Sales of taxable goods that have a discount and a provisional assessment

Create a sales order

- Go to Accounts receivable > Sales orders > All sales orders.

- Create a sales order for a taxable item.

- Select Header view.

- On the Price and discount FastTab, in the Total discount % field, enter 10.00.

- Select Line view.

- On the Lines details FastTab, on the Address tab, in the Delivery address field, select a value.

- Save the record.

- Select Tax information.

- Select the GST FastTab.

- Select the Customer tax information FastTab.

- Select OK.

- On the Action Pane, on the Sell tab, in the Tax group, select Tax document.

- Verify that the tax that is calculated considers the discount, and then select Close.

Post the invoice

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- In the Quantity field, select All.

- Select the Print invoice check box.

- Select the Provisional assessment check box.

- Select OK, and then select Yes to acknowledge the warning message that you receive.

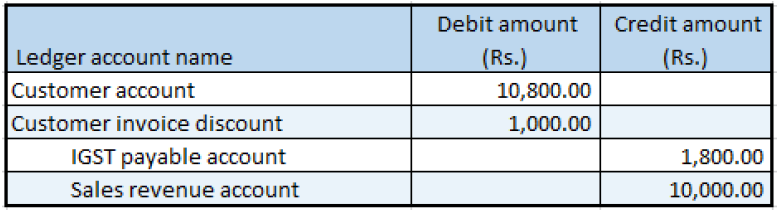

Validate the voucher

- On the Action Pane, on the Invoice tab, in the Journals group, select Invoice.

- Select Voucher.

Feedback

Coming soon: Throughout 2024 we will be phasing out GitHub Issues as the feedback mechanism for content and replacing it with a new feedback system. For more information see: https://aka.ms/ContentUserFeedback.

Submit and view feedback for