Tax

Every company must collect and pay taxes to various tax authorities. The rules and rates vary by country or region, state, county, and city.

Also, the rules must be updated periodically when tax authorities change their requirements.

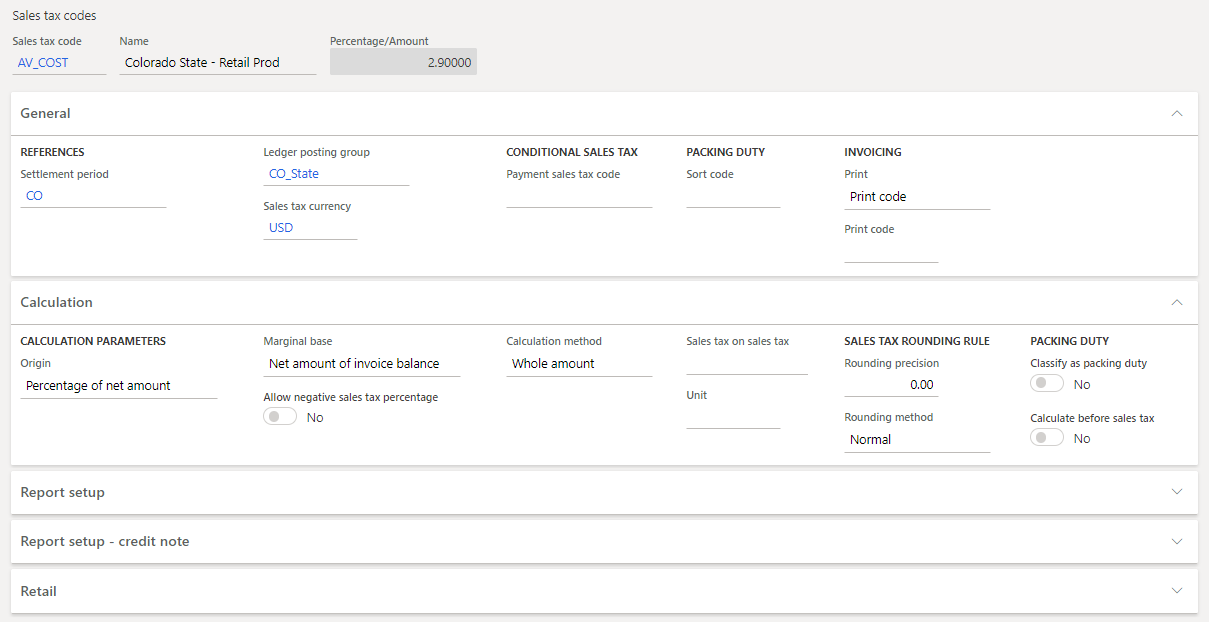

Sales tax codes contain the basic information about how much you collect and pay to the authorities. When setting up sales tax codes, you define the amounts or percentages that must be collected. You also define the various methods by which those amounts or percentages are applied to transaction amounts.

The sales tax framework supports many types of indirect taxes, such as sales tax, value-added tax (VAT), goods and services tax (GST), unit-based fees, and withholding tax. These taxes are calculated and documented during purchase and sales transactions. Periodically, they must be reported and paid to tax authorities.