Adjust exchange rates for the additional reporting currency

When you use an additional reporting currency, run the Adjust Exchange Rates batch job to record any exchange rate differences for previously posted transactions. Typically, the batch job is run at the end of the month, and its process is as follows:

Find the appropriate adjustment exchange rate on the Currency Exchange Rates page.

Compare the amounts in the Amount and Additional-Currency Amount fields on the general ledger entries and VAT entries to determine an exchange rate gain or loss.

Use the option that is selected in the Exchange Rate Adjustment field to determine whether to calculate and post exchange rate gains or losses for general ledger accounts and VAT accounts.

To run the Adjust Exchange Rates batch job for the additional reporting currency, follow these steps:

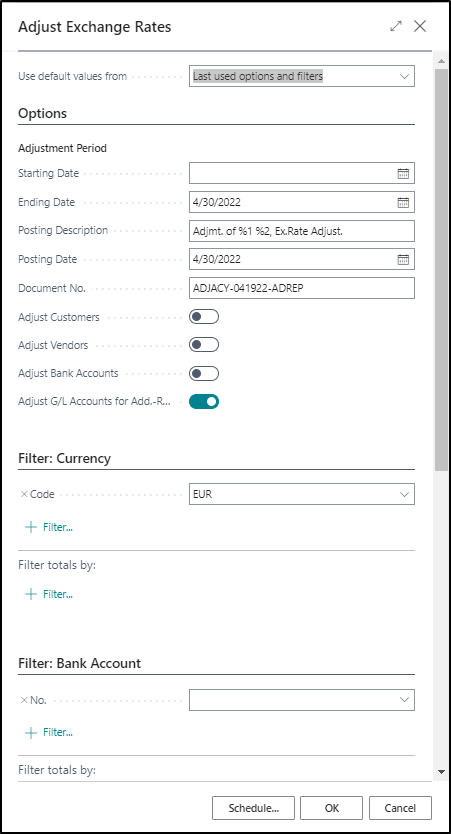

Select the Search for Page icon in the top-right corner of the page, enter adjust exchange rates, and then choose the related link.

In the Starting Date field, enter the starting date. You can also leave this field blank.

In the Ending Date field, enter the ending date. Business Central copies the ending date to the Posting Date field.

In the Document No. field, enter a document number.

Enable the Adjust G/L Accounts for Add.-Rep Currency field.

Select OK.