Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

RCM transactions

Reverse charge mechanism (RCM) transactions are posted for a vendor that is marked as a goods transport agency (GTA). Additionally, the transactions are marked to indicate that the reverse charge percentage was updated to 100 percent in the tax document. However, the value of the Is reverse charge applicable field isn't updated to Yes on the GSTR 2 report.

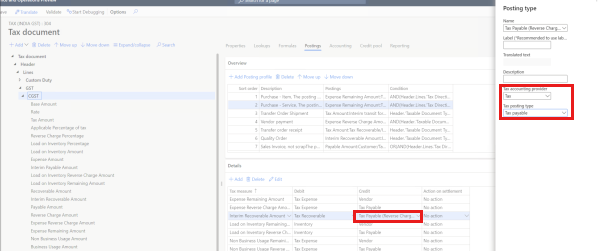

To fix this issue, when you create a new posting type for a tax payable in a tax configuration, select Tax in the Tax accounting provider field and Tax payable in the Tax Posting Type field.

For more information, see RCM transaction for GTA vendor does not show as "Y" in RCM column in GSTR2 report.

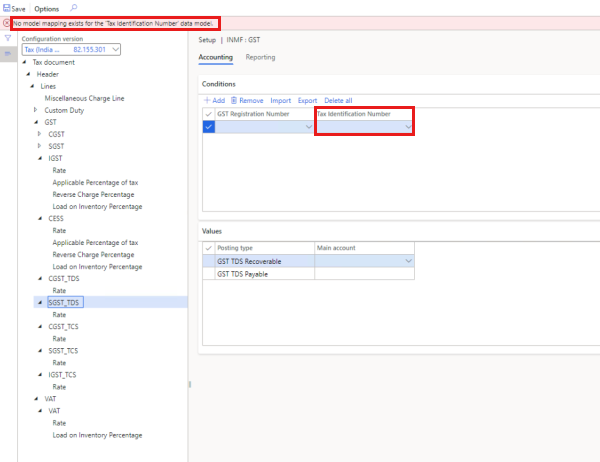

Model mapping error when CGST_TDS is configured

When you're configuring CGST_TDS, a model mapping error might occur. The error message states that no model mapping exists for the TDS TCS Registration Number data model. To fix this issue, see While configuring CGST_TDS facing model mapping error.

If you receive similar error messages, in the form "No model mapping exists for the 'xxx' data model," follow these steps:

Go to Workspaces > Electronic reporting > Tax configurations.

Select Taxable Document, select Taxable Document (India), and then select Designer to open the designer for Taxable Document (India).

Go to the Taxable Document node, expand Header > Lines > Tax Identification Number, and verify that the reference model is selected in the Natural key field.

Select Map model to datasource, and verify that the model mapping for the reference model exists.

Define a model mapping for the tax identification number that refers to the model mapping of GST registration number. For more information, see Extend tax engine configurations.

Error when GST is calculated

When you use division in a formula, pay close attention when the divisor is 0 (zero), because this value might cause an error when Goods and Services Tax (GST) is calculated. The error message is in the following form:

Attempted to divide by zero. Please check the formula of mapping field 'xxx' for taxable document mapping 'xxx' in active taxable document, it encounters an unhandled exception.

In the following procedure, the formula Net price = @.'Net Amount'/@.Quantity that is defined on the PurchParmTable model mapping is used as an example.

Go to Workspaces > Electronic reporting > Tax configurations.

Select Taxable Document > Taxable Document (India), and then select Designer to open the designer for Taxable Document (India).

Select Map model to datasource.

Find and select the Bundler.PurchOrderParm model mapping, and then select Designer to open the model mapping designer.

In the Data model section, expand Header > Lines, and find Net price.

Notice that the formula for the Net price field is @.'Net Amount'/@.Quantity.

Contact the business department, and confirm that a quantity of 0 (zero) is allowed. If it isn't allowed, correct the transaction, and then perform the operation again. If it's allowed, change the formula to a format such as IF(@.Quantity = 0, @.'Net Amount', @.'Net Amount'/@.Quantity).