Nota

L'accesso a questa pagina richiede l'autorizzazione. Puoi provare ad accedere o a cambiare directory.

L'accesso a questa pagina richiede l'autorizzazione. Puoi provare a cambiare directory.

To make the India localization solution for Goods and Services Tax (GST) in Microsoft Dynamics 365 Finance available, you must complete the following master data setup:

- Define a business vertical.

- Update the state code and union territory.

- Create a Goods and Services Tax Identification Number (GSTIN) master.

- Define GSTINs for the legal entity, warehouse, vendor, or customer masters.

- Define Harmonized System of Nomenclature (HSN) codes and Service Accounting Codes (SACs).

- Create main accounts for the GST posting type.

- Create a tax settlement period.

- Attach the GSTIN to a tax registration group.

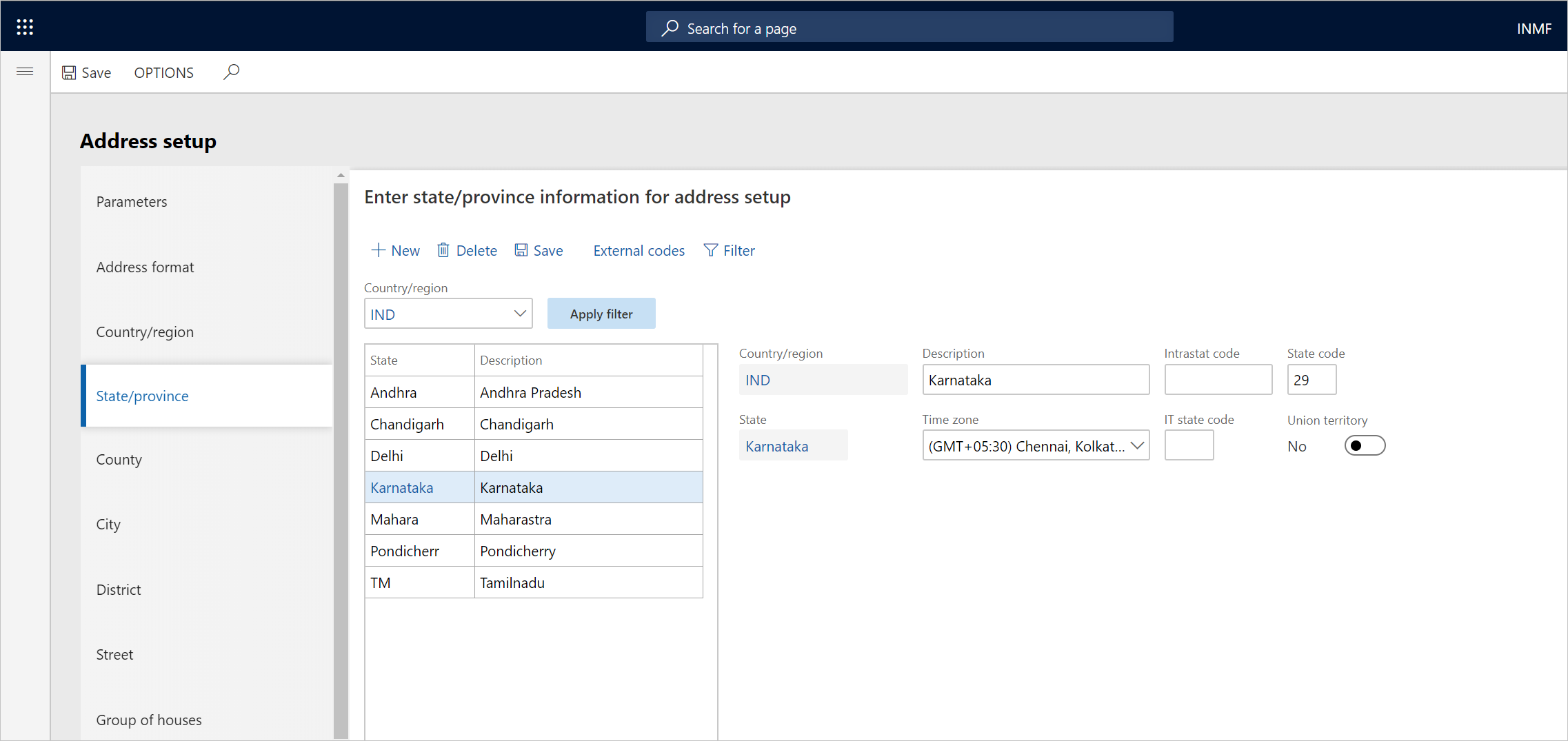

Follow these steps to update the state code and union territory.

- Go to Organization administration > Global address book > Addresses > Address setup.

- On the State/province tab, select a state.

- In the State code field, enter a value.

- Set the Union territory option to Yes to identify the state as a union territory.

- Select Close.