Set up allocations

Allocations move costs and revenues between cost types, cost centers, and cost objects. Business Central provides flexibility when you define allocations.

You can define as many allocations as you need, and each allocation consists of an allocation source and one or more allocation targets.

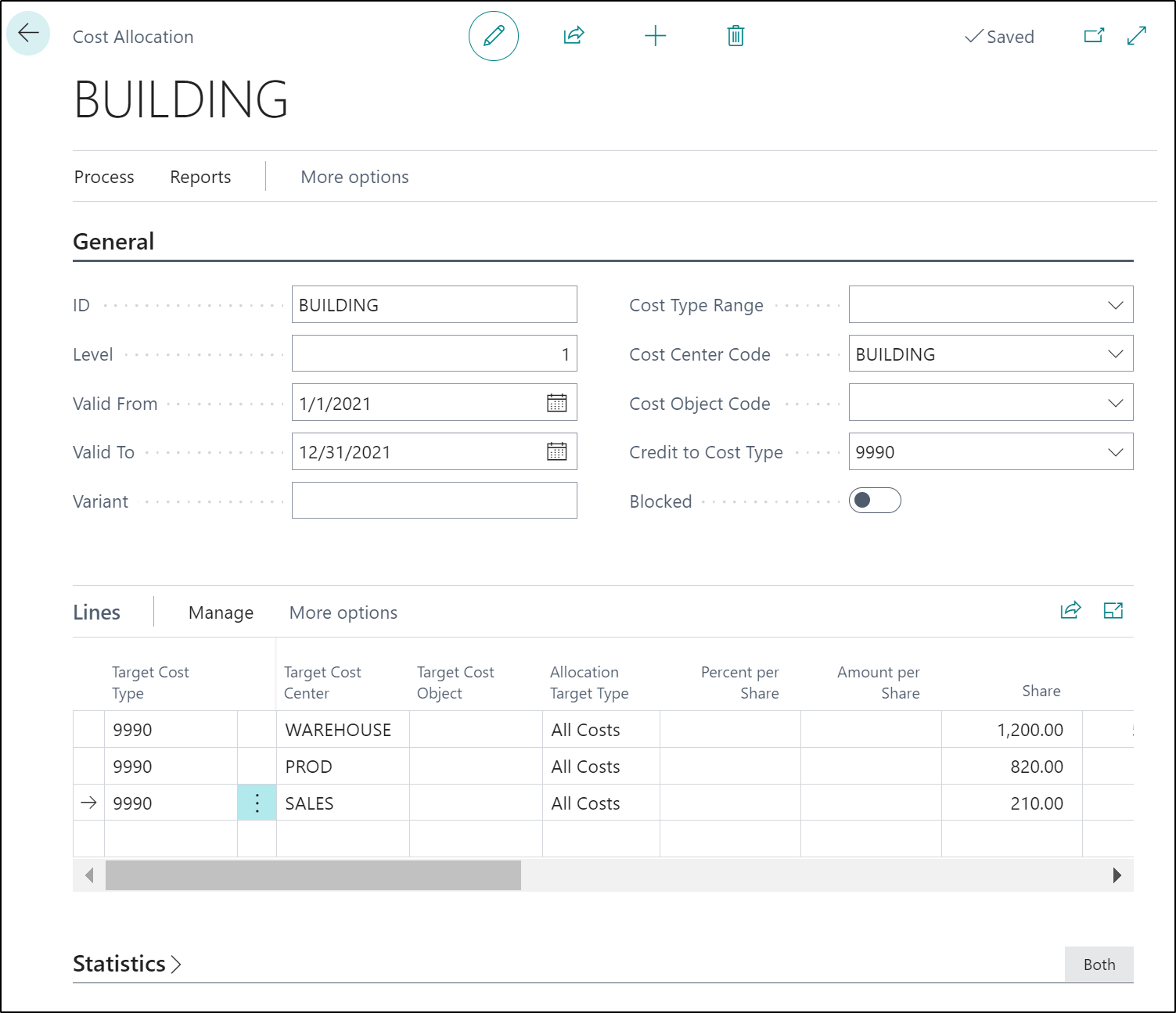

For example, all costs for the cost type Building (an allocation source) can be allocated to the cost centers of Warehouse, Production, and Sales (three allocation targets).

For each allocation, you can define an allocation level, a validity period, and a variant identifier. If you run an automatic cost allocation, you can use appropriate filters to select the allocation definitions to be handled in the batch job.

For each allocation target, you can define an allocation base, which can be either static or dynamic:

Static allocation bases are based on a definite value, such as square footage or an established allocation ratio, such as 5:2:4.

Dynamic allocation bases depend on other, changeable values, such as the number of employees in a cost center or sales revenue of a cost object in a certain time period.

Cost accounting in Business Central contains the following features as related to allocation, where you can:

Allocate actual values or budget values.

Create static allocations by using either fixed shares or percentages.

Use dynamic allocations with nine predefined allocation bases and 12 dynamic date ranges.

Choose from 99 different allocation levels.

Use as many allocation variants that you want.

Define allocations with expiration date ranges.

Define allocations between cost types, cost centers, and cost objects.

Cancel allocations and posting processes.

To set up cost allocations, follow these steps:

Select the Search for Page icon in the top-right corner of the page, enter Cost Allocations, and then select the related link.

On the Cost Allocation page, select New.

The General FastTab contains information about the allocation source, which establishes which costs should be allocated.

ID - Users can freely define the ID. The program uses the ID to identify the allocation and to establish the connection to the allocation targets. If users do not want to define the ID, they can press ENTER in the empty field. The program then uses the ID that follows the ID that appears in the Last Allocation ID field on the Cost Accounting Setup page.

Level - Users can define a level as a number between 1 and 99. The allocation posting will follow the order of the levels. The level might be important, for example, to make sure that first ADM is allocated to WORKSHOP before WORKSHOP is allocated to VEHICLE and PROD.

Valid From & Valid To - With these two dates, users can define the validity period for the allocation. All allocations will be processed that have allocation dates that fall within the validity period. If users don't define dates here, all dates are valid.

Variant - With a variant code, users can group allocations. When users run the allocation, they can use a filter to select only the allocation definitions that they want. Users can leave the variant code empty if they want to use only one variant.

Cost Type Range - Use this field to set up a filter to establish which cost types should be allocated. If all costs for a cost center are allocated, no range is defined.

Cost Center Code - Use this field to define the cost center with costs to be allocated.

Cost Object Code - Use this field to define the cost object with costs to be allocated. Most frequently, this field stays empty because cost objects are rarely allocated to other cost objects.

Credit to Cost Type - The costs to be allocated will be credited (or debited) to the source cost center indicated in this field. It can be helpful to set up a helping cost type to later highlight the allocation postings in the statistics and reports.

Blocked - Use this field to deactivate the allocation by selecting this option.

The Lines FastTab contains information about the allocation targets. The allocation targets determine where the costs should be allocated.

Allocations to cost centers or cost objects differ only in that either the Target Cost Center or the Target Cost Object field is filled. Make sure that the cost center is allocated before the allocation to the cost object. Users can control this by assigning levels in the Level field.

The Lines and Statistics FastTabs contains the following fields:

ID & Line No - The program automatically assigns the ID and line number. The ID shows the relationship to the allocation source. The program assigns ascending line numbers to the allocation targets within an ID.

Target Cost Type - The target cost type determines to which cost type the allocation is debited.

Target Cost Center and Target Cost Object - These two fields define to which cost center or cost object the allocation should be debited. Only one of these fields can be filled, not both.

Allocation Type - The allocation type determines how much of the total costs of the allocation source should be allocated. The options in this field are as follows:

All Costs - Accrued costs must be transferred from one cost center to another cost center or cost object. In such a case, use the Allocation Type of All Costs.

Amount per share - You can also carry out an allocation that is independent of the size of the accumulated costs. For example, the target cost centers might generally be charged 100.00 LCY each year for each square meter of building area that is used. The total of the charge would be credited to the Building cost center. When this process is done, the credit no longer agrees with the accrued costs of the Building cost center, which then results in a deficit or an excess for the Building cost center. If the credit is higher than the accrued costs, the cost center has gained an operational profit.

Percent per share - Instead of using a set amount, you can offset a percentage based on the share. For example, depending on income total of each cost center, 15 percent for the share is debited to the social welfare expense.

Percent per Share - If the allocation type is Percent per Share, enter the percentage in this field.

Amount per Share - If the allocation type is Amount per Share, enter the amount in this field.

Static Base and Static Weighting - The values in these two fields will be multiplied and carried over to the Share field. For example, you might define that the base of 2000 square feet for the area of a warehouse should be weighted with a factor of 0.8.

Share - For a static allocation, this field contains a definite value, or the value in this field is calculated by using the static base and static weighting. For dynamic allocations, the program calculates the share by using the dynamic base.

Percent - The share is calculated by Business Central, dependent on all other allocation targets in a percentage rate.

Base - In this field, define whether the allocation is static or dynamic, meaning that it depends on a dynamic value.

No. Filter, Cost Center Filter, Cost Object Filter, Date Filter Code, and Group Filter - For dynamic allocations, fill in these five fields with the allocation base. For static allocations, leave these fields blank.

Share Updated on - Date that the Share field was last changed.

Last Date Modified - Date that the allocation target was last updated.

User ID - User who last updated the allocation target.

Comment - Use this field to enter a short description for the allocation target.