Introduction

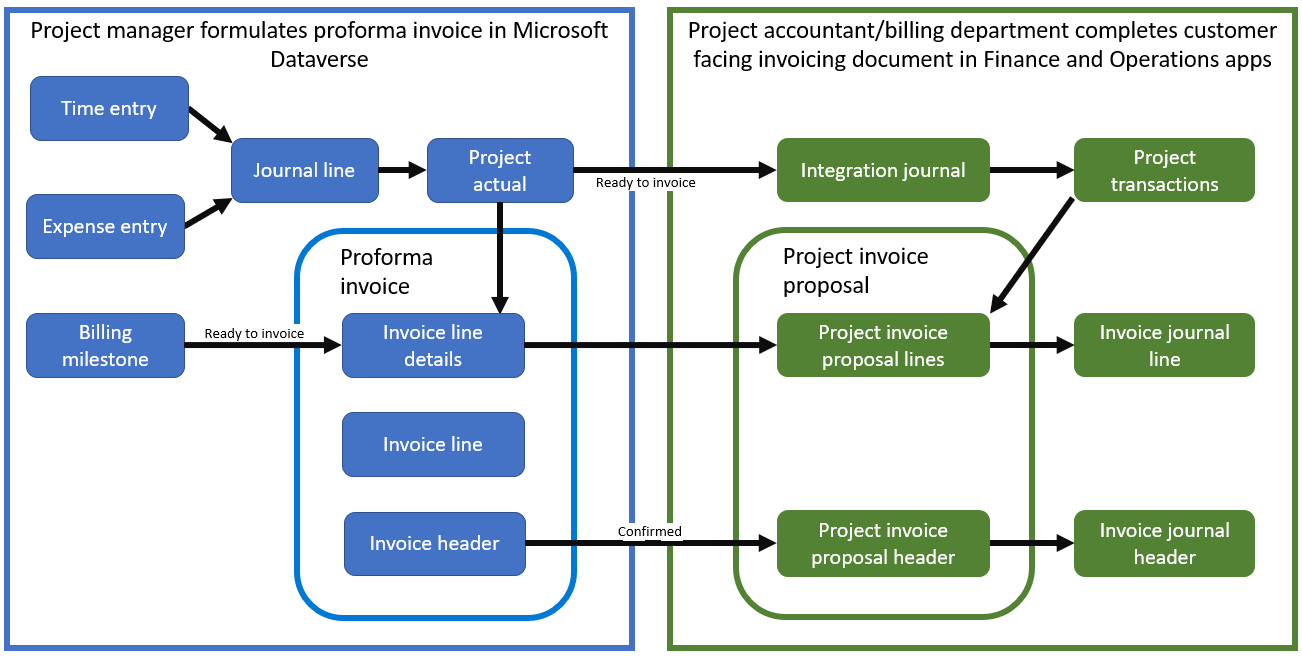

For the invoicing process, the project manager will manage the project billing backlog, and the accounts receivable clerk/project accountant will create a compliant and accurate customer-facing invoice document.

The project contract line defines the billing method for associated project transactions. When the project manager approves time and expense transactions, the system records the transactions in the Project Actuals entity and then sends the information to the Project management and accounting module in Microsoft Dynamics 365 Finance. The project accountant then reviews and posts the records by using the Integration journal in Microsoft Dynamics 365 Project Operations. This journal includes important accounting details for project actuals, such as billing, sales tax group, billing item sales tax group, and financial dimensions.

The project manager can review unbilled sales transactions by using the time and material billing method in the Time and material billing backlog and fixed price billing in Fixed price milestones. These views allow you to filter and select transactions that need to be included in the next billing cycle and then mark them as Ready to Invoice.

You can manually create a proforma invoice or use a periodic process. The project manager can adjust a draft proforma invoice as needed and then confirm it.

The confirmed proforma invoice is sent to the Project management and accounting module in Finance. The project accountant will format and update the project invoice proposal and will then post and print the document. Posted project invoices are recorded in the General ledger and the Customer and Project subledgers.