Map text on recurring payments

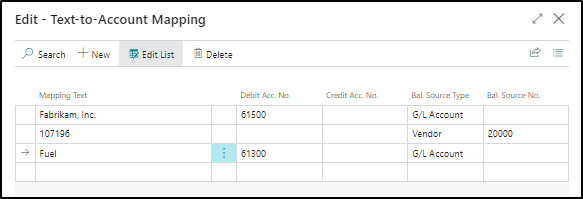

On the Text-to-Account Mapping page, which you can open from the Payment Reconciliation Journal page, you can set up mappings between text on payments and specific debit, credit, and balancing accounts so that such payments are posted to the specified accounts when you post the payment reconciliation journal.

Payments that are posted based on text-to-account mapping are not applied to open entries but are posted to the specified accounts and used to create bank account ledger entries. Accordingly, text-to-account mapping is best suited for recurring cash receipts or expenses, such as frequent purchases of car fuel or bank fees and interest, that regularly occur on the bank statement and do not need a related business document.

For example, to always post fuel expenses that are incurred to the general ledger account for gasoline (account 61300), follow these steps:

Select the Search for Page icon in the top-right corner of the page, enter Payment Reconciliation Journals, and then select the related link.

Open a payment reconciliation journal that you want to process.

On the action menu, select Manual Application and then select Map Text to Account. The Text-to-Account Mapping page opens.

In the Mapping Text field, enter any text that occurs on payments that you want to post to specified accounts without applying to an open entry. You can enter up to 50 characters. For this example, enter Fuel.

In the Debit Acc. No. field, enter 61300.

Select Close.

Next time that you import a bank statement file or select the Apply Automatically action on the Payment Reconciliation Journal page, journal lines for the payments that contain "Fuel" are automatically mapped to the specified account type and account number. The Match Confidence field will contain High - Text-to-Account Mapping.