Should you found a startup?

Let's assume that you're here because you're working on an early-stage startup or a startup idea. You'd like to make sure you have a good grasp of essential startup concepts before you go much further.

How will you know if founding a startup is right for you? For many startup founders (and aspiring founders), there are a few critical considerations that can help to answer this important question.

Are you passionate about solving a specific problem?

To be a successful entrepreneur, you need to be passionate about solving a problem. Many successful entrepreneurs report that they would have pursued their idea regardless of whether there was a business opportunity; they were that passionate about solving that particular problem.

The road from startup idea to successful business is often a long one, with the typical time from launch to exit being anywhere from 4 to 10 years.

Bear in mind that few startup founders set out with anything like this commitment up front. It's entirely rational to start a company with a modest time horizon and become more committed as the opportunity solidifies and the company grows.

Nevertheless, it's much easier for you to devote meaningful time to solving a problem if you're passionate about it. This is especially the case in the early days, when there's likely to be lots of hard work and before you reach any significant commercial milestones.

Tip

Ask yourself: Am I passionate about solving this problem, and can I imagine devoting years of my life to working on it?

Do you have deep domain expertise?

The odds of a startup succeeding are always higher if the founders have unique insights into the problem space—or domain expertise—in which their startup is going to operate. These insights are typically acquired over a long period of time (either through work or a personal interest), accompanied by a thirst for understanding problems and exploring potential solutions.

In fact, in the early days of many startups, these unique insights are the only competitive advantage the company has. So, it's important to make sure you're able to identify and articulate the insights on which you're going to base your startup.

There are four main ways in which startup founders can take advantage of their domain expertise to create value:

- By identifying an important problem that many others don't realize exists. Many great startup ideas came from time spent "marinating" in the problem space, exploring interesting problems with potential customers and developing unique insights over a long period of time. Finding great problems to work on often means skipping over the problems on which everyone else is working and identifying others that are hidden or that seem unsolvable, but that still represent a great opportunity.

- By coming up with a compelling solution that's unlikely to occur to others, and might even seem unlikely to succeed. Historically, many of the best startup ideas seemed wild at the outset, and it was only with hindsight that their value became evident.

- By making connections with customers that would be difficult for a newcomer to make. Founders can tap into their existing network, or use their profile as a thought leader.

- By developing novel, cutting-edge technology that can become the basis for the company's competitive advantage. Especially with deep-tech startups that are based on advanced technology or scientific research.

Tip

Ask yourself:

- Does my startup idea take advantage of the time and energy I've already invested in my career or my other interests?

- What insights do I have (that most of my peers don't) that will open up an opportunity that might have been invisible to others?

How much financial freedom do you have?

Almost all startups require an up-front investment in product and market development before meaningful revenues start to flow.

Technically capable founders might have a slight advantage over non-technical founders. They can spend their time building the product, rather than having to spend cash to pay an external developer to build it for them.

Nevertheless, it's vital that all startup founders understand the likely cost of building and launching their product. This awareness helps them budget for this expenditure and ensure that they can get their product in the hands of customers before they run out of money.

As a startup founder, you need to work on three tasks to determine your startup's financial runway:

Understand the cost of building and launching your product. This estimate should include all outlays, including legal, marketing, and staffing costs.

Predict the likely revenues you'll generate when the product is in the hands of customers. Consider how long it will take to reach that juncture.

- This prediction is the trickiest part, and many would argue that forecasting future revenues for a pre-launch startup is at best a rough guess.

- Almost all startup pitch decks are heavily influenced by optimism bias. They have a revenue chart that goes steeply up and to the right. A good rule of thumb is to double the length of time you think it will take to get to revenue, and halve the amount of revenue you think you'll generate.

Determine how much capital you have and are willing to invest in the company before it receives funding from revenues or external investment. If you have cofounders, this is a great topic to discuss as a team.

Answering these questions helps you develop a cashflow forecast that allows you to make informed decisions about where to invest time and money early on.

What is your risk tolerance?

A startup is one of the most uncertain business environments in which you can place yourself. To be successful as a startup founder, it's critical that you're not just comfortable with uncertainty, but that you thrive in this dynamic environment.

An important part of this process is considering your own risk tolerance in the context of your personal financial commitments.

Everyone has their own unique risk profile, but as a generalization, risk tolerance for most people is highest when they're young. Younger individuals tend to have relatively few financial obligations and don't yet have an established career. If founding a startup doesn't work out (or takes longer than planned to get off the ground), it doesn't seem like that big of a deal, at least financially.

Risk tolerance generally decreases over time. As people take on financial commitments like buying a house and have responsibilities such as supporting a family, they tend to be less willing to take large financial risks.

Additionally, opportunity cost generally increases over time. It can be more difficult to leave a successful career in which you've invested over many years than to start something when your career is still in its infancy.

As a founder, you should think about your own risk tolerance at the beginning of the startup journey. If you have cofounders, this is an excellent time to have a frank and open conversation about each individual's risk profile and financial situation. It's a good idea to find out whether you're collectively aligned on these fronts.

Tip

Ask yourself: How much cash am I willing to put into this company? How much income am I willing to forego as I work on this company instead of doing other paid work? What's the minimum income that I need to generate, and can I do that while working on this startup? What are my financial objectives, and will they be met by building this startup?

Are the cofounders aligned?

Misaligned expectations among cofounders can lead to a loss of team cohesion. This is one of the most common causes of startup failure, particularly if it occurs early in the startup's life.

Cofounder misalignment can take many forms, including:

- Differences in the amount of time, money, and/or energy each founder is willing to put into the company, particularly before it generates significant revenues or raises external funding.

- Differences in what each founder wants to get out of building the startup. These differing desires can include financial reward, freedom, self-actualization, or fame and recognition.

- Differences in how each founder views success for the company. They might have differing goals about financial success, impact on the world, solving the problem on which the startup is focused, or some other outcome.

The good news is that by identifying misalignment early on, it's often possible to address any issues before they become a destructive force.

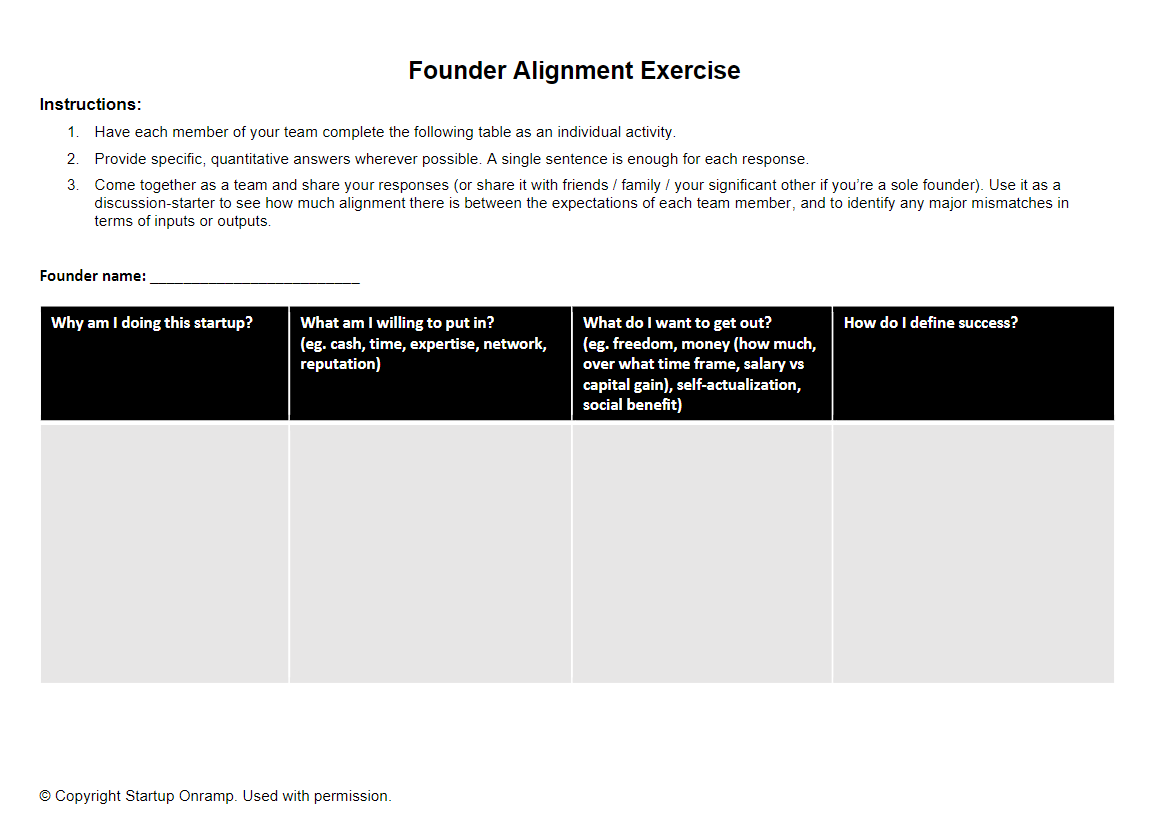

One way to do this is for cofounders to each reflect on their individual goals for the company and themselves, to write these down, and then to come together as a team and discuss their responses.

Even if you're a sole founder, it's still useful to capture these thoughts and discuss them with friends, family, or your partner. You can "pressure test" your own goals and the viability of your expectations.

Worksheet

Download and complete the Founder Alignment Exercise worksheet. Use it to start discussions with your cofounders (or if you're a sole founder, with your friends or family).

When should you go full-time?

At some point, founders need to make the decision to step back from other work in order to focus exclusively on building their startup. However, it's a common myth that startup founders should commit full-time to their startup from the beginning.

For most people, this isn't a rational path. If you have finite financial resources and some immovable financial commitments, it's generally wiser to commit to your startup incrementally. Start with a small time commitment, during which you test your idea and establish whether it's worth proceeding any further.

It's helpful to think about the early stages of your startup as an opportunity to explore and experiment. You don't need to lock in a business model or decide on exactly what product to build right away. Instead, approach these things iteratively over a period of time so that you can have some certainty about what product to build and who's going to pay for it.

Many people can do this part-time around their existing job or other commitments.

By identifying critical milestones or inflection points that allow you to build increasing conviction, you can identify stages in the development of your company. These stages allow you to commit additional time and money as you gain greater certainty about the prospects of your company.

Founders should consciously decide to invest their time and money into their startup in the same way that an investor would decide to invest in your company. Base your investment on a rational and hard-nosed assessment of the company's prospects, including the extent to which the founders have been able to identify, address, and retire the core risks that could cause the startup to fail.

For example, make an investment case to yourself that begins: "It's rational for me to invest this amount of my time and/or money at this point, because..." The things that should convince you that it's sensible to invest might include validating core assumptions, receiving positive feedback from potential customers, and generating early revenues.

Scenario: A milestone chart for commitments

Emily is working on an idea for a financial tech startup that she hopes will make it easier for people to consolidate the bank feeds they receive from multiple banks. She comes from a consumer banking background, and she's pretty sure the idea has value.

However, she's decided that she wants to test some of her assumptions with potential customers. Moreover, she wants to do this before making any moves to leave her job or investing significant amounts of time and money in building a product.

Emily has decided that she'll stagger her commitment of time and money to the company by using milestones that reflect the de-risking of the opportunity. To help her think this through, Emily created a milestone chart and penciled in some commitments that she'd be willing to make as she hits each milestone.

| When I hit this milestone | I'll be willing to invest this much time in my startup | I'll be willing to invest this much of my own cash | This is rational because |

|---|---|---|---|

| Complete 50 customer interviews, and at least 50 percent identify with the problem and would be interested in a solution. | One person-month (evenings and weekends) over the next three months to build a minimum viable product (MVP). | $500 to run some social ad campaigns to test demand. | I won't need to reduce my income and I have enough savings to pay for the ads. |

| Launch MVP, get at least 100 people using it, and collect positive feedback. | One day per week (reduce job to four days), plus evenings and weekends, to focus on building version 1 of the product and connecting with at least three banks. | $5,000 to hire a front-end developer to help build the product. | I've discussed this matter with my manager, and she's supportive of me taking time off to explore this without jeopardizing my employment. I have enough savings to cover the reduced income and am willing to cut back on some discretionary expenditure. |

| Launch v 1.0 and get first 50 paying customers. | Leave my job to go full-time, but with up to two days a week available to do contract or project work if I need the income. | $10,000 to keep front-end developer working on the product, and to do some paid customer acquisition. | Having 50 paying customers demonstrates demand for the product and represents $5,000 in revenue. |

| 200 paying customers and at least 90 percent retention of the first 50 customers after six months. | Full-time | $20,000 in savings, will need to raise seed round soon! | 200 customers equate to $20,000 in revenues. High retention rate supports assumption of high lifetime value of customers. Should be enough to raise a seed round. |

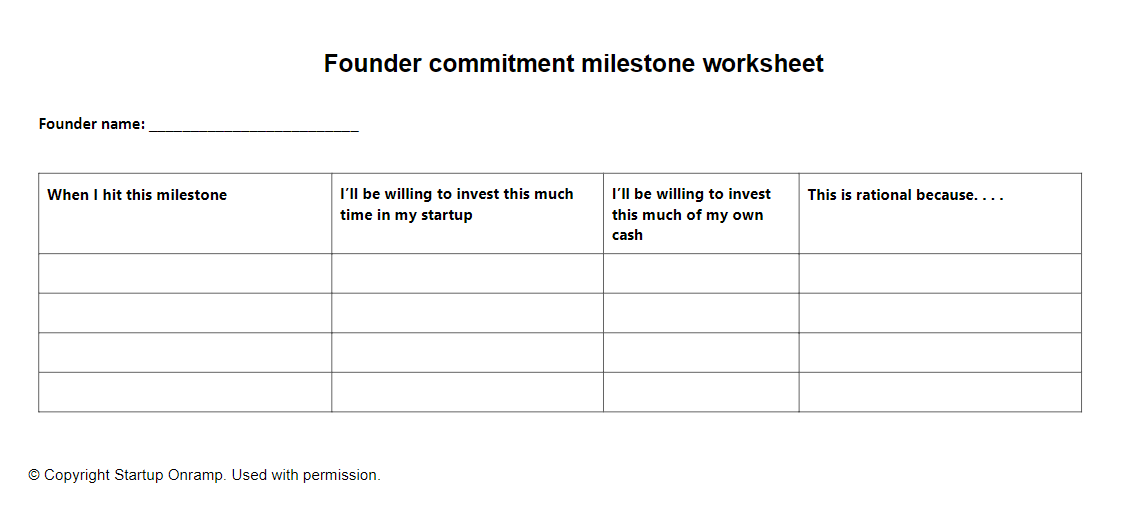

Worksheet

Download and complete the milestone worksheet. Use it as a tool to capture your thoughts about what milestones you'll need to hit before you're prepared to invest time and cash in your company.

Remember that this is a living document, and you'll need to adjust the milestones and your commitments as you progress.