Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

The Project integration journal is extended so that you can select tax attributes of direct and indirect taxes of India in the Integration journal. You can use this extension to apply and calculate the required taxes on Project invoice proposal transactions that go through Microsoft Dynamics 365 Project Operations.

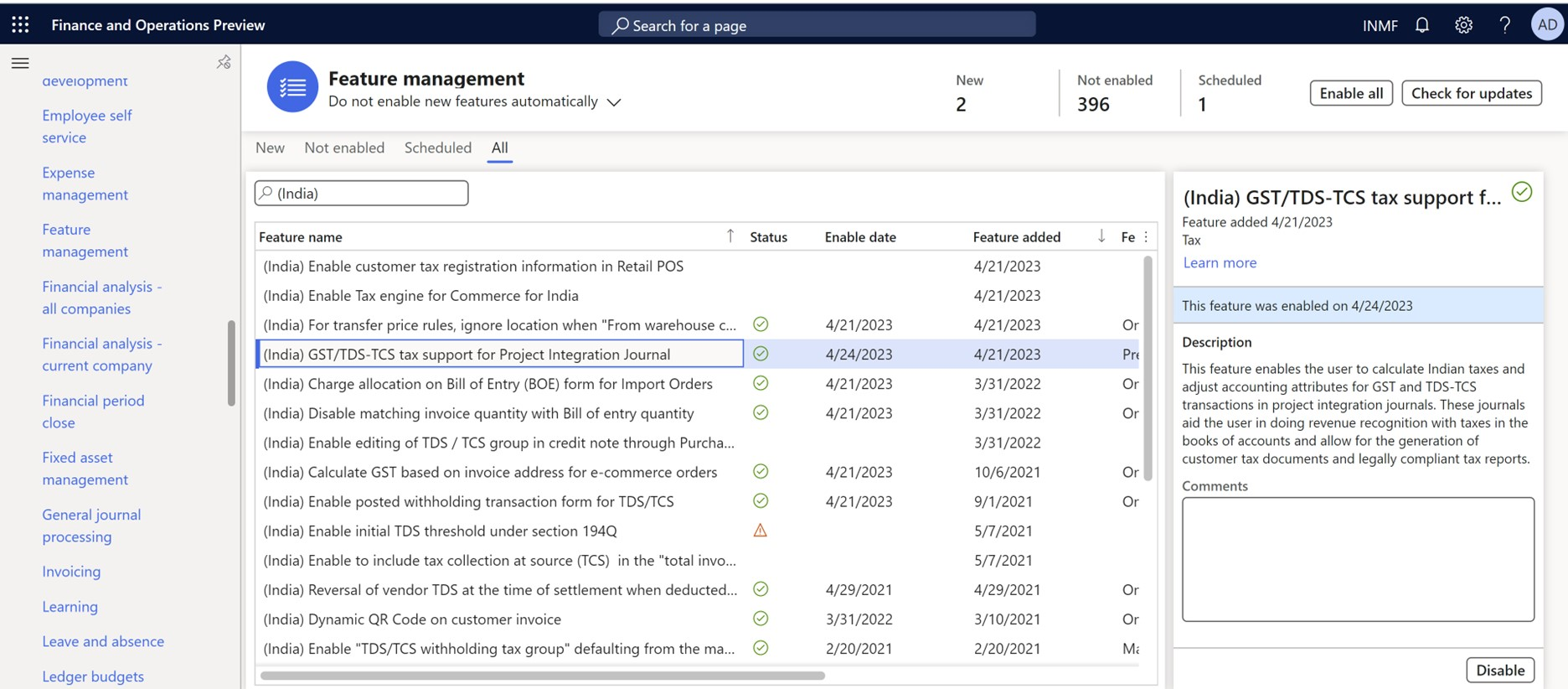

To activate this feature, follow these steps.

Open the Feature management workspace.

Find and select Enable (India) GST/TDS-TCS tax support for Project Integration Journal feature in the list.

Select Enable.

For tax setup, the required configuration version is 83.157.303.

Enable GST/TDS-TCS taxes in Integration journals

Project Operations Integration journals are created by using the Import from staging table periodic process. You can run this process in Dynamics 365 Finance by going to Project management and accounting > Periodic > Project Operations Integration > Import from staging table.

When this feature is enabled, you can calculate Indian taxes and adjust accounting attributes for Goods and Services Tax (GST) and Tax Deducted at Source–Tax Collected at Source (TDS-TCS) transactions in project integration journals. These journals help you use revenue recognition with taxes in the books of accounts. They also let you generate customer tax documents and legally compliant tax reports, such as GSTR-1, GSTR-2, and the GST offline tool.

India-specific tax information is added to the following processes:

Dynamics 365 Finance:

- Hour, Fee, Item, and Expense journals

- Integration journals

- Project invoice proposals

Dataverse:

- Invoice corrections

- Project invoice proposals

Default tax information and TDS/TCS groups are included in the Hour, Fee, Item, and Expense journals. In Dynamics 365 Finance, you can edit the default tax attributes in Integration journals and Project invoice proposals.

GST calculation is included on the tax document for Expense integration journals. TDS/TCS calculation is included in the withholding tax in Expense integration journals.

Feature scenarios

The following scenarios are affected by this feature.

Expense

- Pending vendor invoices that have a project category expense in Finance

- Expense submissions or Project journals that have an expense in Dataverse

Hour

- Pending vendor invoices that have a project category hour in Finance

- Time entries for a project in Dataverse or creation of a journal that has time

Fee

- Creation of a fee journal line in Dataverse

On account

- Project contracts that have fixed price and milestones on an invoice schedule

- Creation of an advance or a retainer in Dataverse

Item

- Project purchase orders in Finance

- Pending vendor invoices for non-stocked and stocked items in Finance

- Creation of a journal line that has material in Dataverse

- Material usage approval in Dataverse