Overview of public sector requirements and features

Public sector organizations need to meet complex regulatory, budgetary requirements, in addition to grant or project compliance requirements. Typically, public sector organizations, such as local and regional governments, educational institutions, non-profit organizations, and healthcare providers are subject to unique controls, rules, and regulations that require specialized operations.

Frequent updates to regulations require modifications to practices and reports and, therefore, require constant inspection of these new practices. Public sector organizations often depend on outdated and complex legacy systems to manage their diverse operations. This results in issues related to reporting, budgeting, and managing information, and cumbersome business processes.

The following are examples of public sector organizations in the United States of America:

- Education - State and local agencies for elementary through high school education, and state universities for secondary education.

- Government - State, county, and city organizations that provide services to the citizens they serve. They provide various services that include, but are not limited to, public safety, infrastructure, recreation, health care, and more.

- Health - Clinics, non-profit hospitals, and other city and county services that are provided to the citizens they serve.

- Non-profit organizations - Transportation districts, redevelopment agencies, and other organizations that provide specific services based on their voter-mandated charters.

- Public work and infrastructure - Utility districts such as water, sewer, power, and public works that provide essential services to the citizens they serve.

Government organizations requirements

Government organizations must adhere to responsible financial practices and provide comprehensive, timely information about their expenses, revenues, assets, liabilities, and equities. They also need to improve their service offerings to meet increasing service expectations.

Finance helps government organizations achieve these objectives by providing the following features:

- Financial management practices can be tailored to organizational needs, which often include multiple legal entities or component units.

- Flexible, user-defined account structures enable detailed financial analysis by any dimension, including fund, function, department, object, program, and more.

- Greater access to financial information and tighter control over spending priorities are possible.

- Advanced budget setup and control features enable dynamic, real-time spending controls, budgeting at higher levels than spending, budget groupings, and multi-year budgets.

- Encumbrance and pre-encumbrance budget tracking and accounting, including year-end carry-forward options, are available.

- It is possible to track and monitor grant funds and associate them with projects.

- Commercial features for warehouse inventory control, ordering, membership tracking, and donations are available.

- Robust procurement and supplier management functionality is provided, such as web-based purchase requisitions that are integrated with vendor websites. Also included is the import of vendor catalogs, blanket orders, contracts, a vendor portal for self-registration and entry of quotes and invoices, RFQ processing, commodity coding and analysis, three-way matching to Accounts payable, and sales tax and 1099 support.

- Tight integration with other Microsoft applications and technologies leads to streamlined processes and better efficiency.

- Pre-built role centers that are customized for public sector users to help simplify access to relevant data.

- Local, personalized services can be provided, from planning and implementation, to customization, to ongoing support and education.

Budgeting module features

If your organization uses budget control, you can enable budget control for advanced ledger entries on the Budget funds available page in Budgeting > Setup > Budget control > Budget control configuration.

- Apportionment budget types - Apportionments provide additional budget control by requiring a budget action to release appropriated funds for use, typically for a selected period such as a quarter. They are an additional, optional setup within budget control.

- Provisional budgets - Provisional budgets let you create a temporary, preliminary budget for cases where the new appropriation is not approved by the start of the budget year.

- Budget carry-forward at year-end - For public sector, the ability to carry forward budgets and budget encumbrances related to open purchase orders at year-end is improved, providing the option to process by fund.

Advanced ledger entries in the public sector

Public-sector organizations can use advanced ledger entries to create, adjust, and reverse ledger entries. For example, advanced ledger entries can be used to reclassify expenditures if invoices are mistakenly posted to the wrong account or project.

By default, Advanced ledger entry is enabled. If you want to disable this feature, go to System administration > Setup > License configuration. Under Configuration keys in the Public sector section, verify that Advanced ledger entry is not selected. Advanced ledger entries require general ledger posting definitions.

These posting definitions can be set up to generate multiple, balanced ledger entries based on the ledger account that was entered in the Advanced ledger entries page.

If you want users to be able to change the financial dimensions for a project on the advanced ledger entry line, you'll need to select the Allow the financial dimensions to be edited on the advanced ledger entry form option on the General ledger parameters page. If you don't select this option, users can change the financial dimensions in the Ledger account field, only if the financial dimensions are not the default financial dimensions for a project.

If you want to use advanced ledger entries to record year-end accrual entries, first create an advanced ledger entry, select the Reversing entry option, and then enter a reversing date. The reversing advanced ledger entry is created when the advanced ledger entry is posted. The reversing advanced ledger entry will have a new transaction number and a draft status.

The reversing date will be used as the accounting date, and the debit or credit amount on each line of the original entry will be reversed. The same posting definition will be used. The transaction text for the header and lines will contain the words "Reversing entry from," the transaction number of the original advanced ledger entry, and the transaction text of the original advanced ledger entry.

Because Advanced journal entries is where you make entries for interest distribution and escheatment processes, you can update bank balances when posting transactions.

All entries made will appear in the Voucher transactions inquiry at General ledger > Inquiries and reports > Voucher transactions. This listing shows all vouchers by account and voucher with amounts, along with Vendor account, Vendor name, Customer account, and Customer name.

Bridged transactions

Some companies use bridged accounts to post payments, so they have time to process them through the bank. The bridged account acts as a temporary account. When a transaction is posted, it goes to the bridging account rather than the actual bank account. When the company receives the bank statement, they can post the transaction from the bridging account to the main account.

There are fields on the Bridged transactions page, the Bank transaction page, and the Checks page to help streamline the reconciliation process.

The Bridged transactions page displays the Vendor number, Name, and Address.

The Bank transactions page displays a Cleared date, so you know when the transaction cleared the bank.

The Checks page displays the Bridge posting field, whether the check has cleared, and the Cleared date.

Year-end processing in the public sector

At the end of a fiscal year, you need to generate closing transactions and prepare your accounts for the next fiscal year. Public sector clients have the following capabilities:

- Select accounts by fund.

- Close funds to different accounts. For example, you can close nominal accounts that are associated with governmental funds to fund balances. You can also close nominal accounts that are associated with proprietary funds to retained earnings.

- Set up year-end closing for all funds and non-funds. Non-funds don't have a fund dimension in the account structure.

- Set up multiple closing periods to segregate different types of closing entries, such as general year-end closing and audit adjustments.

You can run the year-end process multiple times for the same set of data. Typically, if additional transactions must be processed after a general ledger year-end process is run, the year-end process can be run again to close out the nominal accounts and correctly set the opening balances in the new year.

Year-end processing of general ledger balances is controlled by fund configuration settings in two places:

- The year-end process, which closes ledger balances in the old year and establishes opening balances in the new year.

- The year-end processing option for purchase order encumbrances is set on the Purchase order year-end process page. You can override the option on a specific fund, provided that the general ledger parameters have been set to allow for overrides.

Make sure that you select a close type for every account in your chart of accounts. The close type determines how the year-end process handles that main account. The four close types are:

- Real - The balance is used to establish opening balances in the new year.

- Nominal - The account is closed by the year-end process.

- Nominal - no close - The account is managed by other closing processes, such as encumbrance accounts for purchase order close.

- Not applicable - The account isn't included in year-end processing.

Posting definitions

Posting profiles can only support one offset ledger entry for a given combination of attributes. Posting profiles cannot help you generate multiple, balanced ledger entries that are based on input transaction attributes. Additionally, posting profiles cannot help you determine posting behavior that depends on a transaction's ledger account and dimension values.

To support complex business requirements of ledger posting, budgeting, and reporting, public sector organizations typically define ledger posting behavior in a single location to ensure that all ledger postings have the appropriate results.

To provide this functionality to the public sector industry, Dynamics 365 for Finance includes posting definitions. A posting definition is a set of rules defined to generate balanced ledger entries. You can apply the rules to account numbers and financial dimensions on an accounting distribution on the source document line. Posting definitions define the accounts or dimensions that are system-generated.

Posting definitions is a required setup for all companies-regardless of whether they are in the public sector or not-to benefit from commitment accounting.

To enable posting definitions:

- Go to General ledger > Ledger setup > General ledger parameters page.

- Select the Ledger tab.

- Select the Accounting rules section and enable Use posting definitions. When you turn this option on, a message with the text If you select this check box, posting profiles are no longer used when you post a transaction that uses a type in the Transaction posting definition form. Also, all posting definitions become active. Are you sure you want to continue? appears.

- Select Yes.

Then, you can enable any of the following options:

- Enable budget appropriation - Select this option to use posting definitions to record budget appropriations in the general ledger for budget register entries. In the Budget parameters page, select a budget journal name for the budget appropriation before you select this option. Budget appropriations represent budget amounts on the balance sheet. They are used to record the estimated revenues and the impact on fund balances in the general ledger for financial reporting. As budget register entries are posted, a general ledger posting must also be generated, which affects the budget appropriations and budgetary fund balance accounts. By using posting definitions with budget register entries, budgets are also recorded in the ledger.

- Enable encumbrance process - Select this option to create encumbrances, which record entries in the general ledger for committed or obligated purchases. When this option is selected, you must use posting definitions for committed or obligated purchases. If you select this check box, encumbrances will not be generated when existing confirmed purchase orders are invoiced or changed. You should select Yes.

- Enable pre-encumbrance process - Select this option to create pre-encumbrances and encumbrances. Pre-encumbrances reserve funds for planned expenditures. When this option is selected, use posting definitions for pre-encumbered purchase requisitions. If you enable the pre-encumbrance process, the purchase requisitions already created will not have pre-encumbrances recorded. To record pre-encumbrances for these purchase requisitions, cancel them and create new purchase requisitions with the same lines.

- General budget reservations - To include pre-encumbrances and encumbrances for pre-existing purchase requisitions or purchase orders in a new general budget reservation, you need to cancel the PRs and POs and recreate them with the same lines. To record encumbrances for any general budget reservations that already exist, cancel the reservations and recreate them with the same lines.

Posting definitions govern how accounting occurs on the closing entries, and they also help create the opening transactions for the new year. To learn more, refer to Posting definitions in the public sector.

To set up, enable, and use a posting definition for commitment accounting, after you enable it in the General ledger parameters page, you must configure the Transaction posting definitions page, which is a posting profile for commitment accounting.

The Transaction posting definitions page in General ledger > Posting setup also directs Finance to associate all, group, or a specific item or a procurement category to use a specific posting definition for activities in purchasing, accounts payable, budget, bank, accounts receivable, and payroll. (Payroll functionality is only available in the United States of America.)

You can use posting definitions only for transactions that use the transaction types that are listed in the Transaction posting definitions page. For any transaction posting type that is not set up to use posting definitions, posting profiles are used.

Restrict ability to edit accounting distribution on vendor invoices

When transactions reference related encumbrance documents, typically purchase orders, you can determine what financial dimensions can be edited on a vendor invoice created from a purchase order.

To restrict changes to the financial dimensions, follow these steps:

- Go to Accounts payable >Setup > Accounts payable parameters > PO/Invoice matching validation.

- In the Financial dimension validation FastTab, select the Matching required checkbox for the Dimension name that you want to restrict from editing on the vendor invoice.

Enable budget appropriations

When enabling appropriations, you need to record an original budget and the appropriation. This option enables you to post to balance sheet accounts for appropriations, estimated revenues, and so on, from Budget register entries. For this to work, you should also create at least one posting definition record and assign it to the original budget transaction type on the Budget tab of the Transaction posting definitions page.

Procurement and sourcing in the public sector

In emergency or special circumstances, public sector organizations sometimes need to make urgent purchases from vendors. To do so, procurement personnel might need to create purchase orders that streamline the standard, more elaborate purchasing process. For example, you might need to authorize a purchase with only a purchase order number instead of a printed purchase order document.

Before you begin to adjust the settings and input your data, you should:

- Set up vendors

- Set up the numbering system for vendors, purchase orders, and so on

- Specify vendor certification types

You might need to set up the Public sector purchase order codes to benefit from Procurement and sourcing features for public sector organizations.

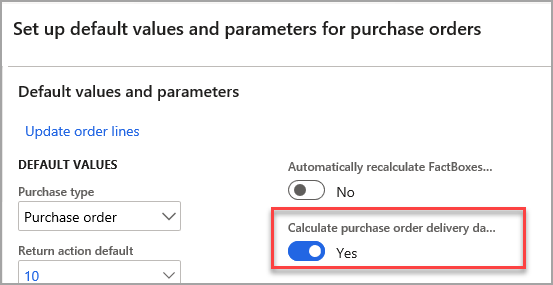

By navigating to Procurement and sourcing > Setup > Procurement and sourcing parameters, you can calculate a delivery date for a line on a PO based on the vendor's lead time and your own working day calendar. By using this feature, you can gain a more accurate expectation of delivery dates should they vary for individual lines.

Public sector purchase order codes - You need to create codes and special messages for confirming purchase orders. A confirming purchase order circumvents the typical purchasing process.

First, determine what your codes and messages will be. You can use the Confirming PO codes page to create codes and special messages that can be used with confirming purchase orders (POs). A confirming purchase order bypasses the typical purchasing process. For example, you can authorize an unplanned order by using a purchase order number at the time of a purchase instead of by using a document that is provided before the item is required.

After you set up the codes, you can assign them to purchase orders on the All purchase orders page.

If you assign a confirming PO code to a purchase order on the Unplanned purchases FastTab (for example, when you create a new purchase order), the message that is associated with the confirming PO code will be printed at the top of the purchase order.

For French organizations, additional steps might be required for the public sector.

Posting product receipts

When you receive products for a purchase order, and the amount received is less than the quantity ordered, the discrepancy is entered on the Posting product receipt page in the Lines FastTab in the Quantity field. When the quantity is entered, the remaining amount will auto-populate in the Deliver remainder field.

Delegate multiple purchase work items

You can delegate multiple work items at one time to streamline the workflow approval process, and to avoid misassignments when delegating purchase work items such as requisitions, agreements, orders, vendor invoices.

On the Work items assigned to me page, select multiple purchase work items, then select Delegate work items in the Action Pane.

Purchase or sales agreement classifications

When users create a new purchase agreement or sales agreement, they must always select the type of purchase agreement or sales agreement. Additional public sector controls are available on the Agreement classifications pages.

To create and specify agreement classifications, you can use the Purchase agreement classification page in Procurement and sourcing or the Sales agreement classification page in Sales and marketing.

- Select the Subcontractors option to be able to enter information about subcontractors on purchase agreements.

- Select the Certifications option to enter information about insurance policies and bonds on purchase agreements. The information can be used to generate a report that you can use to monitor vendor compliance with certification requirements. To generate the report, go to the Purchase agreement certification compliance page.

- Select the Activities option to enter information about milestones and tasks on purchase agreements.

- Select the Require direct invoicing option to require direct invoicing and prevent the use of release orders with purchase agreements.