Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

This article explains how to configure and generate the VAT return form for legal entities in Bahrain with Microsoft Dynamics 365 Finance.

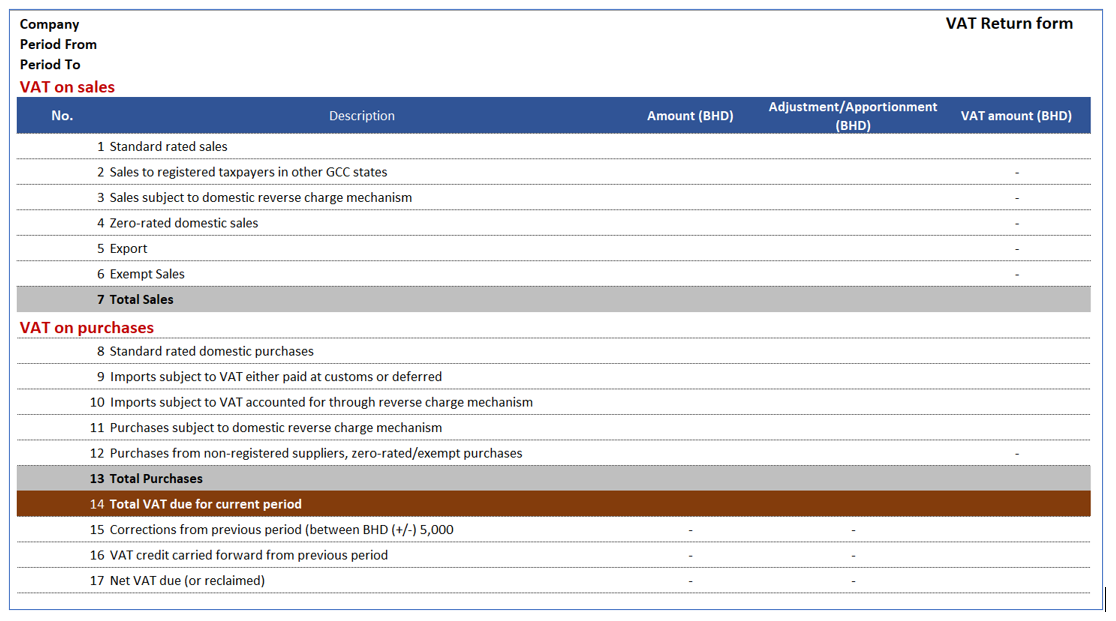

The VAT return form for Bahrain is the official document that summarizes the total output VAT tax amount due, the total input VAT tax amount recoverable, and the related VAT tax amount liability. The form is used for all types of taxpayers and should be completed manually through the tax authority portal. The VAT return form is commonly referred to as VAT return filing.

The VAT return form in Dynamics 365 Finance includes the following reports:

- VAT return form, which provides a breakdown of amounts, adjustments, and VAT amount per line item in the VAT return form as is described in the legislation.

- Sales transactions details grouped by box classification from Box1 to Box6.

- Purchase transaction details grouped by box classification from Box8 to Box12.

Prerequisites

- The primary address of the legal entity must be in Bahrain.

In the Feature management workspace, enable the following features:

- (Bahrain) Category hierarchy for Sales and purchase tax report.

For more information about how to enable features, see Feature management overview.

In the Electronic reporting workspace, import the following Electronic Reporting formats from the repository:

- VAT declaration Excel (BH)

Note

The formats above are based on Tax declaration model and use Tax declaration model mapping. These additional configurations will be automatically imported.

For more information about how to import Electronic Reporting configurations, see Download Electronic reporting configurations from Lifecycle Services.

Download Electronic reporting configurations

The implementation of the VAT return form for Bahrain is based on Electronic reporting (ER) configurations. For more information about the capabilities and concepts of configurable reporting, see Electronic reporting.

For production and user acceptance testing (UAT) environments, follow the instructions Download Electronic reporting configurations from Lifecycle Services.

To generate the VAT return form and related reports in a Bahrain legal entity, you need to upload the following configurations:

- Tax declaration model.version.64.xml

- Tax declaration model mapping.version.64.90.xml

- VAT Declaration Excel (BH).version.64.6 or a later version

After you've finished downloading the ER configurations from Lifecycle Services (LCS) or the global repository, follow these steps.

- In Dynamics 365 Finance, go to the Electronic reporting workspace.

- Select the Reporting configurations tile.

- On the Configurations page, on the Action Pane, select Exchange > Load from XML file.

- Upload all the files in the order in which they are listed in the previous bullets. After all the configurations are uploaded, the configuration tree should be present in Finance.

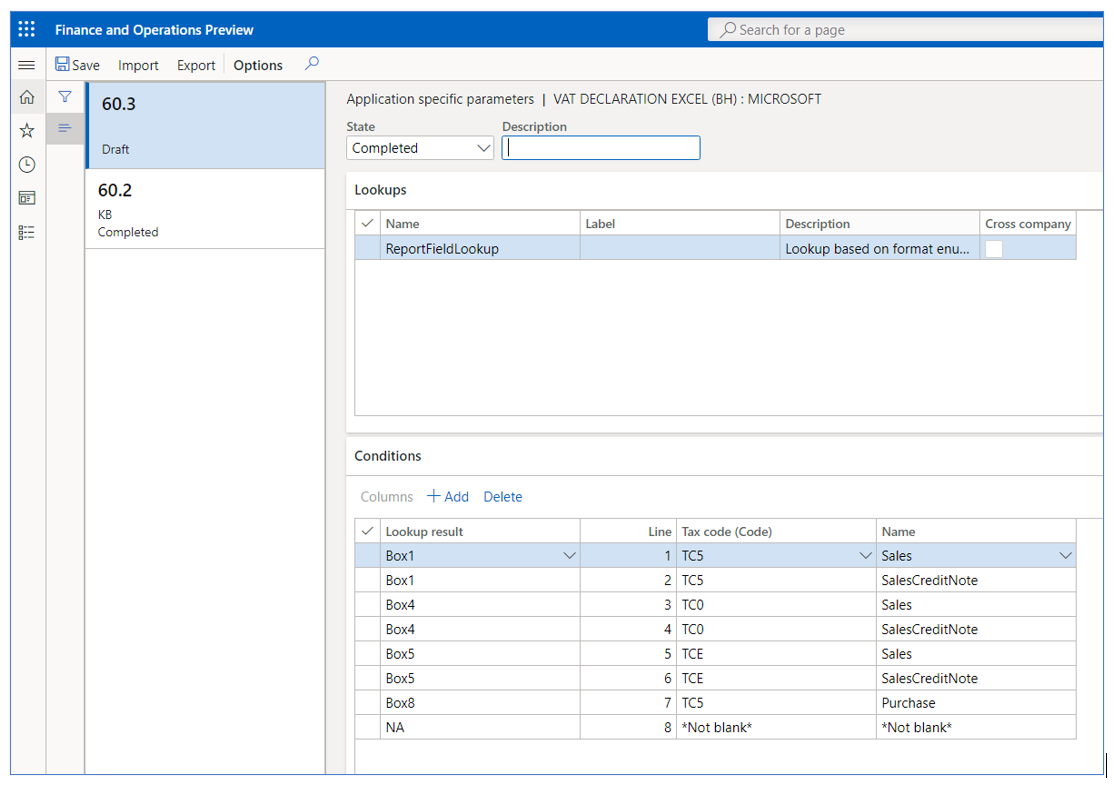

Set up application-specific parameters

The VAT declaration form includes a set of boxes (lines) that correspond to specific parts of the VAT return process. Each box should include information about the base, adjustment, and VAT amounts. To include the requirements established by the form, you must configure each box with the information that is automatically provided from the sales tax transactions generated from sales, purchases, or other operations where VAT tax is posted through the sales tax code configuration.

Example

Line/Box1 - Standard rated sales: Per legal definition, this box includes the total amount of standard rated goods and services (excluding collected VAT) sold during the current period in The Kingdom of Bahrain, and the VAT that was collected on the sale or adjustments to similar sales made in the previous reporting periods. Examples of adjustments include:

- The return of goods and services by customers on which you have declared/paid VAT to NBR (National Bureau for Revenue).

- Sales made to tourists under a VAT refunds for tourist scheme and refunded to the refund operator.

- Bad debt write-off on standard-rated receivables.

In Finance, you can have a specific sales tax code implemented that represents and calculates the operations at a standard sales rate. In this example, it is necessary to configure Box1 as follows.

The Application-specific parameters option let the users to establish the criteria of how the tax transactions will be collected and calculated in each box (line) of the declaration form when the report is generated depending on the configuration of sales tax code.

To set up application-specific parameters, follow these steps.

- In Dynamics 365 Finance, go to the Electronic reporting workspace.

- Select Configurations > Setup to set up the rules to identify the tax transaction into the related box of the VAT return form.

- Select the current version. On the Lookups FastTab, select the lookup name ReportFieldLookup. This lookup identifies the list of boxes (lines) in the VAT form required by tax authority.

- On the Conditions FastTab, select Add, and in the new line in the Lookup result column, select the related line of VAT return form.

- In the Tax code (Code) column, select the sales tax code that is used to calculate the related line of VAT return form.

- In the Name column, select the tax transaction classification where the sales tax code is used.

- Repeat steps 3-5 for all VAT return form boxes (lines) and the combination of sales tax code and tax transaction types configured in your legal entity.

- Select Add again, and then follow these steps to include the final record line:

- In the Lookup result column, select NA.

- In the Tax code (Code) column, select Not blank.

- In the Name column, select Not blank.

By adding this last record (NA), you define the following rule: When the tax code and name that is passed as an argument doesn't satisfy any of the previous rules, the transactions will not be included in the VAT return form. Although this rule is not used when generating the report, the rule does help to avoid errors in report generation when there is a missing rule configuration.

- In the State field, select Completed, and then select Save.

- Close the Application specific parameters page.

The following table represent an example of how the user needs to configure these parameters to establish the configuration between the different boxes in the declaration form and sales tax code configuration implemented in Finance.

| Lookup result | Label | Tax code (Code) | Name |

|---|---|---|---|

| Box1 | Standard rated sales | VAT_ST | Sales |

| Box1Adj | Standard rated sales adjustment | VAT_STA | Sales |

| Box1 | Standard rated sales | VAT_ST | SalesCreditNote |

| Box1Adj | Standard rated sales adjustment | VAT_STA | SalesCreditNote |

| Box3 | Sales subject to domestic reverse charge mechanism | VAT_RV | SalesReverseCharge |

| Box3Adj | Sales subject to domestic reverse charge mechanism adjustment | VAT_RVA | SalesReverseCharge |

| Box3 | Sales subject to domestic reverse charge mechanism | VAT_RV | SalesReverseChargeCreditNote |

| Box3Adj | Sales subject to domestic reverse charge mechanism adjustment | VAT_RVA | SalesReverseChargeCreditNote |

| Box4 | Zero-rated domestic sales | VAT_0% | Sales |

| Box4Adj | Zero-rated domestic sales adjustment | VAT_0%A | Sales |

| Box4 | Zero-rated domestic sales | VAT_0% | SalesCreditNote |

| Box4Adj | Zero-rated domestic sales adjustment | VAT_0%A | SalesCreditNote |

| Box5 | Export | VAT_EXP | Sales |

| Box5Adj | Export adjustment | VAT_EXPA | Sales |

| Box5 | Export | VAT_EXP | SalesCreditNote |

| Box5Adj | Export adjustment | VAT_EXPA | SalesCreditNote |

| Box6 | Exempt Sales | VAT_EXE | SaleExempt |

| Box6Adj | Exempt Sales Adjustment | VAT_EXE | SaleExempt |

| Box6 | Exempt Sales | VAT_EXE | SaleExemptCreditNote |

| Box6Adj | Exempt Sales Adjustment | VAT_EXE | SalesExemptCreditNote |

| Box8 | Standard rated domestic purchases | VAT_ST | Purchase |

| Box8adj | Standard rated domestic purchases adjustment | VAT_ST | Purchase |

| Box8 | Standard rated domestic purchases | VAT_ST | PurchaseCreditNote |

| Box8adj | Standard rated domestic purchases adjustment | VAT_ST | PurchaseCreditNote |

| Box9 | Imports subject to VAT either paid at customs or deferred | VAT_IMP | Purchase |

| Box9Adj | Imports subject to VAT either paid at customs or deferred adjustment | VAT_IMPA | Purchase |

| Box9 | Imports subject to VAT either paid at customs or deferred | VAT_IMP | PurchaseCreditNote |

| Box9Adj | Imports subject to VAT either paid at customs or deferred adjustment | VAT_IMPA | PurchaseCreditNote |

| Box10 | Imports subject to VAT accounted for through reverse charge mechanism | VAT_IRV | PurchaseReverseCharge |

| Box10Adj | Imports subject to VAT accounted for through reverse charge mechanism adjustment | VAT_IRVA | PurchaseReverseCharge |

| Box10 | Imports subject to VAT accounted for through reverse charge mechanism | VAT_IRV | PurchaseReverseChargeCreditNote |

| Box10Adj | Imports subject to VAT accounted for through reverse charge mechanism adjustment | VAT_IRVA | PurchaseReverseChargeCreditNote |

| Box11 | Purchases subject to domestic reverse charge mechanism | VAT_PRV | PurchaseReverseCharge |

| Box11Adj | Purchases subject to domestic reverse charge mechanism adjustment | VAT_PRVA | PurchaseReverseCharge |

| Box11 | Purchases subject to domestic reverse charge mechanism | VAT_PRV | PurchaseReverseChargeCreditNote |

| Box11Adj | Purchases subject to domestic reverse charge mechanism adjustment | VAT_PRVA | PurchaseReverseChargeCreditNote |

| Box12 | Purchases from non-registered suppliers, zero-rated/exempt purchases | VAT_0% | Purchase |

| Box12Adj | Purchases from non-registered suppliers, zero-rated/exempt purchases adjustment | VAT_0%A | Purchase |

| Box12 | Purchases from non-registered suppliers, zero-rated/exempt purchases | VAT_0% | PurchaseCreditNote |

| Box12Adj | Purchases from non-registered suppliers, zero-rated/exempt purchases adjustment | VAT_0%A | PurchaseCreditNote |

| Box12 | Purchases from non-registered suppliers, zero-rated/exempt purchases | VAT_EXE | PurchaseExempt |

| Box12Adj | Purchases from non-registered suppliers, zero-rated/exempt purchases adjustment | VAT_EXEA | PurchaseExempt |

| Box12 | Purchases from non-registered suppliers, zero-rated/exempt purchases | VAT_EXE | PurchaseExemptCreditNote |

| Box12Adj | Purchases from non-registered suppliers, zero-rated/exempt purchases adjustment | VAT_EXEA | PurchaseExemptCreditNote |

| Box15 | Corrections from previous period (between BHD (+/-) 5,000 | VAT_COR | Sales |

| Box15 | Corrections from previous period (between BHD (+/-) 5,000 | VAT_COR | SalesCreditNote |

| Box15 | Corrections from previous period (between BHD (+/-) 5,000 | VAT_COR | Purchase |

| Box15 | Corrections from previous period (between BHD (+/-) 5,000 | VAT_COR | PurchaseCreditNote |

| NA | Not applicable | Not blank | Not blank |

Box2 and Box2Ajd represent the total amount of sales to GCC states and all adjustments to sales to registered customers in GCC states will be treated as exports (Box5 and Box5Adj) until integrated GCC customs system goes live. After the tax authority enables this option, then the configuration should be changed to achieve the original requirement.

To avoid issues when the report is generated, create all mappings where the sales tax codes are posted. For example, if the line has SalesCreditNote as the name of the operation is omitted in this configuration, and tax transactions are posted by using sales tax code VAT_ST, you will encounter issues when the report is generated. We recommend that you use the Tax > Inquire > Posted sales tax menu to review all posted sales tax codes and those that are not included in this mapping of the configuration.

The following table provides the available values in the Name column. This information will help you understand how the tax transactions are classified and assigned to the related sales tax code.

| Classifier value | Condition |

|---|---|

| PurchaseCreditNote |

|

| Purchase |

|

| SalesCreditNote |

|

| Sales |

|

| PurchaseExemptCreditNote |

|

| PurchaseExempt |

|

| SalesExemptCreditNote |

|

| SaleExempt |

|

| UseTaxCreditNote |

|

| UseTax |

|

| PurchaseReverseChargeCreditNote |

|

| PurchaseReverseCharge |

|

| SalesReverseChargeCreditNote |

|

| SalesReverseCharge |

|

Set up general ledger parameters

To generate the VAT return form report in Microsoft Excel format, you must define an ER format on the General ledger parameters page.

To set up general ledger parameters, follow these steps.

- In Dynamics 365 Finance, go to Tax > Setup > General ledger parameters.

- On the Sales tax tab, in the Tax options section, in the VAT statement format mapping field, select VAT Declaration Excel (BH). If you leave the field blank, the standard sales tax report will be generated in SSRS format.

- Select the Category hierarchy. This category enables the C\commodity code in Foreign trade tab transactions to allow users to select and classify goods and services. The description of this classification is detailed in sales and purchase transaction reports.

Generate a VAT return report

The process of preparing and submitting a VAT return report for a period is based on sales tax payment transactions that were posted during the Settle and post sales tax job. For more information about sales tax settlement and reporting, see Sales tax overview.

To generate a VAT return report, follow these steps.

- In Dynamics 365 Finance, go to Tax > Declarations > Sales tax > Report sales tax for settlement period or Settle and post sales tax.

- Select the Settlement period.

- Select the from date.

- Select the sales tax payment version.

- Select OK to confirm the above steps.

- Enter the amount of credit from the previous period, if applicable, or leave the amount as zero.

- In the Generate details field, select one of the following available options. The VAT return form is always generated in this process.

- All - Generate sales and purchase tax transactions details reports.

- None - Generate only the VAT declaration return form.

- Purchase transactions

- Sales transactions