Include GST when calculating tax collections

Set up GST requirements

- Go to Tax > Indirect Tax > Withholding tax > Withholding tax groups.

- Select a withholding tax group.

- On the General FastTab, in the Include GST tax components for TDS or TCS calculation field, select the required Goods and Services Tax (GST) components.

- Select Close.

Create a sales order

- Go to Accounts receivable > Sales orders > All sales orders.

- Create a sales order.

- Select OK.

Validate the tax details

On the Action Pane, on the Purchase tab, in the Tax group, select Tax document to review the calculated taxes.

Here is an example of what you should see:

- Taxable value: 10,000.00

- IGST: 20 percent

Select Close.

Select Product and supply > Withholding tax.

Select Close.

Post the purchase invoice

- On the Action Pane, on the Invoice tab, in the Generate group, select Invoice.

- Select OK.

- Select OK.

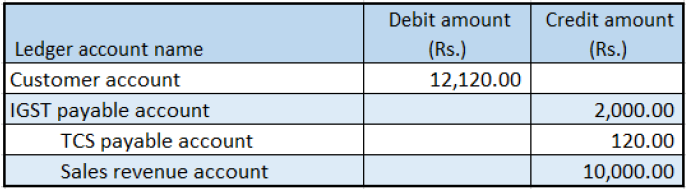

- On the Action Pane, on the Invoice tab, in the Journals group, select Invoice.

- On the Overview tab, select Voucher.

Commentaires

Bientôt disponible : Tout au long de 2024, nous allons supprimer progressivement GitHub Issues comme mécanisme de commentaires pour le contenu et le remplacer par un nouveau système de commentaires. Pour plus d’informations, consultez https://aka.ms/ContentUserFeedback.

Envoyer et afficher des commentaires pour