Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

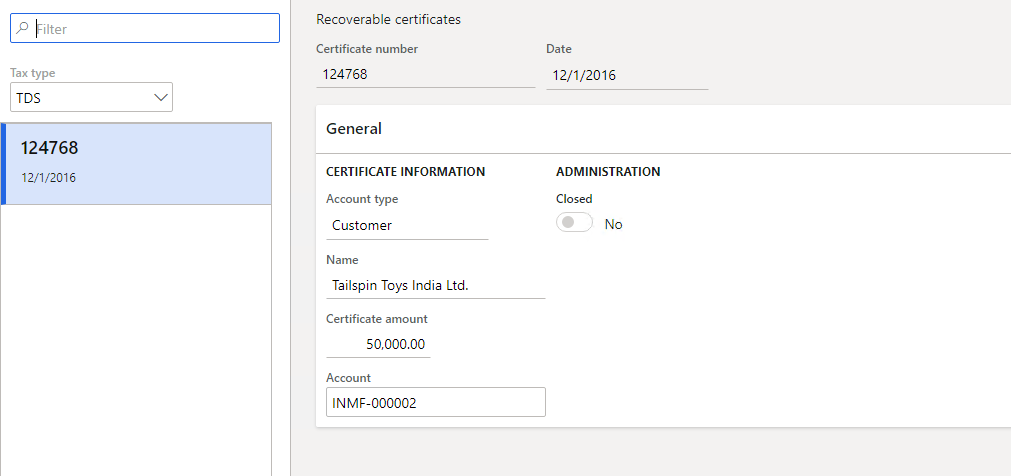

This article explains how to use the Recoverable certificates page to record the certificate numbers and dates for Tax Deducted at Source (TDS) certificates that are received for a specific vendor, customer, or ledger. To update the TDS certificate numbers and dates that are recorded for TDS transactions on this page, use the Update certificate page (General ledger > Periodic > Withholding tax > Update certificate). After you've finished updating TDS certificate numbers, close them.

Follow these steps to record the TDS certificate numbers and dates.

Go to Tax > Indirect tax > Withholding tax > Recoverable certificates.

[

]

]On the Recoverable certificates page, in the Tax type field, select TDS.

Select New to create a record.

In the Certificate number field, enter the TDS certificate number.

In the Account type field, select the type of account that the TDS certificate is received for: Vendor, Customer, or Ledger.

In the Account field, select the vendor, customer, or ledger account number, depending on the account type that you selected. The Name field shows the name of the vendor, customer, or ledger account.

In the Certificate amount field, enter the amount of the TDS certificate.

In the Date field, enter the certificate date for the certificate number.

Select Inquiries to open the Certificate transactions page, where you can view the TDS transactions that the TDS certificate number and date are updated for. This information can be updated on the Update certificate page (Tax > Declarations > Withholding tax > Update certificate).

The Update certificate page shows the following information for each TDS transaction:

- Date – The posting date of the TDS transaction.

- Voucher – The voucher number of the TDS transaction.

- Source – The module that the TDS transaction was created in.

- Account – The vendor, customer, or ledger account number that the TDS transaction was created for.

- Name – The name of the vendor, customer, or ledger account that the TDS transaction was created for.

- Amount – The invoice amount that the TDS was calculated on.

- Tax amount – The TDS tax amount that was calculated for the transaction.

- Certificate date – The TDS certificate date that was updated for the TDS transaction.

- Certificate number – TDS certificate number that was updated for the TDS transaction.

On the Recoverable certificates page, select the Closed check box to close the TDS certificate number after you've finished updating it for TDS transactions on the Update certificate page.

To select the Closed check box for all records on the page, select Mark all.

Note

TDS certificate numbers that the Closed check box is selected for aren't available on the Update certificate page.