Charges allocation on Bill of entry page for import orders

For transactions for the import of goods, duty and taxes are calculated based on a custom cost, insurance, and freight (CIF) value that is determined by adding freight and insurance charges to the value of the imported goods. The custom CIF value is also known as the assessable value. Customs authorities determine this value when a bill of entry (BOE) is submitted.

Generally, actual freight and insurance charges are added to the value of goods to determine the assessable value. Sometimes, the quantity of goods that are received against an import order or a purchase order differs from the actual quantity that was ordered. This difference affects the actual amount of charges that are incurred for freight and insurance, and the assessable value that is used to determine the customs duty and goods and services tax (GST). Therefore, this feature lets you edit the charge amount at the BOE stage and allocate charges to all BOE line items on a net amount or quantity basis. This capability will help you match the BOE assessable value with the value that customs authorities determine, for taxation purposes.

Currently, the system applies freight and insurance charges to the full value or quantity of all the line items on an import order or purchase order to determine the assessable value. However, importers often receive only a partial quantity of goods. In these cases, and the freight and insurance charges can't be edited on the Bill of entry page. Additionally, these partial receipts also cause the assessable value that is used to determine duties and taxes to be incorrect. Therefore, the new feature lets you edit charges on the Bill of entry page and allocate the edited charges to selected BOE lines. This capability will help you allocate actual charges to the line items and determine the correct assessable value as it's determined by customs authorities.

Note

The government determines the assessable value when a BOE is submitted. Therefore, we recommend that you to allocate charges on the Bill of entry page instead of the Import order or Purchase order page.

Key changes introduced

The new feature introduces the following key changes:

Charges that are defined on the import order header are automatically copied to the Bill of entry page.

Charges can be defined or edited on the Bill of entry page.

Allocation of charges must be done on the Bill of entry page instead of at the import order level.

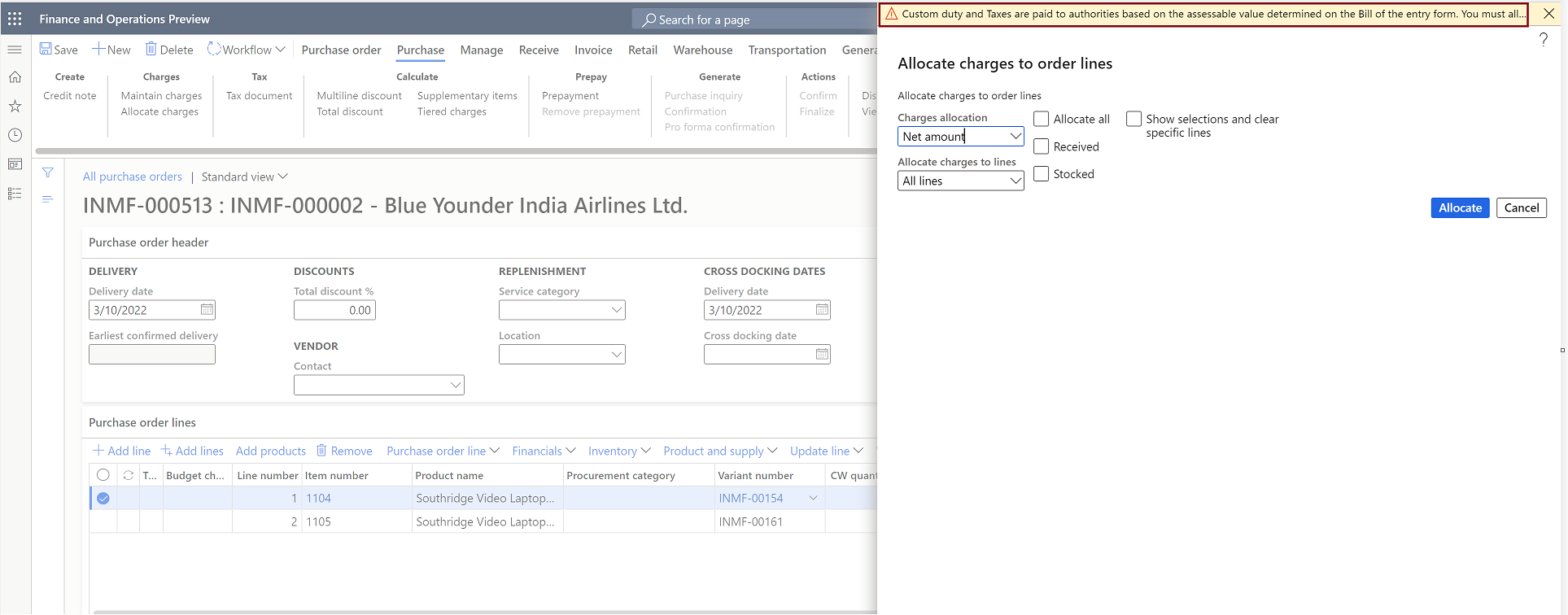

You receive a warning if you try to allocate header charges on import order lines.

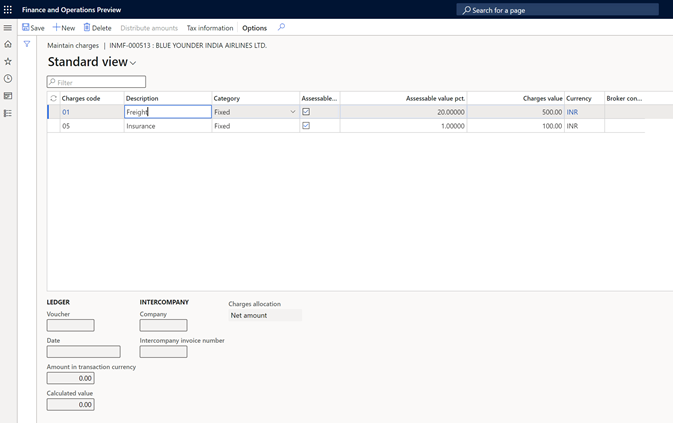

The charge allocation option on the Bill of entry page is available only for the Fixed charge calculation category, because customs authorities consider charges only on an actual or notional percentage basis.

Charges that are allocated on BOE lines can be edited.

The assessable value is automatically calculated for every BOE line after charges are added.

Either the actual charge amount or charge percentage of the assessable value, whichever is lower, is considered when the assessable value is determined.

Charges that are posted on the Bill of entry page will be copied to the Posting invoice page.

Although you can edit the charges on the Posting invoice page, your changes won't affect the assessable value of items on the import order.

You can post-import an invoice on the following bases:

- One BOE > One invoice

- One BOE > One product receipt > One invoice

- One BOE > Multiple receipts > One invoice

- One BOE > Multiple receipts > Multiple invoices

Charges can be applied to the BOE in the company currency and a foreign currency.

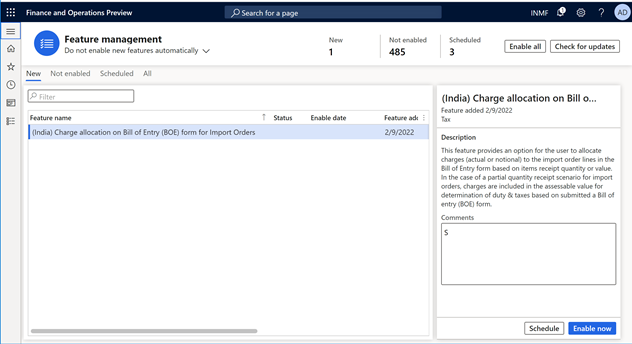

Enable the feature

Go to Workspaces > Feature management.

In the list, find and select the Charge allocation on Bill of entry (BOE) form for import orders feature.

Select Enable now.

Create a purchase (import) order

Go to Accounts payable > Purchase orders > All purchase orders.

Create a purchase order that has a foreign vendor account and a port ID.

Add multiple line items.

On the purchase order header, enter the charges for freight and insurance.

Note

If you allocate charges on the purchase order lines, you will receive a warning when you select Allocation.

Save the record.

Select Tax information.

Select the Harmonized System of Nomenclature (HSN) code and the customs tariff code, and then select OK.

Validate the tax details

- On the Purchase order page, on the Action Pane, on the Purchase tab, in the Tax group, select Tax document.

- On the Tax details FastTab, review the tax calculation.

- Select Close.

- Select Confirm.

Update the invoice registration

- On the Import order page, on the Action Pane, on the Customs tab, in the Maintain group, select Invoice registration.

- Select Import invoice number.

- Edit the quantity that was received, and then select Update.

Post the BOE

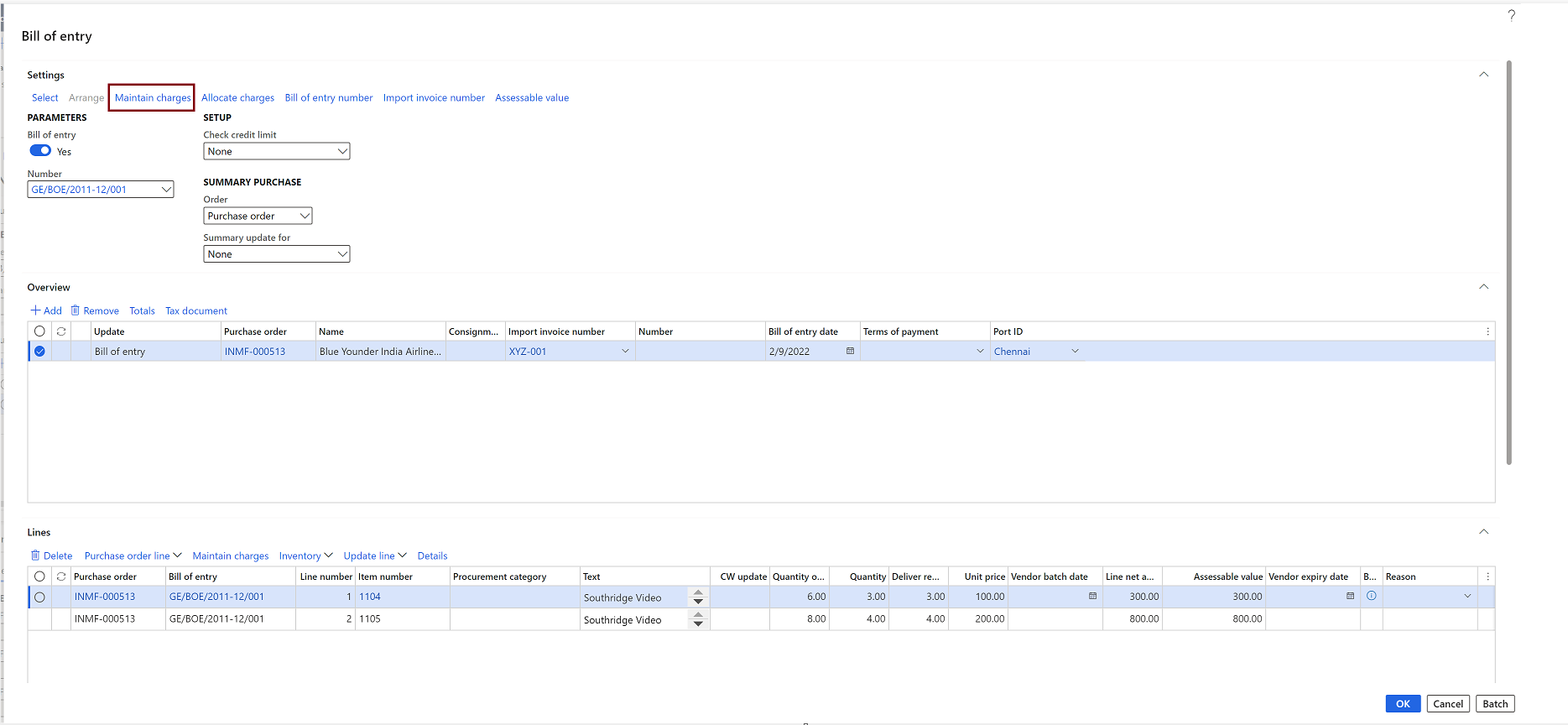

On the Import order page, on the Action Pane, on the Customs tab, in the Generate group, select Bill of entry.

Select Import invoice number.

Select Bill of entry number.

In the Settings group, select Maintain charges.

Charges that are defined on the purchase order header are entered by default under Maintain charges on the Bill of entry page.

Edit the charges as required.

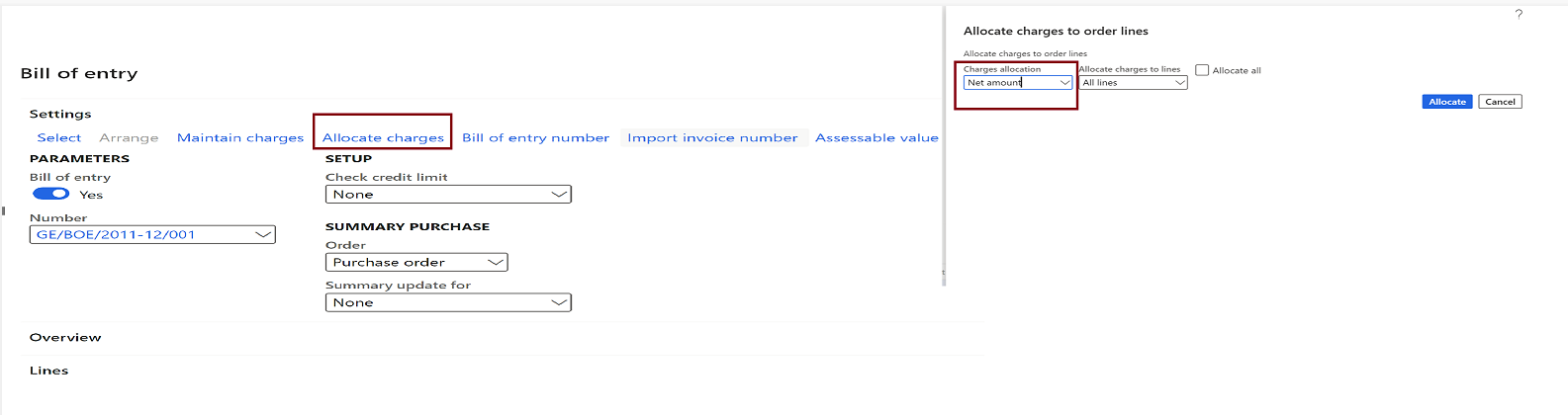

On the Bill of entry page, on the Action Pane, select Allocate charges.

Charges are allocated to BOE lines. Charge allocation can be done on the following bases:

- Net amount

- Quantity

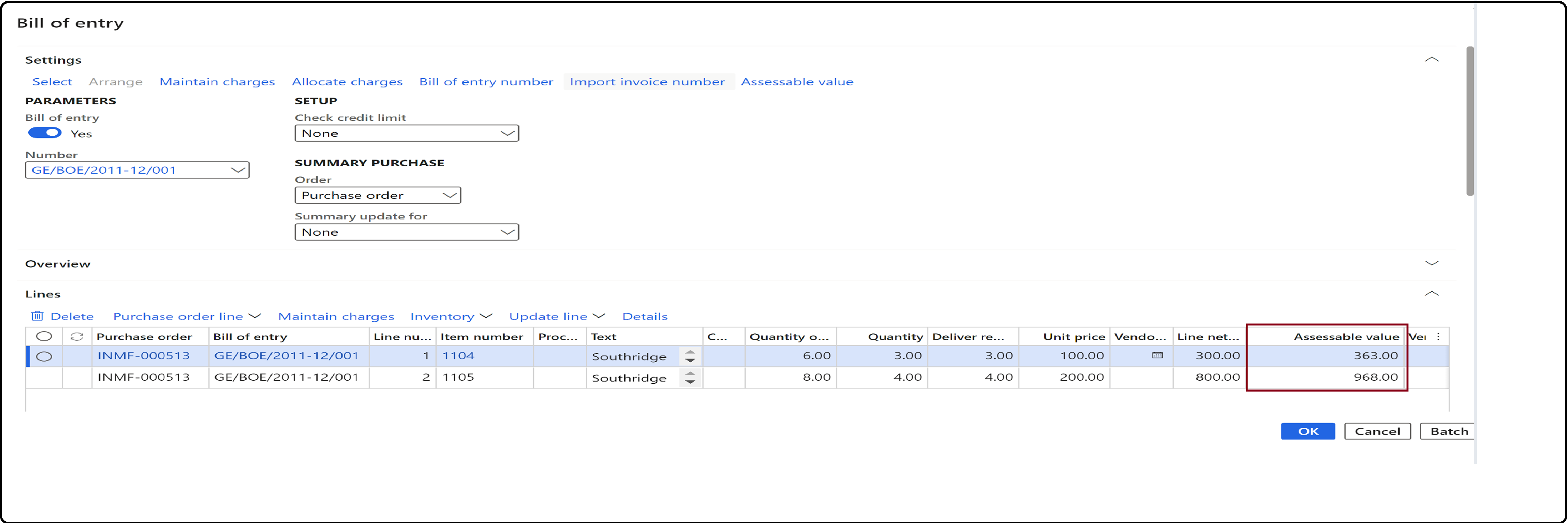

Review the assessable value for each BOE line.

[NOTE] You can still edit charges on the BOE lines.

Save your changes, and then post the BOE.

Post the purchase invoice

- On the Bill of entry page, on the Action Pane, on the Invoice tab, in the Generate group, select Invoice. By default, the value of the Quantity for lines field will equal the value of the Bill of entry quantity field. You can select the product receipt quantity as required. You can continue to edit charges on lines on the Posting invoice page without affected the posted assessable value.

- Enter the invoice number.

- On the Action Pane, on the Vendor invoice tab, in the Actions group, select Post > Post.

- On the Action Pane, on the Invoice tab, in the Journals group, select Invoice > Overview > Voucher.