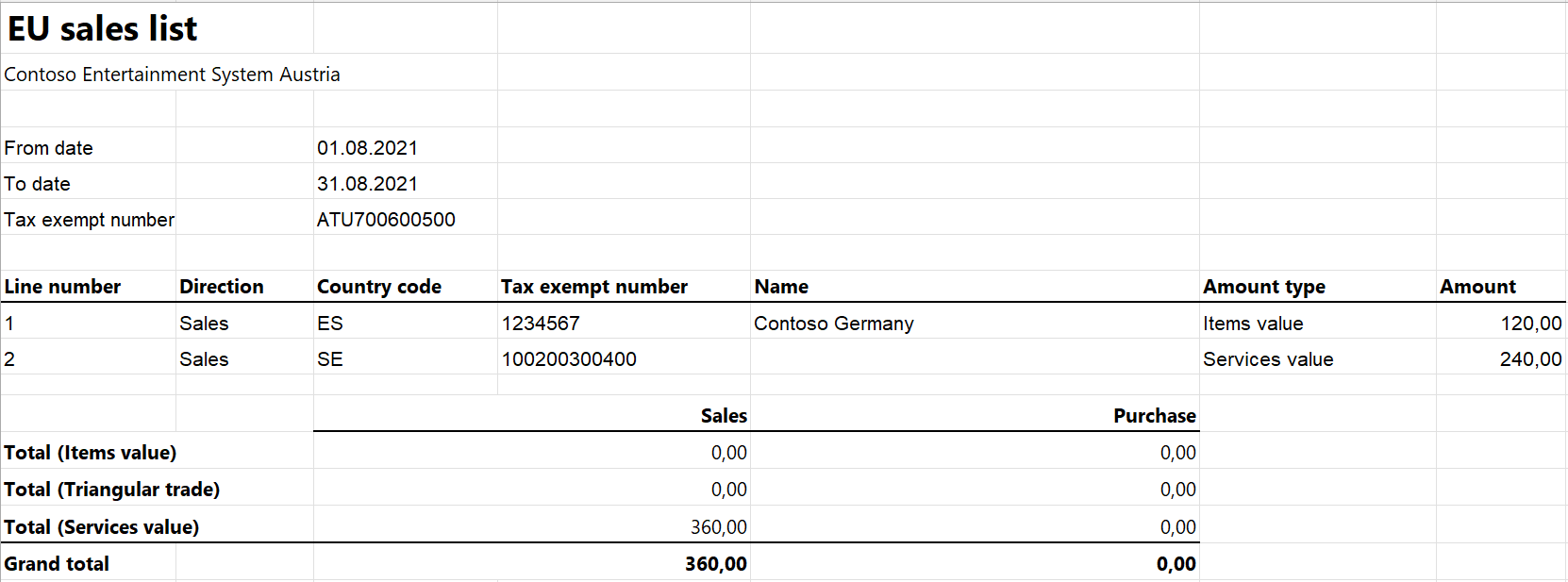

Select OK, and review the report in XML format that is generated. The following tables show the values in the example report.

EU sales list header

Field Value Comment IDENTIFIKATIONSBEGRIFF 55203/118/12345 The authority's ID and tax registration number. PAKET NR 000023 The smallest value from the Dispatch column on the EU sales list page. DATUM ERSTELLUNG 2021-11-25 The date when the report was created. UHRZEIT ERSTELLUNG 16:28:15 The time when the report was created. ERKLAERUNG U13 The report form. ZRVON 2021-08 The month and year from the From date field. ZRBIS 2021-08 The month and year from the To date field. FASTNR 55203/118/12345 The authority's ID and tax registration number. KUNDENINFO KUNDENINFO The text from the Customer information field. EU sales list lines

Field Line 1 value Line 2 value Comment UID MS ES1234567 SE100200300400 The customer's VAT ID. SUM BGL 120.00 240.00 The sum of all invoices by customer. SOLEI 1 The SOLEI field is available only for service transactions and has a value of 1. For triangular transactions, there is a DREIECK field that has a value of 1. Review the report in Microsoft Excel format that is generated.