Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Important

As of February 3, 2025, Dynamics 365 Fraud Protection is no longer available for purchase. Support for Fraud Protection will end on February 3, 2026. For more information, refer to the End of support for Dynamics 365 Fraud Protection article.

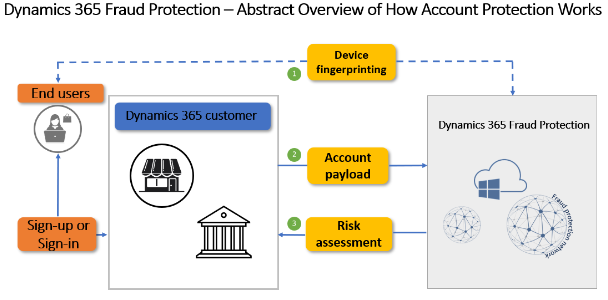

This article describes how Microsoft Dynamics 365 Fraud Protection account protection works.

Dynamics 365 Fraud Protection helps clients assess whether attempts to create new accounts and attempts to sign in to a client's ecosystem are fraudulent. Clients can use Fraud Protection risk assessment to block or challenge suspicious attempts to create new fake accounts or compromise existing accounts.

The following illustration highlights some of Fraud Protection's capabilities and application programming interfaces (APIs), to help you better understand risk assessment interactions.

Here is an explanation of the numbered elements in the illustration:

- Device fingerprinting (1) – Device fingerprinting lets you collect crucial device telemetry during online actions. The data includes hardware information, browser information, geographic information, and the Internet Protocol (IP) address that is used. This feature is based on artificial intelligence (AI) and can be used as input to the fraud assessments process. A Java-based web software development kit (SDK) is available, as are iOS, Android, and React Native SDKs for mobile applications.

- Account payload (2) – Clients pass information that is related to account creation or account sign-in to Fraud Protection. This data is compared to data that is already in the Fraud Protection network, and the machine learning model analyzes the data for linkages.

- Risk assessment (3) – The machine learning model can return a score to you for bot and risk scores. The scoring advises you about the probability of fraud risk, or the likelihood of possible fraud that you might want to review or reject.

Required APIs and components

The following APIs and components are required to take advantage of Fraud Protection account protection's features:

- Device fingerprinting – Device fingerprinting lets you collect crucial device telemetry during online actions. The data includes hardware information, browser information, geographic information, and the IP address. This feature is based on AI and can be used as input to the fraud assessments process. A Java-based web SDK is available, as are iOS, Android, and React Native SDKs for mobile applications.

- Account creation and/or account sign-in API – This API passes data attributes that are related to the account creation or account sign-in from clients to Fraud Protection. This data is compared to data that is already in the fraud protection network, and machine learning searches for linkages.

- Rules or policies – You can use the predefined rules in the account protection solution, or you can set up custom rules that are based on your policies. Rule scoring can tell you the probability of fraud risk, or the likelihood of fraud that you might want to review or reject.

- Account status API – This API is used to inform Fraud Protection of a client's final decision about a transaction. For example, did a sign-in transaction actually occur, or was it rejected (and if so, for what reason)? Fraud Protection adapts and learns from client fraud patterns.

- Account label API – This API lets you send information for model training to Fraud Protection, in addition to the data that informs the reporting and monitoring features.

How Fraud Protection account protection connects with clients

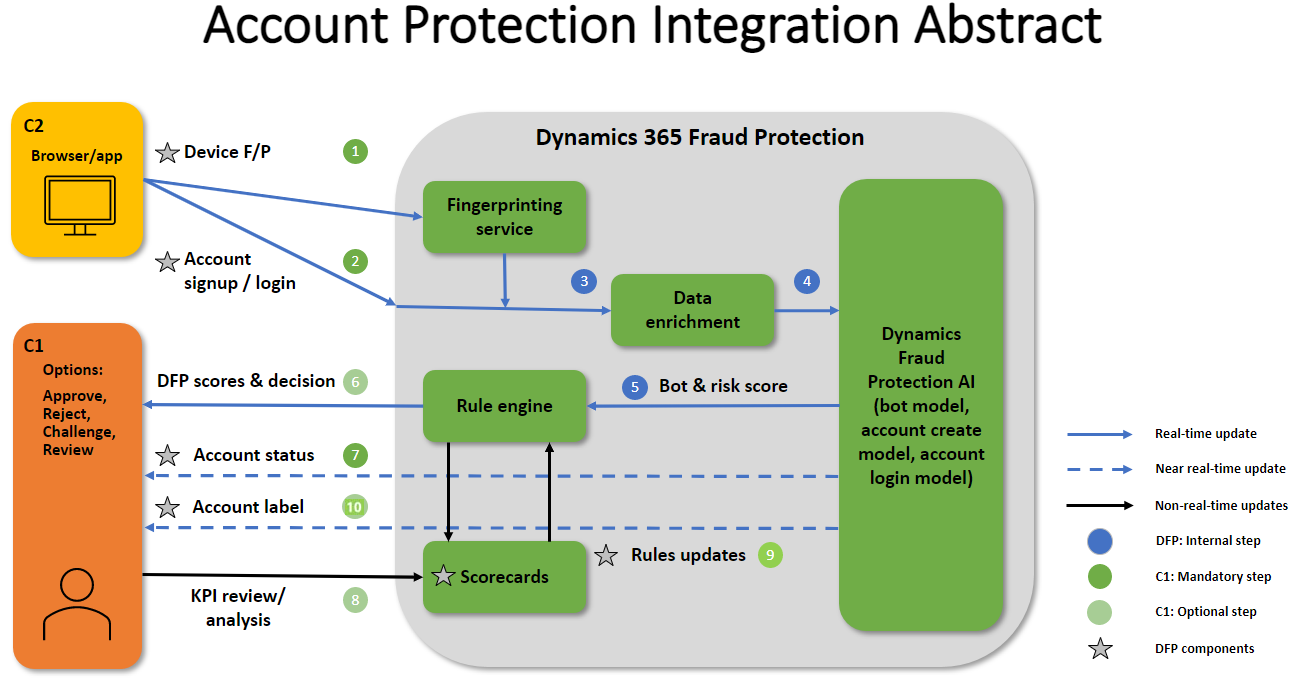

The following illustration shows how Fraud Protection account protection typically connects with clients. For example, it shows at which stage of the process an API call occurs, which API is called, and which Dynamics 365 components return information to clients.

Here is an explanation of the numbered elements in the illustration:

Device fingerprinting (1), front end – Fraud Protection's device fingerprinting feature is based on AI, and device identification can be used as input to the fraud assessment process. This feature helps Fraud Protection track and link unrelated events in the fraud network to help identify patterns of fraud.

The data that is collected isn't just a static list of attributes. It also includes data that is dynamically captured based on the evaluation of specific combinations of attributes, such as the browser, system, network, and geolocation coordinates. When device characteristics and attributes are collected, the device fingerprinting service uses machine learning to probabilistically identify the device. For example, when a user enters their credentials, the device fingerprinting service does an authentication pass to help determine whether the user credentials are correct. Device fingerprinting runs on Azure, and includes benefits from proven cloud scalability, reliability, and enterprise-grade security.

Clients and payment service providers (PSPs) have control over their user experience (UX) and systems, and can decide to implement Fraud Protection's device fingerprinting service on the front end.

Account sign-up or account sign-in API (2) – The first API call occurs at this stage. However, device fingerprinting is technically the first time that you're communicating with Fraud Protection account protection. There's a common link between device fingerprinting and the account sign-up or account sign-in API calls. For example, when you initiate device fingerprinting, you create a unique device context ID that you include when you make the second API call.

Data enrichment (3) – Data enrichment helps connect device fingerprinting, account sign-up, and account sign-in. Fraud Protection account protection does some data enrichment before it runs the data attributes through the bot, account creation, and account sign-in models.

Dynamics Fraud Protection AI model (4, 5) – Within a few milliseconds after the data attributes pass through the AI models, a response is processed by Fraud Protection rules and decisions. Fraud Protection then provides a bot and risk score (5, back end) in the response, based on the machine learning scores.

Rules engine (6) – The output of the scores and decisions depends on the client policies that are set in the Fraud Protection rules engine. The scores that are provided are based on a risk or bot scale, where a lower score indicates less likelihood of fraud, and a higher score indicates more likelihood of fraud. There are four decisions that you can make: approve, reject, challenge, or review. A challenge decision indicates that you should possibly implement a capture or some other type of verification challenge. A review decision typically indicates that you should do a manual review. The decisions are recommendations from Fraud Protection and are based on the policies that have been configured in the rules engine. It's up to you to decide what rules or decisions you want to set up or activate.

Account sign-in or account creation status API (7) – Fraud Protection needs to know the final status decision that you made about the account attempt. For example, did you approve or reject the attempt? The account status that you send back to Fraud Protection helps ensure that machine learning considers the correct information in the future.

Monitoring dashboards (8) – Transactions that come from clients to Fraud Protection also make their way onto monitoring dashboards.

Rules updates (9) – You might decide that you must update some of your rules or policies. For example, a member of your team reviews the monitoring dashboards, and you decide to update rules or policies, based on what you see on the monitoring dashboards.

Label API (10) – The label API lets you send additional information to Fraud Protection about account sign-in attempts, instrument details, and reversals, in addition to the data that informs the reporting and monitoring features. The labels API provides knowledge for model training that is based on a set of fraud signals.