Create a debit note against a purchase invoice

Go to General ledger > Journals > General journal.

Create a journal, and name it.

Select Lines.

In the Account type field, select Vendor. Then, in the Account field, select a value.

In the Credit field, enter a value.

In the Offset account type field, select Ledger. Then, in the Offset account field, select a value.

On the General tab, in the Original purchase invoice section, in the Original invoice number field, select a value.

Verify that the Original invoice date field is automatically set, based on the original invoice.

Note

You can post a revised debit note by selecting Revised in the Invoice type field and then adding a reference to the original debit note.

Select Tax information.

On the GST FastTab, in the HSN code field, select a value.

Select the Vendor tax information FastTab.

Select OK.

Validate the tax details

- Select Tax document.

- Select Close.

- Select Post > Post.

- Close the message that you receive.

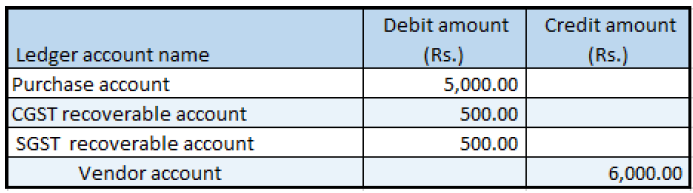

Validate the financial entries

To validate the financial entries, select Inquiries > Voucher.