EU Sales list for Latvia

This article provides information about the European Union (EU) sales list report for Latvia. The Latvian EU sales list report contains information about the sale of goods and services for reporting in XML format. The following fields are included on the Latvian EU sales list report:

- EU sales list lines:

- Customer VAT ID

- Sum of all item invoices by customer

- Sum of all service invoices by customer

- Sum of triangular trade by customer

- Line type

The following fields are included on the Latvian EU sales list corrective report:

EU sales list header:

- Company routing number

- Company name

- Responsible person title

- Company's primary phone

- Date and time of the report creation

- Name of the responsible person

EU sales list lines:

- New transaction year and month

- Customer country/region code

- Customer VAT ID without country/region code

- New line amount

- Customer VAT ID

- The total amount of a line

Setup

For general setup information, see EU Sales list reporting.

Set up information about the company

- In Microsoft Dynamics 365 Finance, go to Organization administration > Organizations > Legal entities.

- In the grid, select your company.

- On the Bank account information FastTab, in the Routing number field, enter the value that should be shown in the .xml file for the EU sales list corrective report.

Import Electronic reporting configurations

In Microsoft Dynamics Lifecycle Services (LCS), import the latest versions of the following Electronic reporting (ER) configurations for the EU sales list:

- EU Sales list model

- EU Sales list by columns report

- EU Sales list by rows report

- EU Sales list (LV)

- EU Sales list corrections (LV)

For more information, see Download Electronic reporting configurations from Lifecycle Services

Set up foreign trade parameters

In Finance, go to Tax > Setup > Foreign trade > Foreign trade parameters.

On the EU sales list tab, set the Report cash discount option to Yes if a cash discount should be included in the value when a transaction is included in the EU sales list.

On the Electronic reporting FastTab, in the File format mapping field, select EU Sales list (LV).

In the Report format mapping field, select EU Sales list by rows report or EU Sales list by columns report.

In the Corrections file format mapping field, select EU Sales list corrections (LV).

On the Country/region properties tab, select New, and specify the following information:

- In the Country/region column, select LVA.

- In the Country/region type column, select Domestic.

List all the countries or regions that your company does business with. For each country that is part of the EU, in the Country/region type field, select EU.

Work with the EU sales list

For general information about which types of transactions are included in the EU sales list, how to generate the EU sales list report, and how to close the EU sales list reporting period, see EU Sales list reporting.

Generate the EU sales list report

Go to Tax > Declarations > Foreign trade > EU sales list.

Transfer transactions. In addition to the main codes in the List code field, you can use the Purchased on behalf code for the trade of items.

On the Action Pane, select Reporting.

In the EU sales list reporting dialog box, on the Parameters FastTab, set the following fields.

Field Description Reporting period Select Monthly. From date Select the start date for the report. Generate report Set this option to Yes to generate an .xml file for your EU sales list report. Report file name Enter the name of the .xml file. Select OK, and review the generated reports.

Generate a corrective EU sales list report

Go to Tax > Declarations > Foreign trade > EU sales list.

Transfer transactions.

For each corrected line, select Copy lines > To lines with status Included on the Action Pane to create corrective lines. The reporting status of corrected lines can be set to Included, Reported, or Closed.

For each corrective line, apply the changes, and select the Corrected checkbox.

On the Action Pane, select Reporting corrections.

In the EU sales list reporting dialog box, on the Parameters FastTab, set the following fields.

Field Description File name Enter the name of the .xml corrective file. Person responsible for reporting Select the person who is responsible for the report.

Example

For information about how to create a general setup, create postings, and transfer transactions by using the DEMF legal entity for Latvia, see Example for generic EU Sales list. Additionally, for this example, create 000000009 as the company's routing number.

Create an EU sales list report

Go to Tax > Declarations > Foreign trade > EU sales list.

On the Action Pane, select Reporting.

In the EU sales list reporting dialog box, on the Parameters FastTab, set the following fields:

- In the Reporting period field, select Monthly.

- In the From date field, select 8/1/2021 (August 1, 2021).

Select OK, and review the report in XML format that is generated. The following tables show the values on the example report.

EU sales list lines

Field Line 1 value Line 2 value Comment Valsts Value ES SE The customer's country/region code. PVN Numurs Value 12345678 100200300400 The customer's value-added tax (VAT) ID without the country/region code. Summa Value 120 240 The sum of all item, service, or triangular invoices by customer. Pazime Value G P The line type. The value is G for an item record, P for a service record, S for a triangular trade record, and C for a record where the List code field is set to Purchased on behalf.

Create a corrective EU sales list report

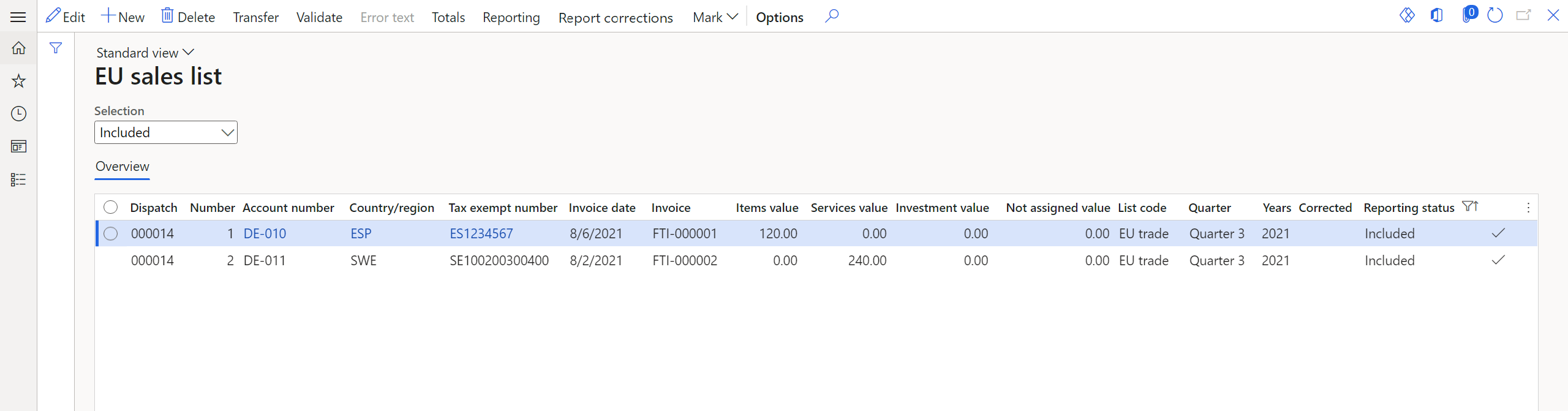

Go to Tax > Declarations > Foreign trade > EU sales list.

Verify that there are one service line and one item line in the grid.

Select a service line, and then, on the Action Pane, select Copy lines > To lines with status Included.

For the corrective line, set the following fields:

- In the Country/region field, select ESP.

- In the Tax exempt number field, select ES1234567.

- In the Invoice date field, select 9/8/2021 (September 8, 2021).

- In the Items value field, enter 20.

- In the Services value field, enter 0.

- Select the Corrected checkbox.

On the Action Pane, select Reporting corrections.

In the EU sales list reporting dialog box, on the Parameters FastTab, in the Person responsible for reporting field, select Jodi Christiansen.

Select OK, and review the report in XML format that is generated. The following tables show the values on the example report.

EU sales list header

Field Value Comment Nmr Kods 000000009 The company's routing number. Nm Nosaukums Contoso Entertainment System Latvia The company's name. Amats Compensation & Benefits Cons. The title of the person who is responsible. Talrunis +99999999 The company's primary telephone number. Sast Dat 2021-09-20T15:07:44+03:00 The date and time when the report was created. Atb Pers Jodi Christiansen The name of the person who is responsible. EU sales list lines

Field Line 1 value Comment Vec Taks Per 2108 The old transaction year and month. Vec Valsts SE The old country/region code of the customer. Vec PVN Numurs 100200300400 The old VAT ID of the customer, without the country/region code. Vec Summa 240 The old line amount. Vec Pazime P The old line type. The value is G for an item record, P for a service record, S for a triangular trade record, and C for a record where the List code field is set to Purchased on behalf. Jaun Valsts ES The new country/region code of the customer. Jaun PVN Numurs 1234567 The new VAT ID of the customer, without the country/region code. Jaun Taks Per 2109 The new transaction year and month. Jaun Valsts ES The new country/region code of the customer. Jaun PVN Numurs 1234567 The new VAT ID of the customer, without the country/region code. Jaun Summa 20 The new line amount. Jaun Pazime G The new line type. The value is G for an item record, P for a service record, S for a triangular trade record, and C for a record where the List code field is set to Purchased on behalf.