Set up currencies and conversions

It is commonly known that currency is a unit of measure for money. However, when it comes to business it is also a unit of measure for the health of a company. Like your blood pressure, the highs and the lows must be checked to maintain a healthy lifestyle, the flow of the cash in a business must be constantly monitored to keep the organization prosperous and healthy.

The first step to set up financial management in Finance is to identify and configure acceptable currencies for the legal entity.

Accounting and reporting currencies

Finance uses the concept of accounting currency and reporting currency.

Accounting currency - This is the monetary unit of measure that is used to record the converted monetary value of economic transactions in ledger accounts. It is also be referred to as the "company" or ledger currency.

Reporting currency - The reporting currency is a secondary accounting currency, that measures the converted monetary value of transactions in a secondary currency, often for the purpose of consolidation or reporting to a parent organization.

An example of this would be if you had a subsidiary company in Canada, your primary company is in the United States. When running reports, you want to see the results of the business operations in Canadian dollars (CAD). To accomplish this, you must convert your US dollars (USD) to CAD. The system uses the exchange rate defined on the Exchange rates page to convert the amounts for reporting purposes.

If the Conversion check box is selected, it allows the display of financial information in a currency other than the default company currency in forms and reports.

In Finance, you can calculate gain/loss for reporting currency only to fully support gain/loss posting during ledger settlement. The accounting currency is used for matching within ledger settlement. The ledger settlement will post a gain/loss for the reporting currency when the accounting amounts are balanced in the accounting currency. This feature can speed up the period-end close process by eliminating the need to manually post the gain/loss in the reporting currency if it has not already been posted.

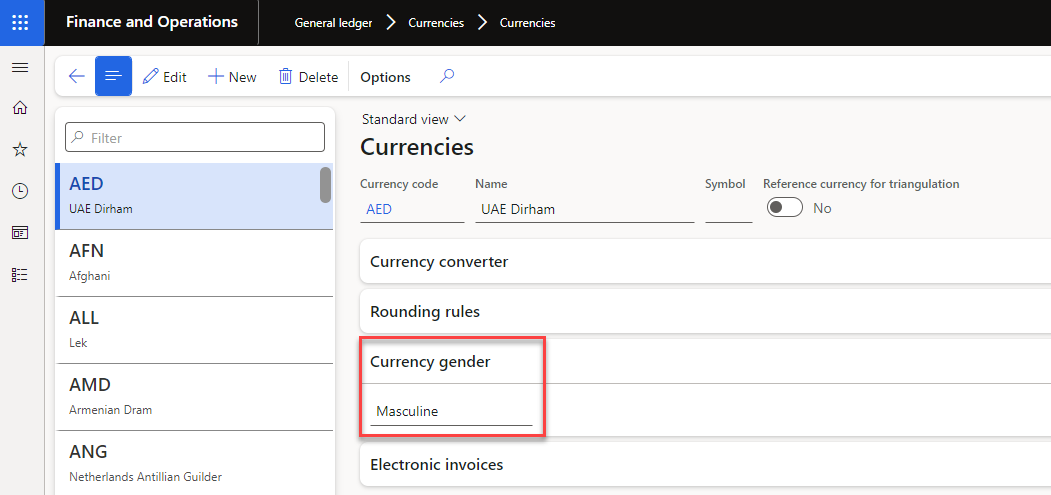

Currency gender

Currency gender in General ledger > Currencies > Currencies is used for Spanish speaking countries or regions to define the gender printed on checks and reports. Select Feminine if the selected currency has a feminine gender and the gender is used on checks and reports. The default value for this field is Masculine, which, in effect, means no gender for that currency.

Currency

Multi-currency functionality is used if your company does business in more than one currency. If your organization has multiple legal entities and transacts in multiple currencies, then maintaining currencies and their corresponding exchange rate is essential.

Currency triangulation refers to the process where the amounts from one national currency must be converted to another participating national currency by comparing it to another currency, such as the euro.

Only one currency can represent the triangulation currency. By default, the EUR currency is selected as the triangulation currency. You can change the triangulation currency, by first clearing the Reference currency for triangulation check box on the EUR record on the Currencies page. Then, you can select the Reference currency for triangulation for the desired currency.

Each currency can have specific attributes associated with it. The name, symbol, and currency code are specific to each currency.

Dual currency consolidation

Finance allows users to control the currency that is used as the transaction currency in the consolidation company (either the accounting or reporting currency). This functionality also allows you to automatically copy amounts from the source company to the consolidation company as long as the currencies are the same.

When you enable the Select consolidation amount from control on the Consolidate online page, users can choose whether the accounting currency or the reporting currency from the source company will be used as the transaction currency in the consolidation company.

You can enable the Directly copy amounts from the source company to the consolidation company if the currencies are the same feature so that the accounting or reporting currency amounts from the source company will be copied directly to the accounting or reporting currency amount in the consolidation company if either of the currencies are the same. When this is used, the accounting and reporting currency amount in the consolidation company are calculated using the exchange rate if neither of the currencies are the same.