Import services that have GST

Complete the procedures in this article to import services that have Goods and Services Tax (GST).

- Go to Accounts payable > Invoices > Invoice journal.

- Create a journal.

- Select Lines.

- Create a purchase of services for a foreign vendor, and save the record.

- Select Tax information.

- On the GST FastTab, in the SAC field, select a value.

- Select the Vendor tax information FastTab.

- Select OK.

Validate the tax details

Select Tax document.

Example

- Taxable value: 20,000.00

- IGST: 20 percent

- Normal exchange rate: 1 USD = 60 INR

Select Close.

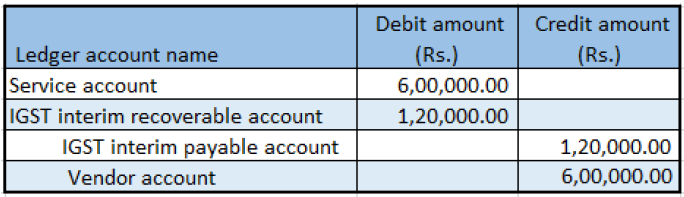

Select Post > Post.

Close the message that you receive.

Select Inquiries > Voucher.