Create and maintain customers

This unit explains how to create and maintain a customer.

Customer workflow

By using the customer workflows in Finance, you can change specific fields for a customer and then send those changes for approval by using the workflow before they are added to the customer.

To set up the customer workflow, follow these steps:

Before you can use the customer workflow feature, you need to enable it.

Go to Accounts receivable > Setup > Accounts receivable parameters.

On the General tab, on the Customer approval FastTab, set the Enable customer approvals option to Yes to enable the feature.

In the Data entity behavior field, select the behavior that the data entities should use when data is imported:

Allow changes without approval - An entity can update the customer record without processing it through the workflow.

Reject changes - Changes can't be made to the customer record. The import will fail for the fields that are enabled for the workflow.

Create change proposals - All fields will be changed except the fields that are enabled for the workflow. The new values for those fields will be added to the customer as proposed changes, and the workflow will be started automatically.

In the list of customer fields select the Enable check box for every field that must be approved before the changes can be made.

Go to Accounts receivable > Setup > Accounts receivable workflows.

Select New.

Select Proposed customer change workflow.

Set up the workflow so that it matches your approval process.

Change customer information and submit the changes to the workflow

When you change a field that is enabled for the workflow, the Proposed changes page appears. This page shows the original value of the field and the new value that you entered.

Every time you change a field that is enabled for the workflow, that field is added to the list of proposed changes. To discard the proposed value for a field, use the Discard button next to the field in the list. To discard all changes, use the Discard all changes button at the bottom of the page. Select OK to close the page.

After you have at least one proposed change, two additional menus appear on the Action Pane: Proposed changes and Workflow.

- Select Proposed changes to open the Proposed changes page and review your changes.

- Select Workflow > Submit to submit the changes to the workflow. The status on the page is changed to Changes pending approval.

The workflow follows the standard workflow process in finance and operations. The approver is directed to the Customer page, where they can review the changes on the Proposed changes page and then select Workflow > Approve to approve the workflow. After all approvals are completed, the fields are updated with the values that you proposed.

For more information regarding for whom to create a workflow, see Work with workflows in finance and operations apps.

Customers

Each accounts receivable transaction must be associated with a customer. Use the Customers page to create, maintain, and inquire about customers.

Enter as much data as possible in advance because the data is used throughout the system for:

- Invoicing

- Payments

- Reports

The base data is automatically displayed as the default for all transactions that involve the customer. You can change default information at any time. To speed up the process of creating customers, you can create templates based on the entries in fields for specific customers that you specify as template models.

Templates can be used by all users or a single user. If a template is available when you create a new customer, a page appears that displays the available customer templates. Select the template that applies to the new customer. The field values of the template are copied to the fields for the new customer. You can make changes to the fields and enter more information, as appropriate.

If using one-time customers, you need to set up a number sequence in the Accounts receivable parameters page in the Number sequence section. In the General area of the Accounts receivable parameters page, select a customer's account number that can serve as the default template for one-time customers. Information is copied automatically when you create a one-time supplier in the Customers page.

Finance automatically creates a one-time customer when you create a sales order for a one-time customer. Except for the customer number, the one-time customer inherits all base information from the customer number that is specified in this field. You must specify the one-time customer number sequence in the Number sequences page. If you do not use a one-time customer, leave the Default customer number blank.

Improve efficiency using Customer page summary

Your organization can enable the Customer page summary feature to receive an AI-generated summary of relevant data for a customer account. Data from customer invoices, payments, sales orders, sales agreements, and more are analyzed and included in the summary located on the All customers page. To enable this feature:

- Go to the Feature management workspace.

- Select the All tab and locate the feature Customer page summary.

- Select Enable.

Customer groups

Consider the following about customer groups:

- You can use customer groups to set up certain information that always defaults when you are entering a new customer. For example, use customer groups to set up automatic posting to General Ledger accounts for revenue that is generated by customers.

- You can set up ledger accounts for the automatic transactions that are generated in connection with receipt and issues of inventory.

- In the Customer groups page, you can set up any number of customer groups. At least one customer group must be set up because a customer group must be specified when you set up a new customer.

Scenario

Adventure Works Cycles has many customers to track. To simplify the handling of customers, the Adventure Works Cycles Company has set up several customer groups to:

- Specify ledger posting for each customer group.

- Record sales budgets for each customer group.

- Generate trade statistics for each customer group, for example, sales statistics that show monthly sales for each customer group.

Accounts receivable > Setup > Customer groups

Copy customers by using shared number sequences

You can use shared number sequences to assign customer IDs. Shared number sequences also let you copy customers from one legal entity to another legal entity but use the same customer IDs in both legal entities.

You need to use the same number sequence in every legal entity that you want to copy a customer to. You can change the customer number sequence on the Accounts receivable parameters page for each legal entity. Select Accounts receivable > Setup > Accounts receivable parameters, and then select the Number sequences tab.

You can also set up customer number sequences for each customer group. The number sequences' scope must also be as type shared. The number sequence for a customer group is used first. If no number sequence is specified for a customer group, the number sequence that is specified on the Accounts receivable parameters page is used.

You can also copy customers between legal entities if you use manual customer IDs. However, if you try to copy a customer to a legal entity where the customer ID already exists, the copy process won't be started.

Credit limits for customers

Setting a credit limit lets you specify the maximum amount of credit to extend to your customers. If a credit limit is specified, it is checked automatically when a user attempts to update a document. If the credit limit is exceeded, a message is displayed to the user. This article provides an overview of how credit limits work and answers the following questions:

- What documents and processes can I check credit limits for?

- Where do I configure the way that the customer's remaining credit is calculated?

- Where is information about a customer's remaining credit used?

- Where do I specify whether identification is required for credit to be extended to a customer, and the credit limit amount that requires identification?

- Where do I specify whether to display a warning or error if the credit limit is exceeded?

- How do I specify the credit limit for a specific customer?

- How do I check credit limits manually on sales orders?

Use the Credit and collections parameters page to specify which documents to check credit limits for. You must be a member of the System administrator (-SYSADMIN-) security role to make changes on this page. You can check credit limits for the following documents and processes:

- Invoices for sales orders when you post the invoices

- Packing slips for sales orders when you update packing slips

- Sales orders when you add lines in the Sales order page

- Sales orders when they are created through a service

- Free text invoices when you post the invoices

Credit limits are automatically checked if either of the following options is set:

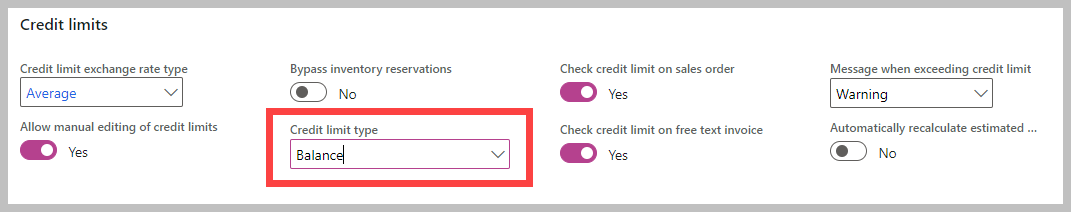

- In the Credit and collections parameter page, the Credit limit type field is set to anything other than None. Credit limits are checked for all customers.

- In the Credit and collections parameter page, the Credit limit type field is set to None, but Mandatory credit limit is selected for a customer in the Customers page. Credit limits are checked only for specific customers.

To check credit limits for the following documents, you must specify additional settings:

- Free text invoice - In the Credit and collections parameter page, in the Credit rating area, select Check credit limit on free text invoice.

- Sales order- In the Credit and collections parameter page, in the Credit rating area, select Check credit limit on sales order.

You can configure Finance to calculate a customer's remaining credit in any of the following ways:

- Compare the credit limit against the customer balance.

- Compare the credit limit against the customer balance and packing slip amounts.

- Compare the credit limit against the customer balance and all open transaction activity. This includes packing slip amounts and sales order amounts.

Use the Credit and collections parameter page to specify the information to compare to. You must be a member of the System administrator (-SYSADMIN-) security role to make changes in this page. In the Credit limit type field, select whether to perform credit limit checks and what transaction information to include when the credit limit is checked. Select from the following options:

- None - Do not check credit limits. You can override this option for a specific customer by selecting the Mandatory credit limit check box in the Customers page. If you do this, the credit limit is checked against the customer balance.

- Balance - The credit limit is checked against the customer balance.

- Balance + packing slip or product receipt - The credit limit is checked against the customer balance and deliveries.

- Balance+All - The credit limit is checked against the customer balance, deliveries, and open orders.

Information about a customer's balance and remaining credit amount is calculated and stored when you create an aging snapshot, and it is displayed in the Collections page. The amounts that are displayed in the Collections page might not include all transaction activity until a new aging snapshot is created.

Depending on the documents that are selected, information about a customer's balance and remaining credit amount is calculated when sales orders, packing slips, and customer invoices are updated. If the amount of the document that you are working with would cause the credit limit to be exceeded, a message is displayed.