Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Set up GST requirements

- Go to Tax > Indirect Tax > Withholding tax > Withholding tax groups.

- Select a withholding tax group.

- On the General FastTab, in the Include GST tax components for TDS or TCS calculation field, select the required Goods and Services Tax (GST) components.

- Select Close.

Create a purchase order

- Go to Accounts payable > Purchase orders > All purchase orders.

- Create a purchase order.

- Select OK.

Validate the tax details

On the Action Pane, on the Purchase tab, in the Tax group, select Tax document to review the calculated taxes.

Here is an example of what you should see:

- Taxable value: 10,000.00

- IGST: 20 percent

Select Close.

Select Withholding tax.

Select Close.

Select Confirm.

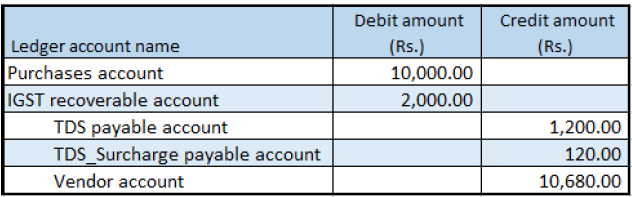

Post the purchase invoice

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- In the Default quantity for lines field, select Ordered quantity.

- Enter the invoice number.

- On the Action Pane, on the Vendor invoice tab, in the Actions group, select Post > Post.

- On the Action Pane, on the Invoice tab, in the Journals group, select Invoice.

- On the Overview tab, select Voucher.