EU Sales list for Denmark

This article provides information about the European Union (EU) sales list report for Denmark. The Danish EU sales list report contains information about the sale of goods and services for reporting in text format. The following fields are included on the Danish EU sales list report:

- EU sales list header:

- Company's VAT ID without country/region code

- EU sales list lines:

- Dispatch ID

- The last day of the selected period

- Company's VAT ID without country/region code

- Customer VAT ID

- The total amount of items

- The total amount of services

- Total amount of the triangular trade

- EU sales list footer:

- Total amount

- Number of EU sales list lines

Setup

For general setup information, see EU Sales list reporting.

Set up information about the company

Create a registration type, and assign it to the VAT ID registration category for Denmark and all the countries or regions that your company does business with, as described in Registration IDs.

In Microsoft Dynamics 365 Finance, go to Organization administration > Organizations > Legal entities.

In the grid, select your company.

On the Action Pane, select Registration IDs.

On the Registration ID FastTab, select Add.

On the Overview tab, in the Registration type field, select the registration type that you created.

Enter your company's value-added tax (VAT) ID.

Optional: On the General tab, in the General section, change the period that the VAT ID is used for.

Close the page.

Note

If the VAT exempt number export field in the Intrastat section of the Foreign trade and logistics FastTab is set (that is, it isn't blank), the value will be used, instead of the VAT ID that you created in step 6, in the .txt and .xlsx files for the EU sales list report.

Import Electronic reporting configurations

- In Microsoft Dynamics Lifecycle Services (LCS), import the latest versions of the following Electronic reporting (ER) configurations for the EU sales list:

- EU Sales list model

- EU Sales list by columns report

- EU Sales list by rows report

- EU Sales list (DK)

For more information, see Download Electronic reporting configurations from Lifecycle Services.

Set up foreign trade parameters

- In Finance, go to Tax > Setup > Foreign trade > Foreign trade parameters.

- On the EU sales list tab, set the Report cash discount option to Yes if a cash discount should be included in the value when a transaction is included in the EU sales list.

- On the Electronic reporting FastTab, in the File format mapping field, select EU Sales list (DK).

- In the Report format mapping field, select EU Sales list by rows report or EU Sales list by columns report.

- On the Country/region properties tab, select New, and specify the following information:

- In the Country/region column, select DNK.

- In the Country/region type column, select Domestic.

- List all the countries or regions that your company does business with. For each country that is part of the EU, in the Country/region type field, select EU.

Work with the EU sales list

For general information about the types of transactions that are included in the EU sales list, and how to generate the EU sales list report and close the EU sales list reporting period, see EU Sales list reporting.

Generate the EU sales list report

Go to Tax > Declarations > Foreign trade > EU sales list.

Transfer transactions.

On the Action Pane, select Reporting.

In the EU sales list reporting dialog box, on the Parameters FastTab, set the following fields.

Field Description Reporting period Select Monthly or Quarterly. From date Select the start date for the report. Generate file Set this option to Yes to generate a .txt file for your EU sales list report. File name Enter the name of .txt file. Generate report Set this option to Yes to generate an .xlsx file for your EU sales list report. Report file name Enter the name of the .xlsx file. Select OK, and review the generated reports.

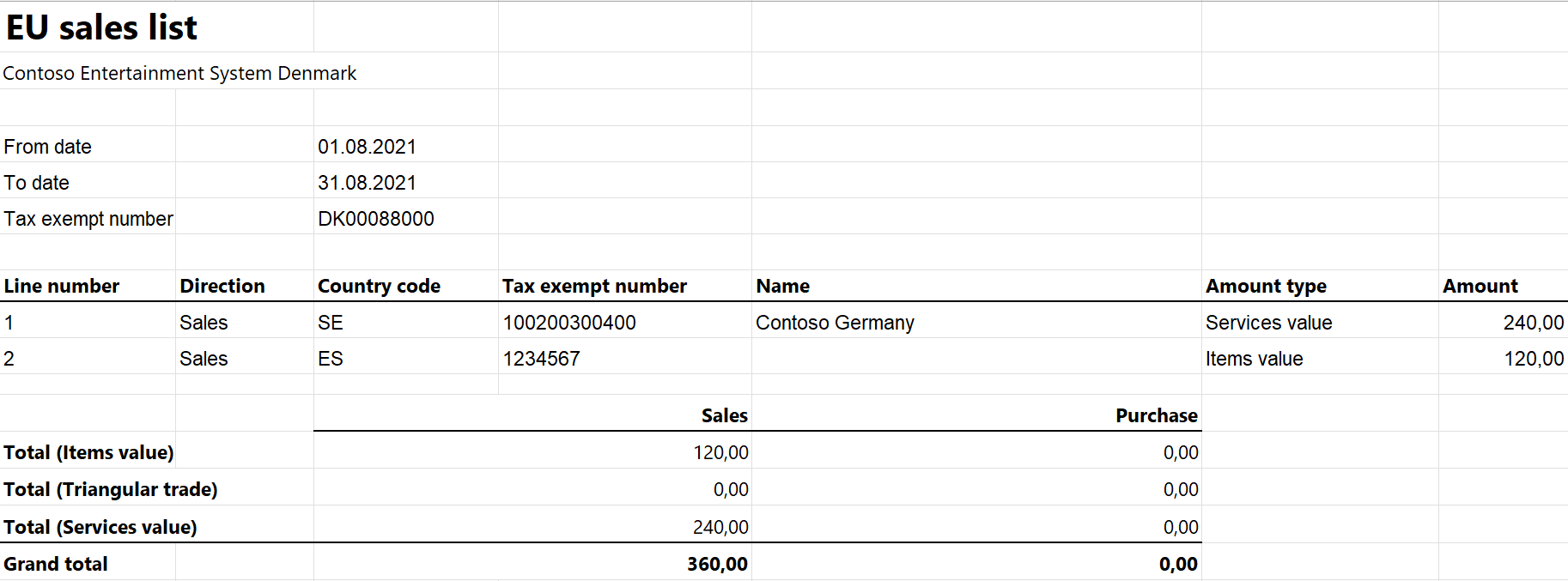

Example

For information about how to create a general setup, create postings, and transfer transactions by using the DEMF legal entity for Denmark, see Example for generic EU Sales list. However, for this example, create DK00088000 as the company's VAT ID.

Create an EU sales list report

Go to Tax > Declarations > Foreign trade > EU sales list.

On the Action Pane, select Reporting.

In the EU sales list reporting dialog box, on the Parameters FastTab, set the following fields:

- In the Reporting period field, select Monthly.

- In the From date field, select 8/1/2021 (August 1, 2021).

Select OK, and review the report in text format that is generated. The following tables show the values on the example report.

EU sales list header

Field Value Record type 0 Company's VAT ID without country/region code 00088000 Technical fields LISTE; ; ; ; ; ; EU sales list lines

Field Line1 value Line 2 value Record type 2 2 Dispatch ID 000002 000002 The last day of the selected period 2021-08-31 2021-08-31 Company's VAT ID without country/region code 00088000 00088000 Customer country/region code ES SE Customer VAT ID without country/region code 12345678 100200300400 Sum of all item invoices by customer 120 0 Sum of triangular trade by customer 0 0 Sum of all service invoices by customer 0 240 EU sales list footer

Field Value Record type 10 Number of EU sales list lines 2 Total amount 360 Review the report in Excel format that is generated.