Quality orders that involve destruction of the sampling item

Purchase order page

- Go to Accounts payable > Purchase orders > All purchase orders.

- Create a purchase order.

Validate the tax details

On the Action Pane, on the Purchase tab, in the Tax group, select Tax document.

What you see should resemble the following example:

- Taxable value: 10,000.00

- CGST: 10 percent

- SGST: 10 percent

Select Close.

Select Confirm.

Post the packing slip

- On the Action Pane, on the Receive tab, in the Generate group, select Product receipt.

- In the Quantity field, select Ordered quantity.

- In the Product receipt field, enter a value.

- Select OK, and then select Show.

Quality order form

Select Results.

Update the Result quantity field.

Select Validate, and then select Close.

Select Tax document.

Note

Tax is calculated for the quantity that was used for the quality check and destroyed.

Select Close, and then select Validate.

In the Validate by field, select a value.

Select OK, and close the Quality orders page.

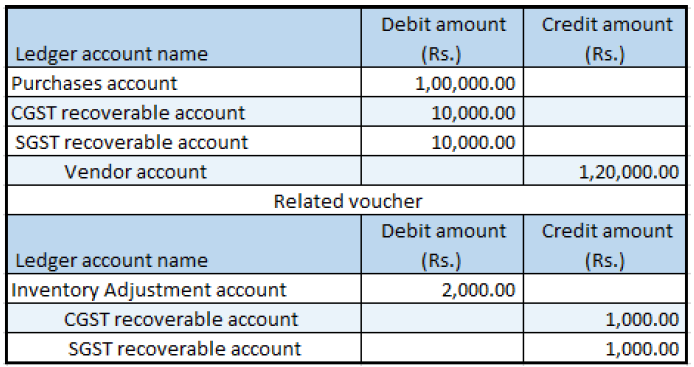

Post the purchase invoice

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- Enter the invoice number.

- On the Action Pane, on the Vendor invoice tab, in the Actions group, select Post > Post.

- On the Action Pane, on the Invoice tab, in the Journals group, select Invoice.

- On the Overview tab, select Voucher.

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for