Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

This article explains how to enable and use the intracommunity value-added tax (VAT) functionality in Microsoft Dynamics 365 Finance, including how to turn on the functionality, calculate and print intracommunity VAT amounts, and review posted intracommunity VAT amounts.

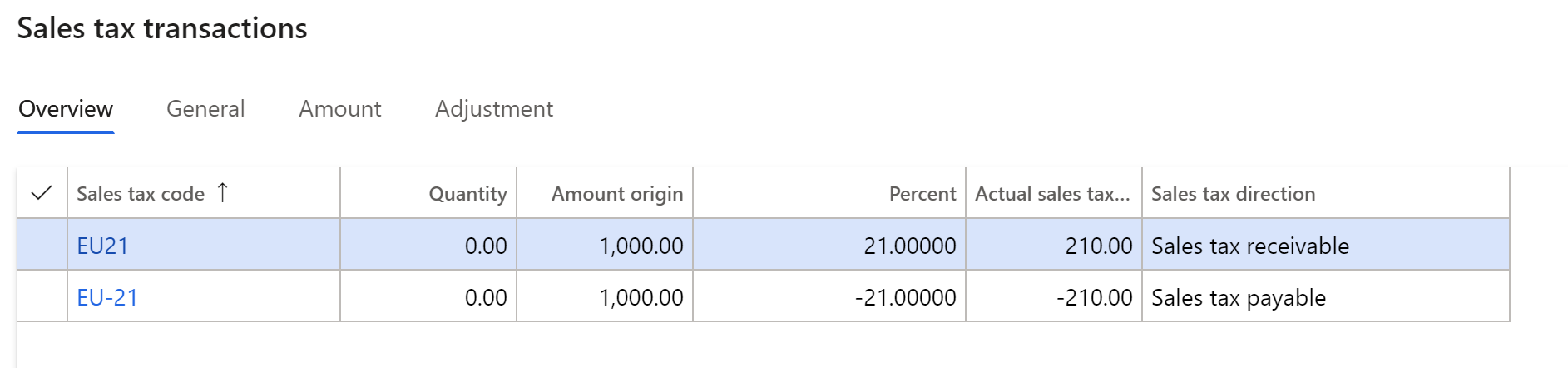

Information about the intracommunity value-added tax (VAT) can be calculated and posted automatically. When you post a European Union (EU) vendor invoice, two VAT transactions are created. One VAT transaction is created for payable sales tax, and the other VAT transaction is created for receivable sales tax.

Before you can use the intracommunity VAT functionality, you must enable it.

To enable the intracommunity VAT functionality, follow these steps.

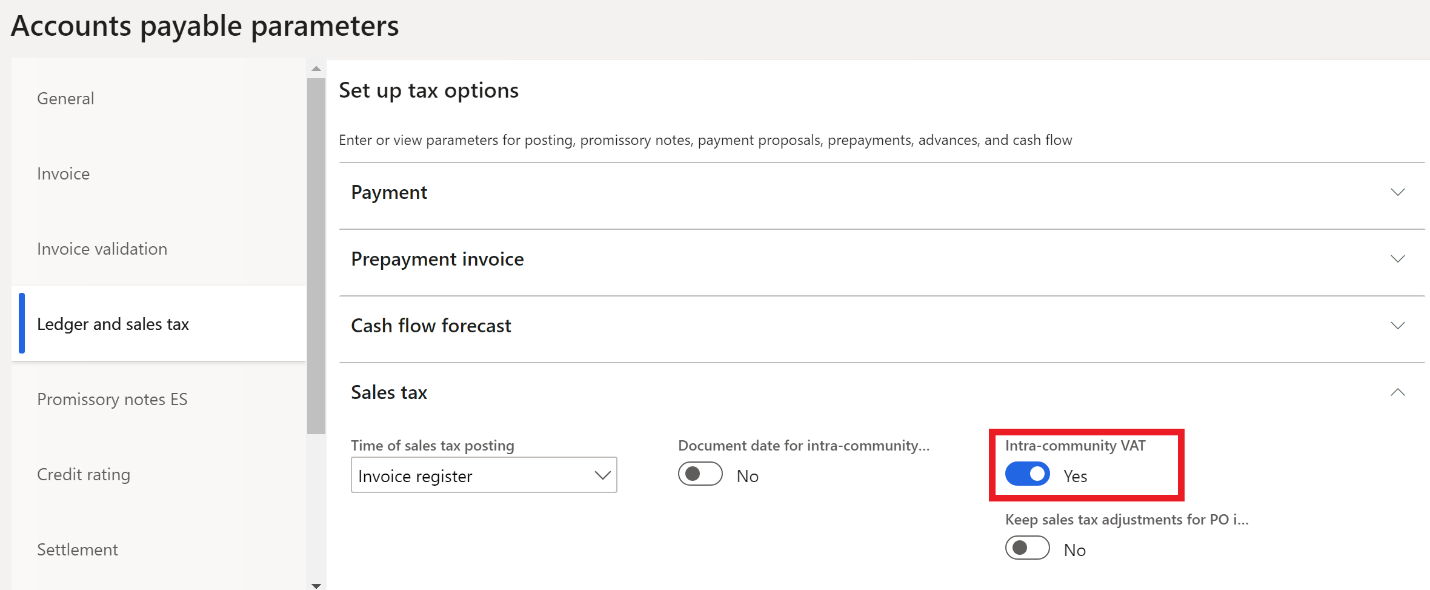

- In Dynamics 365 Finance, go to the Accounts payable parameters page (Accounts payable > Setup > Accounts payable parameters).

- Select the Ledger and sales tax tab.

- On the Sales tax FastTab, enable the the Intra-community VAT option.

Calculate intracommunity VAT for purchase transactions

To calculate intracommunity VAT for purchase transactions, you must have two sales tax codes that have the same tax percentage. However, one code must have a positive tax percentage, and the other code must have a negative tax percentage. You must also have a sales tax group that contains both a positive sales tax code and a negative sales tax code.

To calculate intracommunity VAT for purchase transactions, select the Intra-community VAT checkbox for the line that has a negative sales tax code.

Print intracommunity VAT on a purchase invoice

To print the intracommunity VAT on a purchase invoice, follow these steps.

- In Dynamics 365 Finance, go to the Form setup page (Accounts payable > Setup > Forms > Form setup).

- On the Invoice tab, enable the Print EU sales tax on Spanish invoices option.

Print invoices that have intracommunity VAT amounts

To print purchase invoices and intracommunity invoices that have intracommunity VAT amounts, follow these steps.

- In Dynamics 365 Finance, go to the vendor invoice page.

- On the Process tab, select Print setup > Print options.

- In the Print options dialog, enable the Print invoice and Print intracommunity invoice options.

Note

You must set up a vendor's country/region as an EU member state on the Tax > Setup > Foreign trade > Foreign trade parameters Country/region properties tab.

Review posted intracommunity VAT amounts

To review posted intracommunity VAT amounts, follow these steps.

- In Dynamics 365 Finance, go to Tax > Inquiries and reports > Sales tax inquiries > Posted sales tax.

- Run the Posted sales tax query.

- On the General tab, if the Intra-community VAT checkbox is selected, the tax transaction is an intracommunity VAT transaction.

- You must set up Spanish VAT books so that posted payable and receivable VAT transactions are reflected in the appropriate sections. To set up Spanish VAT books, go to Tax > Setup > Sales tax > Spanish VAT books. Learn more at Report 340 for Spain.

Example

The following example procedure shows you how to set up sales tax codes and post and print transactions for Intra-community VAT.

In Dynamics 365 Finance, go to Accounts payable > Setup > Accounts payable parameters.

On the Ledger and sales tax tab, on the Sales tax FastTab, set the Intra-community VAT option to Yes.

Go to Tax > Indirect taxes > Sales tax > Sales tax codes and create a pair of sales tax codes with the same tax percentage for each tax rate. One code must have a positive tax percentage, and the other code must have a negative tax percentage. For codes with negative tax percentage, on the Calculation FastTab, set the Allow negative sales tax percentage option to Yes.

Sales tax code Percentage Description EU21 21 EU purchases at a rate of 21 percent. EU-21 -21 EU purchases at a rate of 21 percent. EU10 10 EU purchases at a rate of 10 percent. EU-10 -10 EU purchases at a rate of 10 percent. EU4 4 EU purchases at a rate of 4 percent. EU-4 -4 EU purchases at a rate of 4 percent. Go to Tax > Indirect taxes > Sales tax > Sales tax groups and create a new sales tax group called EU.

On the Setup FastTab, add the following codes.

Sales tax code Intra-community VAT EU21 No EU-21 Yes EU10 No EU-10 Yes EU4 No EU-4 Yes Go to Tax > Indirect taxes > Sales tax > Item sales tax groups and create the following item sales tax groups.

Item sales tax group Sales tax codes 21 EU21, EU-21 10 EU10, EU-10 4 EU4, EU-4 Go to Accounts payable > Invoices > Invoice journal and create the following line.

Date Transaction type Amount net VAT amount Sales tax codes January 1, 2020 Customer invoice 1000 210 EU21 EU-21 Verify that there are two lines in the Sales tax transactions list.

Select Post to post the transaction, and then select OK.